How To Calculate An Annuity Due 2024: A Comprehensive Guide – Annuities due are a powerful financial tool, offering a steady stream of income over time. Understanding how to calculate their present value is crucial for anyone considering an annuity, whether for retirement planning, mortgage payments, or other financial goals.

An annuity of $400,000 can be a significant financial asset. Annuity $400 000 2024 explores the potential benefits and considerations associated with such a substantial annuity.

This guide provides a step-by-step approach to calculating annuities due, covering the key concepts, formulas, and practical considerations.

An annuity due is a series of equal payments made at the beginning of each period, which distinguishes it from an ordinary annuity where payments are made at the end of each period. The timing of payments plays a significant role in determining the overall value of the annuity, as the earlier payments have more time to accumulate interest.

Annuities are often considered a form of fixed income, providing a steady stream of payments. Is Annuity Fixed Income 2024 explains why annuities are generally viewed as a fixed income investment.

Understanding this difference is essential for accurate annuity calculations.

Understanding the present value of an annuity is crucial for making informed financial decisions. Calculating Annuity Present Values 2024 offers a comprehensive guide on calculating present values of annuities.

Contents List

- 1 Understanding Annuities Due

- 2 Formula for Calculating Annuity Due

- 3 Applications of Annuity Due Calculations: How To Calculate An Annuity Due 2024

- 4 Factors Affecting Annuity Due Calculations

- 5 Using Financial Calculators and Software

- 6 Illustrative Examples

- 7 Practical Considerations

- 8 Last Point

- 9 FAQ Summary

Understanding Annuities Due

An annuity due is a series of equal payments made at the beginning of each period. This distinguishes it from an ordinary annuity, where payments are made at the end of each period. Understanding the timing of payments is crucial in annuity calculations, as it directly impacts the overall value of the annuity.

Calculating the exclusion ratio for an annuity is important for tax purposes. Calculate Annuity Exclusion Ratio 2024 provides a detailed guide on how to determine the exclusion ratio for your annuity.

Defining Annuities Due

An annuity due is a stream of equal payments made at the beginning of each period. This differs from an ordinary annuity, where payments are made at the end of each period. For example, if you have an annuity due that pays $100 per month, you would receive the first payment on the first day of the month, the second payment on the first day of the following month, and so on.

Importance of Payment Timing

The timing of payments significantly influences the overall value of an annuity. This is because payments made at the beginning of each period have the potential to earn interest for the entire duration of the period, unlike payments made at the end.

When purchasing an annuity, it’s important to consider the life expectancy of the person receiving the payments. Understanding who the annuity is written for and their expected lifespan can help you make a more informed decision. When Annuity Is Written Whose Life Expectancy 2024 offers more insights on this aspect.

Therefore, an annuity due will generally have a higher present value than an ordinary annuity with the same payment amount, interest rate, and number of periods.

Formula for Calculating Annuity Due

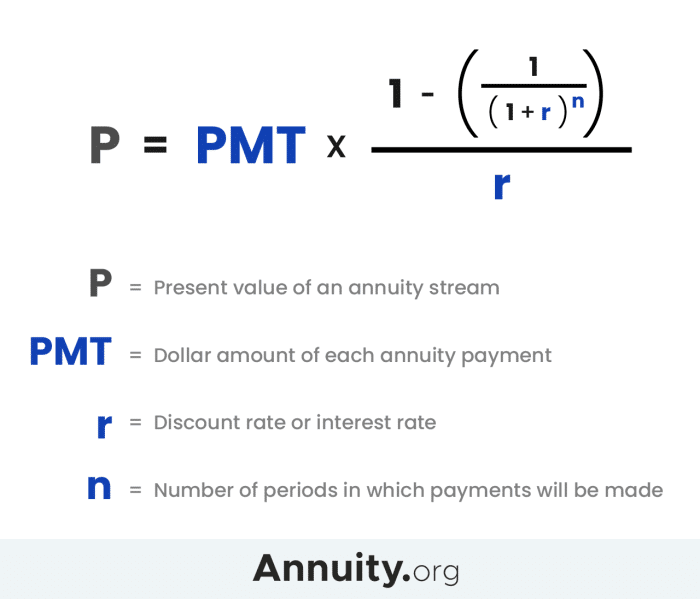

The present value of an annuity due can be calculated using the following formula:

PV = PMT

- [(1

- (1 + r)^-n) / r]

- (1 + r)

Where:

- PV = Present Value

- PMT = Payment Amount

- r = Interest Rate per Period

- n = Number of Periods

Numerical Example

Let’s assume you want to calculate the present value of an annuity due with a payment amount of $1,000, an interest rate of 5% per year, and a term of 10 years. Using the formula above, we can calculate the present value as follows:

PV = $1,000 – [(1 – (1 + 0.05)^-10) / 0.05] – (1 + 0.05)

Omni Calculator is a great online resource for a wide range of calculations, including annuities. Omni Calculator Annuity 2024 provides a user-friendly interface for calculating various aspects of annuities.

PV = $1,000 – [7.72173] – 1.05

The Jaiib (Junior Associate of the Indian Institute of Bankers) exam often includes questions on annuities. Annuity Formula Jaiib 2024 provides a comprehensive guide to the annuity formulas relevant for the Jaiib exam.

PV = $8,115.82

Therefore, the present value of this annuity due is $8,115.82.

One of the key advantages of annuities is their guaranteed nature. Is Annuity Guaranteed 2024 delves into the guarantees offered by annuities and what they mean for your financial security.

Applications of Annuity Due Calculations: How To Calculate An Annuity Due 2024

Annuity due calculations are widely used in various financial planning scenarios. Some common applications include:

- Retirement Planning:Annuity due calculations can be used to determine the present value of future retirement income streams, such as pensions or 401(k) distributions.

- Mortgage Payments:Most mortgage payments are structured as annuities due, with the first payment due at the beginning of the loan term. Annuity due calculations can be used to determine the monthly payment amount and the total amount of interest paid over the life of the loan.

- Loan Amortization:Annuity due calculations can be used to calculate the regular payments required to amortize a loan over a specific period. This is commonly used for car loans, student loans, and other types of installment loans.

Impact of Payment Timing

The timing of payments significantly impacts the overall value of the annuity. In the context of retirement planning, for example, receiving annuity payments at the beginning of each month allows for greater investment growth potential compared to receiving payments at the end of the month.

If you’re planning to take out a loan, understanding the concept of an annuity can be helpful. Annuity Loan Calculator 2024 provides insights into how annuities work in the context of loans.

Factors Affecting Annuity Due Calculations

Several factors can influence the present value of an annuity due. Understanding these factors is essential for accurate calculation and financial planning.

Impact of Interest Rates

Interest rates have a direct impact on the present value of an annuity due. Higher interest rates generally result in a higher present value, as future payments are discounted at a higher rate. Conversely, lower interest rates lead to a lower present value.

Relationship Between Number of Periods and Annuity Due Value

The number of periods also influences the present value of an annuity due. A longer period generally leads to a higher present value, as there are more future payments to be discounted. Conversely, a shorter period results in a lower present value.

Impact of Payment Amounts

The payment amount is a key factor determining the present value of an annuity due. Higher payment amounts lead to a higher present value, while lower payment amounts result in a lower present value.

If you’re lucky enough to win the lottery, you might want to consider an annuity. Annuity Calculator Lottery 2024 can help you explore the different options and determine if an annuity is the right choice for you.

Using Financial Calculators and Software

Financial calculators and software can simplify the process of calculating annuities due. These tools allow users to input relevant parameters, such as payment amount, interest rate, and number of periods, and automatically calculate the present value.

If you’re living in the UK, you might be interested in learning more about annuities. Calculate Annuity Uk 2024 offers specific information on annuities in the UK context.

Inputting Parameters, How To Calculate An Annuity Due 2024

To calculate an annuity due using a financial calculator or software, you will typically need to input the following parameters:

- Payment Amount (PMT)

- Interest Rate (r)

- Number of Periods (n)

Features and Capabilities

Financial calculators and software offer various features and capabilities for annuity due calculations. Some common features include:

- Calculation of present value and future value

- Amortization schedules

- Sensitivity analysis to assess the impact of changes in input parameters

- Graphing and visualization tools

Illustrative Examples

The following table presents various scenarios of annuity due calculations, showcasing the impact of different payment amounts, interest rates, and number of periods on the present value.

The annuity equation is a fundamental formula used in finance to calculate the present or future value of a stream of payments. Annuity Equation 2024 provides a detailed explanation of the equation and its applications.

| Scenario | Payment Amount | Interest Rate | Number of Periods | Present Value |

|---|---|---|---|---|

| 1 | $1,000 | 5% | 10 | $8,115.82 |

| 2 | $2,000 | 5% | 10 | $16,231.64 |

| 3 | $1,000 | 7% | 10 | $9,446.08 |

| 4 | $1,000 | 5% | 15 | $11,618.93 |

Analysis of Results

As shown in the table, higher payment amounts, higher interest rates, and longer periods generally result in higher present values. Conversely, lower payment amounts, lower interest rates, and shorter periods lead to lower present values. This highlights the importance of considering all relevant factors when calculating annuities due.

The BA II Plus calculator is a popular tool for financial calculations, including annuity payments. Calculate Annuity Payments Ba Ii Plus 2024 guides you through the steps involved in calculating annuity payments using this calculator.

Practical Considerations

When calculating annuities due, it is essential to consider practical factors that can impact the real value of the annuity over time. These factors include:

Inflation

Inflation erodes the purchasing power of money over time. Therefore, it is crucial to factor in inflation when calculating annuities due to ensure that the future payments have the same real value as the present value. This can be done by using a real interest rate, which adjusts the nominal interest rate for inflation.

Figuring out how to calculate an annuity due on a TI-84 calculator can be a bit tricky, but it’s definitely doable. Check out this guide How To Calculate Annuity Due On Ti-84 2024 to help you navigate the process.

Taxes

Taxes can significantly reduce the value of an annuity. Depending on the type of annuity and the tax laws in your jurisdiction, a portion of the annuity payments may be subject to income tax. It is essential to consider the potential tax implications when calculating the present value of an annuity due.

Recommendations

To incorporate inflation and taxes into annuity due calculations, you can:

- Use a real interest rate that accounts for inflation.

- Estimate the tax rate that will apply to the annuity payments.

- Adjust the payment amount or the present value to reflect the impact of inflation and taxes.

Last Point

Calculating annuities due involves understanding the key components of the formula, including the payment amount, interest rate, and number of periods. By applying the formula and considering factors such as inflation and taxes, you can accurately determine the present value of an annuity due.

Armed with this knowledge, you can make informed decisions about your financial future and optimize your investment strategies.

There are a variety of annuity options available, each with its own advantages and disadvantages. Annuity Options 2024 provides a comprehensive overview of the different types of annuities and their key features.

FAQ Summary

What are some real-world examples of annuity due calculations?

Annuities due calculations are commonly used in retirement planning, mortgage payments, and loan amortization. For example, a retirement annuity provides a regular income stream during retirement, while a mortgage payment is an annuity due where the payment is made at the beginning of each month.

How can I calculate an annuity due using a financial calculator?

Most financial calculators have a dedicated function for calculating annuities due. You simply need to input the relevant parameters, such as the payment amount, interest rate, and number of periods, and the calculator will automatically calculate the present value of the annuity due.

What are the limitations of using financial calculators and software for annuity due calculations?

While financial calculators and software can provide accurate calculations, they may not always account for all the complexities of real-world scenarios. For example, they may not factor in inflation or taxes, which can significantly impact the actual value of the annuity over time.

Therefore, it’s essential to consider these factors when making financial decisions.