Variable Annuity Account 2024: A Guide for Investors, presents a comprehensive look at this complex financial instrument, exploring its features, benefits, risks, and how it can be incorporated into your retirement planning strategy. In an era marked by market volatility and evolving regulations, understanding the nuances of variable annuities is crucial for informed investment decisions.

There are different methods for calculating annuities, each with its own strengths and weaknesses. Calculating Annuity Method 2024 explores these methods, comparing their accuracy, complexity, and suitability for various scenarios.

This guide delves into the core components of variable annuities, such as sub-accounts and investment options, providing insights into how these elements work together. We examine key considerations for 2024, including current market conditions, regulatory changes, and interest rate trends.

Additionally, we explore the tax implications of variable annuities and compare them to other retirement investment options.

Problem 6-24 in many finance textbooks focuses on calculating the future value of annuities. Problem 6-24 Calculating Annuity Future Values 2024 provides a step-by-step solution to this classic problem, helping students grasp the concepts of time value of money.

Contents List

- 1 Introduction to Variable Annuities

- 2 Understanding Variable Annuity Components

- 3 Key Considerations for 2024: Variable Annuity Account 2024

- 4 Variable Annuities and Retirement Planning

- 5 Choosing the Right Variable Annuity

- 6 Variable Annuity Fees and Expenses

- 7 Tax Implications of Variable Annuities

- 8 Final Wrap-Up

- 9 FAQ Section

Introduction to Variable Annuities

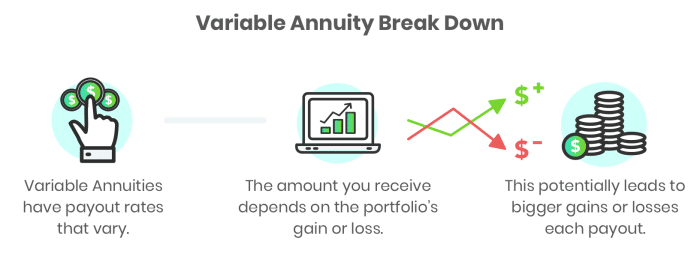

Variable annuities are a type of insurance product that combines investment features with income guarantees. Unlike traditional fixed annuities, which offer a fixed rate of return, variable annuities allow investors to allocate their contributions to different sub-accounts that invest in a variety of assets, such as stocks, bonds, and mutual funds.

When considering an annuity, it’s important to plan for the future. Annuity No Beneficiary 2024 examines the implications of having no designated beneficiary, highlighting the importance of naming someone to receive the proceeds.

Core Features and Differences

Here’s a breakdown of the core features of variable annuities and how they differ from traditional annuities:

| Feature | Traditional Annuity | Variable Annuity | Key Differences |

|---|---|---|---|

| Return | Fixed interest rate | Variable, based on investment performance | Traditional annuities provide a guaranteed rate of return, while variable annuities offer the potential for higher returns but also carry the risk of losing principal. |

| Investment Options | None, principal is held by the insurance company | Investors choose sub-accounts with different investment options | Variable annuities offer flexibility in investment choices, while traditional annuities do not. |

| Risk | Low risk, principal is guaranteed | Higher risk, potential for principal loss | Variable annuities are subject to market fluctuations, while traditional annuities are not. |

| Income Guarantee | Guaranteed lifetime income | May offer optional income guarantees, but not guaranteed | Traditional annuities typically provide guaranteed lifetime income, while variable annuities may offer optional income guarantees, but they are not guaranteed. |

Benefits and Risks, Variable Annuity Account 2024

Variable annuities offer potential benefits, but they also come with certain risks. Consider these factors before investing:

- Potential for higher returns:Variable annuities allow investors to potentially earn higher returns than traditional annuities, as the returns are tied to the performance of the underlying investments.

- Flexibility in investment choices:Variable annuities offer a wide range of investment options, allowing investors to tailor their portfolio to their risk tolerance and financial goals.

- Tax-deferred growth:Earnings within a variable annuity grow tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them.

- Potential for principal loss:Unlike traditional annuities, variable annuities do not guarantee the return of your principal. If the investments in your sub-accounts perform poorly, you could lose some or all of your principal.

- Fees and expenses:Variable annuities typically have higher fees and expenses than traditional annuities. These fees can eat into your returns over time.

- Market risk:The value of your variable annuity can fluctuate with market conditions, meaning you could lose money if the market declines.

Understanding Variable Annuity Components

Variable annuities consist of several key components that work together to provide investors with a combination of investment growth and income protection. Understanding these components is crucial for making informed decisions about whether a variable annuity is right for you.

Calculating annuity present values can be daunting, but Excel offers a powerful tool for simplifying the process. Calculating Annuity Present Value In Excel 2024 provides step-by-step instructions and practical examples to help you make informed financial decisions.

Sub-Accounts

The heart of a variable annuity is the sub-account system. When you invest in a variable annuity, your contributions are allocated to different sub-accounts, each of which invests in a specific asset class, such as stocks, bonds, or money market instruments.

Calculating annuities manually can be tedious, but financial calculators can simplify the process. How To Calculate Annuity On Calculator 2024 provides a guide to using calculators for annuity calculations, highlighting the key functions and steps involved.

The performance of each sub-account directly impacts the value of your variable annuity. If the sub-accounts you’ve chosen perform well, the value of your annuity will grow. Conversely, if the sub-accounts perform poorly, the value of your annuity could decline.

HDFC, a leading financial institution in India, offers an annuity calculator to help customers estimate their potential income from annuities. Annuity Calculator Hdfc 2024 provides a user-friendly platform for exploring different annuity options and comparing their estimated payouts.

Investment Options

Variable annuity providers offer a variety of investment options within their sub-accounts. These options can range from conservative investments, such as money market funds, to more aggressive investments, such as stock funds. The specific investment options available will vary depending on the provider and the type of variable annuity you choose.

Calculator.net is a popular online resource for financial calculations, including annuities. Calculator.Net Annuity 2024 explores its user-friendly interface and various annuity calculations it offers, making it a valuable tool for financial planning.

| Investment Option | Description |

|---|---|

| Money Market Funds | Invest in short-term, low-risk debt securities, offering stability and low returns. |

| Bond Funds | Invest in a variety of bonds, offering potential for income and capital appreciation, with varying levels of risk. |

| Stock Funds | Invest in stocks, offering potential for higher returns but also greater risk. |

| Target-Date Funds | Automatically adjust their asset allocation over time, becoming more conservative as you approach retirement. |

| Index Funds | Track the performance of a specific market index, such as the S&P 500. |

Key Considerations for 2024: Variable Annuity Account 2024

The variable annuity landscape is constantly evolving, influenced by market conditions, regulatory changes, and interest rate trends. Here’s a look at some key factors to consider in 2024:

Market Conditions

The current market environment, characterized by inflation, rising interest rates, and geopolitical uncertainty, can significantly impact the performance of variable annuities. Higher interest rates can make fixed income investments less attractive, potentially affecting the returns on bond sub-accounts. Volatility in the stock market can also impact the performance of equity sub-accounts.

Calculating the present value of an annuity is crucial for making sound financial decisions. Calculating Annuity Present Value 2024 explores the methods and formulas used for this calculation, providing insights into its practical applications.

Investors should carefully assess their risk tolerance and investment goals in light of these market conditions.

The UK government provides an online annuity calculator to help individuals estimate their potential income from annuities. Annuity Calculator Uk Gov 2024 offers a user-friendly interface for exploring various annuity options and comparing their estimated payouts.

Regulatory Changes

The insurance industry is subject to ongoing regulatory scrutiny. In 2024, investors should be aware of any new regulations or updates that may affect variable annuity contracts. These changes could impact features like fees, investment options, or income guarantees. Staying informed about regulatory developments is crucial for making informed decisions.

Interest Rate Environment

The current interest rate environment, with the Federal Reserve aggressively raising rates, is a key factor to consider. Higher interest rates can impact the performance of fixed income investments, potentially reducing the returns on bond sub-accounts. However, rising interest rates can also make certain income guarantees more attractive.

Dreaming of winning big? Annuity Jackpot 2024 explores the exciting possibilities of lottery winnings and the various ways they can be structured through annuities. It’s important to consider tax implications and investment strategies for maximizing your winnings.

Investors should carefully analyze the impact of interest rates on their specific variable annuity contract and investment strategy.

As an annuity owner, it’s vital to understand your rights and responsibilities. Annuity Owner Is 2024 provides guidance on managing your annuity, including beneficiary designations, withdrawal options, and potential tax considerations.

Variable Annuities and Retirement Planning

Variable annuities can play a role in retirement planning, offering potential for growth and income protection. However, it’s essential to understand how they fit into your overall retirement strategy.

Annuity income is subject to taxation in India, but the specific rules and regulations can be complex. Is Annuity Taxable In India 2024 provides clarity on tax implications for annuities in India, helping you plan accordingly.

Retirement Income Strategy

Variable annuities can be used as a component of a diversified retirement income strategy. They can provide a potential source of income during retirement, especially if you choose a contract with income guarantees. However, it’s important to remember that variable annuities are not a guaranteed source of income, and their value can fluctuate with market conditions.

Annuity contracts can vary widely, and understanding their different types is essential. 1 An Annuity Is 2024 provides a basic introduction to the concept of annuities and their diverse applications in financial planning.

Advantages and Disadvantages

Here’s a breakdown of the advantages and disadvantages of using variable annuities in retirement planning:

| Retirement Planning Goals | How Variable Annuities Can Help |

|---|---|

| Growth Potential | Variable annuities offer the potential for higher returns than traditional annuities, which can help your retirement savings grow faster. |

| Income Protection | Some variable annuity contracts offer income guarantees, providing a safety net against market fluctuations. |

| Tax-Deferred Growth | Earnings within a variable annuity grow tax-deferred, allowing your savings to compound faster. |

| Flexibility | Variable annuities offer a variety of investment options, allowing you to tailor your portfolio to your risk tolerance and financial goals. |

| High Fees and Expenses | Variable annuities typically have higher fees and expenses than other retirement investment options, which can eat into your returns. |

| Market Risk | The value of your variable annuity can fluctuate with market conditions, meaning you could lose money if the market declines. |

| Complexity | Variable annuities can be complex products, requiring careful research and understanding before investing. |

Choosing the Right Variable Annuity

With a variety of variable annuity contracts available, it’s crucial to carefully consider your individual needs and goals before making a decision. Here’s a checklist of factors to help you select the right contract:

Factors to Consider

- Your investment goals:What are you hoping to achieve with your variable annuity? Are you seeking growth potential, income protection, or a combination of both?

- Your risk tolerance:How much risk are you comfortable taking with your investment? Choose a contract with investment options that align with your risk appetite.

- Your time horizon:How long do you plan to invest in the variable annuity? A longer time horizon allows for greater potential for growth but also exposes you to more market risk.

- Fees and expenses:Compare the fees and expenses associated with different variable annuity contracts. Choose a contract with fees that are reasonable and transparent.

- Income guarantees:If you’re seeking income protection, consider a contract with income guarantees. However, be aware that these guarantees may come with additional fees and limitations.

- Investment options:Review the investment options available within the contract and choose those that align with your investment goals and risk tolerance.

- Financial health:Consider your overall financial health and make sure a variable annuity fits into your overall financial plan.

Types of Variable Annuity Contracts

Variable annuities come in several different types, each with its own features, benefits, and drawbacks. Here’s a comparison of some common types:

| Contract Type | Key Features | Pros | Cons |

|---|---|---|---|

| Fixed Variable Annuity | Combines fixed annuity features with variable investment options. | Provides a guaranteed minimum rate of return, offers flexibility in investment choices. | Returns may be lower than pure variable annuities, may have higher fees. |

| Indexed Variable Annuity | Links returns to the performance of a specific index, such as the S&P 500. | Offers potential for higher returns than fixed annuities, may provide downside protection. | Returns may be capped, may have higher fees than traditional variable annuities. |

| Variable Annuity with Income Guarantees | Provides a guaranteed stream of income during retirement. | Offers income protection, can help ensure a steady income stream. | May have higher fees and limitations on withdrawals. |

Variable Annuity Fees and Expenses

Variable annuities come with a range of fees and expenses that can impact your returns. Understanding these fees is crucial for making informed investment decisions.

Looking to understand John Hancock’s annuity offerings in 2024? Annuity John Hancock 2024 provides insights into their current products and features. It’s essential to consider factors like interest rates, guarantees, and tax implications when making decisions about annuities.

Fee Types

Here’s a breakdown of the common fees associated with variable annuities:

| Fee Type | Description | Potential Impact |

|---|---|---|

| Mortality and Expense (M&E) Charge | Covers the insurance company’s costs of providing death benefits and administrative expenses. | Reduces the potential for growth in your annuity. |

| Investment Management Fees | Charged by the mutual funds or other investment vehicles within the variable annuity sub-accounts. | Can impact the overall returns of your investment. |

| Surrender Charges | Penalties charged if you withdraw your money from the variable annuity before a certain period. | Can discourage early withdrawals and lock in your investment for a longer term. |

| Rider Fees | Charged for optional features, such as income guarantees or death benefits. | Increase the overall cost of the variable annuity. |

| Administrative Fees | Cover the administrative costs associated with managing the variable annuity. | Reduce the potential for growth in your annuity. |

Hidden Costs

Be aware of potential hidden costs or fees that may not be immediately apparent. These can include:

- Sales charges:Some variable annuities may have sales charges or commissions that are paid to the financial advisor who sells you the product. These charges can eat into your returns.

- Annual fees:Some variable annuities may have annual fees, in addition to the other fees mentioned above. These fees can add up over time and reduce your returns.

- Account maintenance fees:Some variable annuity providers may charge account maintenance fees, which are typically small but can add up over time.

Tax Implications of Variable Annuities

Variable annuities have unique tax implications that you should understand before investing. Here’s a breakdown of the key tax considerations:

Tax Implications

| Tax Implications | Explanation |

|---|---|

| Tax-Deferred Growth | Earnings within a variable annuity grow tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them. |

| Withdrawals | Withdrawals from a variable annuity are generally taxed as ordinary income. |

| Distributions | Distributions from a variable annuity may include both earnings and principal. The portion of the distribution that represents earnings is taxed as ordinary income. |

| Death Benefits | Death benefits from a variable annuity are generally tax-free to your beneficiaries. |

Tax Advantages and Disadvantages

- Tax-deferred growth:Tax-deferred growth allows your savings to compound faster, as you’re not paying taxes on the earnings until you withdraw them. This can be a significant advantage over other retirement investment options that are taxed annually.

- Potential for tax-free withdrawals:Some variable annuities offer the potential for tax-free withdrawals, such as for qualified education expenses or medical expenses. However, these options are often subject to limitations and restrictions.

- Tax liability on withdrawals:When you withdraw money from a variable annuity, the earnings portion of the withdrawal is taxed as ordinary income. This can be a disadvantage compared to other retirement investment options, such as Roth IRAs, which offer tax-free withdrawals in retirement.

Final Wrap-Up

Variable annuities offer a unique combination of potential growth and guaranteed income, making them an attractive option for some investors. However, they also come with inherent risks and complexities. This guide has provided a comprehensive overview of variable annuities, equipping you with the knowledge to make informed decisions about whether this investment strategy aligns with your financial goals and risk tolerance.

Remember, it is essential to consult with a qualified financial advisor to determine the best course of action for your specific circumstances.

FAQ Section

What are the main differences between traditional annuities and variable annuities?

Traditional annuities offer fixed payments, while variable annuities provide payments that fluctuate based on the performance of the underlying investments. Variable annuities have the potential for higher returns but also carry greater risk.

Understanding the difference between an ordinary annuity and an annuity due is crucial for accurate financial planning. Annuity Due Is 2024 delves into the nuances of these payment structures, highlighting the impact on present and future values.

Are variable annuities suitable for all investors?

Variable annuities are best suited for investors with a long-term investment horizon and a moderate to high risk tolerance. They are not appropriate for investors who require guaranteed income or are averse to market fluctuations.

How can I reduce the fees associated with variable annuities?

You can reduce fees by carefully comparing different variable annuity contracts and selecting one with lower expense ratios and management fees. Consider opting for contracts with lower surrender charges and look for options with lower mortality and expense risk charges.