Variable Annuity Life Insurance Company 2024: Navigating the evolving landscape of variable annuity life insurance can be daunting. This guide provides a comprehensive overview of this complex financial product, examining its features, benefits, risks, and the current market trends shaping its future.

Annuity value calculators can simplify the process of determining the value of an annuity. Our article, Annuity Value Calculator 2024 , provides information on using these calculators and highlights their advantages. It can help you quickly estimate the value of your annuity and make informed decisions.

We will delve into the operations of variable annuity life insurance companies, exploring their investment strategies, regulatory environment, and the challenges they face. We will also analyze the diverse range of products available, offering insights into their unique characteristics and comparing their key features.

Many people wonder if an annuity is a loan. Our article, Annuity Is Loan 2024 , clarifies the difference between annuities and loans. It explains the unique characteristics of annuities and how they differ from borrowing money.

This comprehensive guide aims to empower individuals with the knowledge necessary to make informed decisions about variable annuity life insurance, ensuring they understand its intricacies and potential implications for their financial well-being.

Finding the right annuity can be overwhelming, but we’ve compiled a list of five popular options in our article, 5 Annuity 2024. It provides information on each annuity type and highlights their key features, making it easier to compare and choose the best fit for your financial goals.

Contents List

- 1 Variable Annuity Life Insurance Company Overview

- 2 Variable Annuity Life Insurance Company Operations

- 3 Variable Annuity Life Insurance Company Products

- 4 Variable Annuity Life Insurance Company in 2024

- 4.1 Current Market Trends Impacting Variable Annuity Life Insurance Companies

- 4.2 Potential Impact of Economic Factors on the Variable Annuity Life Insurance Market, Variable Annuity Life Insurance Company 2024

- 4.3 Emerging Trends and Innovations in Variable Annuity Life Insurance

- 4.4 Top Variable Annuity Life Insurance Companies in 2024

- 5 Investing in Variable Annuity Life Insurance

- 5.1 Investment Options Available Within Variable Annuity Life Insurance Contracts

- 5.2 Risks and Potential Returns Associated with Investment Options

- 5.3 Choosing the Right Variable Annuity Life Insurance Product for Individual Needs

- 5.4 Evaluating the Performance of Variable Annuity Life Insurance Contracts

- 6 Final Conclusion: Variable Annuity Life Insurance Company 2024

- 7 FAQ Explained

Variable Annuity Life Insurance Company Overview

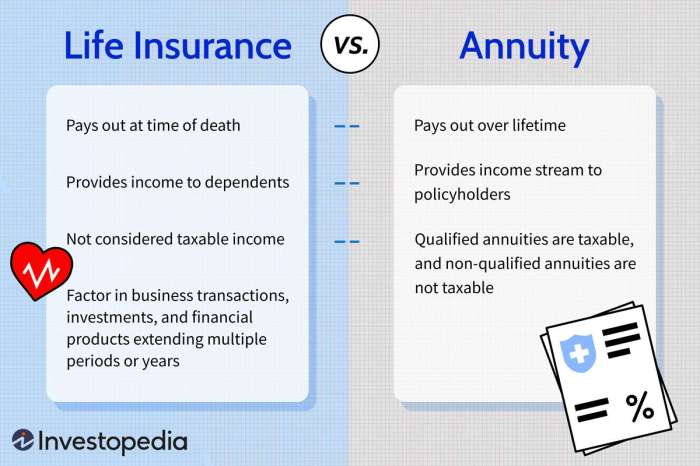

Variable annuity life insurance is a type of insurance that combines life insurance coverage with investment opportunities. This unique product allows policyholders to invest their premiums in a range of sub-accounts, similar to mutual funds, aiming for potential growth. Unlike traditional fixed annuities, which guarantee a fixed rate of return, variable annuities offer the potential for higher returns but also carry the risk of losing principal.

Calculating the value of an annuity is essential for understanding its potential returns. Our article, Calculating Annuity Values 2024 , provides a detailed explanation of the methods used for calculating annuity values. It can help you understand the factors that influence the value of your annuity.

Key Features of Variable Annuity Life Insurance

- Investment Options:Variable annuities provide access to a diverse range of investment options, such as stocks, bonds, and money market accounts. Policyholders can choose from different sub-accounts based on their risk tolerance and investment goals.

- Death Benefit:Variable annuities offer a death benefit, which is paid to beneficiaries upon the policyholder’s death. The death benefit may be a guaranteed amount or a variable amount based on the performance of the investment sub-accounts.

- Living Benefits:Some variable annuity contracts offer living benefits, such as guaranteed minimum income or guaranteed minimum death benefit riders. These riders provide additional protection against market downturns and ensure a certain level of income or death benefit, regardless of investment performance.

Annuity is a financial product that provides regular payments for a specific period of time. You can learn more about it in our article, Annuity Explained 2024. It’s a great way to ensure a steady income stream during retirement, but whether it’s a good idea for you depends on your individual circumstances.

- Tax Deferred Growth:Investment gains within a variable annuity contract are tax deferred, meaning taxes are not paid until the money is withdrawn. This can help individuals accumulate wealth more efficiently.

Potential Benefits and Drawbacks of Variable Annuity Life Insurance

- Potential for Higher Returns:Variable annuities offer the potential for higher returns compared to fixed annuities, as investments can grow based on market performance.

- Investment Flexibility:Policyholders have control over their investment choices, allowing them to adjust their portfolio based on their risk tolerance and market conditions.

- Tax Advantages:Tax deferred growth can help individuals maximize their investment returns over time.

- Risk of Principal Loss:Variable annuities are subject to market fluctuations, and there is a risk of losing principal if investments perform poorly.

- Fees and Expenses:Variable annuities typically have higher fees and expenses compared to traditional life insurance products.

- Complexity:Understanding the intricacies of variable annuities and their investment options can be challenging for some individuals.

Comparison to Other Types of Life Insurance

- Term Life Insurance:Term life insurance provides coverage for a specific period, typically 10 to 30 years. It is generally less expensive than permanent life insurance, but it does not offer any investment features.

- Whole Life Insurance:Whole life insurance provides lifelong coverage and includes a cash value component that grows at a fixed rate. However, whole life insurance premiums are typically higher than term life insurance premiums.

- Universal Life Insurance:Universal life insurance offers flexible premiums and death benefit options. It also includes a cash value component that can be invested in a variety of options, but the returns are not guaranteed.

Variable Annuity Life Insurance Company Operations

Variable annuity life insurance companies play a crucial role in providing and managing these complex financial products. They act as intermediaries between policyholders and the investment markets, offering a range of services to ensure the smooth operation of variable annuity contracts.

Understanding how an annuity works with a specific investment amount is important. Our article, Annuity 70000 2024 , provides insights into the potential returns and features of an annuity with a $70,000 investment. This can help you visualize how your investment might grow over time.

Structure and Operations of a Variable Annuity Life Insurance Company

- Investment Management:Variable annuity companies employ professional investment managers to manage the investment sub-accounts offered to policyholders. These managers are responsible for selecting and allocating investments based on the company’s investment strategy and the specific needs of each sub-account.

- Risk Management:Variable annuity companies have robust risk management systems in place to mitigate potential losses due to market fluctuations or other unforeseen events. They employ risk analysts and actuaries to assess and manage the company’s overall risk exposure.

- Product Development:Variable annuity companies are constantly innovating and developing new products to meet the evolving needs of their customers. They conduct market research and analyze industry trends to identify new opportunities and address emerging challenges.

- Customer Service:Variable annuity companies provide customer service support to policyholders, assisting them with investment decisions, benefit claims, and other inquiries. They maintain a dedicated team of customer service representatives to address any concerns or issues that may arise.

Investment Strategies Employed by Variable Annuity Life Insurance Companies

- Diversification:Variable annuity companies typically employ a diversified investment strategy, allocating investments across different asset classes, such as stocks, bonds, and real estate. This helps to reduce overall risk and improve long-term returns.

- Active Management:Some variable annuity companies use active management strategies, where investment managers actively buy and sell securities based on market conditions and their investment expertise. This approach aims to outperform the market by identifying undervalued investments and capitalizing on market trends.

- Passive Management:Other variable annuity companies utilize passive management strategies, such as index tracking or exchange-traded funds (ETFs). These strategies aim to replicate the performance of a specific market index, such as the S&P 500, with minimal active management.

Regulatory Environment for Variable Annuity Life Insurance Companies

- State Insurance Departments:Variable annuity life insurance companies are regulated by state insurance departments, which oversee their financial solvency, product offerings, and consumer protection measures.

- Securities and Exchange Commission (SEC):The SEC regulates the investment sub-accounts offered within variable annuities, ensuring that they comply with federal securities laws and investor protection regulations.

- Financial Industry Regulatory Authority (FINRA):FINRA regulates the sale and distribution of variable annuities, ensuring that brokers and other financial professionals comply with ethical standards and disclosure requirements.

Risks and Challenges Faced by Variable Annuity Life Insurance Companies

- Market Volatility:Variable annuity companies are exposed to market volatility, which can impact the performance of investment sub-accounts and potentially lead to losses for policyholders.

- Interest Rate Risk:Variable annuity companies are also subject to interest rate risk, as changes in interest rates can affect the value of their investments and the cost of providing guarantees.

- Competition:The variable annuity market is highly competitive, with a large number of companies vying for customers. This can lead to price wars and pressure on profit margins.

- Regulatory Changes:Variable annuity companies must adapt to changes in regulations, which can impact their product offerings and operating costs.

Variable Annuity Life Insurance Company Products

Variable annuity life insurance companies offer a variety of products to meet the diverse needs of their customers. These products differ in their features, benefits, and investment options, providing policyholders with a range of choices based on their individual circumstances and financial goals.

Calculating annuity payments can be a bit tricky, but spreadsheets like Excel can simplify the process. Explore our article, Calculating Annuity Payments In Excel 2024 , for a step-by-step guide on using Excel for your annuity calculations. It can help you understand the potential payouts and make informed decisions.

Types of Variable Annuity Life Insurance Products

- Fixed Indexed Annuity (FIA):FIAs offer a guaranteed minimum return based on the performance of a specific index, such as the S&P 500. However, the return is capped, meaning that policyholders cannot benefit from market gains beyond the cap.

- Variable Annuity with Guaranteed Minimum Income Benefit (GMIB):These annuities provide a guaranteed minimum income stream during retirement, regardless of the performance of the investment sub-accounts. This feature offers peace of mind and protects against market downturns.

- Variable Annuity with Guaranteed Minimum Death Benefit (GMDB):These annuities guarantee a minimum death benefit, ensuring that beneficiaries receive a certain amount even if the investment sub-accounts perform poorly.

- Variable Annuity with Living Benefits:These annuities offer various living benefits, such as long-term care protection or guaranteed lifetime withdrawal benefits. These benefits provide additional financial security and protection against unforeseen events.

Comparison of Variable Annuity Life Insurance Products

| Product Type | Key Features | Benefits | Drawbacks |

|---|---|---|---|

| Fixed Indexed Annuity (FIA) | Guaranteed minimum return based on an index, capped return | Guaranteed minimum return, protection against market downturns | Limited potential for growth, capped return |

| Variable Annuity with Guaranteed Minimum Income Benefit (GMIB) | Guaranteed minimum income stream during retirement, investment options | Guaranteed income stream, protection against market downturns | Higher premiums, limited investment flexibility |

| Variable Annuity with Guaranteed Minimum Death Benefit (GMDB) | Guaranteed minimum death benefit, investment options | Guaranteed death benefit, protection against market downturns | Higher premiums, limited investment flexibility |

| Variable Annuity with Living Benefits | Various living benefits, such as long-term care protection or guaranteed lifetime withdrawal benefits, investment options | Comprehensive protection against various risks, flexibility | Higher premiums, complex product structure |

Variable Annuity Life Insurance Company in 2024

The variable annuity life insurance market is constantly evolving, influenced by various factors such as economic conditions, regulatory changes, and consumer preferences. In 2024, several trends are shaping the landscape of this industry, impacting the operations and product offerings of variable annuity life insurance companies.

Current Market Trends Impacting Variable Annuity Life Insurance Companies

- Low Interest Rates:Persistent low interest rates have made it challenging for variable annuity companies to generate attractive returns on their fixed income investments. This has led to a decline in the popularity of traditional fixed annuities and increased demand for variable annuities, which offer the potential for higher returns.

Planning for retirement requires careful calculations. Our article, Calculating Retirement Annuity 2024 , offers insights into calculating your retirement annuity payments. It covers essential factors to consider and provides guidance on estimating your potential retirement income.

- Increased Focus on Living Benefits:As individuals are living longer and facing greater healthcare expenses, there is a growing demand for variable annuities with living benefits, such as long-term care protection or guaranteed lifetime withdrawal benefits. These benefits provide financial security and peace of mind during retirement.

To get a comprehensive understanding of annuities, explore our article, Annuity Is 2024. It covers various aspects of annuities, including their different types, benefits, and potential drawbacks. This information can help you make informed decisions about incorporating annuities into your financial plan.

- Technological Advancements:The adoption of digital technologies, such as online platforms and mobile apps, is transforming the way variable annuity companies interact with their customers. These advancements offer greater transparency, efficiency, and personalized service.

- Regulatory Scrutiny:Variable annuity products have been subject to increased regulatory scrutiny in recent years, with regulators focusing on ensuring that these products are fair and transparent for consumers. This has led to changes in product design and distribution practices.

Potential Impact of Economic Factors on the Variable Annuity Life Insurance Market, Variable Annuity Life Insurance Company 2024

- Inflation:Rising inflation can erode the purchasing power of investment returns, potentially impacting the performance of variable annuity contracts. Variable annuity companies may need to adjust their investment strategies to mitigate the impact of inflation.

- Economic Recession:A recession can lead to market volatility and potential losses for investors. Variable annuity companies may need to offer additional protection features, such as guaranteed minimum death benefits or income guarantees, to reassure policyholders during uncertain economic times.

- Interest Rate Hikes:Interest rate hikes can increase the cost of providing guarantees within variable annuity contracts. Variable annuity companies may need to adjust their pricing models or product offerings to reflect the higher cost of capital.

Emerging Trends and Innovations in Variable Annuity Life Insurance

- Personalized Investment Solutions:Variable annuity companies are increasingly offering personalized investment solutions tailored to the specific needs and risk tolerance of individual policyholders. This approach utilizes sophisticated algorithms and data analytics to create customized portfolios that align with each customer’s financial goals.

To understand if an annuity is a good choice for you, consider factors like your risk tolerance and financial goals. You can find insights on this topic in our article, Annuity Is It A Good Idea 2024. It’s essential to weigh the pros and cons carefully before making a decision.

- Hybrid Products:There is a growing trend towards hybrid products that combine features of traditional fixed annuities with the investment potential of variable annuities. These products offer a balance between guaranteed returns and potential growth, catering to individuals seeking a more conservative approach.

- Retirement Income Planning Tools:Variable annuity companies are developing innovative retirement income planning tools that help policyholders estimate their future income needs and create personalized retirement income strategies. These tools provide valuable insights and guidance for individuals seeking to secure their financial future.

Top Variable Annuity Life Insurance Companies in 2024

- [Company Name 1]:[Brief description of the company’s focus, products, and market presence]

- [Company Name 2]:[Brief description of the company’s focus, products, and market presence]

- [Company Name 3]:[Brief description of the company’s focus, products, and market presence]

- [Company Name 4]:[Brief description of the company’s focus, products, and market presence]

- [Company Name 5]:[Brief description of the company’s focus, products, and market presence]

Investing in Variable Annuity Life Insurance

Variable annuities offer a range of investment options within their contracts, allowing policyholders to customize their portfolio based on their risk tolerance and financial goals. However, it is crucial to understand the risks and potential returns associated with these investment options before making any decisions.

One of the key features of annuities is tax deferral. Our article, Is Annuity Tax Deferred 2024 , explains how tax deferral works with annuities and its potential benefits. It can help you understand how this feature might impact your tax liability in the future.

Investment Options Available Within Variable Annuity Life Insurance Contracts

- Equity Sub-accounts:These sub-accounts invest primarily in stocks, offering the potential for higher returns but also carrying a higher level of risk. Equity sub-accounts can be further diversified across different sectors, industries, and market capitalization.

- Fixed Income Sub-accounts:These sub-accounts invest in bonds, which are generally considered less risky than stocks. Fixed income sub-accounts provide a steady stream of income and can help to stabilize a portfolio during market downturns.

- Money Market Sub-accounts:These sub-accounts invest in short-term, low-risk securities, such as Treasury bills and commercial paper. Money market sub-accounts provide a safe haven for cash and can be used to meet short-term liquidity needs.

- Target-Date Funds:These funds automatically adjust their asset allocation over time, becoming more conservative as the investor approaches their target retirement date. Target-date funds provide a convenient and diversified investment option for individuals who are unsure how to allocate their assets.

Risks and Potential Returns Associated with Investment Options

- Equity Sub-accounts:Equity sub-accounts offer the potential for higher returns, but they also carry a higher level of risk. Stock prices can fluctuate significantly, and there is a risk of losing principal if the market performs poorly.

- Fixed Income Sub-accounts:Fixed income sub-accounts are generally considered less risky than equity sub-accounts, but they are not immune to market fluctuations. Interest rate changes can affect the value of bonds, and there is a risk of losing principal if interest rates rise.

There are different types of annuities available, and each has its unique features. Our article, 8 Annuities 2024 , explores eight popular annuity types, providing insights into their characteristics and potential benefits. It can help you identify which type might be most suitable for your needs.

- Money Market Sub-accounts:Money market sub-accounts are considered low-risk, but they typically offer lower returns than other investment options. These sub-accounts are suitable for individuals who prioritize safety and liquidity.

- Target-Date Funds:Target-date funds provide a diversified investment option, but their performance is dependent on the underlying investments. The asset allocation of these funds can change over time, which may not always align with an individual’s investment goals.

Choosing the Right Variable Annuity Life Insurance Product for Individual Needs

- Risk Tolerance:Consider your risk tolerance and how much volatility you are comfortable with. If you are risk-averse, you may prefer a product with a guaranteed minimum return or a higher allocation to fixed income investments.

- Investment Goals:Determine your investment goals, such as retirement income, long-term growth, or protection against market downturns. The right variable annuity product should align with your financial objectives.

- Time Horizon:Consider your time horizon for investing. If you have a long time horizon, you may be able to tolerate more risk and invest in equity sub-accounts. If you have a shorter time horizon, you may prefer a more conservative approach.

To accurately calculate the present value of an annuity, you can use a PV calculator. Explore our article, Pv Calculator Annuity 2024 , for a guide on using PV calculators for annuity calculations. This can help you understand the current value of your future annuity payments.

- Fees and Expenses:Compare the fees and expenses associated with different variable annuity products. Higher fees can significantly impact your investment returns over time.

Evaluating the Performance of Variable Annuity Life Insurance Contracts

- Investment Returns:Monitor the performance of your investment sub-accounts and compare them to benchmarks, such as market indices or other similar investment options. This will help you assess the effectiveness of your investment strategy.

- Fees and Expenses:Regularly review the fees and expenses associated with your variable annuity contract. High fees can erode your investment returns, so it is essential to keep them under control.

- Living Benefits:If your variable annuity contract includes living benefits, ensure that you understand the terms and conditions of these benefits. This will help you determine if they meet your needs and provide the level of protection you desire.

- Death Benefit:Review the death benefit provisions of your variable annuity contract. Ensure that the death benefit is sufficient to meet your beneficiaries’ financial needs.

Final Conclusion: Variable Annuity Life Insurance Company 2024

Variable annuity life insurance is a multifaceted financial product with both potential benefits and risks. Understanding its nuances is crucial for making informed investment decisions. By carefully considering the investment options, potential returns, and regulatory environment, individuals can determine if variable annuity life insurance aligns with their financial goals and risk tolerance.

As the market continues to evolve, staying informed about emerging trends and innovations will be key to navigating this complex financial landscape.

FAQ Explained

What are the tax implications of variable annuity life insurance?

The tax implications of variable annuity life insurance can be complex and vary depending on the specific product and individual circumstances. It’s crucial to consult with a tax professional for personalized advice.

What are the surrender charges associated with variable annuity life insurance?

Annuity contracts can be quite complex, and it’s important to understand their structure. Our article, Is Annuity A Qualified Plan 2024 , delves into the details of qualified annuities and their features. This knowledge can help you determine if an annuity aligns with your retirement planning needs.

Surrender charges are fees levied when withdrawing funds from a variable annuity before a certain period. These charges can vary significantly depending on the product and the length of time the annuity has been held. It’s essential to understand the surrender charge structure before investing in a variable annuity.

How does variable annuity life insurance compare to traditional life insurance?

Variable annuity life insurance differs from traditional life insurance in its investment component. While traditional life insurance provides a death benefit, variable annuities offer the potential for investment growth alongside a death benefit. However, variable annuities carry investment risk, unlike traditional life insurance, which provides a guaranteed death benefit.

Understanding the tax implications of annuities is crucial. Check out our article, Annuity Is Taxable Or Not 2024 , to learn about the tax treatment of annuities. You’ll find information on whether the payments are taxed and how it might affect your overall financial planning.

Is variable annuity life insurance suitable for everyone?

Variable annuity life insurance is not suitable for everyone. It’s essential to carefully consider your risk tolerance, financial goals, and time horizon before investing. Consult with a financial advisor to determine if variable annuity life insurance aligns with your individual needs.