Variable Annuity 2024: A powerful tool for retirement planning, variable annuities offer the potential for growth while providing some downside protection. But understanding their complexities and navigating the market in 2024 requires careful consideration.

This comprehensive guide will delve into the key features, benefits, and risks of variable annuities, offering insights into their role in retirement planning and how they stack up against other investment options.

Understanding the date your annuity begins is crucial. This article discusses the specifics of annuity start dates. Variable annuities often involve a specific type of account. This article delves into the characteristics of variable annuity accounts.

Contents List

- 1 Variable Annuities: An Overview

- 2 Understanding Variable Annuity Components: Variable Annuity 2024

- 3 Variable Annuity Features and Benefits

- 4 Variable Annuity Fees and Expenses

- 5 Variable Annuities in 2024: Current Market Trends

- 6 Considerations for Choosing a Variable Annuity

- 7 Concluding Remarks

- 8 FAQ Guide

Variable Annuities: An Overview

Variable annuities are a type of retirement savings product that offers the potential for growth through investments in a variety of sub-accounts. These sub-accounts are similar to mutual funds, allowing investors to diversify their portfolio across different asset classes, such as stocks, bonds, and real estate.

Unlike traditional or Roth IRAs, which provide fixed interest rates or tax advantages, variable annuities offer the opportunity for higher returns, but also come with greater risk.

Definition and Key Features

Variable annuities are insurance contracts that provide a guaranteed death benefit and the potential for tax-deferred growth. They function as a retirement savings vehicle, offering a combination of investment flexibility and insurance protection. The key features of variable annuities include:

- Investment Options:Variable annuities allow investors to choose from a variety of sub-accounts, each representing a different investment strategy or asset class. This flexibility enables investors to tailor their portfolio based on their risk tolerance and investment objectives.

- Tax-Deferred Growth:Earnings within a variable annuity are not taxed until they are withdrawn in retirement. This tax-deferred growth allows investments to compound over time, potentially leading to higher returns.

- Guaranteed Death Benefit:Variable annuities typically include a guaranteed death benefit, which ensures that a beneficiary will receive a minimum payout upon the policyholder’s death. This feature provides a safety net and can be particularly valuable for those with dependents.

- Living Benefits:Some variable annuities offer living benefits, such as guaranteed income payments or protection against market downturns. These features can provide additional security and income stability during retirement.

Variable Annuities vs. Other Retirement Savings Products

Variable annuities differ from other retirement savings products, such as traditional or Roth IRAs, in several key ways. Here’s a comparison:

| Feature | Variable Annuity | Traditional IRA | Roth IRA |

|---|---|---|---|

| Investment Options | Wide range of sub-accounts | Limited investment options | Limited investment options |

| Tax Treatment | Tax-deferred growth | Tax-deductible contributions, taxable withdrawals | Tax-free withdrawals in retirement |

| Guaranteed Death Benefit | Typically included | Not included | Not included |

| Living Benefits | May be available | Not available | Not available |

| Fees and Expenses | Higher than traditional IRAs | Lower than variable annuities | Lower than variable annuities |

Understanding Variable Annuity Components: Variable Annuity 2024

Variable annuities consist of several key components that work together to provide investment and insurance protection. These components include:

Sub-Accounts

Variable annuities are structured around sub-accounts, which are similar to mutual funds. Each sub-account represents a different investment strategy or asset class. Investors can allocate their funds across different sub-accounts to create a diversified portfolio. Examples of sub-accounts include:

- Stock Funds:Invest in a basket of stocks, providing potential for growth but also higher risk.

- Bond Funds:Invest in bonds, offering lower risk and potential for steady income.

- Real Estate Funds:Invest in real estate, offering diversification and potential for long-term growth.

Investment Options

The investment options available within a variable annuity will vary depending on the insurance company offering the product. However, most variable annuities offer a wide range of sub-accounts to choose from, allowing investors to tailor their portfolio based on their risk tolerance and investment objectives.

Some common investment options include:

- Target-Date Funds:These funds automatically adjust their asset allocation over time, becoming more conservative as retirement approaches.

- Index Funds:These funds track a specific market index, such as the S&P 500, offering low-cost exposure to the broader market.

- Managed Accounts:These accounts are managed by professional investment advisors, providing personalized investment strategies.

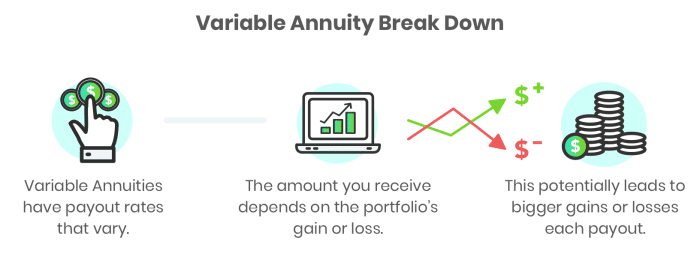

Market Fluctuations

The performance of a variable annuity is directly tied to the performance of the underlying investments in its sub-accounts. This means that market fluctuations can have a significant impact on the value of a variable annuity. During periods of market growth, the value of a variable annuity is likely to increase.

However, during periods of market decline, the value of a variable annuity may decrease.

Variable Annuity Features and Benefits

Variable annuities offer several features and benefits that can be attractive to retirement savers. These features include:

Guaranteed Death Benefit

A guaranteed death benefit is a feature that ensures a minimum payout to a beneficiary upon the policyholder’s death. The death benefit is typically based on the initial investment amount, plus any accumulated earnings. This feature provides a safety net for beneficiaries and can help protect them from financial hardship.

Annuity options for individuals turning 65 in 2024 are explored in this article. A basic annuity calculator can help you understand the fundamentals. This calculator provides a simplified approach.

Tax-Deferred Growth

Earnings within a variable annuity are not taxed until they are withdrawn in retirement. This tax-deferred growth allows investments to compound over time, potentially leading to higher returns. By delaying tax payments, investors can maximize their investment returns and potentially accumulate a larger nest egg for retirement.

Variable annuities have unique tax implications. This article delves into the taxation of variable annuities. If you’re using the Groww platform, this calculator can assist with your annuity calculations.

Living Benefits

Some variable annuities offer living benefits, which provide additional income protection and security during retirement. These benefits can include:

- Guaranteed Income Payments:These benefits provide a guaranteed stream of income during retirement, regardless of market performance.

- Market Downturn Protection:These benefits protect against losses during market downturns, providing a safety net for retirement savings.

Variable Annuity Fees and Expenses

Variable annuities come with various fees and expenses that can impact overall investment returns. It is essential to understand these fees before investing in a variable annuity. Common fees include:

Types of Fees

- Mortality and Expense (M&E) Charges:These charges cover the cost of insurance and administrative expenses.

- Investment Management Fees:These fees are charged by the investment managers who oversee the sub-accounts.

- Surrender Charges:These charges are applied if you withdraw funds from the annuity before a certain period.

- Administrative Fees:These fees cover the costs of managing the annuity contract.

Expense Ratios, Variable Annuity 2024

Expense ratios measure the annual cost of managing a variable annuity. They are expressed as a percentage of the annuity’s assets. Expense ratios can vary widely among different variable annuity products, so it is important to compare them carefully. Expense ratios can have a significant impact on overall investment returns.

For example, an expense ratio of 2% means that 2% of your investment will be used to cover fees and expenses each year. Over time, these fees can significantly reduce your investment returns.

Impact of Fees

Fees can have a significant impact on overall investment returns. It is important to carefully consider the fees associated with a variable annuity before investing. Higher fees can significantly reduce investment returns, especially over the long term. For example, if you invest $100,000 in a variable annuity with an expense ratio of 2%, you will pay $2,000 in fees each year.

Annuity options within a 401k plan can be beneficial. This article explains more about annuities in 401k plans. For those seeking a growing annuity calculator, this resource is a great starting point.

Over 20 years, this would amount to $40,000 in fees, which could significantly reduce your investment returns.

Variable Annuities in 2024: Current Market Trends

The variable annuity market is constantly evolving, influenced by factors such as interest rates, market volatility, and regulatory changes. Here’s a look at some of the key trends impacting variable annuities in 2024:

Impact of Interest Rates and Market Volatility

Interest rates and market volatility have a significant impact on the performance of variable annuities. Rising interest rates can make fixed income investments, such as bonds, more attractive, potentially leading to a shift in investor preference away from variable annuities.

Increased market volatility can also make investors more risk-averse, leading to a decline in demand for variable annuities.

Regulatory Changes and Industry Trends

The insurance industry is subject to ongoing regulatory changes, which can impact variable annuities. Recent regulatory changes have focused on transparency and consumer protection. These changes may affect the fees and features of variable annuities. The insurance industry is also witnessing a shift towards digital platforms and technology-driven solutions.

This trend could lead to more efficient and accessible variable annuity products in the future.

The question of whether an annuity is better than drawdown is a common one. This article compares these two retirement income strategies.

Challenges and Opportunities

Variable annuities face several challenges in the current market environment, including competition from other retirement savings products, low interest rates, and market volatility. However, variable annuities also offer several opportunities, such as the potential for higher returns and the flexibility to customize investment strategies.

Considerations for Choosing a Variable Annuity

Choosing a variable annuity requires careful consideration of your investment objectives, risk tolerance, and time horizon. Here are some key factors to consider:

Investment Objectives

What are your investment goals? Are you looking for growth, income, or a combination of both? Your investment objectives will help you determine the appropriate asset allocation and sub-accounts for your variable annuity.

Risk Tolerance

How much risk are you willing to take? Your risk tolerance will influence the type of sub-accounts you choose for your variable annuity. If you are risk-averse, you may prefer to allocate more of your funds to lower-risk investments, such as bonds.

If you are comfortable with higher risk, you may choose to allocate more of your funds to stocks.

For those in Kenya, this annuity calculator can be a valuable tool. If you’re using Excel for your financial calculations, this article guides you on how to calculate interest rates for annuities.

Time Horizon

How long do you plan to invest in the variable annuity? Your time horizon will influence your investment strategy. If you have a long time horizon, you may be able to take on more risk. If you have a short time horizon, you may prefer to invest in more conservative investments.

Deciding whether an annuity is a good investment in 2024 is a crucial step. This article provides a detailed analysis to help you make an informed decision. If you’re thinking about an annuity with a larger sum, this article explores the specifics of a 2 million dollar annuity.

Comparing Variable Annuity Products

When comparing different variable annuity products, consider the following factors:

- Fees and Expenses:Compare the expense ratios and other fees associated with different products.

- Investment Options:Consider the range of sub-accounts available and whether they align with your investment objectives.

- Guaranteed Death Benefit:Compare the death benefit guarantees offered by different products.

- Living Benefits:Consider whether the product offers any living benefits, such as guaranteed income payments or market downturn protection.

Consulting with a Financial Advisor

It is important to consult with a qualified financial advisor before investing in a variable annuity. A financial advisor can help you understand the complexities of variable annuities, evaluate your investment objectives and risk tolerance, and choose the best product for your needs.

Concluding Remarks

As you navigate the world of variable annuities, remember that informed decision-making is key. Understanding the nuances of this product, including its potential for growth and its inherent risks, is crucial. With careful planning and a thoughtful approach, variable annuities can play a valuable role in building a secure and prosperous retirement.

If you’re considering a fixed annuity for your IRA in 2024, this article offers some helpful insights. You might also be interested in learning about the current payments for annuitants, as detailed in this article.

FAQ Guide

Are variable annuities right for everyone?

Variable annuities are not a one-size-fits-all solution. They can be complex and require a certain level of risk tolerance. It’s crucial to consult with a financial advisor to determine if a variable annuity aligns with your individual financial goals and risk profile.

What are the tax implications of variable annuities?

Variable annuities offer tax-deferred growth, meaning you won’t pay taxes on investment earnings until you withdraw them in retirement. However, withdrawals are typically taxed as ordinary income.

How do I choose the right variable annuity?

Consider factors such as your investment objectives, risk tolerance, and time horizon. Compare fees, investment options, and guaranteed benefits offered by different variable annuity products. It’s essential to consult with a financial advisor for personalized guidance.