Variable Annuity After Annuitization 2024: A pivotal moment in your retirement planning journey, annuitizing your variable annuity in 2024 presents both opportunities and challenges. This guide explores the key considerations, advantages, and potential drawbacks of taking this step, offering insights into the income stream, growth potential, tax implications, and crucial factors to weigh before making your decision.

BMO offers a variety of annuity products, and they also have an annuity calculator that can help you estimate your potential income stream. You can access the BMO Annuity Calculator here. The calculator is easy to use and can help you compare different annuity options and make an informed decision about which one is right for you.

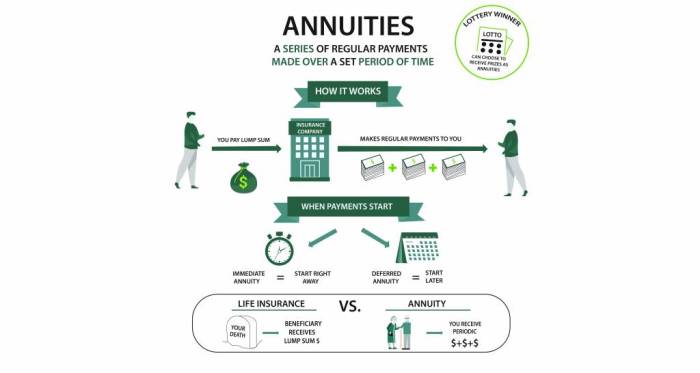

Annuitization transforms your variable annuity from a growth-oriented investment into a steady stream of income for life. This transformation comes with significant implications, particularly in today’s volatile market environment. Understanding the intricacies of annuitization, its impact on your retirement income, and the potential tax implications is crucial to making an informed decision.

Contents List

Variable Annuity Basics

A variable annuity is a type of retirement savings product that offers the potential for growth while providing income guarantees. Variable annuities are characterized by their investment flexibility, offering a range of investment options within the contract. These options typically include mutual funds, sub-accounts, and other investment vehicles, allowing individuals to customize their investment portfolio based on their risk tolerance and financial goals.

Excel is a powerful spreadsheet program that can be used to calculate annuities. You can find a guide on how to do this by clicking here. Excel has built-in functions for calculating annuities, which makes it easy to calculate the present value, future value, and payment amount of an annuity.

Underlying Investment Portfolio

The performance of the underlying investment portfolio directly impacts the value of a variable annuity. The value of the annuity fluctuates with the market performance of the chosen investments. This means that, unlike fixed annuities, variable annuities don’t guarantee a fixed rate of return.

Annuity 3 2024, also known as a fixed annuity, is a type of annuity that guarantees a fixed rate of return. This means that you will know exactly how much income you will receive each year. To learn more about Annuity 3 2024, click here.

This type of annuity is a good option for individuals who are looking for a low-risk investment with a predictable income stream.

However, they offer the potential for higher returns, which can be beneficial for long-term investors.

Calculating annuities on a TI-84 calculator can be a bit tricky, but it’s definitely possible. If you need help with this, you can find some helpful resources here. The TI-84 calculator has a built-in function for calculating annuities, but it’s important to understand the different inputs and outputs before using it.

Annuitization, Variable Annuity After Annuitization 2024

Annuitization is the process of converting the accumulated value of a variable annuity into a guaranteed stream of income payments. Once annuitized, the annuity holder receives regular payments for life, typically starting at a specific age. Annuitization is a key feature of variable annuities, providing a source of retirement income that can help ensure financial security in later years.

If you inherited an annuity, you might be wondering if it’s taxable. The answer is, it depends. You can find out more by clicking here. The taxability of an inherited annuity depends on several factors, including the type of annuity and the terms of the inheritance.

It’s always best to consult with a tax professional to determine the tax implications of your specific situation.

Variable Annuity After Annuitization in 2024

For variable annuity holders considering annuitization in 2024, it’s essential to carefully evaluate the current market environment and the potential implications for their income stream. Several factors come into play, including interest rates, inflation, and the performance of the underlying investment portfolio.

Considerations for Annuitization

- Market Volatility:In a volatile market, the value of a variable annuity can fluctuate, impacting the income stream generated after annuitization. It’s crucial to assess the potential for market downturns and their impact on your retirement income.

- Interest Rates:Interest rates play a significant role in annuity payouts. Rising interest rates can generally lead to higher annuity payouts, while declining rates can have the opposite effect. It’s essential to consider the current interest rate environment and its potential impact on your income stream.

An annuity NPV calculator is a useful tool for determining the present value of an annuity. You can find a calculator by clicking here. This can help you make informed decisions about whether or not to invest in an annuity, as it allows you to compare the present value of the annuity to the cost of purchasing it.

- Inflation:Inflation can erode the purchasing power of your annuity payments over time. Consider the potential for inflation to impact your long-term retirement income. Some variable annuity contracts offer inflation protection features, which can help mitigate the impact of rising prices.

Calculating the future value of an annuity compounded monthly can be a bit more complex than calculating the future value of a simple annuity. You can learn more about this by clicking here. It’s important to use the correct formula and inputs to ensure that you are getting an accurate calculation.

Advantages and Disadvantages

Annuitizing a variable annuity can offer both advantages and disadvantages. It’s essential to weigh these factors carefully before making a decision.

- Advantages:

- Guaranteed income for life: Annuitization provides a guaranteed stream of income that can’t be outlived.

- Protection against market volatility: Once annuitized, your income stream is no longer subject to market fluctuations.

- Potential for tax advantages: Depending on the specific annuitization options chosen, there may be tax advantages associated with receiving annuity payments.

- Disadvantages:

- Limited growth potential: Once annuitized, your annuity payments are fixed, and there is no further opportunity for investment growth.

- Irreversible decision: Annuitization is an irreversible decision. Once you annuitize your contract, you can’t access the principal or change the payout options.

- Potential for lower returns: In a rising market, the potential for growth from a variable annuity can be limited after annuitization.

Annuitization Options

Variable annuity holders have various annuitization options available to them. These options can differ in terms of payment structures, income guarantees, and tax implications. Here are some common annuitization options:

- Life Annuity:This option provides payments for the lifetime of the annuitant. The payments typically stop upon the annuitant’s death.

- Joint Life Annuity:This option provides payments for the lifetime of two individuals, such as a couple. The payments typically stop upon the death of the second annuitant.

- Period Certain Annuity:This option provides payments for a specific period of time, regardless of the annuitant’s lifespan. If the annuitant dies before the period ends, payments continue to a beneficiary.

- Guaranteed Minimum Income Benefit (GMIB):This option provides a minimum guaranteed income stream, even if the value of the underlying investment portfolio declines.

Income Stream and Growth Potential

The income stream generated from a variable annuity after annuitization is influenced by several factors, including the accumulated value of the annuity, the annuitization options chosen, and the prevailing interest rates.

An annuity can be a valuable tool for financial planning, especially for individuals who are 85 years old or older. To learn more about annuities for those 85 years old, click here. Annuities can provide a guaranteed income stream for life, which can help seniors meet their financial needs and maintain their independence.

Factors Influencing Income Stream

- Accumulated Value:The higher the accumulated value of the annuity, the higher the income stream generated after annuitization.

- Annuitization Options:The specific annuitization option chosen can impact the income stream. For example, a life annuity will typically generate higher monthly payments than a period certain annuity.

- Interest Rates:Interest rates can influence the payout rates offered by insurance companies. Higher interest rates generally lead to higher annuity payouts.

Growth Potential

Once annuitized, a variable annuity’s growth potential is limited. The income stream is fixed and does not fluctuate with market performance. However, some annuitization options, such as GMIBs, can provide a minimum guaranteed income stream, offering some protection against market downturns.

The HP10bii calculator is a popular choice for calculating annuities. You can learn more about how to use it by clicking here. The HP10bii has a dedicated function for calculating annuities, which makes it easy to calculate the present value, future value, and payment amount of an annuity.

Inflation

Inflation can erode the purchasing power of an annuitized variable annuity over time. It’s essential to consider the potential impact of inflation on your long-term retirement income. Some variable annuity contracts offer inflation protection features, which can help mitigate the impact of rising prices.

Tax Implications: Variable Annuity After Annuitization 2024

The tax implications of annuitizing a variable annuity can vary depending on the specific annuitization options chosen and the individual’s tax situation. It’s crucial to consult with a tax advisor to understand the potential tax implications of annuitization.

Tax Treatment of Annuity Payments

Annuity payments are generally taxed as ordinary income. However, the portion of each payment that represents a return of principal is tax-free. The tax treatment of annuity payments can be complex, and it’s essential to understand the specific rules and regulations that apply to your situation.

An annuity of 2 million dollars is a significant sum of money that can provide a substantial income stream. To learn more about Annuity 2 Million 2024, click here. It’s important to understand the different types of annuities and their features before making a decision about how to use this type of financial product.

Potential Tax Advantages

- Tax-Deferred Growth:The earnings within a variable annuity grow tax-deferred, meaning taxes are not paid until the funds are withdrawn or annuitized.

- Tax-Free Principal:The portion of each annuity payment that represents a return of principal is tax-free.

Potential Tax Disadvantages

- Taxable Income:The portion of each annuity payment that represents earnings is taxed as ordinary income.

- Potential for Higher Taxes:Annuitization can trigger a taxable event, potentially resulting in a higher tax burden.

Examples of Tax Implications

The tax implications of annuitization can vary depending on the specific annuitization options chosen. For example, if you choose a life annuity, the entire amount of each payment may be taxed as ordinary income. However, if you choose a period certain annuity, the portion of each payment that represents a return of principal may be tax-free.

An FV calculator is a great tool for calculating the future value of an annuity. To find a calculator that can help you with this, you can click here. By entering the relevant information, such as the payment amount, interest rate, and number of periods, you can calculate the future value of an annuity and see how your investment will grow over time.

Considerations for Variable Annuity Holders

Before annuitizing a variable annuity, it’s essential for holders to carefully consider several factors, including their financial goals, risk tolerance, and tax situation. It’s also essential to understand the potential risks and rewards associated with annuitization.

NerdWallet offers a variety of financial tools, including an annuity calculator. You can access the NerdWallet Annuity Calculator by clicking here. This calculator can help you compare different annuity options and estimate your potential income stream.

Key Factors to Consider

- Financial Goals:What are your retirement income goals? Annuitization can provide a guaranteed stream of income, but it also limits growth potential. It’s essential to ensure that annuitization aligns with your financial goals.

- Risk Tolerance:Are you comfortable with the potential for market volatility? Annuitization removes the risk of market downturns, but it also limits the potential for investment growth.

- Tax Situation:How will annuitization impact your tax liability? It’s essential to understand the tax implications of annuitization before making a decision.

- Health and Life Expectancy:Your health and life expectancy can influence your annuitization decisions. If you expect to live a long life, a life annuity may be a good option. However, if you have a shorter life expectancy, a period certain annuity may be more suitable.

An annuity is not technically a loan, but it can be used to finance a loan. To learn more about this, you can click here. This is because the regular payments of an annuity can be used to make loan payments.

This can be a good option for individuals who are looking for a way to pay off a loan over time.

Best Practices for Annuitization

- Consult with a Financial Advisor:A financial advisor can help you evaluate your options and determine the best annuitization strategy for your situation.

- Review the Contract:Carefully review the terms and conditions of your variable annuity contract before annuitizing.

- Consider Your Options:Explore the various annuitization options available to you and choose the one that best meets your needs.

- Seek Tax Advice:Consult with a tax advisor to understand the tax implications of annuitization.

Risks and Rewards

Annuitization can offer both risks and rewards. It’s essential to carefully weigh these factors before making a decision.

- Risks:

- Limited growth potential: Once annuitized, your income stream is fixed, and there is no further opportunity for investment growth.

- Irreversible decision: Annuitization is an irreversible decision. Once you annuitize your contract, you can’t access the principal or change the payout options.

- Potential for lower returns: In a rising market, the potential for growth from a variable annuity can be limited after annuitization.

- Rewards:

- Guaranteed income for life: Annuitization provides a guaranteed stream of income that can’t be outlived.

- Protection against market volatility: Once annuitized, your income stream is no longer subject to market fluctuations.

- Potential for tax advantages: Depending on the specific annuitization options chosen, there may be tax advantages associated with receiving annuity payments.

Final Review

Navigating the world of variable annuities after annuitization in 2024 requires careful consideration. By understanding the key factors, exploring available options, and weighing the potential risks and rewards, you can make a decision that aligns with your retirement goals and financial security.

This guide provides a starting point for your research and exploration, empowering you to make informed choices about your retirement income.

Annuity M 2024 is a type of annuity that is designed to provide a guaranteed income stream for a specific period of time. You can learn more about it here. This type of annuity is often used by individuals who are looking to supplement their retirement income or to provide financial security for their loved ones.

Answers to Common Questions

What is the difference between a fixed and variable annuity?

A fixed annuity guarantees a specific rate of return, while a variable annuity’s return is tied to the performance of underlying investments. Fixed annuities provide predictable income, while variable annuities offer potential for growth but also carry investment risk.

An annuity is a series of equal periodic payments that are made over a specific period of time. You can find more information about it here. Annuities are often used for retirement planning, but they can also be used for other purposes, such as saving for a child’s education or paying off a debt.

What are the potential risks of annuitizing a variable annuity?

Risks include the potential for lower-than-expected income if market performance is poor, the loss of access to your investment principal, and the possibility of outliving your annuity payments.

How can I determine if annuitizing my variable annuity is the right decision for me?

Consult with a financial advisor to assess your individual circumstances, risk tolerance, and retirement goals. They can help you determine if annuitization aligns with your overall financial plan.