Variable Annuity Calculator 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Variable annuities, a popular retirement savings option, offer the potential for growth but also come with inherent risks.

An annuity of R200,000 can be a valuable financial asset. The Annuity 200k 2024 page offers information on how this type of annuity can work for you.

Understanding these risks and potential rewards is crucial for making informed financial decisions. This guide delves into the world of variable annuities, exploring their intricacies and providing a comprehensive overview of how to use a variable annuity calculator to assess your retirement savings potential.

There are different types of annuities, and the 3 Annuity 2024 page provides an overview of some of the most common types.

The Variable Annuity Calculator 2024 is a powerful tool that can help you understand the potential impact of various factors on your retirement savings. By inputting information about your current financial situation, investment preferences, and retirement goals, you can gain valuable insights into the potential growth of your investments.

Annuity calculators can be a helpful tool for planning your retirement in South Africa. You can use a tool like the Annuity Calculator South Africa 2024 to see how much income you can expect from your savings. You can also use it to see how much you’ll need to save each month to reach your retirement goals.

This guide will walk you through the process of using a variable annuity calculator, highlighting the key factors to consider and providing practical tips for interpreting the results.

Contents List

- 1 Introduction to Variable Annuities

- 2 Understanding Variable Annuity Calculators

- 3 Factors Affecting Variable Annuity Calculations

- 4 Using a Variable Annuity Calculator in 2024

- 5 Considerations for Choosing a Variable Annuity: Variable Annuity Calculator 2024

- 6 Potential Risks and Limitations of Variable Annuities

- 7 Alternative Retirement Savings Options

- 8 Resources and Further Information

- 9 Closing Summary

- 10 FAQ Section

Introduction to Variable Annuities

Variable annuities are a type of retirement savings product that offers the potential for growth while providing some protection against market downturns. They are complex financial instruments that can be a valuable addition to your retirement portfolio, but it’s crucial to understand their features, benefits, risks, and how they work before making an investment decision.

If you’re facing financial hardship, you may be able to withdraw some of your annuity funds early. The Annuity Hardship Withdrawal 2024 page explains the process and the criteria you need to meet to qualify for a hardship withdrawal.

Defining Variable Annuities

Variable annuities are insurance contracts that combine features of both investments and insurance. They allow you to invest your money in a variety of sub-accounts, typically mutual funds, similar to a traditional mutual fund. The value of your annuity fluctuates based on the performance of these underlying investments, hence the term “variable.”

To ensure a comfortable retirement, you need to determine the required annuity amount over a specific period. The What Annuity Is Required Over 12 Years 2024 page provides insights into how to calculate this amount.

Benefits of Variable Annuities

- Potential for Growth:Variable annuities offer the potential for higher returns than traditional fixed annuities, as the value of your investment can grow based on the performance of the underlying investments.

- Tax-Deferred Growth:Earnings on your investment grow tax-deferred, meaning you won’t have to pay taxes on them until you withdraw the money in retirement.

- Death Benefit:Some variable annuities offer a death benefit that guarantees a minimum payout to your beneficiaries, even if the value of your investment has declined.

- Living Benefits:Certain variable annuities may include living benefits, such as guaranteed minimum income or protection against market losses, providing some downside protection.

Risks of Variable Annuities

- Market Risk:The value of your variable annuity can fluctuate based on the performance of the underlying investments. If the market declines, your investment may lose value.

- Fees and Expenses:Variable annuities typically have higher fees and expenses than other retirement savings options. These fees can erode your investment returns over time.

- Complexity:Variable annuities are complex financial products that can be difficult to understand. It’s essential to carefully review the contract and seek professional financial advice before investing.

- Surrender Charges:Some variable annuities have surrender charges that you may have to pay if you withdraw your money before a certain period. These charges can reduce your overall returns.

Real-World Scenarios

Variable annuities can be suitable for individuals who:

- Have a long-term investment horizon:Variable annuities are best suited for individuals who are comfortable with market volatility and have a long-term investment horizon, such as those saving for retirement.

- Seek potential for growth:Variable annuities offer the potential for higher returns than fixed annuities, making them an attractive option for those seeking to grow their retirement savings.

- Desire downside protection:Some variable annuities offer living benefits that provide some downside protection against market losses, which can be appealing to risk-averse investors.

Understanding Variable Annuity Calculators

Variable annuity calculators are online tools that help you estimate the potential growth of your variable annuity investment over time. They can provide valuable insights into the potential returns you might expect, the impact of fees and expenses, and the effect of market volatility on your investment.

Calculating your annuity income is essential for retirement planning. The Calculating Annuity Income 2024 page provides a guide on how to estimate your income from an annuity.

Purpose and Functionality

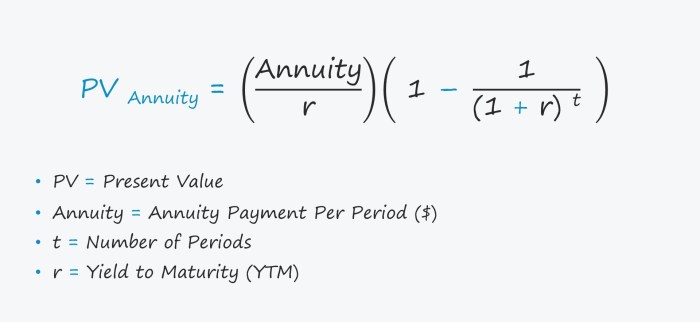

Variable annuity calculators work by taking into account various factors, such as your initial investment amount, the expected rate of return, the fees and expenses associated with the annuity, and the length of your investment horizon. They use these inputs to project the future value of your investment, taking into account the compounding effect of interest and the potential for market growth or decline.

If you’re familiar with Excel, you can use it to calculate annuity payments. The Calculating Annuity With Excel 2024 page provides a guide on how to use Excel for annuity calculations.

Key Variables and Inputs

- Initial Investment Amount:The amount of money you plan to invest in the variable annuity.

- Expected Rate of Return:The average annual return you expect to earn on your investment. This is often based on historical market performance and your investment strategy.

- Fees and Expenses:The fees and expenses associated with the variable annuity, such as annual fees, mortality and expense charges, and surrender charges.

- Investment Horizon:The length of time you plan to hold the variable annuity, typically until retirement.

Types of Variable Annuity Calculators

There are several different types of variable annuity calculators available online, each with its own features and functionality. Some calculators are designed to be simple and user-friendly, while others offer more advanced features and customization options. You can find variable annuity calculators on the websites of insurance companies, financial institutions, and independent financial websites.

Factors Affecting Variable Annuity Calculations

Several factors can influence the projected returns and outcomes of variable annuity calculations. Understanding these factors is essential for making informed investment decisions.

Variable annuity contracts offer the potential for growth but also carry more risk. The Variable Annuity Contracts 2024 page provides information on these contracts and their features.

Investment Choices

The investment choices you make within your variable annuity will significantly impact your projected returns. Different sub-accounts offer varying levels of risk and potential reward. Choosing investments that align with your risk tolerance and investment goals is crucial for maximizing potential returns while managing risk.

Fees and Expenses

Fees and expenses associated with variable annuities can significantly impact your investment returns. These fees include annual fees, mortality and expense charges, surrender charges, and administrative fees. It’s essential to carefully review the fees and expenses associated with any variable annuity contract before investing.

Market Volatility and Interest Rate Changes

Market volatility and interest rate changes can significantly affect the performance of your variable annuity. During periods of market decline, the value of your investment may decrease, reducing your potential returns. Similarly, rising interest rates can impact the performance of certain investments within your variable annuity.

If you’re a federal employee, you can calculate your annuity using the FERS system. The Calculate Annuity Fers 2024 page explains the process and provides resources for calculating your annuity.

It’s essential to consider these factors and their potential impact on your investment strategy.

Using a Variable Annuity Calculator in 2024

Variable annuity calculators can be valuable tools for planning your retirement savings. By inputting relevant information into the calculator, you can gain insights into the potential growth of your investment and the impact of various factors on your returns.

Step-by-Step Guide, Variable Annuity Calculator 2024

- Choose a reputable variable annuity calculator:Look for calculators from reliable sources such as insurance companies, financial institutions, or independent financial websites.

- Input your initial investment amount:Enter the amount of money you plan to invest in the variable annuity.

- Select your investment options:Choose the sub-accounts or investment strategies you plan to use within your variable annuity. Consider your risk tolerance and investment goals.

- Enter your expected rate of return:Based on your investment strategy and historical market performance, estimate the average annual return you expect to earn on your investment.

- Input the fees and expenses:Carefully review the variable annuity contract and enter the fees and expenses associated with the annuity.

- Specify your investment horizon:Enter the length of time you plan to hold the variable annuity, typically until retirement.

- Run the calculation:Once you’ve entered all the necessary information, run the calculation to generate a projection of your investment’s potential growth.

Interpreting and Analyzing the Results

The results generated by the variable annuity calculator will provide insights into the potential growth of your investment over time. You can use this information to compare different variable annuity options, evaluate the impact of fees and expenses, and assess the potential risks and rewards associated with your investment strategy.

Whether or not annuity income is considered capital gains depends on the specific type of annuity. The Is Annuity Income Capital Gains 2024 page explains the tax implications of annuity income.

Remember that these projections are based on assumptions and estimations, and actual results may vary.

An annuity is a financial product that provides a regular stream of income for a set period of time. The An Annuity Is Quizlet 2024 page offers a more detailed explanation of this concept.

Considerations for Choosing a Variable Annuity: Variable Annuity Calculator 2024

Choosing the right variable annuity is essential for maximizing your retirement savings potential. There are numerous options available, each with its own features, benefits, and risks. It’s important to carefully consider your individual circumstances and investment goals before making a decision.

An annuity is a financial product that provides you with a regular stream of income for a set period of time. To understand how annuities work, check out the Annuity Meaning With Example 2024 page for a clear explanation and example.

Comparing and Contrasting Options

When comparing different variable annuity options, consider factors such as:

- Investment options:The range of sub-accounts or investment strategies available within the annuity.

- Fees and expenses:The annual fees, mortality and expense charges, surrender charges, and other fees associated with the annuity.

- Living benefits:The types of living benefits offered, such as guaranteed minimum income or protection against market losses.

- Death benefit:The amount and type of death benefit offered, which guarantees a minimum payout to your beneficiaries.

- Contract terms:The terms and conditions of the annuity contract, including the surrender charges, withdrawal restrictions, and other provisions.

Seeking Professional Financial Advice

It’s highly recommended to seek professional financial advice before investing in a variable annuity. A financial advisor can help you assess your individual circumstances, understand the complexities of variable annuities, and recommend suitable options based on your investment goals and risk tolerance.

Key Factors to Consider

- Your investment goals:What are you hoping to achieve with your variable annuity investment? Are you seeking growth, income, or downside protection?

- Your risk tolerance:How comfortable are you with market volatility? Are you willing to accept the potential for losses in exchange for higher potential returns?

- Your investment horizon:How long do you plan to hold the variable annuity? Variable annuities are best suited for long-term investments.

- Your financial situation:What are your current financial resources and income? Can you afford to pay the fees and expenses associated with a variable annuity?

Potential Risks and Limitations of Variable Annuities

While variable annuities offer potential benefits, it’s crucial to be aware of their potential downsides and limitations. Understanding these risks is essential for making informed investment decisions.

Market Risk

The value of your variable annuity can fluctuate based on the performance of the underlying investments. If the market declines, your investment may lose value. This market risk is inherent to all investments, but it’s particularly important to consider with variable annuities, as their value is directly tied to market performance.

Fees and Charges

Variable annuities typically have higher fees and expenses than other retirement savings options. These fees can erode your investment returns over time. It’s essential to carefully review the fees and expenses associated with any variable annuity contract before investing and compare them to other investment options.

An annuity of R600,000 can provide a substantial income stream for retirement. The Annuity 600 000 2024 page provides insights into the potential income you can expect from such an annuity.

Other Risks

- Surrender charges:Some variable annuities have surrender charges that you may have to pay if you withdraw your money before a certain period. These charges can reduce your overall returns.

- Complexity:Variable annuities are complex financial products that can be difficult to understand. It’s essential to carefully review the contract and seek professional financial advice before investing.

- Insurance company risk:The financial stability of the insurance company issuing the variable annuity can impact your investment. If the insurance company fails, your investment may be at risk.

Alternative Retirement Savings Options

Variable annuities are not the only retirement savings option available. There are other alternatives that may be more suitable for your individual circumstances and investment goals.

Calculating annuity payments can be a bit tricky, but it’s important to understand how it works. The Calculating Annuity Payments 2024 article provides a step-by-step guide on how to calculate your annuity payments.

Comparison of Options

| Retirement Savings Option | Features | Risks | Suitability |

|---|---|---|---|

| Traditional IRA | Tax-deductible contributions, tax-deferred growth, tax-deferred withdrawals in retirement | Market risk, potential for taxes on withdrawals in retirement | Suitable for individuals seeking tax advantages and potential for growth |

| Roth IRA | After-tax contributions, tax-free growth and withdrawals in retirement | Limited contribution limits, potential for lower returns due to after-tax contributions | Suitable for individuals who expect to be in a higher tax bracket in retirement |

| 401(k) | Employer-sponsored retirement plan, tax-deferred contributions, potential for employer matching contributions | Market risk, potential for limited investment options | Suitable for employees with access to an employer-sponsored plan |

| 403(b) | Retirement plan for employees of certain non-profit organizations, tax-deferred contributions | Market risk, potential for limited investment options | Suitable for employees of eligible organizations |

| Annuities (Fixed and Indexed) | Guaranteed interest rates (fixed) or returns linked to an index (indexed) | Limited potential for growth, potential for lower returns than variable annuities | Suitable for individuals seeking guaranteed income or protection against market losses |

Suitability of Different Strategies

The suitability of different retirement savings strategies depends on your individual circumstances, including your age, income, risk tolerance, and investment goals. It’s essential to carefully consider your options and seek professional financial advice to determine the best strategy for you.

An annuity is a sequence of payments made over time, often used in retirement planning. The Annuity Is Sequence Of Mode Of Payment 2024 page provides more information about this concept.

Resources and Further Information

For additional information on variable annuities and other retirement savings options, you can consult the following resources:

| Resource | Description | Link |

|---|---|---|

| Financial Industry Regulatory Authority (FINRA) | Provides information and resources on variable annuities and other investment products | https://www.finra.org/ |

| Securities and Exchange Commission (SEC) | Regulates the securities industry and provides investor education materials | https://www.sec.gov/ |

| National Association of Insurance Commissioners (NAIC) | Provides information and resources on insurance products, including variable annuities | https://www.naic.org/ |

| National Endowment for Financial Education (NEFE) | Offers financial education resources, including information on retirement planning | https://www.nefe.org/ |

You can also consult with a financial advisor for personalized advice on your retirement savings strategy.

Closing Summary

As you navigate the complex world of retirement planning, remember that a variable annuity calculator can be a valuable resource. By understanding how these calculators work and the factors that influence their calculations, you can make more informed decisions about your retirement savings.

While variable annuities can offer potential growth, it’s essential to weigh the risks and benefits carefully and seek professional financial advice before making any investment decisions.

FAQ Section

What is the difference between a fixed annuity and a variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s return is tied to the performance of the underlying investments. Fixed annuities offer stability, but their returns may not keep pace with inflation. Variable annuities offer the potential for higher returns but also carry more risk.

How do I choose the right variable annuity for my needs?

Choosing the right variable annuity depends on your risk tolerance, investment goals, and financial situation. It’s essential to consider factors such as the fees, investment options, and death benefit provisions. Consulting with a financial advisor can help you make an informed decision.

What are the potential risks associated with variable annuities?

Variable annuities carry market risk, meaning the value of your investment can fluctuate based on the performance of the underlying investments. You could lose money if the market declines. It’s also important to understand the fees and charges associated with variable annuities, which can impact your returns.