Variable Annuity Contribution Limits 2024: Navigating the landscape of variable annuities in 2024 requires a clear understanding of contribution limits. These limits, set by the IRS, dictate the maximum amount you can contribute to a variable annuity each year.

For those seeking a convenient way to calculate annuity payments, an online calculator can be a valuable tool. Explore the features of E Annuity Calculator in 2024 to simplify your planning.

Understanding these limits is crucial for maximizing your retirement savings potential while staying compliant with tax regulations.

If you’re in Kenya and looking to understand how annuities work, a dedicated calculator can be helpful. Check out the Annuity Calculator for Kenya in 2024 to get a clear picture of your potential income.

This guide will delve into the intricacies of variable annuity contribution limits in 2024, exploring factors that influence them, tax implications, and strategies for optimizing your contributions. We’ll also address common questions and concerns surrounding these limits, providing you with the knowledge needed to make informed decisions about your retirement savings.

Annuity and 401(k) are both popular retirement savings options. To make an informed decision, compare the features and benefits of each by reading Annuity Vs 401k in 2024.

Contents List

- 1 Understanding Variable Annuity Contribution Limits

- 2 Final Wrap-Up

- 3 Essential FAQs: Variable Annuity Contribution Limits 2024

Understanding Variable Annuity Contribution Limits

Variable annuities are retirement savings products that offer the potential for growth while providing income guarantees. They are popular with investors who want to diversify their portfolios and seek a balance between growth and security. However, like most retirement savings products, variable annuities have contribution limits.

If you’re looking for a deeper understanding of how annuities work, a good place to start is with the formulas. Check out Annuity Formula Youtube in 2024 for helpful videos that break down the calculations.

Understanding these limits is crucial for maximizing your savings and ensuring that you comply with IRS regulations.

An annuity is a financial product that provides a stream of income for a set period of time. To understand how annuities work, it’s helpful to know the definition. Explore An Annuity Is Best Defined As in 2024 to get a clear picture.

Variable Annuity Contribution Limits in 2024

The maximum annual contribution amount allowed for variable annuities in 2024 is $7,500. This limit applies to individuals regardless of their age. For couples, the maximum combined contribution is $15,000. This limit is the same for traditional and Roth variable annuities.

Factors Affecting Contribution Limits

While the annual contribution limit for variable annuities is fixed, several factors can affect how much you can contribute.

Annuities can provide a steady stream of income during retirement, but it’s also important to consider potential growth. Learn more about Fv Annuity with Growth in 2024 to understand how your income can potentially increase.

Age

The contribution limits for variable annuities are not affected by your age. Regardless of whether you are 25 or 75, the maximum contribution limit remains the same.

There are various types of annuities available, each with its own features and benefits. Discover the 5 Annuity Options in 2024 to find the best fit for your retirement goals.

Income Levels

Income levels can influence your ability to contribute to a variable annuity, but not directly by impacting the contribution limit itself. However, if your income is high enough, you may be subject to higher tax rates, which could impact your net income available for contributions.

Other Relevant Factors

Several other factors can affect your ability to contribute to a variable annuity, including:

- Prior Contributions:If you have already contributed to a variable annuity in a previous year, the remaining contribution room for the current year may be reduced.

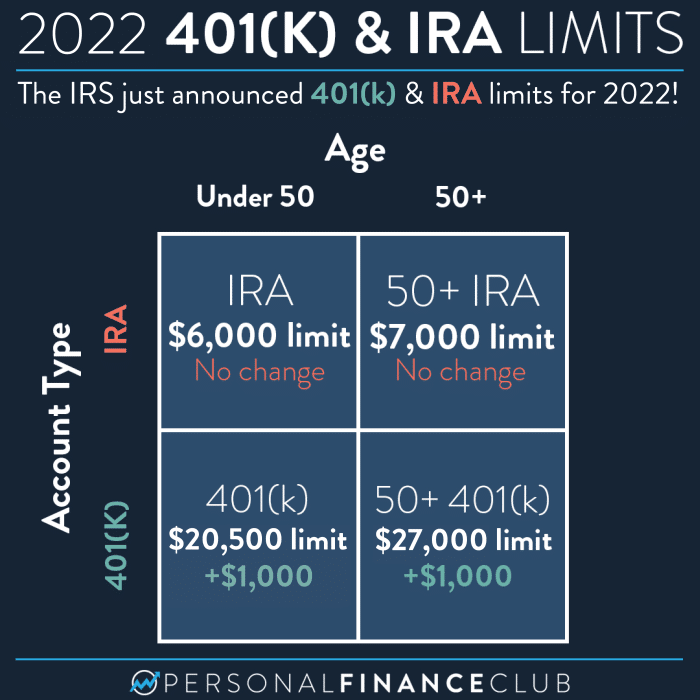

- Other Retirement Accounts:The contribution limits for variable annuities are separate from those for other retirement accounts, such as 401(k)s and IRAs.

When it comes to retirement savings, you might wonder if an annuity is a better choice than a 401(k). Learn more about Is Annuity Better Than 401k in 2024 to make an informed decision.

However, if you contribute to other retirement accounts, you may have less money available to contribute to a variable annuity.

- Financial Situation:Your overall financial situation, including your income, expenses, and debt, can influence your ability to contribute to a variable annuity.

Tax implications are an important consideration when choosing a financial product. Explore Is Annuity Taxable in India in 2024 to understand the tax rules.

Tax Implications of Contributions

Variable annuity contributions are typically tax-deferred, meaning that you will not have to pay taxes on the contributions until you withdraw the money in retirement. This can provide significant tax savings over time.

Retirement planning involves calculating how much income you’ll need and how to generate it. A key part of this is figuring out your retirement annuity. Find out more about Calculating Retirement Annuity in 2024 to ensure a comfortable retirement.

Tax Benefits

- Tax-Deferred Growth:Earnings on your contributions grow tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them in retirement.

- Potential Tax-Free Withdrawals:Depending on the type of variable annuity you choose, you may be able to withdraw your contributions tax-free.

Tax Implications of Withdrawals

When you withdraw money from a variable annuity, the withdrawals are generally taxed as ordinary income. However, if you withdraw your contributions before age 59 1/2, you may be subject to a 10% early withdrawal penalty.

The HP10bii financial calculator is a popular tool for financial professionals. Find out how to use it to calculate annuity payments by exploring Calculate Annuity with HP10bii in 2024.

Variable Annuity Contribution Strategies, Variable Annuity Contribution Limits 2024

- Max Out Contributions:If you can afford it, contributing the maximum amount allowed each year can help you maximize your savings potential.

- Contribute Regularly:Instead of making large lump-sum contributions, consider making smaller contributions regularly. This can help you stay on track with your savings goals and avoid having to make large contributions later on.

- Adjust Contributions Based on Income:As your income increases, you may be able to increase your contributions to a variable annuity.

Considerations for Variable Annuity Contributions

While variable annuities offer potential benefits, it is important to be aware of the risks involved.

Annuity income can be a valuable source of retirement income, but there are strategies to maximize your returns. Discover 8 Annuity Income Secrets in 2024 to make the most of your annuity.

Risks

- Market Risk:The value of your variable annuity investments can fluctuate based on market performance. If the market declines, the value of your annuity may decrease.

- Fees and Expenses:Variable annuities typically come with fees and expenses, which can reduce your returns.

- Insurance Company Risk:The financial stability of the insurance company issuing your variable annuity is important.

If the insurance company becomes insolvent, you may lose your investment.

Choosing the Right Variable Annuity

- Consider Your Investment Goals:Before choosing a variable annuity, it is important to consider your investment goals, risk tolerance, and time horizon.

- Compare Fees and Expenses:Compare the fees and expenses of different variable annuity products to find the most affordable option.

- Read the Prospectus:The prospectus provides detailed information about the variable annuity, including its fees, expenses, and risks.

Understanding the term of an annuity is crucial for making informed decisions about your retirement income. Learn more about Annuity Term in 2024 to make the right choices.

Consulting a Financial Advisor

- Seek Professional Advice:Before making any investment decisions, it is important to consult with a qualified financial advisor.

- Personalized Guidance:A financial advisor can help you develop a personalized financial plan and choose the right variable annuity product for your needs.

Final Wrap-Up

Variable annuity contribution limits play a vital role in retirement planning. By understanding these limits, you can make informed decisions about your contributions, ensuring you maximize your savings potential while staying within the boundaries of tax regulations. Remember to consult with a financial advisor to tailor your contribution strategy to your specific financial goals and circumstances.

Estimating how much income an annuity will provide is important for retirement planning. Utilize How Much Will An Annuity Pay Calculator in 2024 to get a realistic picture of your potential income.

Essential FAQs: Variable Annuity Contribution Limits 2024

What are the penalties for exceeding the variable annuity contribution limits?

Exceeding the contribution limits for variable annuities can result in penalties, including taxes and interest on the excess contributions. It’s essential to stay within the limits to avoid these penalties.

The accumulation phase of a variable annuity is the period when you contribute money and it grows based on the performance of the underlying investments. Learn more about the Variable Annuity Accumulation Phase in 2024 to understand how your savings can grow over time.

Can I withdraw contributions from a variable annuity before retirement?

Yes, you can withdraw contributions from a variable annuity before retirement, but there may be penalties and taxes associated with early withdrawals. Consult with a financial advisor to understand the specific implications of early withdrawals.

Are variable annuities a good investment for everyone?

Variable annuities are not a one-size-fits-all investment. They can be a suitable option for individuals seeking potential growth and tax advantages, but they also carry investment risks. Consulting with a financial advisor is crucial to determine if a variable annuity aligns with your individual financial goals and risk tolerance.