Deferred Variable Annuities 2024 takes center stage as a powerful retirement savings tool, offering a blend of potential growth and tax advantages. This guide explores the intricate workings of these annuities, delving into their features, risks, and benefits in the context of today’s financial landscape.

While annuities can be a valuable financial tool, there are potential issues to be aware of. This article explores some common annuity issues in 2024: Annuity Issues 2024. It’s important to be informed and understand the potential risks involved.

A lifetime annuity provides income for as long as you live, offering peace of mind in retirement. To learn more about lifetime annuities and their associated calculators in 2024, read this article: Annuity Calculator Lifetime 2024. It can help you understand the potential benefits and drawbacks of this type of annuity.

While annuities can offer certain advantages, they also have potential drawbacks. This article explores some reasons why an annuity might not be the best option for you in 2024: Why An Annuity Is Bad 2024. It’s important to weigh the pros and cons before making a decision.

Deferred variable annuities function by pooling your contributions into a sub-account that invests in a range of assets, like stocks, bonds, or mutual funds. The growth of your investment is tied to the performance of these underlying assets, providing the potential for significant returns.

If you’re comfortable using Excel, you can calculate the present value of an annuity using its built-in functions. This article provides guidance on calculating annuity present value in Excel in 2024: Calculating Annuity Present Value In Excel 2024.

It’s a convenient way to perform these calculations.

However, it’s important to remember that these annuities also carry inherent risks, such as market volatility and potential loss of principal. Understanding the nuances of deferred variable annuities is crucial for making informed investment decisions that align with your retirement goals.

Contents List

- 1 Deferred Variable Annuities: A Comprehensive Overview

- 2 Tax Implications of Deferred Variable Annuities

- 3 Risk and Return Considerations in Deferred Variable Annuities

- 4 Deferred Variable Annuities in 2024: Current Market Trends

- 5 Choosing the Right Deferred Variable Annuity

- 6 Deferred Variable Annuities vs. Other Retirement Savings Options: Deferred Variable Annuities 2024

- 7 Epilogue

- 8 Essential Questionnaire

Deferred Variable Annuities: A Comprehensive Overview

Deferred variable annuities are a type of insurance product that allows individuals to accumulate funds for retirement while potentially earning higher returns than traditional fixed annuities. These annuities are designed to provide a stream of income during retirement, and they offer several key features and benefits.

Understanding the interest rate associated with an annuity is crucial for determining its potential returns. This article provides insights into calculating annuity interest rates in 2024: Calculating Annuity Interest Rate 2024. It’s important to consider this factor when evaluating different annuity options.

Concept of Deferred Variable Annuities

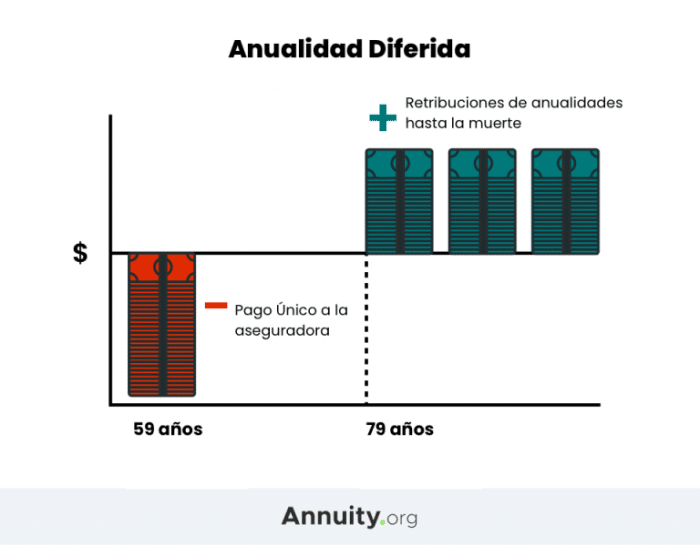

A deferred variable annuity is a contract between an individual and an insurance company. The individual invests a lump sum or makes periodic payments into the annuity, and the insurance company invests these funds in a variety of sub-accounts, typically comprised of mutual funds.

The value of the annuity grows based on the performance of the underlying investments. Deferred variable annuities are called “deferred” because payments are not received until a later date, typically at retirement.

Key Features and Benefits

Deferred variable annuities offer several key features and benefits that can make them attractive to investors:

- Tax-Deferred Growth:Earnings on the investment grow tax-deferred, meaning that taxes are not paid until withdrawals are made. This can lead to significant tax savings over time.

- Guaranteed Death Benefit:Most deferred variable annuities offer a guaranteed death benefit, which ensures that a beneficiary will receive a minimum amount of money, even if the investment loses value. This can provide peace of mind for those who want to protect their loved ones.

Finding the right annuity can be tricky, especially with so many options available. If you’re looking for guidance on which annuity might be best for your situation in 2024, check out this resource: Annuity Which Is Best 2024.

It provides valuable insights to help you make an informed decision.

- Investment Flexibility:Deferred variable annuities typically offer a wide range of investment options, allowing investors to choose a portfolio that aligns with their risk tolerance and investment goals. This flexibility can help investors tailor their investment strategy to their specific needs.

- Income Options:Deferred variable annuities offer a variety of income options, including fixed, variable, and guaranteed lifetime income. This can provide investors with flexibility in how they receive their retirement income.

How Deferred Variable Annuities Work

Deferred variable annuities work by allowing individuals to invest in a variety of sub-accounts, each representing a different investment strategy. These sub-accounts are typically comprised of mutual funds, which invest in stocks, bonds, or other assets. The value of the annuity grows based on the performance of the underlying investments.

Investment Options Within Deferred Variable Annuities

Deferred variable annuities typically offer a wide range of investment options, allowing investors to customize their portfolios based on their risk tolerance and investment goals. Some common investment options include:

- Equity Sub-accounts:These sub-accounts invest primarily in stocks, offering the potential for higher returns but also higher risk. They are suitable for investors with a longer time horizon and a higher risk tolerance.

- Fixed Income Sub-accounts:These sub-accounts invest primarily in bonds, offering lower potential returns but also lower risk. They are suitable for investors who prioritize income and stability.

- Balanced Sub-accounts:These sub-accounts invest in a mix of stocks and bonds, offering a balance of potential growth and income. They are suitable for investors with a moderate risk tolerance.

Tax Implications of Deferred Variable Annuities

Deferred variable annuities have unique tax implications that investors should understand before making any investment decisions.

SBI also provides an annuity calculator to help you understand your potential payouts. This article explores the SBI annuity calculator and its features in 2024: Annuity Calculator Sbi 2024. It’s a valuable resource for anyone considering an annuity.

Tax Treatment During the Accumulation Phase

During the accumulation phase, the earnings on the investment grow tax-deferred. This means that taxes are not paid until withdrawals are made. This can be a significant tax advantage, especially for investors in higher tax brackets.

Annuity payouts can vary depending on the terms of the contract. If you’re considering an annuity with a payout of $60,000 per year, this article can provide helpful information: Annuity 60000 2024. It explores the potential implications of such a payout.

Tax Implications of Withdrawals

When withdrawals are made from a deferred variable annuity, they are taxed as ordinary income. This is because the earnings on the investment have grown tax-deferred. However, the principal amount invested is typically not taxed.

Potential Tax Advantages and Disadvantages

Deferred variable annuities can offer both tax advantages and disadvantages. The tax-deferred growth can be a significant benefit, especially for long-term investors. However, the taxation of withdrawals as ordinary income can be a drawback, especially for investors in higher tax brackets.

Tax Considerations and Investment Decisions

Tax considerations can significantly influence investment decisions related to deferred variable annuities. For example, an investor in a high tax bracket may choose to invest in a deferred variable annuity to take advantage of the tax-deferred growth, while an investor in a low tax bracket may prefer to invest in a traditional IRA or 401(k) plan.

Risk and Return Considerations in Deferred Variable Annuities

Deferred variable annuities offer the potential for higher returns than traditional fixed annuities, but they also come with increased risk.

Potential Risks

Deferred variable annuities carry several potential risks, including:

- Market Risk:The value of the annuity can fluctuate based on the performance of the underlying investments. If the market declines, the value of the annuity may also decline.

- Investment Risk:Investors must choose investment options that align with their risk tolerance and investment goals. A poorly chosen investment strategy can lead to losses.

- Insurance Company Risk:The financial stability of the insurance company issuing the annuity can affect the value of the investment. If the insurance company becomes insolvent, investors may lose their investment.

Potential for Growth and Returns

Deferred variable annuities offer the potential for higher returns than traditional fixed annuities, but this potential comes with increased risk. The growth potential of a deferred variable annuity depends on the performance of the underlying investments.

Annuity options are often available within 401(k) plans, providing another way to secure your retirement income. To learn more about annuities and 401(k) plans in 2024, read this article: Annuity 401k 2024. It’s important to understand the various options available to you.

Risk and Return Profiles of Different Investment Options

Different investment options within deferred variable annuities have different risk and return profiles. For example, equity sub-accounts offer the potential for higher returns but also higher risk, while fixed income sub-accounts offer lower potential returns but also lower risk.

Charles Schwab offers a user-friendly annuity calculator that can help you estimate your potential returns. Check out this article for more information on using the Charles Schwab annuity calculator in 2024: Annuity Calculator Charles Schwab 2024. It can be a helpful tool for making informed decisions.

Common Investment Options and Associated Risk Levels

The following table summarizes some common investment options within deferred variable annuities and their associated risk levels:

| Investment Option | Risk Level |

|---|---|

| Equity Sub-accounts | High |

| Fixed Income Sub-accounts | Low |

| Balanced Sub-accounts | Moderate |

If you’re considering a growing annuity, you’ll want to utilize a present value calculator. This article provides insights into using a growing annuity calculator to determine present value in 2024: Growing Annuity Calculator Present Value 2024. It can help you make informed decisions about your investment strategy.

Deferred Variable Annuities in 2024: Current Market Trends

The deferred variable annuity market is constantly evolving, influenced by a variety of factors, including economic conditions, regulatory changes, and investor preferences.

Key Market Trends Influencing Deferred Variable Annuities

Several key market trends are influencing deferred variable annuities in 2024, including:

- Rising Interest Rates:Rising interest rates can impact the performance of bond investments, which are a key component of many deferred variable annuity portfolios.

- Inflation:High inflation can erode the purchasing power of retirement savings, making it more challenging to maintain a comfortable lifestyle in retirement.

- Increased Longevity:People are living longer, which means they need to save more for retirement to cover their expenses over a longer period.

Impact of Current Economic Conditions

The current economic conditions are having a significant impact on deferred variable annuities. For example, rising interest rates are making it more expensive to borrow money, which can impact the growth of the annuity.

Recent Regulatory Changes or Developments

The regulatory environment for deferred variable annuities is constantly evolving. Recent regulatory changes have focused on increasing transparency and consumer protection.

The government also provides an annuity calculator to help you estimate your potential retirement income. Learn more about the government’s annuity calculator in 2024: Annuity Calculator Gov 2024. It can be a useful tool for planning your financial future.

Future Outlook for Deferred Variable Annuities

The future outlook for deferred variable annuities is uncertain, but it is likely that the market will continue to evolve in response to changing economic conditions and investor preferences.

If you’re unfamiliar with annuities, this article explains what an annuity is in 2024: Annuity Kya Hai 2024. Understanding the basics is essential before making any investment decisions.

Choosing the Right Deferred Variable Annuity

Selecting the right deferred variable annuity is an important decision that can significantly impact your retirement savings.

Key Factors to Consider

When choosing a deferred variable annuity, it is important to consider several key factors, including:

- Investment Options:The annuity should offer a wide range of investment options that align with your risk tolerance and investment goals.

- Fees and Expenses:The annuity should have reasonable fees and expenses, as these can significantly impact the overall return on your investment.

- Death Benefit:The annuity should offer a guaranteed death benefit to protect your loved ones.

- Income Options:The annuity should offer a variety of income options to meet your retirement needs.

- Financial Strength of the Insurance Company:The insurance company issuing the annuity should be financially sound to ensure that your investment is secure.

Comparing and Contrasting Deferred Variable Annuity Products

Different deferred variable annuity products offer different features and benefits. It is important to compare and contrast different products to find one that meets your specific needs.

One of the most common questions about annuities is whether they are tax-deferred. The answer, thankfully, is generally yes. To learn more about the tax implications of annuities in 2024, read this article: Is Annuity Tax Deferred 2024.

Understanding the tax aspects is crucial for maximizing your financial gains.

Key Features and Benefits of Different Deferred Variable Annuity Options, Deferred Variable Annuities 2024

The following table summarizes some key features and benefits of different deferred variable annuity options:

| Deferred Variable Annuity Option | Key Features | Benefits |

|---|---|---|

| Variable Annuity with Guaranteed Lifetime Income | Provides a guaranteed stream of income for life | Protects against outliving your savings |

| Variable Annuity with Death Benefit | Guarantees a minimum payout to beneficiaries | Provides peace of mind for loved ones |

| Variable Annuity with Investment Flexibility | Offers a wide range of investment options | Allows investors to customize their portfolios |

Deferred Variable Annuities vs. Other Retirement Savings Options: Deferred Variable Annuities 2024

Deferred variable annuities are just one of many retirement savings options available to investors. It is important to compare and contrast different options to determine the best fit for your individual needs.

Comparison with Traditional IRAs, 401(k)s, and Other Retirement Plans

Deferred variable annuities can be compared to other retirement savings options, such as traditional IRAs, 401(k)s, and other retirement plans. Each option has its own advantages and disadvantages, and the best choice will depend on your individual circumstances.

Advantages and Disadvantages of Deferred Variable Annuities

Deferred variable annuities offer several advantages, including tax-deferred growth, investment flexibility, and guaranteed death benefits. However, they also come with disadvantages, such as potential market risk, investment risk, and insurance company risk.

Suitability for Different Investor Profiles

Deferred variable annuities may be suitable for different investor profiles, depending on their risk tolerance, investment goals, and tax situation. For example, investors with a long time horizon and a higher risk tolerance may find deferred variable annuities to be a suitable investment option.

Calculating the present value of an annuity can be a complex task, but it’s essential for making sound financial decisions. This article provides a comprehensive guide on calculating annuity present values in 2024: Calculating Annuity Present Values 2024.

With this knowledge, you can better understand the true worth of your annuity.

Key Differences Between Deferred Variable Annuities and Other Retirement Savings Options

The following table summarizes the key differences between deferred variable annuities and other retirement savings options:

| Retirement Savings Option | Key Features | Advantages | Disadvantages |

|---|---|---|---|

| Deferred Variable Annuity | Tax-deferred growth, investment flexibility, guaranteed death benefit | Potential for higher returns, tax advantages, protection for beneficiaries | Market risk, investment risk, insurance company risk |

| Traditional IRA | Tax-deductible contributions, tax-deferred growth | Tax savings on contributions, potential for tax-free withdrawals in retirement | Limited investment options, potential for taxes on withdrawals in retirement |

| 401(k) | Employer-sponsored retirement plan, tax-deferred growth | Employer matching contributions, tax advantages | Limited investment options, potential for taxes on withdrawals in retirement |

Epilogue

As you navigate the complexities of retirement planning, deferred variable annuities present a multifaceted option worth considering. By carefully weighing the potential benefits and risks, you can determine if these annuities fit seamlessly into your overall financial strategy. Remember, seeking professional financial advice tailored to your individual circumstances is essential for making sound investment decisions that secure a comfortable and fulfilling retirement.

Essential Questionnaire

What are the minimum contribution requirements for deferred variable annuities?

Minimum contribution requirements vary depending on the specific annuity provider and product. It’s best to check with the issuer for their specific guidelines.

Are there any penalties for withdrawing funds from a deferred variable annuity before retirement?

Yes, there are often surrender charges and potential tax penalties for withdrawing funds from a deferred variable annuity before age 59 1/2. Consult with a financial advisor to understand the specific terms of your annuity contract.

How can I determine the right level of risk for my deferred variable annuity investment?

Your risk tolerance is a key factor in choosing an investment strategy. Consider your age, time horizon, and financial goals when determining the appropriate level of risk for your deferred variable annuity. Consulting with a financial advisor can help you assess your risk profile and make informed investment decisions.