Variable Annuity Fixed Account 2024: A Safe Haven in Uncertain Times. In a world of fluctuating markets and rising interest rates, seeking stable returns is paramount. Enter Variable Annuity Fixed Accounts (VAFAs), a financial product offering a unique blend of security and potential growth.

Understanding how to calculate annuity values is crucial for financial planning. Calculating Annuity Values 2024 provides a comprehensive guide on how to determine the present and future value of annuities.

VAFAs provide a fixed income stream, shielded from market volatility, while offering opportunities for capital appreciation through market-linked options. But how do they work, and what are the potential risks involved?

Need a compound value annuity factor table? Compound Value Annuity Factor Table 2024 offers a handy resource for your calculations. These tables can be helpful for determining the future value of an annuity.

This guide delves into the intricacies of VAFAs, exploring their features, benefits, and drawbacks. We will analyze the current market landscape and its implications for VAFA performance in 2024, comparing them to other fixed income investments. By understanding the key considerations and exploring real-world examples, you can determine if VAFAs align with your individual investment goals and risk tolerance.

Contents List

Variable Annuity Fixed Account Overview

A Variable Annuity Fixed Account (VAFA) is a type of annuity contract that combines the security of a fixed income investment with the potential for growth. It’s a unique product that offers a guaranteed minimum rate of return on your principal, while also providing the opportunity to participate in the growth of the market through sub-accounts invested in mutual funds.

Curious about calculating a deferred annuity? Calculating A Deferred Annuity 2024 provides insights into this type of annuity. Deferred annuities can be a good option for those who want to delay receiving income until a later date.

Key Features and Benefits

VAFAs offer a combination of features that can be attractive to investors seeking a balance between security and potential growth:

- Guaranteed Minimum Rate of Return:VAFAs typically provide a guaranteed minimum interest rate on the principal invested in the fixed account. This ensures that your investment won’t lose value, even if market conditions are unfavorable.

- Potential for Growth:VAFAs allow you to allocate a portion of your investment to sub-accounts that invest in mutual funds. These sub-accounts can participate in the growth of the market, potentially providing higher returns than the fixed account.

- Tax-Deferred Growth:Earnings in a VAFA grow tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them.

- Protection from Market Volatility:The fixed account provides a safety net against market downturns, protecting your principal from losses.

Risks Associated with VAFAs

While VAFAs offer attractive features, it’s essential to understand the potential risks associated with them:

- Interest Rate Risk:If interest rates rise, the guaranteed minimum rate of return on your fixed account may become less attractive compared to other investment options.

- Market Volatility Risk:The value of your investment in the sub-accounts can fluctuate with market conditions, potentially leading to losses.

- Expense Fees:VAFAs typically come with various fees, such as administrative fees, mortality and expense risk charges, and sub-account expense ratios. These fees can impact your overall returns.

How VAFAs Work

VAFAs work by combining a fixed account with sub-accounts that invest in mutual funds. Here’s a breakdown of how they function:

Fixed Account

The fixed account provides a guaranteed minimum rate of return on your principal. This rate is typically set at a fixed percentage, and it remains unchanged for a specified period.

Are annuities qualified or nonqualified? Is An Annuity Qualified Or Nonqualified 2024 helps clarify this distinction. The type of annuity can impact tax implications and other factors.

Sub-Accounts

You can allocate a portion of your investment to sub-accounts that invest in mutual funds. These sub-accounts offer the potential for growth based on the performance of the underlying investments. You can choose from a variety of sub-accounts, each with a different investment objective and risk profile.

Generating Returns

Returns from a VAFA are generated through a combination of the guaranteed minimum rate of return on the fixed account and the potential growth of the sub-accounts. The allocation between the fixed account and the sub-accounts determines the overall risk and return profile of your investment.

Need to calculate an annuity in Excel? Calculating Annuity In Excel 2024 provides a comprehensive guide on how to do so. Whether you’re planning for retirement or saving for a specific goal, understanding annuities is essential.

Withdrawals and Distributions

You can withdraw funds from your VAFA at any time, but there may be penalties for early withdrawals. Withdrawals can be taken from either the fixed account or the sub-accounts. Distributions from the fixed account are typically guaranteed, while distributions from the sub-accounts are subject to market fluctuations.

What are variable annuity accumulation units? Variable Annuity Accumulation Units 2024 explains this important aspect of variable annuities. Understanding these units can help you make informed investment decisions.

VAFAs in 2024: Market Outlook

The market outlook for VAFAs in 2024 depends on various factors, including interest rate trends, market volatility, and economic conditions. Let’s explore some key considerations:

Interest Rate Environment

The Federal Reserve’s monetary policy plays a significant role in shaping interest rate trends. In 2024, the Fed is expected to continue its efforts to combat inflation, potentially leading to further interest rate hikes. This could impact the attractiveness of VAFAs, as the guaranteed minimum rate of return on the fixed account may become less competitive compared to other fixed income investments.

Market Volatility

Market volatility is a constant factor, and it can significantly impact the performance of VAFAs. In a volatile market, the value of your investment in the sub-accounts can fluctuate, potentially leading to losses. However, the fixed account provides a safety net, protecting your principal from losses.

Want to calculate an annuity due in Excel? Calculating Annuity Due In Excel 2024 provides step-by-step instructions. Annuity due payments are made at the beginning of each period, which can impact the overall return.

Economic Conditions

The overall economic landscape can influence investor sentiment and market performance. Factors such as inflation, unemployment, and consumer spending can impact the growth potential of the sub-accounts. A strong economy typically supports market growth, while a weak economy can lead to volatility and lower returns.

Comparing VAFAs with Other Investments: Variable Annuity Fixed Account 2024

VAFAs are a unique product that combines features of both fixed income and equity investments. Let’s compare them to other investment options:

VAFAs vs. CDs and Bonds

VAFAs offer a similar level of security as CDs and bonds, providing a guaranteed minimum rate of return. However, VAFAs also offer the potential for growth through sub-accounts, which CDs and bonds do not. CDs and bonds typically have lower potential returns than VAFAs, but they also come with lower risk.

Learn about variable annuity accounts. Variable Annuity Account 2024 offers an explanation of these accounts. Variable annuities provide the potential for growth but also come with investment risk.

VAFAs vs. Other Annuity Products

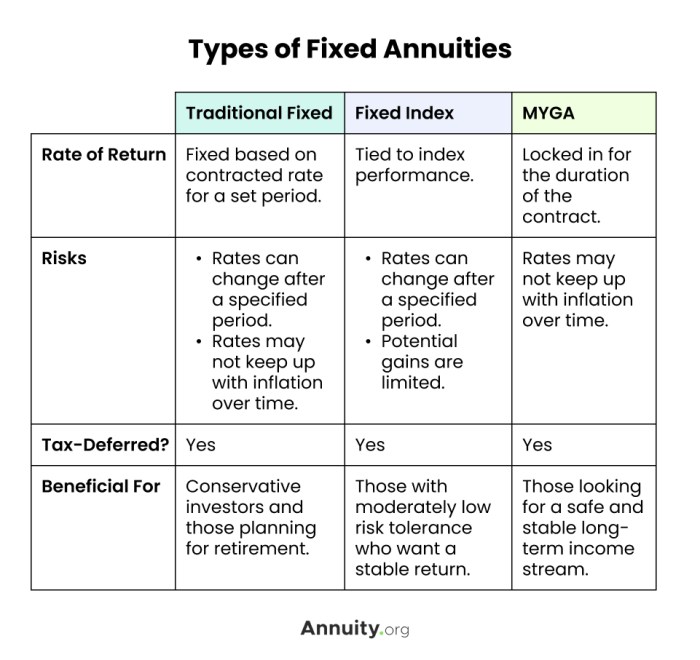

VAFAs are a type of variable annuity, which differs from other annuity products such as fixed annuities and indexed annuities. Fixed annuities offer a guaranteed rate of return but do not provide the potential for growth. Indexed annuities offer a minimum rate of return and a potential for growth tied to a specific market index, but they typically have limitations on how much growth you can achieve.

An annuity is a series of equal periodic payments. An Annuity Is A Series Of Equal Periodic Payments 2024 explores the basic definition of an annuity. Understanding this fundamental concept is essential for making informed financial decisions.

Key Considerations for Investors

Before investing in a VAFA, it’s crucial to consider various factors to ensure it aligns with your financial goals and risk tolerance:

Investment Horizon

VAFAs are typically long-term investments, as they are designed to provide income in retirement. If you have a short-term investment horizon, VAFAs may not be the best option.

Is income from an immediate annuity taxable? Is Immediate Annuity Income Taxable 2024 answers this question. Tax implications are a crucial factor to consider when planning for retirement.

Risk Tolerance

VAFAs involve a degree of risk, as the value of your investment in the sub-accounts can fluctuate with market conditions. If you have a low risk tolerance, you may want to consider other investment options.

Financial Goals

VAFAs can be used to achieve various financial goals, such as retirement income, income supplementation, or long-term savings. It’s essential to choose a VAFA that aligns with your specific financial objectives.

Choosing the Right VAFA

There are numerous VAFA products available in the market, each with its own features, benefits, and risks. When choosing a VAFA, consider factors such as the guaranteed minimum rate of return, the investment options available in the sub-accounts, and the fees associated with the product.

Need to use an R formula for annuities? R Annuity Formula 2024 provides the necessary formula for your calculations. R is a powerful statistical programming language that can be used for various financial applications.

Understanding VAFA Contracts, Variable Annuity Fixed Account 2024

Before investing in a VAFA, it’s essential to carefully review the contract and understand the terms and conditions. This includes the guaranteed minimum rate of return, the investment options available, the fees associated with the product, and the withdrawal rules.

VAFA Examples and Case Studies

VAFA Products

| Product Name | Guaranteed Minimum Rate of Return | Investment Options | Fees |

|---|---|---|---|

| VAFA Plus | 2.5% | Equity, Fixed Income, Balanced | 1.5% annual fee |

| Growth VAFA | 1.0% | Equity, Emerging Markets, Global | 1.0% annual fee |

| Secure VAFA | 3.0% | Fixed Income, Money Market | 0.5% annual fee |

Real-World Examples

In a bull market, a VAFA with a higher allocation to equity sub-accounts would likely perform well. However, in a bear market, the fixed account would provide a safety net, protecting your principal from losses. For example, during the 2008 financial crisis, VAFAs with a significant allocation to the fixed account performed relatively well compared to other investment options.

What does annuity mean in Bengali? Annuity Is Bengali Meaning 2024 offers the translation for this financial term. Understanding the meaning of financial concepts in different languages can be helpful for diverse audiences.

Case Study

Imagine a 60-year-old investor named John, who is nearing retirement and wants to secure a steady stream of income. John has a moderate risk tolerance and is looking for a product that offers both security and potential growth. He decides to invest $100,000 in a VAFA with a 2.5% guaranteed minimum rate of return.

He allocates 70% of his investment to a balanced sub-account and 30% to a fixed income sub-account. Over the next five years, John’s investment grows steadily, thanks to the performance of the sub-accounts and the guaranteed minimum rate of return on the fixed account.

Want to learn about the “3 Annuity” concept? 3 Annuity 2024 provides an overview of this strategy. This can be a useful approach for retirement planning and wealth management.

John is able to withdraw a consistent income stream from his VAFA, providing him with financial security in retirement.

Final Conclusion

As we navigate the ever-changing financial landscape, VAFAs offer a compelling alternative for investors seeking a balance between security and growth potential. By carefully evaluating your investment horizon, risk tolerance, and financial goals, you can determine if VAFAs are the right fit for your portfolio.

Annuity options for your 401k? Annuity 401k 2024 explores how annuities can be incorporated into your 401k plan. This can be a valuable strategy for retirement planning.

While VAFAs provide a measure of protection from market volatility, it’s crucial to understand the potential risks associated with them. Remember to consult with a qualified financial advisor before making any investment decisions.

Query Resolution

What is the minimum investment required for a VAFA?

The minimum investment amount for a VAFA varies depending on the specific product and provider. It’s best to check with the issuing company for their specific requirements.

Are VAFAs suitable for all investors?

VAFAs are not suitable for all investors. They are generally best suited for individuals seeking a fixed income stream with some potential for growth and who are comfortable with the risks involved.

Can I withdraw my money from a VAFA before maturity?

Want to know the future value of an annuity? Fv Calculator Annuity 2024 offers a convenient tool for calculating the future value of your annuity. This can help you understand the potential growth of your savings over time.

Yes, but early withdrawals may be subject to penalties. It’s important to review the terms and conditions of the VAFA contract to understand the withdrawal rules.

How are VAFAs taxed?

The tax treatment of VAFAs depends on the specific product and your individual circumstances. It’s best to consult with a tax advisor to understand the tax implications of investing in a VAFA.