Variable Annuity Guaranteed Death Benefit 2024 offers a unique approach to retirement planning, combining the potential for growth with a safety net for loved ones. This financial instrument allows individuals to invest their retirement savings in a diversified portfolio of assets while ensuring that a predetermined death benefit is paid to their beneficiaries upon their passing.

Variable annuities work by allowing investors to allocate their funds into sub-accounts that track the performance of various investment options, such as stocks, bonds, and mutual funds. The value of these sub-accounts fluctuates based on the market performance of the underlying investments, providing the potential for higher returns but also carrying some risk.

However, the Guaranteed Death Benefit (GDB) acts as a safety net, guaranteeing a minimum payout to beneficiaries, regardless of the performance of the investment sub-accounts.

Contents List

Variable Annuity Fundamentals

Variable annuities are complex financial instruments that offer a blend of investment growth potential and guaranteed income streams. Unlike traditional fixed annuities, which provide a fixed rate of return, variable annuities allow policyholders to invest their premiums in a range of sub-accounts, each with its own investment objective and risk profile.

Chapter 9 of a finance textbook often covers annuities in detail. For a comprehensive understanding of annuities in this context, you can refer to this article: Chapter 9 Annuities 2024. Understanding how to calculate the annuity factor is crucial when working with annuities.

This article provides a guide on that process: Calculating The Annuity Factor 2024.

Investment Component of Variable Annuities

The core of a variable annuity lies in its investment component. Policyholders choose from various sub-accounts, each representing a distinct investment strategy. These sub-accounts might include mutual funds, index funds, or other investment vehicles, each with its own potential for growth and risk.

One of the main concerns people have about annuities is whether the income they receive is taxable. Immediate annuities are generally taxed as ordinary income. For more details on the tax implications, visit Is Immediate Annuity Income Taxable 2024.

If you’re looking for a comprehensive understanding of annuities, you can check out this article that includes multiple choice questions: Annuity Is Mcq 2024.

The value of the variable annuity fluctuates based on the performance of the underlying investments within these sub-accounts.

The growth potential of a variable annuity is directly linked to the performance of the chosen sub-accounts. If the underlying investments perform well, the value of the annuity will increase, and vice versa. However, it’s crucial to understand that the investment component of a variable annuity carries market risk.

If the market experiences a downturn, the value of the annuity could decline, potentially impacting the future income stream.

Types of Investment Options within Variable Annuities

Variable annuity contracts offer a variety of investment options to suit different risk tolerances and financial goals. Some common types of investment options include:

- Equity Sub-accounts:These sub-accounts invest primarily in stocks, offering the potential for higher returns but also greater volatility.

- Fixed Income Sub-accounts:These sub-accounts invest in bonds and other fixed-income securities, providing a more stable income stream with lower risk compared to equity sub-accounts.

- Balanced Sub-accounts:These sub-accounts offer a mix of stocks and bonds, aiming to balance potential growth with risk mitigation.

- Target-Date Funds:These funds automatically adjust their asset allocation over time, becoming more conservative as the investor approaches their retirement date.

Guaranteed Death Benefit Explained

A Guaranteed Death Benefit (GDB) is a crucial feature of variable annuities, providing a safety net for beneficiaries in case of the policyholder’s death. It ensures that a minimum amount will be paid out to the designated beneficiaries, regardless of the performance of the underlying investments.

GDB as a Safety Net for Beneficiaries

The GDB acts as a guarantee that a specific minimum amount will be paid out to the beneficiary, even if the value of the annuity has declined due to poor market performance. This protection can be especially valuable in situations where the policyholder dies unexpectedly or before their investments have had time to fully recover from a market downturn.

Annuity bonds are a specific type of bond that pays out a regular stream of income. To learn about the formula used for these bonds, check out this article: Formula Annuity Bond 2024. Understanding the present value of an annuity is important for financial planning.

This article provides an example to illustrate this concept: Pv Annuity Example 2024.

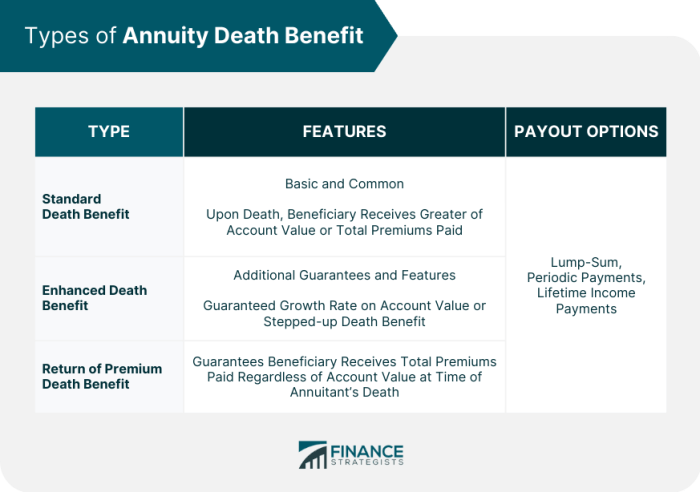

Types of Guaranteed Death Benefit Options

Variable annuities offer different types of GDB options, each with its own terms and conditions. Here are some common types:

- Guaranteed Minimum Death Benefit (GMDB):This option guarantees a minimum payout equal to the original premium invested, regardless of the current value of the annuity.

- Enhanced Death Benefit (EDB):This option offers a higher guaranteed payout than the GMDB, often based on a percentage of the original premium or the account value, whichever is greater.

- Return of Premium Death Benefit (RPDB):This option guarantees the return of the premium paid, regardless of the account value, offering a straightforward safety net.

GDB in 2024: Current Landscape

The GDB landscape for variable annuities is constantly evolving. In 2024, several key trends are shaping the availability and features of GDBs.

For those studying for the Jaiib exam, annuities are a key topic. This article provides information on annuities relevant to the Jaiib syllabus: Annuity Jaiib 2024. Whether you’re considering an annuity for retirement or just learning about them, it’s essential to have a good understanding of these financial instruments.

Trends and Changes in GDB Provisions

One notable trend is the increasing popularity of “living benefit” riders, which provide guaranteed income streams to policyholders during their lifetime, in addition to the GDB for beneficiaries. These riders offer a more comprehensive approach to lifetime income planning.

Another trend is the rise of personalized GDB options, allowing policyholders to tailor the level of protection based on their individual needs and risk tolerance. Some insurance companies are offering flexible GDB features, such as the ability to adjust the guaranteed payout amount or choose different benefit periods.

Annuity due is a type of annuity where payments are made at the beginning of each period. You can find more information on this topic by checking out this article: Annuity Due Is 2024. Annuity funds, on the other hand, are investment vehicles that are designed to provide a stream of income in retirement.

For more on this, visit Annuity Fund Is 2024.

Comparison of GDB Features Across Insurance Companies, Variable Annuity Guaranteed Death Benefit 2024

It’s essential to compare the GDB features offered by different insurance companies before making a decision. Factors to consider include the guaranteed payout amount, the benefit period, any associated fees, and the overall financial strength of the insurance company.

For instance, some companies may offer higher guaranteed payouts but charge higher fees, while others may offer lower payouts but have a strong financial track record. Carefully evaluating these factors will help you choose the GDB option that best aligns with your financial goals and risk tolerance.

Impact of Market Conditions on GDB Provisions

The current market environment can significantly impact the availability and features of GDBs. In periods of market volatility, insurance companies may adjust their GDB provisions to reflect the increased risk. This could involve lowering the guaranteed payout amount or increasing the associated fees.

It’s crucial to stay informed about current market conditions and how they might affect the GDB options available to you. Consulting with a financial advisor can provide valuable insights into the potential impact of market fluctuations on your GDB provisions.

GDB and Investment Strategy: Variable Annuity Guaranteed Death Benefit 2024

The GDB plays a crucial role in shaping the investment strategy within a variable annuity. The level of protection provided by the GDB can influence the types of investments chosen and the overall risk tolerance of the portfolio.

Sample Investment Strategy for a Variable Annuity with GDB

Let’s consider a hypothetical example. An investor with a moderate risk tolerance and a GDB that guarantees a minimum payout of 100% of the original premium might choose a balanced portfolio with a mix of stocks and bonds. The GDB provides a safety net, allowing the investor to allocate a portion of their assets to growth-oriented investments, such as stocks, while still having a guaranteed minimum payout for their beneficiaries.

An investor with a higher risk tolerance and a GDB that offers a higher guaranteed payout might allocate a larger portion of their assets to equities, seeking higher potential returns. However, it’s crucial to remember that higher risk investments also carry the potential for greater losses.

Interplay Between GDB and Investment Strategy

The GDB and the investment strategy within a variable annuity are interconnected. The GDB acts as a floor, setting a minimum guaranteed payout, while the investment strategy determines the potential for growth and the level of risk exposure.

If you’re looking to generate leads for annuity sales, you can find helpful tips in this article: Annuity Leads 2024. When considering an annuity provider, it’s crucial to ensure they’re reputable. To check the legitimacy of Annuity Gator, you can read this article: Is Annuity Gator Legit 2024.

For instance, an investor with a high-risk tolerance and a GDB that offers a significant guaranteed payout might choose to invest in a more aggressive portfolio with a higher proportion of equities. The GDB provides a cushion against potential losses, allowing the investor to take on more risk in pursuit of higher returns.

Impact of GDB on Investment Decisions

The presence of a GDB can influence investment decisions within a variable annuity. Investors with GDBs may feel more comfortable taking on higher risk, knowing that their beneficiaries are protected by the guaranteed minimum payout. However, it’s essential to strike a balance between risk and reward, considering the individual’s financial goals, time horizon, and risk tolerance.

Considerations for Individuals

Deciding whether a variable annuity with a GDB is appropriate for your individual needs requires careful consideration of several factors.

Many people wonder if an annuity is considered life insurance. It’s important to understand that annuities are not life insurance, although they can provide a death benefit. To learn more about the differences, visit Is Annuity Life Insurance 2024.

If you’re still unsure what an annuity is, you can check out the definition in this article: Annuity What Is It Definition 2024.

Key Factors to Consider

Here are some key factors to consider:

- Financial Goals:Are you primarily seeking investment growth potential or income guarantees?

- Risk Tolerance:How comfortable are you with market volatility and potential losses?

- Time Horizon:How long do you plan to hold the annuity?

- Tax Implications:Understand the tax implications of variable annuities and GDBs.

- Fees and Expenses:Compare the fees and expenses associated with different variable annuity contracts and GDB options.

Pros and Cons of Variable Annuities with GDBs

Here’s a table comparing the pros and cons of variable annuities with GDBs versus other retirement planning options:

| Feature | Variable Annuity with GDB | Other Retirement Planning Options |

|---|---|---|

| Investment Growth Potential | High | Variable |

| Guaranteed Income | Yes (through GDB) | May or may not be available |

| Tax Advantages | Deferred taxation on investment growth | Variable |

| Fees and Expenses | Generally higher | Variable |

| Liquidity | Limited | Variable |

Decision-Making Process Flowchart

Here’s a flowchart illustrating the decision-making process for individuals considering a variable annuity with a GDB:

- Assess Financial Goals:What are your primary financial goals? Are you seeking investment growth, income guarantees, or both?

- Determine Risk Tolerance:How comfortable are you with market volatility and potential losses?

- Consider Time Horizon:How long do you plan to hold the annuity?

- Evaluate GDB Options:Compare the features, fees, and benefits of different GDB options available.

- Compare with Other Options:Consider other retirement planning options, such as traditional IRAs, 401(k)s, or Roth IRAs.

- Consult with a Financial Advisor:Seek professional advice from a qualified financial advisor to make an informed decision.

Concluding Remarks

In conclusion, Variable Annuity Guaranteed Death Benefit 2024 offers a compelling option for individuals seeking to balance potential growth with guaranteed protection for their beneficiaries. Understanding the intricacies of GDBs, available options, and their impact on investment strategies is crucial for making informed decisions.

Annuity loans are a type of loan that is repaid in regular installments. You can find a guide to calculating these loans in this article: Calculate Annuity Loan 2024. For those of you using the HP10bii calculator, there’s a separate article on calculating annuities using that specific model: Calculate Annuity Hp10bii 2024.

By carefully considering individual needs, risk tolerance, and long-term financial goals, individuals can leverage the unique features of Variable Annuities with GDBs to secure a more confident and stable future.

FAQ Insights

How does the Guaranteed Death Benefit (GDB) work in a variable annuity?

The GDB acts as a safety net, guaranteeing a minimum payout to beneficiaries upon the policyholder’s death. It typically works by guaranteeing a certain percentage of the initial investment, regardless of the performance of the investment sub-accounts. This ensures that beneficiaries receive a minimum death benefit, even if the value of the annuity has declined.

What are the different types of GDB options available?

There are several types of GDB options, including:

- Guaranteed Minimum Death Benefit (GMDB):Guarantees a minimum death benefit based on the initial investment amount.

- Enhanced Death Benefit (EDB):Offers a death benefit that can increase over time based on the performance of the investment sub-accounts.

What are the key considerations when deciding if a variable annuity with a GDB is right for me?

Factors to consider include your risk tolerance, time horizon, financial goals, and beneficiary needs. It’s essential to consult with a financial advisor to determine if a variable annuity with a GDB aligns with your overall financial strategy.