Variable Annuity General Account 2024 sets the stage for a comprehensive exploration of this complex financial instrument. This guide will delve into the intricacies of variable annuity general accounts, offering insights into their investment options, risk management strategies, fees, tax implications, and the evolving landscape for 2024.

Variable annuities are offered by various companies, and it’s important to compare different options to find the best fit for your needs. M&E Variable Annuity 2024 is just one example of a variable annuity offered by a specific company. Make sure to research the company’s reputation and track record before making any decisions.

We will examine how these accounts work, the factors influencing their performance, and their suitability for various investment goals.

If you’re considering a variable annuity, it’s important to be aware of the fees associated with it. These fees can impact your overall return, so it’s essential to understand what you’re paying for. A Variable Annuity Charges 2024 can include administrative fees, mortality and expense charges, and investment management fees.

Variable annuity general accounts are a type of investment vehicle that offers the potential for growth while providing some protection against market downturns. They function as a pool of assets managed by an insurance company, where investors can choose from a variety of investment options, typically mutual funds or sub-accounts.

Retirement income is often subject to taxation, and annuities are no exception. Is Annuity Subject To Rmd 2024 is a question that many retirees have. The answer depends on the specific type of annuity and your individual circumstances.

The value of the annuity contract fluctuates based on the performance of the underlying investments within the general account.

Contents List

Variable Annuity General Account: Overview

A variable annuity general account is a core component of a variable annuity product. It functions as a pool of investment options, allowing annuitants to allocate their funds across various assets. This account is managed by the insurance company offering the annuity and is subject to market fluctuations.

Variable annuities allow you to invest in a range of sub-accounts, but there may be limits on how much you can contribute each year. Variable Annuity Contribution Limits 2024 are subject to change, so it’s important to stay updated on the current regulations.

The performance of the general account directly impacts the value of the annuity contract. This means that the value of your annuity contract will fluctuate based on the performance of the investments within the general account.

Annuity payments can be a reliable source of income in retirement, but it’s important to understand the different types available. A Fixed Variable Annuity Definition 2024 is one type that combines features of both fixed and variable annuities. It offers the potential for growth with a variable component, while also providing a guaranteed minimum return.

Investment Options in the General Account

Variable annuity general accounts typically offer a range of investment options, providing flexibility for annuitants to tailor their investment strategy based on their risk tolerance and investment goals. These options often include:

- Mutual Funds:These funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other assets. Each mutual fund has a specific investment objective and strategy.

- Sub-Accounts:These are similar to mutual funds but are managed specifically for the variable annuity contract. Sub-accounts offer a wider range of investment choices, including actively managed funds, index funds, and target-date funds.

- Other Investment Vehicles:Depending on the insurer, the general account may offer access to other investment options, such as exchange-traded funds (ETFs), real estate investment trusts (REITs), or even alternative investments like private equity.

Impact of General Account Performance

The performance of the general account directly affects the value of your annuity contract. When the investments within the general account perform well, the value of your annuity contract will increase. Conversely, if the investments underperform, the value of your contract will decline.

It is important to understand that the value of your annuity contract is not guaranteed and is subject to market risks.

Tax implications are an important consideration when planning for retirement. Is Annuity Exempt From Tax 2024 is a question that often arises. While some annuities may offer tax advantages, it’s crucial to understand the specific rules and regulations that apply to your situation.

Investment Strategies and Risk Management

Investment strategies employed in variable annuity general accounts are designed to balance growth potential with risk management. These strategies typically involve a combination of asset allocation and diversification.

Annuity payments are often seen as a reliable source of income in retirement, but it’s important to understand how they differ from bonds. Is Annuity Bond 2024 is a question that often arises. While annuities and bonds both provide income, they have distinct characteristics and risks.

Asset Allocation

Asset allocation refers to the distribution of an investment portfolio across different asset classes, such as stocks, bonds, and real estate. By diversifying across asset classes, investors can mitigate risk and potentially enhance returns. In variable annuity general accounts, asset allocation is typically guided by the investment objectives and risk tolerance of the annuitant.

It’s common to wonder how much return you can expect from an annuity. Calculating Annuity Rate Of Return 2024 can be done using various methods, but it’s important to remember that the actual return may vary depending on the type of annuity and the market conditions.

For instance, an investor with a longer time horizon and a higher risk tolerance might allocate a larger portion of their portfolio to stocks, while a more conservative investor might prefer a greater allocation to bonds.

Diversification

Diversification involves spreading investments across a variety of assets to reduce the impact of any single investment’s performance on the overall portfolio. Within a variable annuity general account, diversification can be achieved by investing in multiple mutual funds, sub-accounts, or other investment vehicles that represent different sectors, industries, or geographic regions.

Diversification helps to mitigate risk by reducing the likelihood of significant losses due to the poor performance of any one investment.

Risks Associated with Variable Annuity General Accounts

While variable annuity general accounts offer the potential for growth, they also carry certain risks that investors should be aware of. These risks include:

- Market Volatility:The value of investments within the general account can fluctuate significantly due to market conditions, economic factors, and other unforeseen events. This volatility can lead to both gains and losses in the value of your annuity contract.

- Inflation:Inflation erodes the purchasing power of money over time. If the rate of inflation outpaces the returns generated by the general account, the real value of your annuity contract may decline.

- Interest Rate Fluctuations:Changes in interest rates can affect the performance of bonds and other fixed-income investments within the general account. Rising interest rates can lead to a decline in the value of fixed-income securities.

Fees and Expenses

Variable annuity general accounts are subject to various fees and expenses that can impact the overall return of your annuity contract. Understanding these fees is crucial for making informed investment decisions.

Types of Fees

- Management Fees:These fees are charged by the investment managers responsible for managing the mutual funds or sub-accounts within the general account. They cover the costs of research, portfolio management, and administrative expenses.

- Administrative Fees:These fees cover the costs associated with running the variable annuity program, such as recordkeeping, customer service, and marketing.

- Mortality and Expense Charges:These fees are designed to cover the insurance company’s costs associated with providing the death benefit and other guarantees offered by the variable annuity contract.

- Other Fees:Depending on the specific annuity contract, there may be other fees associated with transactions, such as withdrawal fees, surrender charges, or investment-specific fees.

Impact of Fees

Fees and expenses can significantly impact the overall return of your annuity contract. The higher the fees, the lower the potential return on your investment. It is essential to compare the fee structures of different variable annuity contracts to find options that offer competitive fees and align with your investment goals.

Tax Considerations

Investing in a variable annuity general account involves tax considerations that are important to understand. The tax implications of variable annuities can vary depending on the specific contract and the type of withdrawals taken.

Tax Treatment of Withdrawals

Withdrawals from a variable annuity general account are generally taxed as ordinary income. This means that you will need to pay federal and state income tax on the amount withdrawn, based on your tax bracket. However, there are exceptions to this rule, such as withdrawals taken after age 59 1/2, which may qualify for favorable tax treatment under certain circumstances.

Tax Strategies, Variable Annuity General Account 2024

To maximize returns and minimize tax liability, investors may consider various tax strategies, such as:

- Tax-Loss Harvesting:Selling investments that have lost value to offset capital gains from other investments. This strategy can help reduce your overall tax liability.

- Roth Conversions:Converting traditional IRA assets to a Roth IRA can provide tax-free withdrawals in retirement. This strategy can be particularly beneficial for investors who expect to be in a higher tax bracket in retirement.

- Tax-Deferred Growth:Variable annuities offer tax-deferred growth, meaning that you will not pay taxes on investment earnings until you withdraw them. This can be advantageous for long-term investments, as it allows your investment to grow tax-free for a longer period.

2024 Trends and Outlook

The variable annuity market is constantly evolving, and 2024 is expected to bring new trends and developments that could impact the performance of variable annuity general accounts. Here are some key factors to consider:

Market Conditions

The performance of variable annuity general accounts is closely tied to overall market conditions. In 2024, investors will be monitoring factors such as inflation, interest rates, and geopolitical events, which can significantly impact asset prices and investment returns.

Economic Factors

Economic factors, such as economic growth, employment rates, and consumer confidence, can influence the performance of the general account. Strong economic growth can support higher investment returns, while economic downturns can lead to market volatility and potential losses.

Regulatory Changes

The insurance industry is subject to ongoing regulatory changes. In 2024, there may be new regulations or industry developments that could affect the structure and performance of variable annuities. These changes could impact fees, investment options, or other aspects of the variable annuity product.

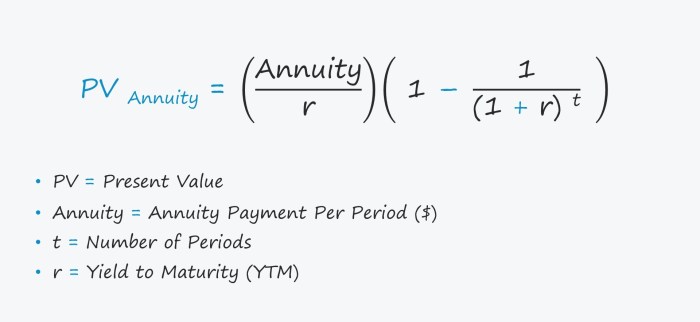

Understanding the formula behind annuity calculations can be helpful in making informed decisions about your retirement planning. Annuity Formula Is 2024 can help you determine the present value of a series of future payments, which is a key aspect of annuity calculations.

Comparison with Other Investment Options: Variable Annuity General Account 2024

Variable annuity general accounts are just one of many investment options available to investors. It is important to compare variable annuities with other investment vehicles to determine the best fit for your individual needs and circumstances.

In some situations, you may need to withdraw money from your annuity before you reach the designated payout period. Annuity Hardship Withdrawal 2024 may be possible, but it’s important to check the terms of your contract and understand any associated penalties or fees.

Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) offer a diversified portfolio of investments, similar to variable annuity general accounts. However, they are not subject to the same fees and expenses as variable annuities. Mutual funds and ETFs also offer greater flexibility in terms of investment choices and tax treatment.

If you’re considering an annuity from LIC, it’s important to be aware of the tax implications. Is Annuity From Lic Taxable 2024 is a question that many individuals have. The answer depends on the specific type of annuity and the applicable tax laws.

Traditional Annuities

Traditional annuities provide guaranteed income payments, but they do not offer the potential for growth that variable annuities provide. Traditional annuities are typically considered a more conservative investment option, suitable for investors seeking guaranteed income streams.

Table Comparing Investment Options

| Investment Option | Risk | Return Potential | Tax Implications | Fees and Expenses | Liquidity |

|---|---|---|---|---|---|

| Variable Annuity General Account | High | High | Tax-deferred growth, withdrawals taxed as ordinary income | High | Limited |

| Mutual Funds | Moderate to High | Moderate to High | Taxable income | Moderate | Daily |

| ETFs | Moderate to High | Moderate to High | Taxable income | Low | Daily |

| Traditional Annuities | Low | Low | Tax-deferred growth, withdrawals taxed as ordinary income | Moderate | Limited |

Considerations for Investors

When evaluating variable annuity general accounts, investors should consider several key factors to determine if this investment option aligns with their individual needs and circumstances.

Investment Goals

What are your investment goals? Are you seeking growth potential, income generation, or a combination of both? Variable annuities can be suitable for investors with a long-term investment horizon and a moderate to high risk tolerance.

Risk Tolerance

How much risk are you comfortable taking? Variable annuity general accounts are subject to market fluctuations, so investors should have a strong understanding of their risk tolerance before investing.

Your age plays a significant role in determining how much you’ll receive from an annuity. A Annuity Calculator By Age 2024 can help you estimate your potential payments based on your current age and other factors. The calculator will take into account factors such as your life expectancy and the interest rate.

Time Horizon

How long do you plan to invest? Variable annuities are typically considered a long-term investment option. If you have a shorter time horizon, other investment options may be more appropriate.

If you’re planning to use your pension to purchase an annuity, it’s helpful to know how much you can expect to receive. Calculate Annuity From Pension 2024 to get a better understanding of your potential income stream. This can help you make informed decisions about your retirement planning.

Fees and Expenses

Compare the fees and expenses associated with different variable annuity contracts to find options that offer competitive pricing and align with your investment goals.

Tax Implications

Understand the tax implications of investing in a variable annuity general account. Consider the tax treatment of withdrawals and distributions, and explore potential tax strategies to minimize your tax liability.

Epilogue

Understanding the nuances of variable annuity general accounts is crucial for making informed investment decisions. This guide has provided a framework for navigating this complex investment landscape, highlighting key considerations, potential risks, and opportunities. As you weigh the advantages and disadvantages, remember that your individual circumstances, risk tolerance, and financial goals should guide your investment choices.

Popular Questions

What are the potential benefits of investing in a variable annuity general account?

Potential benefits include tax-deferred growth, the potential for higher returns than traditional fixed annuities, and the ability to customize your investment portfolio.

What are the risks associated with variable annuity general accounts?

Risks include market volatility, potential loss of principal, and the possibility of higher fees compared to other investment options.

Are variable annuity general accounts suitable for everyone?

Variable annuity general accounts are not suitable for everyone. They are best suited for investors with a long-term investment horizon, a moderate to high risk tolerance, and a willingness to accept potential fluctuations in their investment value.

Figuring out how much you’ll get from an annuity can be a bit tricky, especially if you’re considering a large sum like Annuity 200k 2024. There are several factors that play a role, such as your age, the interest rate, and the duration of the payments.

Thankfully, you can use an online calculator to help you estimate your potential annuity payments. Just enter your information and the calculator will do the rest.

How do I choose the right variable annuity general account?

It’s essential to carefully consider your investment goals, risk tolerance, and time horizon. Seek advice from a qualified financial advisor to determine if a variable annuity general account is the right fit for your specific needs.