How Variable Annuity Works 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Variable annuities, a complex yet potentially rewarding financial instrument, have evolved significantly over the years, becoming a crucial component of many retirement plans.

This guide delves into the intricacies of variable annuities, providing a comprehensive overview of their mechanics, benefits, and potential risks.

If you’re looking to receive a large annuity payout, you might be curious about the possibility of a $2 million annuity. The article Annuity 2 Million 2024 provides information on this type of annuity.

Variable annuities offer a unique blend of investment growth potential and guaranteed income, appealing to those seeking a balanced approach to retirement planning. Understanding the intricacies of variable annuities is crucial for making informed financial decisions, especially in today’s dynamic market landscape.

Contents List

- 1 Introduction to Variable Annuities

- 2 Understanding the Mechanics of Variable Annuities

- 3 Key Components of a Variable Annuity Contract

- 4 Tax Considerations and Investment Strategies

- 5 Risks and Considerations: How Variable Annuity Works 2024

- 6 Variable Annuities in 2024: Current Trends and Future Outlook

- 7 Conclusion

- 8 FAQ Explained

Introduction to Variable Annuities

Variable annuities are a type of retirement savings product that offers the potential for growth while providing some downside protection. They differ from traditional fixed annuities, which guarantee a fixed rate of return, in that the investment returns in a variable annuity are tied to the performance of underlying mutual funds or sub-accounts.

This means that the value of your annuity can fluctuate based on the market performance of the chosen investment options.

Variable annuities are known for their flexibility and potential for higher returns compared to fixed annuities. They also offer various features that can enhance your retirement savings strategy, such as tax deferral, death benefit guarantees, and living benefit options. However, it’s crucial to understand the inherent risks associated with variable annuities, including the potential for loss of principal.

Variable annuities emerged in the 1950s as a response to the growing demand for investment options that could provide higher returns than traditional fixed annuities. They quickly gained popularity as a retirement savings vehicle, especially among investors seeking a balance between growth potential and some level of downside protection.

Key Features and Benefits of Variable Annuities

- Potential for Higher Returns:Variable annuities offer the potential for higher returns compared to fixed annuities because your investment is tied to the performance of the underlying mutual funds or sub-accounts. However, this also means that your investment is subject to market risk.

A growing annuity is one where payments increase over time. If you’re using a BA II Plus calculator, the article Calculate Growing Annuity Ba Ii Plus 2024 will provide step-by-step instructions for calculating these annuities.

- Tax Deferral:Earnings on your variable annuity are not taxed until you withdraw them in retirement. This allows your money to grow tax-deferred, potentially increasing your overall returns.

- Death Benefit Guarantees:Many variable annuities offer death benefit guarantees, which ensure that your beneficiary will receive a minimum amount of money even if your investment loses value.

- Living Benefit Options:Some variable annuities offer living benefit options, such as guaranteed minimum income benefits (GMIBs) or guaranteed minimum withdrawal benefits (GMWBs). These features provide a level of downside protection and can help ensure a steady stream of income in retirement.

Understanding the Mechanics of Variable Annuities

Investment Options

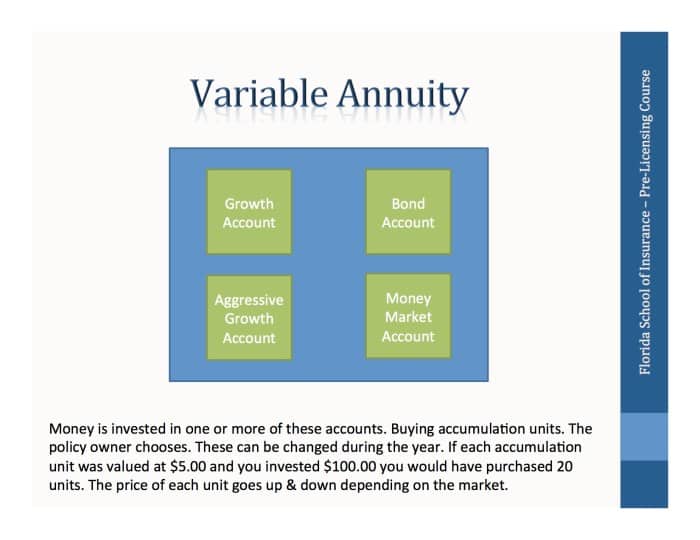

Variable annuities offer a wide range of investment options, allowing you to tailor your portfolio to your risk tolerance and financial goals. These investment options are typically structured as sub-accounts, each representing a different mutual fund or investment strategy. Sub-accounts can range from conservative options like money market funds to more aggressive options like stock funds or sector-specific funds.

The risk profile of each sub-account is determined by the underlying investments. For instance, a sub-account investing in a large-cap stock fund would generally be considered more volatile than a sub-account investing in a bond fund. You can allocate your investment across multiple sub-accounts to create a diversified portfolio that aligns with your risk tolerance and financial goals.

One question many people have is whether an annuity is guaranteed. The article Is Annuity Certain 2024 provides information about the guarantees associated with different types of annuities.

Role of the Insurance Company

The insurance company issuing the variable annuity plays a crucial role in providing guarantees and managing the investment options. They are responsible for selecting and monitoring the underlying investment options and ensuring that the contract terms are met. The insurance company also provides certain guarantees, such as death benefit guarantees and living benefit options, which can provide a level of downside protection.

Many annuities have payments compounded monthly. If you’re looking for an annuity calculator that accounts for monthly compounding, the Annuity Calculator Compounded Monthly 2024 might be a useful tool.

Accumulation Phase

The accumulation phase of a variable annuity is the period during which your investment grows. The value of your annuity is determined by the performance of the chosen sub-accounts. Any gains are tax-deferred until you withdraw them in retirement. The growth of your investment is calculated based on the investment returns of the underlying sub-accounts, minus any applicable fees and expenses.

It’s important to note that the value of your annuity can fluctuate based on the performance of the underlying investments, and you could potentially lose some or all of your principal.

Key Components of a Variable Annuity Contract

A variable annuity contract Artikels the terms and conditions of your investment. It includes details about the investment options, fees, guarantees, and other important provisions. Understanding the key components of your contract is essential for making informed investment decisions.

An annuity factor is a key component in calculating annuity payments. The Calculating Annuity Factor 2024 article explains how to calculate this factor and its importance.

Death Benefit

The death benefit provision in a variable annuity contract specifies what will happen to your investment if you die before annuitizing it. Most variable annuities offer a death benefit guarantee, which ensures that your beneficiary will receive a minimum amount of money, even if your investment loses value.

Understanding how to calculate the present value of an annuity can be beneficial, especially if you’re planning for retirement. You can find resources and calculators online, like the one for Pv Annuity Excel 2024 , to help you with your calculations.

The death benefit guarantee can be a fixed amount or a percentage of the original investment, depending on the terms of the contract.

Living Benefit Options

Living benefit options are additional features that can enhance your retirement savings strategy by providing a level of downside protection and ensuring a steady stream of income in retirement. Some common living benefit options include:

- Guaranteed Minimum Income Benefit (GMIB):This option guarantees a minimum level of income for life, even if your investment loses value. It’s typically a fixed amount or a percentage of your initial investment.

- Guaranteed Minimum Withdrawal Benefit (GMWB):This option allows you to withdraw a specific percentage of your investment each year, regardless of the performance of the underlying investments. It’s often designed to provide a guaranteed income stream for a set period of time.

Living benefit options can be valuable for investors seeking a level of downside protection and a guaranteed income stream in retirement. However, they typically come with additional fees, which can impact the overall performance of your annuity. It’s crucial to carefully evaluate the terms of these options and consider their potential impact on your investment strategy.

While it’s not common, some lottery winnings are paid out as annuities. If you’re interested in learning more about annuity options for lottery winnings, the article Annuity Lottery 2024 can be helpful.

Surrender Charges

Surrender charges are fees that are imposed if you withdraw your investment from a variable annuity before a specified period of time. These charges are designed to discourage investors from withdrawing their money early and can significantly impact the overall performance of your annuity.

Surrender charges are typically highest in the early years of the contract and gradually decline over time.

Tax Considerations and Investment Strategies

Tax Implications

Variable annuities offer tax deferral on earnings during the accumulation phase, meaning that you don’t have to pay taxes on your investment gains until you withdraw them in retirement. This can be a significant advantage, as it allows your money to grow tax-deferred, potentially increasing your overall returns.

If you’re participating in the Thrift Savings Plan (TSP), you may have the option of receiving an annuity payout. The article Calculating Tsp Annuity 2024 can help you understand the process and factors involved.

However, it’s important to note that when you withdraw your investment in retirement, it will be taxed as ordinary income. This is different from withdrawals from traditional IRAs or 401(k)s, which are taxed as ordinary income as well, but withdrawals from Roth IRAs are tax-free in retirement.

For those looking to learn more about annuities offered through the National Pension System (NPS), the article Annuity Nps 2024 provides valuable information about this specific type of annuity.

Hypothetical Investment Strategy, How Variable Annuity Works 2024

Let’s consider a hypothetical investment strategy for a variable annuity. Suppose you are a 50-year-old investor with a moderate risk tolerance and a 15-year time horizon. You are aiming to accumulate a significant retirement nest egg and are looking for an investment option that offers growth potential with some downside protection.

If you’re using a TI-84 calculator for your calculations, you can find instructions on how to calculate annuities in the article titled How To Calculate Annuities On Ti 84 2024.

In this scenario, a variable annuity could be a suitable investment option. You could allocate your investment across multiple sub-accounts, including a mix of stock funds, bond funds, and potentially some real estate or commodity funds, to create a diversified portfolio that aligns with your risk tolerance and financial goals.

The specific allocation would depend on your individual circumstances and investment objectives. You could also consider incorporating a living benefit option, such as a GMIB or GMWB, to provide a level of downside protection and ensure a steady stream of income in retirement.

Tax Treatment Comparison

| Investment Option | Tax Treatment During Accumulation | Tax Treatment During Distribution |

|---|---|---|

| Variable Annuity | Tax-deferred | Taxed as ordinary income |

| Traditional IRA | Tax-deductible | Taxed as ordinary income |

| 401(k) | Tax-deferred | Taxed as ordinary income |

| Roth IRA | Taxed upfront | Tax-free |

Risks and Considerations: How Variable Annuity Works 2024

Inherent Risks

Variable annuities are not without risk. Some key risks associated with variable annuities include:

- Market Volatility:The value of your annuity can fluctuate based on the performance of the underlying investments. This means that you could lose some or all of your principal, especially during periods of market downturn.

- Investment Performance:The performance of your annuity is directly tied to the performance of the chosen sub-accounts. If the underlying investments perform poorly, your annuity value will also decline.

- Fees and Expenses:Variable annuities typically have higher fees and expenses than traditional fixed annuities. These fees can significantly impact the overall performance of your annuity.

- Potential Loss of Principal:Unlike fixed annuities, variable annuities do not guarantee a minimum return. You could potentially lose some or all of your principal if the underlying investments perform poorly.

Comparison with Other Investment Products

Variable annuities are similar to mutual funds and exchange-traded funds (ETFs) in that they invest in a portfolio of underlying securities. However, variable annuities offer certain features that distinguish them from these other investment products, such as tax deferral, death benefit guarantees, and living benefit options.

However, these features often come with additional fees and complexities that may not be suitable for all investors.

Unsuitable Scenarios

Variable annuities may not be the most suitable investment option for everyone. They can be complex products with high fees and potential for loss of principal. If you are risk-averse or have a short time horizon, a variable annuity may not be the best choice for you.

If you’re considering an annuity that will continue payments to your surviving spouse, you may want to research a joint and survivor annuity. The Annuity Joint And Survivor 2024 article can help you understand the benefits and details of this type of annuity.

It’s important to carefully evaluate your risk tolerance, financial goals, and time horizon before investing in a variable annuity.

When you’re ready to start receiving annuity payments, you’ll want to know how much you can expect to receive. The Calculating Annuity Payout 2024 article can help you understand the factors that influence your payout amount.

Variable Annuities in 2024: Current Trends and Future Outlook

Current Trends

The variable annuity market has been evolving in recent years, with a growing emphasis on transparency, fee disclosure, and product innovation. The market has seen an increase in the adoption of guaranteed lifetime withdrawal benefits (GLWBs), which provide a guaranteed stream of income for life, regardless of market performance.

If you’re considering an annuity backed by a bond, you may want to understand how to calculate the value of such an annuity. The article Calculate Annuity Bond 2024 provides details on this type of calculation.

There has also been a trend towards lower fees and more flexible investment options, making variable annuities more accessible to a wider range of investors.

A good starting point for anyone looking to plan for retirement is to estimate their savings needs. You can utilize an online calculator, such as the Calculator Annuity Savings 2024 , to get a better idea of how much you might need to save.

Impact of Macroeconomic Factors

Macroeconomic factors, such as interest rates and inflation, can significantly impact the performance of variable annuities. Rising interest rates can negatively impact the performance of bond funds, which are a common component of variable annuity portfolios. Inflation can also erode the purchasing power of your investment returns.

It’s important to consider the potential impact of macroeconomic factors when evaluating variable annuities.

A deferred variable annuity is a type of annuity that delays payments until a later date. The article Deferred Variable Annuity Definition 2024 provides a detailed explanation of this annuity type.

Key Factors to Consider in 2024

| Factor | Description |

|---|---|

| Fees | Compare the fees charged by different variable annuity providers. Look for contracts with low annual fees and minimal surrender charges. |

| Investment Options | Evaluate the range of investment options available within the variable annuity contract. Choose a provider that offers a diverse selection of sub-accounts that align with your risk tolerance and financial goals. |

| Guarantee Features | Consider the availability and terms of guarantee features, such as death benefit guarantees and living benefit options. These features can provide a level of downside protection and ensure a steady stream of income in retirement. |

Conclusion

Variable annuities, with their combination of investment growth potential and guaranteed income features, can be a valuable addition to a diversified retirement portfolio. However, it’s essential to carefully consider the risks and complexities associated with these products before making any investment decisions.

Consulting with a qualified financial advisor can help you determine if a variable annuity aligns with your individual financial goals and risk tolerance.

FAQ Explained

What is the minimum investment amount for a variable annuity?

The minimum investment amount for a variable annuity can vary depending on the insurance company and the specific product. It’s best to check with the provider directly for their minimum investment requirements.

Are variable annuities suitable for everyone?

Variable annuities are not suitable for everyone. They are generally best suited for investors with a long-term investment horizon and a moderate to high risk tolerance. They may not be appropriate for those who need guaranteed income or who are averse to market volatility.

How do I choose the right variable annuity?

Choosing the right variable annuity involves considering factors such as fees, investment options, guaranteed features, and the financial strength of the insurance company. It’s crucial to carefully compare different products and seek advice from a qualified financial advisor.