I Inherited A Variable Annuity 2024: What to Do Next? Receiving an inheritance can be a mixed bag of emotions, especially when it involves a variable annuity. These complex financial instruments offer growth potential, but also come with unique risks and considerations.

This guide aims to shed light on navigating the inheritance process, exploring your options, and making informed decisions about your newfound financial responsibility.

Variable annuities are investment contracts that offer the potential for growth in your investment while also providing a guaranteed minimum death benefit. They are different from traditional annuities, which provide a guaranteed stream of income payments. Variable annuities are more complex than traditional annuities, but they can also be more lucrative.

Are you interested in receiving a regular income stream for a set period of time? An annuity can be a great option. If you’re looking for information on annuities, including how to calculate the amount of your payments, check out the Calculate Annuity Amount 2024 page.

This page provides a step-by-step guide on calculating your annuity amount, ensuring you understand the intricacies of this financial product.

Contents List

Understanding Variable Annuities: I Inherited A Variable Annuity 2024

Variable annuities are a type of insurance product that combines investment features with the potential for tax-deferred growth. They are often used as part of a retirement savings strategy, but can also be used for other financial goals. In this article, we’ll explore the ins and outs of variable annuities, particularly in the context of inheriting one.

Defining Variable Annuities

A variable annuity is a contract between an individual and an insurance company. The individual invests a lump sum or makes regular payments into the annuity, which is then invested in a portfolio of sub-accounts. These sub-accounts are similar to mutual funds, offering various investment options, such as stocks, bonds, and money market instruments.

Variable annuities offer the potential for growth, but they also carry a certain level of risk. If you’re interested in learning more about variable annuities that include enhanced death benefits, you can visit the Variable Annuity Enhanced Death Benefit 2024 page.

This page provides information about this type of annuity, including the benefits and potential risks associated with it.

- Growth Potential:The value of the variable annuity can fluctuate based on the performance of the underlying investments. This means you could potentially earn higher returns than a fixed annuity, but also face greater risk of losing money.

- Tax-Deferred Growth:Earnings within the annuity are not taxed until they are withdrawn, which can be advantageous for long-term growth.

- Death Benefit:Most variable annuities offer a death benefit that guarantees a minimum payout to your beneficiaries, even if the annuity’s value has declined. This can provide some peace of mind for your loved ones.

- Guaranteed Minimum Death Benefit (GMDB):This feature provides a guaranteed minimum payout to your beneficiaries, even if the annuity’s value has declined. The GMDB is typically a fixed amount or a percentage of the initial investment. This can provide some peace of mind for your loved ones.

Variable annuities can be invested in a variety of assets, including exchange-traded funds (ETFs). If you’re interested in exploring variable annuities that invest in ETFs, you can visit the Variable Annuity Etf 2024 page. This page provides information about variable annuities that invest in ETFs, including the potential benefits and risks associated with this type of investment.

- Living Benefits:Some variable annuities offer living benefits, such as guaranteed income payments or a guaranteed minimum withdrawal rate. These features can provide income protection during retirement.

Comparing Variable Annuities with Other Investment Options

Variable annuities offer a unique combination of investment and insurance features, setting them apart from other investment options. Here’s a comparison with mutual funds and traditional annuities:

| Feature | Variable Annuity | Mutual Fund | Traditional Annuity |

|---|---|---|---|

| Investment Options | Variety of sub-accounts with different investment options | Variety of funds with different investment options | Fixed interest rate or fixed return |

| Growth Potential | Potential for higher returns, but also greater risk | Potential for higher returns, but also greater risk | Guaranteed return, but typically lower than other options |

| Tax Treatment | Tax-deferred growth, taxed upon withdrawal | Taxable income | Tax-deferred growth, taxed upon withdrawal |

| Death Benefit | Guaranteed minimum payout to beneficiaries | None | Guaranteed payout to beneficiaries |

| Fees | Higher fees than mutual funds, including mortality and expense charges | Lower fees than variable annuities | Lower fees than variable annuities |

Benefits and Risks of Variable Annuities, I Inherited A Variable Annuity 2024

Variable annuities offer potential benefits, but also carry certain risks:

- Potential for Higher Returns:The investment component of variable annuities allows for potential growth beyond what a fixed annuity could offer. However, this also comes with greater risk of losing money.

- Tax-Deferred Growth:The tax-deferred growth of earnings within the annuity can lead to significant tax savings over time, especially if the funds are held for many years. However, it’s important to remember that you will eventually pay taxes on the earnings when you withdraw them.

Annuities can provide a guaranteed income stream for a specific period of time. If you’re interested in learning more about annuities that offer a payment of $4 per period, you can visit the Annuity 4 2024 page. This page provides information about annuities that offer this specific payment amount, allowing you to explore this type of annuity further.

- Death Benefit:The death benefit provides some peace of mind for your beneficiaries, ensuring a minimum payout even if the annuity’s value has declined. However, the death benefit may be limited, and the actual payout could be less than the initial investment.

Annuities can offer a guaranteed income stream for a specific period of time. If you’re interested in learning more about annuities that provide a payment of $2,000 per month, you can visit the Annuity 2000 Per Month 2024 page.

This page provides information about annuities that offer this specific payment amount, allowing you to explore this type of annuity further.

- High Fees:Variable annuities typically come with higher fees than mutual funds, including mortality and expense charges. These fees can erode your returns over time.

- Market Risk:The value of your variable annuity is tied to the performance of the underlying investments. This means you could lose money if the market declines.

- Complexity:Variable annuities can be complex products with various features and options. It’s important to understand the contract terms and conditions before investing.

Inheriting a Variable Annuity

When someone passes away, their assets, including variable annuities, are typically passed down to their beneficiaries. Understanding the process of inheriting a variable annuity and its tax implications is crucial for making informed decisions.

Understanding how to calculate an annuity is essential for making informed financial decisions. If you’re looking for a comprehensive guide on calculating annuities, you can visit the Calculating An Annuity 2024 page. This page provides a step-by-step guide on calculating annuities, covering various aspects of this financial product.

The Inheritance Process

The process of inheriting a variable annuity typically involves the following steps:

- Notification from the Insurance Company:You will receive notification from the insurance company about the inherited annuity, outlining the contract details and your beneficiary status.

- Reviewing the Contract:Carefully review the annuity contract to understand the terms and conditions, including the investment options, death benefit, and any applicable fees.

- Updating Beneficiary Information:If you are not the original beneficiary, you may need to update the beneficiary information with the insurance company to ensure you receive the funds.

- Choosing an Option:You will have several options for managing the inherited annuity, which we’ll discuss in the next section.

Tax Implications of Inheriting a Variable Annuity

The tax implications of inheriting a variable annuity depend on the beneficiary’s relationship to the deceased and the type of annuity contract. Here’s a breakdown of common scenarios:

- Spouse as Beneficiary:If you are the spouse of the deceased, you may inherit the variable annuity with a “stepped-up basis.” This means the cost basis of the annuity is adjusted to its fair market value at the time of death, potentially reducing your capital gains tax liability upon withdrawal.

Annuity calculators are a valuable tool for understanding the potential benefits of an annuity. To explore the features and functionalities of a specific annuity calculator, you can visit the Annuity Calculator Hk 2024 page. This page offers detailed information about the calculator, its capabilities, and how it can be used to analyze different annuity options.

- Non-Spouse Beneficiary:If you are a non-spouse beneficiary, the inherited annuity will have a cost basis equal to the original investment amount. This means you will be taxed on the full amount of earnings when you withdraw funds.

- Inherited Annuity with a Death Benefit:If the annuity has a death benefit, the death benefit may be subject to income tax, depending on the specific contract terms.

- Inherited Annuity with Living Benefits:If the annuity has living benefits, such as guaranteed income payments, these benefits may be subject to income tax.

Examples of Inheritance Scenarios

- Scenario 1: Spouse inherits a variable annuity with a stepped-up basis.The spouse can choose to continue the annuity contract, withdraw funds, or surrender the annuity. The stepped-up basis will reduce the capital gains tax liability upon withdrawal.

- Scenario 2: Child inherits a variable annuity with a cost basis equal to the original investment amount.The child will be taxed on the full amount of earnings when they withdraw funds. They can choose to continue the annuity contract, withdraw funds, or surrender the annuity.

- Scenario 3: Non-spouse beneficiary inherits a variable annuity with a death benefit.The death benefit may be subject to income tax, depending on the specific contract terms. The beneficiary can choose to continue the annuity contract, withdraw funds, or surrender the annuity.

Options for the Inherited Annuity

As the beneficiary of a variable annuity, you have several options for managing the inherited asset. Each option comes with its own pros and cons, and the best choice depends on your individual circumstances and financial goals.

Annuity calculators are available online, allowing you to easily estimate the potential payments you could receive from an annuity. If you’re looking for a lifetime annuity calculator, you can visit the Annuity Calculator Lifetime 2024 page. This page provides access to a lifetime annuity calculator, allowing you to explore the potential benefits of this type of annuity.

Surrendering the Annuity

Surrendering the annuity means cashing it out and receiving a lump sum payment. This option may be suitable if you need the money immediately or prefer not to manage the investment. However, it also has some drawbacks:

- Tax Liability:You will be taxed on the full amount of earnings when you surrender the annuity, which can result in a significant tax bill.

- Potential for Loss:If the annuity’s value has declined since the original investment, you may receive less than the initial investment amount.

- Loss of Tax-Deferred Growth:Surrendering the annuity means losing the potential for tax-deferred growth, which can be beneficial for long-term investments.

Withdrawing Funds

Instead of surrendering the entire annuity, you can choose to withdraw funds gradually. This option allows you to access the money as needed while still benefiting from the potential for tax-deferred growth. However, there are some things to consider:

- Minimum Withdrawal Amounts:Most variable annuities have minimum withdrawal amounts, which can limit your flexibility.

- Tax Liability:Withdrawals are generally taxed as ordinary income, which can be a significant tax burden, especially if the funds have grown significantly.

- Potential for Loss:If you withdraw funds during a market downturn, you may lose money on your investment.

Continuing the Contract

You can choose to continue the variable annuity contract, allowing the funds to continue growing tax-deferred. This option may be suitable if you are comfortable with the investment strategy and want to benefit from the potential for long-term growth. However, it’s important to consider the following:

- Investment Strategy:The investment strategy of the annuity may not align with your own financial goals. You may need to adjust the investment portfolio to meet your needs.

- Fees:Variable annuities typically come with high fees, which can erode your returns over time. It’s important to factor in these fees when making your decision.

- Market Risk:The value of your variable annuity is tied to the performance of the underlying investments. This means you could lose money if the market declines.

Examples of Suitable Scenarios

- Scenario 1: A young beneficiary inherits a variable annuity with a large sum of money.They may choose to continue the annuity contract, allowing the funds to grow tax-deferred for the long term.

- Scenario 2: An older beneficiary needs immediate access to funds.They may choose to surrender the annuity and receive a lump sum payment.

- Scenario 3: A beneficiary with a short-term financial need may choose to withdraw funds gradually from the annuity.This allows them to access the money while still benefiting from the potential for tax-deferred growth.

Managing the Inherited Annuity

Once you’ve chosen an option for managing the inherited variable annuity, it’s essential to understand how to track its performance, adjust the investment portfolio, and withdraw funds.

Tracking Performance

The insurance company will provide you with regular statements outlining the performance of the variable annuity. You should review these statements carefully to track the growth of your investment and monitor any changes in the investment portfolio.

The HP-10bii financial calculator is a popular tool for financial professionals and individuals alike. If you’re interested in using this calculator to calculate annuities, you can find helpful instructions and examples on the Calculate Annuity On Hp10bii 2024 page.

This page provides a step-by-step guide on using the HP-10bii calculator to calculate annuities, making it easier for you to use this tool for your financial calculations.

- Review the Investment Portfolio:Make sure the investment portfolio aligns with your risk tolerance and financial goals. You may need to adjust the portfolio by shifting funds between different sub-accounts.

- Monitor Fees:Keep an eye on the fees associated with the variable annuity. These fees can erode your returns over time, so it’s important to make sure they are reasonable.

- Compare Performance to Benchmarks:Compare the performance of the variable annuity to relevant benchmarks, such as the S&P 500 index, to assess how well the investment is doing.

Adjusting the Investment Portfolio

You may need to adjust the investment portfolio of the variable annuity to reflect your own risk tolerance and financial goals. This could involve shifting funds between different sub-accounts, such as moving from stocks to bonds or vice versa.

The world of annuities is constantly evolving, with new products and features being introduced regularly. If you’re interested in staying up-to-date on the latest annuity news and developments, you can visit the Annuity News 2024 page. This page provides the latest news and insights into the annuity market, keeping you informed about the current trends and developments in this area.

- Consider Your Time Horizon:If you have a long time horizon, you may be more comfortable with a higher-risk investment portfolio. If you need the money in the short term, you may prefer a lower-risk portfolio.

- Review Your Risk Tolerance:Your risk tolerance is how comfortable you are with the potential for losing money. It’s important to adjust the investment portfolio to match your risk tolerance.

- Seek Professional Advice:If you’re unsure about how to adjust the investment portfolio, consider seeking professional advice from a financial advisor.

Withdrawing Funds

If you decide to withdraw funds from the variable annuity, you should understand the withdrawal rules and tax implications. Most variable annuities have minimum withdrawal amounts and may charge fees for withdrawals.

Annuity payments can vary depending on the type of annuity you choose. For example, if you’re looking to receive a monthly payment of $10,000, you can find information on Annuity 10000 Per Month 2024 page. This page provides insight into annuities that offer such a substantial monthly payment, allowing you to explore this specific type of annuity further.

- Understand the Withdrawal Rules:Review the contract terms to understand the withdrawal rules, including minimum withdrawal amounts and any applicable fees.

- Consider Tax Implications:Withdrawals from a variable annuity are generally taxed as ordinary income. It’s important to factor in the tax implications when planning your withdrawals.

- Withdraw Strategically:If you need to withdraw funds, consider doing so strategically to minimize your tax liability. For example, you may want to withdraw funds during a year when your income is lower.

Understanding the Annuity Contract

It’s crucial to understand the terms and conditions of the annuity contract. This includes the investment options, death benefit, fees, and withdrawal rules.

Calculating an annuity can be a complex process. If you’re looking for a simple and straightforward approach to calculating an annuity, you can find helpful information on the Calculating Simple Annuity 2024 page. This page provides a simplified explanation of annuity calculations, making it easier for you to understand the fundamentals of this financial product.

- Review the Contract Carefully:Read the contract thoroughly and ask questions if you don’t understand anything.

- Seek Professional Advice:If you’re unsure about the contract terms, consider seeking professional advice from a financial advisor.

- Keep the Contract Safe:Store the contract in a safe place where you can easily access it.

Tips for Making Informed Decisions

- Consider Your Financial Goals:Before making any decisions about the inherited variable annuity, consider your own financial goals and how the annuity fits into your overall financial plan.

- Seek Professional Advice:If you’re unsure about the best course of action, consider seeking professional advice from a financial advisor.

- Don’t Rush into Decisions:Take your time to understand the options and make informed decisions.

Closing Summary

Inheriting a variable annuity can be a significant financial event. By understanding the intricacies of variable annuities, the available options, and the potential tax implications, you can make informed decisions that align with your financial goals. Remember, seeking professional financial advice tailored to your specific circumstances is crucial.

Retirement planning is a crucial aspect of financial planning. If you’re considering annuities as a part of your retirement strategy, you might be interested in learning more about whether annuities are suitable for retirement. The Is Annuity Retirement 2024 page can provide you with valuable insights into this topic, helping you make informed decisions about your retirement planning.

Quick FAQs

What is the difference between a variable annuity and a traditional annuity?

A variable annuity is an investment contract that allows you to invest in a variety of sub-accounts, similar to mutual funds. The value of your investment will fluctuate based on the performance of the underlying investments. A traditional annuity, on the other hand, provides a guaranteed stream of income payments for a set period of time.

The amount of the payments is typically fixed, but it can be adjusted for inflation.

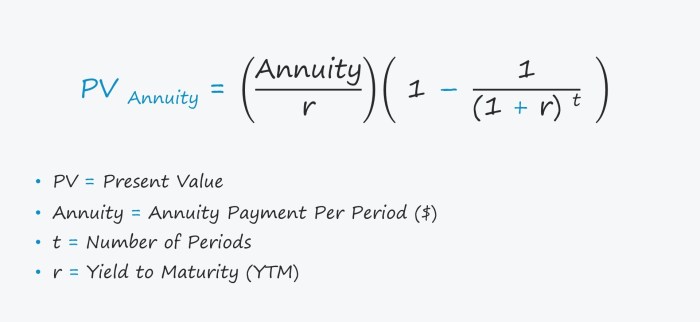

Annuity is a financial product that provides a stream of regular payments for a specific period. If you’re looking to calculate the present value of an annuity, you can find helpful examples and guidance on the Pv Annuity Example 2024 page.

This page will walk you through the process of calculating the present value of an annuity and provides real-world examples to help you understand the concept better.

What are the tax implications of inheriting a variable annuity?

The tax implications of inheriting a variable annuity depend on a number of factors, including the type of annuity, the age of the beneficiary, and the beneficiary’s tax bracket. Generally, you will not be taxed on the death benefit of a variable annuity, but you will be taxed on any withdrawals you make from the annuity.

What are the different options for managing an inherited variable annuity?

You have several options for managing an inherited variable annuity. You can surrender the annuity and receive the cash value, withdraw funds from the annuity, or continue the contract and manage the investment portfolio. The best option for you will depend on your individual circumstances and financial goals.