Variable Annuity Investment Options 2024 offer a unique approach to retirement planning, blending the security of traditional annuities with the growth potential of the stock market. This guide explores the intricacies of variable annuities, dissecting their features, investment options, and considerations for 2024.

Looking for a tool to help you calculate a 3-year annuity? Check out this article on 3 Year Annuity Calculator 2024.

Variable annuities, unlike their fixed counterparts, allow investors to allocate their premiums to a variety of investment options, such as mutual funds, sub-accounts, and separate accounts. This flexibility empowers individuals to tailor their investment strategy to their risk tolerance, time horizon, and financial goals.

This article on Annuity Vs 401k 2024 compares annuities and 401(k)s, helping you choose the right option for your retirement planning.

However, it’s crucial to understand the associated risks, fees, and tax implications before making any investment decisions.

Contents List

- 1 Understanding Variable Annuities

- 2 Investment Options within Variable Annuities

- 3 Key Features and Considerations

- 4 Variable Annuities in 2024: Trends and Considerations: Variable Annuity Investment Options 2024

- 5 Choosing the Right Variable Annuity

- 6 Variable Annuities vs. Other Investment Options

- 7 Closing Summary

- 8 Frequently Asked Questions

Understanding Variable Annuities

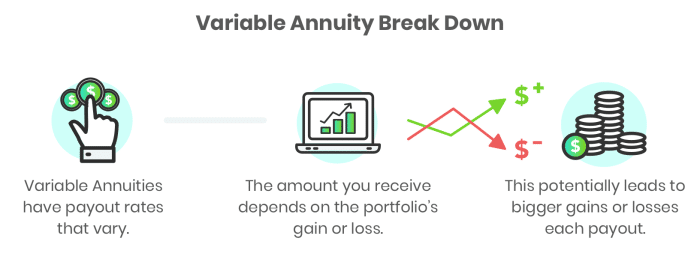

Variable annuities are a type of insurance contract that combines the features of an annuity with the investment potential of the stock market. They are designed to provide retirement income and growth potential, offering a way to potentially outpace inflation and build wealth over time.

Check out this article on Annuity Rates 2021 2024 to learn about recent annuity rates.

Key Features of Variable Annuities

Variable annuities are characterized by several key features that differentiate them from traditional fixed annuities:

- Investment Options:Variable annuities allow investors to allocate their funds across a variety of investment options, such as mutual funds, sub-accounts, and separate accounts.

- Growth Potential:The value of a variable annuity is tied to the performance of the underlying investments. If the investments perform well, the annuity’s value will increase.

- Tax-Deferred Growth:Earnings from variable annuities are tax-deferred, meaning that taxes are not paid until withdrawals are taken.

- Death Benefit:Many variable annuities offer a guaranteed minimum death benefit (GMD), which ensures that a beneficiary will receive at least a certain amount upon the death of the annuitant.

- Living Benefits:Some variable annuities include living benefit riders, which can provide additional guarantees such as minimum income payments or protection against market losses.

Variable Annuities vs. Traditional Annuities

Variable annuities differ from traditional fixed annuities in several key ways:

- Investment Risk:Variable annuities carry investment risk, as the value of the annuity is tied to the performance of the underlying investments. Fixed annuities, on the other hand, offer guaranteed returns, but these returns are typically lower than the potential returns offered by variable annuities.

- Growth Potential:Variable annuities have the potential for higher growth than fixed annuities, but they also have the potential for losses.

- Fees:Variable annuities typically have higher fees than fixed annuities, due to the investment options and features they offer.

Risks and Potential Rewards

Variable annuities offer the potential for higher returns than fixed annuities, but they also come with greater risk. The value of a variable annuity can fluctuate based on the performance of the underlying investments, and there is no guarantee of a return.

If you’re interested in creating an annuity calculator using Visual Basic, this article on Annuity Calculator Visual Basic 2024 might be helpful.

Investors should carefully consider their risk tolerance and investment goals before investing in a variable annuity.

- Market Risk:The value of a variable annuity can decline if the market experiences a downturn. Investors should be prepared for potential losses, especially in the short term.

- Interest Rate Risk:If interest rates rise, the value of a variable annuity may decline. This is because investors may be able to earn higher returns on other investments, making variable annuities less attractive.

- Inflation Risk:The purchasing power of a variable annuity can be eroded by inflation. Investors should consider investing in a variable annuity that offers protection against inflation.

- Fees and Expenses:Variable annuities typically have higher fees and expenses than other investment options. Investors should carefully review the fees associated with a variable annuity before investing.

Investment Options within Variable Annuities

Variable annuities offer a variety of investment options that allow investors to tailor their portfolio to their specific needs and goals. These options typically include:

Mutual Funds

Mutual funds are a popular investment option within variable annuities. They allow investors to diversify their portfolio across a wide range of asset classes, such as stocks, bonds, and real estate. Mutual funds are managed by professional fund managers who select and oversee the investments in the fund.

Investors can choose from a variety of mutual funds, each with its own investment objective, risk profile, and expense ratio.

Want to know how to calculate an annuity in Excel? Check out this article on Calculating Annuity Excel 2024 for a step-by-step guide.

Sub-Accounts

Sub-accounts are similar to mutual funds, but they are offered exclusively within variable annuities. They are typically managed by the insurance company that issues the annuity and offer a variety of investment options, including stocks, bonds, and money market instruments.

Sub-accounts provide investors with a diversified investment portfolio and may have lower expense ratios than mutual funds.

This article on Annuity Is Mcq 2024 provides a helpful overview of annuities in the form of multiple-choice questions.

Separate Accounts

Separate accounts are investment accounts that are managed by a third-party investment manager. They offer investors a higher level of customization and control over their investments. Separate accounts are typically available only for larger investors or those with complex investment needs.

Investment Strategies

Variable annuities offer a range of investment strategies that cater to different risk tolerances and investment goals. Common strategies include:

- Active Management:Active management involves actively buying and selling investments in an attempt to outperform the market. This strategy is typically used by mutual funds and sub-accounts that are managed by professional fund managers.

- Passive Indexing:Passive indexing involves investing in a portfolio of assets that mirrors a specific market index, such as the S&P 500. This strategy is typically used by index funds and ETFs, which are designed to track the performance of the underlying index.

Learn about the expenses associated with variable annuities with this article on Variable Annuity Expenses 2024.

- Target-Date Funds:Target-date funds are designed to automatically adjust their asset allocation over time, becoming more conservative as the investor approaches retirement. They are a popular option for investors who want to simplify their investment strategy and ensure that their portfolio is appropriately balanced for their age and risk tolerance.

Use this calculator to estimate your annuity savings with this article on Calculator Annuity Savings 2024.

Selecting Investment Options, Variable Annuity Investment Options 2024

When selecting investment options within a variable annuity, investors should consider several factors, including:

- Risk Tolerance:Investors should choose investments that align with their risk tolerance. If they are comfortable with higher risk, they may consider investments in stocks or other growth-oriented assets. If they are more risk-averse, they may prefer investments in bonds or other conservative assets.

- Investment Goals:Investors should choose investments that are aligned with their investment goals. If they are saving for retirement, they may consider investments in stocks or other growth-oriented assets. If they are saving for a short-term goal, they may prefer investments in bonds or other conservative assets.

Want to know more about the history of variable annuities? This article on Variable Annuity History 2024 provides a detailed overview.

- Time Horizon:Investors should choose investments that are appropriate for their time horizon. If they are investing for the long term, they may consider investments in stocks or other growth-oriented assets. If they are investing for the short term, they may prefer investments in bonds or other conservative assets.

Key Features and Considerations

Variable annuities offer a range of features that can provide additional benefits and protection for investors. These features include:

Guaranteed Minimum Death Benefit (GMD)

A guaranteed minimum death benefit (GMD) is a rider that guarantees that a beneficiary will receive at least a certain amount upon the death of the annuitant. The GMD is typically based on the initial investment amount, and it may grow over time, depending on the terms of the rider.

The GMD can provide peace of mind for investors who are concerned about the possibility of market losses.

Living Benefit Riders

Living benefit riders are designed to provide additional guarantees and protection for annuitants while they are still alive. These riders can provide a variety of benefits, such as:

- Guaranteed Minimum Income Payments:This rider guarantees a minimum income payment for the annuitant, even if the market experiences a downturn.

- Market Loss Protection:This rider protects the annuitant from market losses, ensuring that they will receive at least a certain amount of income, even if the value of their annuity declines.

Surrender Charges and Fees

Variable annuities typically have surrender charges, which are fees that are charged if the annuitant withdraws their funds before a certain period of time. These charges are designed to discourage investors from withdrawing their funds too early, as this can reduce the potential for long-term growth.

Learn the basics of calculating annuities with this article on How To Calculate Annuities 2024.

Variable annuities also have other fees, such as annual administrative fees, investment management fees, and mortality and expense charges. Investors should carefully review the fees associated with a variable annuity before investing.

Tax Implications

Variable annuities offer tax-deferred growth, meaning that taxes are not paid until withdrawals are taken. This can be a significant benefit for investors, as it allows their investment to grow tax-free for a longer period of time. However, withdrawals from a variable annuity are typically taxed as ordinary income, which can result in a higher tax bill than withdrawals from other retirement accounts, such as Roth IRAs.

Discover how to use Excel for annuity calculations in this article on Annuity Is Excel 2024.

Variable Annuities in 2024: Trends and Considerations: Variable Annuity Investment Options 2024

The variable annuity market is constantly evolving, and there are several trends and considerations for investors in 2024.

Emerging Trends

The variable annuity market is expected to continue to evolve in 2024, with several emerging trends:

- Increased Focus on Living Benefits:As investors seek greater protection against market volatility, there is an increasing focus on living benefit riders, which can provide guaranteed income payments and protection against market losses.

- Growth of Target-Date Funds:Target-date funds are becoming increasingly popular, as they offer a simple and convenient way to manage asset allocation over time. They are expected to continue to grow in popularity in 2024.

- Rising Interest Rates:Rising interest rates are likely to have a mixed impact on variable annuities. While higher interest rates may lead to higher returns on other investments, they could also make variable annuities less attractive.

Impact of Economic Conditions

The current economic climate is likely to have a significant impact on variable annuity investments in 2024. Inflation and rising interest rates are creating challenges for investors, and the market remains volatile. Investors should carefully consider their risk tolerance and investment goals before investing in a variable annuity.

Find out more about 6 percent annuities with this article on 6 Percent Annuity 2024.

Regulatory Changes

Regulatory changes can also have an impact on the variable annuity market. The Department of Labor (DOL) has recently issued new regulations that aim to protect investors from abusive sales practices. These regulations are likely to have an impact on the way variable annuities are sold and marketed in the future.

If you’re looking for information about annuities with an 8% return, you can find it in this article on Annuity 8 Percent 2024.

Benefits and Drawbacks

Variable annuities can offer several benefits for investors, including tax-deferred growth, potential for higher returns, and access to a variety of investment options. However, they also come with several drawbacks, such as high fees, surrender charges, and investment risk. Investors should carefully consider the benefits and drawbacks of variable annuities before investing.

Choosing the Right Variable Annuity

Choosing the right variable annuity can be a complex process. Investors should carefully consider their needs and goals, and compare different products from reputable providers.

Comparing Variable Annuity Products

| Provider | Investment Options | Fees | Riders | Minimum Investment |

|---|---|---|---|---|

| Provider 1 | Mutual Funds, Sub-Accounts | [Insert Fee Details] | GMD, Living Benefits | [Insert Minimum Investment] |

| Provider 2 | Mutual Funds, Separate Accounts | [Insert Fee Details] | GMD, Income Guarantee | [Insert Minimum Investment] |

| Provider 3 | Sub-Accounts, Target-Date Funds | [Insert Fee Details] | GMD, Market Loss Protection | [Insert Minimum Investment] |

Checklist for Selecting a Variable Annuity

When selecting a variable annuity, investors should consider the following factors:

- Investment Options:The annuity should offer a variety of investment options that align with the investor’s risk tolerance and investment goals.

- Fees:Investors should carefully review the fees associated with the annuity, including surrender charges, annual administrative fees, and investment management fees.

- Riders:Investors should consider the riders that are available with the annuity, such as GMD, living benefit riders, and other guarantees.

- Financial Strength of the Provider:Investors should choose an annuity from a reputable provider with a strong financial track record.

Suitability for Financial Goals

Variable annuities can be a suitable investment option for investors who are seeking tax-deferred growth, potential for higher returns, and access to a variety of investment options. However, they are not appropriate for all investors. Investors should carefully consider their risk tolerance, investment goals, and time horizon before investing in a variable annuity.

Variable Annuities vs. Other Investment Options

Variable annuities are just one of many investment options available for retirement savings. Investors should compare variable annuities with other options to determine which is best for their individual needs and goals.

Learn how to find the annuity formula in this article on How To Find Annuity Formula 2024.

Traditional IRAs, Roth IRAs, and 401(k) Plans

Traditional IRAs, Roth IRAs, and 401(k) plans are all tax-advantaged retirement savings accounts. Traditional IRAs and 401(k) plans offer tax-deferred growth, while Roth IRAs offer tax-free withdrawals in retirement. These accounts typically offer a wider range of investment options than variable annuities, and they may have lower fees.

However, they do not offer the same level of guarantees or protection as variable annuities.

Mutual Funds, ETFs, and Individual Stocks

Mutual funds, ETFs, and individual stocks offer investors the opportunity to invest in a variety of asset classes, such as stocks, bonds, and real estate. These investment vehicles can offer higher potential returns than variable annuities, but they also carry greater risk.

Investors should carefully consider their risk tolerance and investment goals before investing in these options.

Suitability of Variable Annuities

Variable annuities can be a suitable choice for investors who:

- Seek tax-deferred growth and potential for higher returns.

- Value the guarantees and protection offered by living benefit riders.

- Are comfortable with investment risk and willing to accept the potential for losses.

Closing Summary

Navigating the world of variable annuities can be complex, but understanding their nuances is essential for making informed investment choices. By carefully considering your risk profile, investment goals, and the current market landscape, you can determine if variable annuities align with your retirement planning strategy.

Remember, consulting with a financial advisor can provide personalized guidance and ensure your investment decisions are aligned with your individual circumstances.

Frequently Asked Questions

What are the potential benefits of investing in variable annuities?

Variable annuities offer the potential for higher returns than traditional fixed annuities due to their exposure to the stock market. They also provide tax-deferred growth, meaning that investment earnings are not taxed until they are withdrawn in retirement.

What are the risks associated with variable annuities?

The primary risk associated with variable annuities is the potential for investment losses. The value of your investment can fluctuate with market conditions, and you may lose money if the market declines. Additionally, variable annuities typically involve fees and surrender charges that can impact your overall returns.

How do variable annuities differ from other retirement savings options?

If you inherited a variable annuity, this article on I Inherited A Variable Annuity 2024 can help you understand what to do next.

Variable annuities differ from traditional IRAs, Roth IRAs, and 401(k) plans in their structure and investment options. Variable annuities offer the potential for higher returns but also come with greater risk and complexity. They may be suitable for investors with a long-term investment horizon and a higher risk tolerance.