Variable Annuity Income Rider 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Variable annuity income riders are a type of insurance product designed to provide a stream of guaranteed income during retirement.

A 5% annuity can offer a steady income stream, but it’s crucial to understand the factors influencing its potential growth. For more details on this specific type of annuity, read 5 Percent Annuity 2024.

They offer a combination of growth potential and income security, making them an attractive option for individuals seeking to supplement their retirement savings.

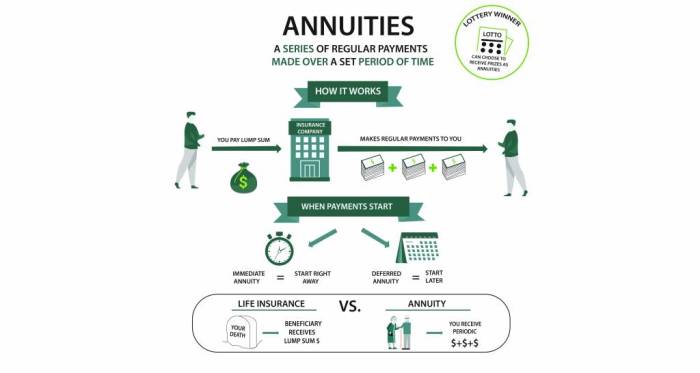

An annuity is essentially a financial product that provides a series of payments over a set period. If you’re unsure about the definition, check out An Annuity Is Defined As 2024 for a clear explanation.

These riders work by allowing you to allocate a portion of your annuity contract to a sub-account that invests in a variety of assets, such as stocks and bonds. The value of your sub-account fluctuates based on the performance of the underlying investments, and the income you receive from the rider is tied to the value of your sub-account.

Annuity options are numerous, with various types designed to fit different needs. If you’re considering an annuity, you might find this article on Annuity 3 2024 helpful in understanding the different types available.

This means that your income payments can grow over time, but they can also decline if the market performs poorly.

When considering an annuity in Singapore, using an online calculator can be a helpful tool. You can explore the features of an Annuity Calculator Singapore 2024 to get a better understanding of your potential returns.

Last Recap

Variable annuity income riders offer a unique blend of investment growth and income security, making them a valuable tool for retirement planning. By carefully considering the various factors involved, including the guaranteed income period, growth potential, and fees, you can make an informed decision about whether a variable annuity income rider is right for you.

Deciding whether an annuity is right for you depends on your individual financial goals and risk tolerance. This article on Is Getting An Annuity Worth It 2024 can help you weigh the pros and cons.

With the right strategy and careful planning, variable annuity income riders can help you achieve your retirement income goals and enjoy a comfortable and secure retirement.

For those seeking to convert their pension into an annuity, understanding how to calculate the amount is essential. This article on Calculate Annuity From Pension 2024 provides valuable insights into the process.

FAQ: Variable Annuity Income Rider 2024

What are the main benefits of variable annuity income riders?

Variable annuity income riders offer several benefits, including the potential for growth, guaranteed income payments, and tax advantages. They can also provide protection against market downturns and inflation.

Are variable annuity income riders right for everyone?

Annuity contracts can last for an indefinite duration, providing a steady stream of income for as long as you need it. To learn more about this concept, check out this article on Annuity Is Indefinite Duration 2024.

Variable annuity income riders are not suitable for everyone. They are best suited for individuals who are comfortable with some level of investment risk and who are seeking a guaranteed stream of income during retirement.

What are the potential risks associated with variable annuity income riders?

The main risk associated with variable annuity income riders is that the value of your sub-account can decline, which could result in lower income payments. You should also be aware of the fees associated with variable annuity income riders, which can impact your overall returns.

Annuity joint ownership allows multiple individuals to share in the benefits of the annuity. For details on this arrangement, refer to Annuity Joint Ownership 2024.

There are various types of annuities, and understanding their differences is crucial. Explore the different options in this article on 8 Annuities 2024 to find the one that best suits your needs.

Calculating the present value of an annuity helps you understand its current worth. To learn more about this process, check out Calculating Annuity Present Value 2024.

Variable annuities offer the potential for higher returns, but they also come with greater risk. For a deeper understanding of variable annuities, read Variable Annuity Air 2024.

An 8% annuity can provide a significant income stream, but its performance depends on various factors. This article on Annuity 8 Percent 2024 can help you understand the intricacies of this type of annuity.

Inflation can erode the purchasing power of your annuity payments over time. Using an Annuity Calculator With Inflation 2024 can help you estimate the impact of inflation on your future income.

Determining the right annuity amount for your needs is a crucial step. You can use an Calculate Annuity Amount 2024 tool to help you determine the ideal amount.

If you want to ensure your annuity benefits go to a specific trust after your passing, you need to understand the process. This article on Annuity Beneficiary Is A Trust 2024 can provide valuable information.