What Is A Variable Annuity And How Does It Work 2024 – Variable Annuities in 2024: What They Are & How They Work. The world of retirement planning is filled with a myriad of options, and variable annuities often stand out as a complex yet potentially rewarding choice. This guide will delve into the intricacies of variable annuities, exploring their unique characteristics, investment components, and the potential benefits and risks associated with them.

Variable annuities are a type of insurance product that combines investment features with income guarantees. They offer the potential for growth through investments in the stock market while providing some protection against market downturns. The core of a variable annuity is its sub-account structure, which allows investors to allocate their funds to various investment options, such as stocks, bonds, and mutual funds.

A 6% annuity can offer a steady stream of income, but it’s important to compare rates and options carefully. 6 Percent Annuity 2024 can provide more information on this type of annuity.

The performance of these sub-accounts directly impacts the value of the annuity, making it a more volatile investment than traditional fixed annuities.

While both annuities and pensions provide income in retirement, they have key differences. Is Annuity Same As Pension 2024 delves deeper into these distinctions.

Contents List

Introduction to Variable Annuities: What Is A Variable Annuity And How Does It Work 2024

Variable annuities are a type of insurance product that combines investment growth potential with the protection of an annuity contract. They offer a way for individuals to grow their savings while also receiving a guaranteed stream of income in retirement.

Unlike traditional fixed annuities, variable annuities are linked to the performance of a variety of underlying investments, such as stocks, bonds, and mutual funds. This means that the value of a variable annuity can fluctuate with the market, potentially providing higher returns but also carrying greater risk.

Key Characteristics of Variable Annuities

- Investment Growth Potential:Variable annuities allow investors to participate in the growth of the underlying investments. This can provide the potential for higher returns compared to fixed annuities.

- Guaranteed Minimum Death Benefit:Most variable annuities offer a guaranteed minimum death benefit, which ensures that a certain amount will be paid to beneficiaries upon the death of the annuitant, even if the account value has declined.

- Tax Deferral:Earnings on variable annuities are not taxed until they are withdrawn, providing tax deferral benefits. This can help individuals save on taxes in the long run.

- Flexible Investment Options:Variable annuities typically offer a range of investment options, allowing individuals to tailor their portfolio to their risk tolerance and financial goals.

Historical Context of Variable Annuities

Variable annuities were first introduced in the United States in the 1950s. They were designed as a way to provide investors with a combination of investment growth potential and guaranteed income. The concept of variable annuities gained popularity in the 1970s and 1980s, as investors sought ways to protect their savings from inflation.

If you’re considering an annuity with a specific investment amount, you can explore the potential returns using an online calculator. Annuity 60000 2024 might be a good starting point for your research.

Today, variable annuities are a widely available and popular retirement savings option.

For couples looking to secure their future together, a joint life annuity calculator can be a valuable tool. Annuity Calculator Joint Life 2024 can help you understand the potential benefits and drawbacks.

How Variable Annuities Work

Variable annuities operate on the principle of investing in sub-accounts, which are separate investment portfolios within the annuity contract. Each sub-account is linked to a specific underlying investment, such as a mutual fund or an exchange-traded fund (ETF). The value of the sub-account fluctuates based on the performance of the underlying investment.

Understanding how to calculate an annuity can be helpful when comparing different options. How Calculate Annuity 2024 provides a step-by-step guide for calculating annuities.

Investment Component of Variable Annuities

- Sub-Accounts:Variable annuities typically offer a variety of sub-accounts, each with its own investment objective and risk profile. Investors can allocate their money across different sub-accounts to diversify their portfolio and manage risk.

- Investment Options:The investment options available within a variable annuity can range from conservative options like fixed income to more aggressive options like equities. Investors can choose sub-accounts that align with their investment goals and risk tolerance.

Role of the Insurance Company

The insurance company that issues the variable annuity plays a crucial role in managing the sub-accounts and providing guarantees. They are responsible for:

- Managing the Sub-Accounts:The insurance company selects and monitors the underlying investments in each sub-account. They may also provide investment advice and guidance to annuitants.

- Providing Guarantees:The insurance company typically guarantees a minimum death benefit, which ensures that a certain amount will be paid to beneficiaries even if the account value has declined.

Accumulation and Growth Potential

During the accumulation phase, the value of the variable annuity grows based on the performance of the underlying investments. The growth potential of a variable annuity depends on the investment options chosen by the annuitant and the overall performance of the market.

Real-life examples can help you visualize how annuities work in practice. Annuity Examples In Real Life 2024 provides scenarios that illustrate the use of annuities.

As the account value grows, it can be used to purchase an annuity, which will provide a guaranteed stream of income in retirement.

When deciding between an annuity and an IRA, it’s crucial to consider your financial goals and risk tolerance. Annuity V Ira 2024 provides a helpful comparison of these investment options.

Benefits of Variable Annuities

Variable annuities offer several potential benefits, including the potential for growth, tax deferral, and guaranteed minimum death benefits. These benefits can help individuals achieve their financial goals, such as retirement planning or income generation.

Key Advantages of Variable Annuities

- Potential for Growth:Variable annuities offer the potential for higher returns compared to fixed annuities, as they are linked to the performance of the underlying investments. This can be particularly beneficial for individuals with a long investment horizon.

- Tax Deferral:Earnings on variable annuities are not taxed until they are withdrawn, providing tax deferral benefits. This can help individuals save on taxes in the long run.

- Guaranteed Minimum Death Benefit:Most variable annuities offer a guaranteed minimum death benefit, which ensures that a certain amount will be paid to beneficiaries upon the death of the annuitant, even if the account value has declined. This can provide peace of mind for individuals with dependents.

The formula used to calculate the value of an annuity certain depends on several factors, including the interest rate and the number of payments. Formula Annuity Certain 2024 provides a breakdown of this formula.

Achieving Financial Goals

- Retirement Planning:Variable annuities can be a valuable tool for retirement planning, as they offer the potential for growth and a guaranteed stream of income in retirement.

- Income Generation:Variable annuities can provide a source of income in retirement, particularly for individuals who want to supplement their Social Security benefits or other retirement income streams.

Benefits in Different Life Stages

- Retirement:Variable annuities can provide a guaranteed stream of income in retirement, helping individuals to meet their expenses and maintain their lifestyle.

- Accumulation Phase:Variable annuities can be a valuable tool for individuals who are saving for retirement or other long-term financial goals. They offer the potential for growth and tax deferral, which can help individuals maximize their savings.

Risks Associated with Variable Annuities

While variable annuities offer potential benefits, they also carry certain risks. It is important to understand these risks before investing in a variable annuity. The most significant risks include market volatility, investment losses, and surrender charges.

Annuity contracts typically specify whose life the payments are based on. When An Annuity Is Written Whose Life 2024 explores the different types of annuity contracts.

Potential Downside Risks

- Market Volatility:The value of a variable annuity can fluctuate with the market, potentially leading to losses. This risk is greater for investors who choose more aggressive investment options.

- Investment Losses:If the underlying investments in a variable annuity perform poorly, the account value can decline. This could result in a loss of principal, especially if the annuity is withdrawn before the investments have recovered.

- Surrender Charges:Most variable annuities have surrender charges, which are fees that are charged if the annuity is withdrawn within a certain period of time. These charges can reduce the amount of money that is available to the investor.

Understanding the Risks

It is crucial to understand the risks associated with variable annuities before investing. Investors should carefully consider their risk tolerance, investment goals, and financial situation before making a decision. They should also consult with a financial advisor to discuss the potential risks and benefits of variable annuities.

Risk Profile Comparison

Variable annuities are generally considered to be more risky than traditional fixed annuities, as they are linked to the performance of the market. However, they also offer the potential for higher returns. The risk profile of a variable annuity will vary depending on the investment options chosen by the investor.

Variable annuities offer the potential for growth but also come with some risks. Variable Annuity Hsbc 2024 provides insights into this type of annuity offered by HSBC.

Choosing the Right Variable Annuity

Choosing the right variable annuity is essential for maximizing its benefits and minimizing its risks. There are several key factors to consider, including investment options, fees, and guarantees.

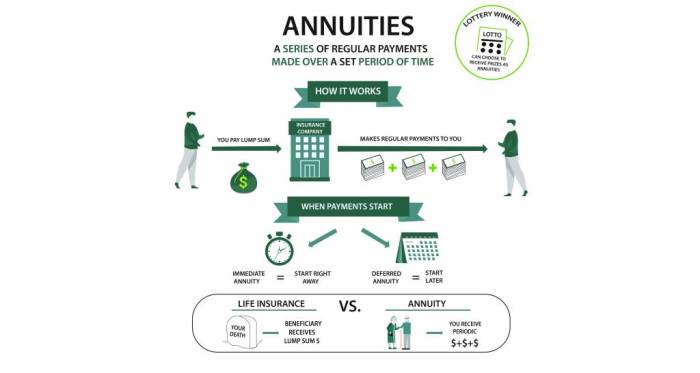

An annuity is essentially a series of payments made over a set period of time. Annuity Is A Series Of 2024 explains this concept in more detail.

Factors to Consider

- Investment Options:The investment options available within a variable annuity should align with the investor’s risk tolerance and financial goals. Investors should carefully consider the investment objectives and risk profiles of the different sub-accounts.

- Fees:Variable annuities can have a variety of fees, including administrative fees, mortality and expense charges, and surrender charges. Investors should compare the fees of different variable annuities before making a decision.

- Guarantees:Most variable annuities offer a guaranteed minimum death benefit. Investors should consider the level of protection provided by the guarantee and the terms and conditions of the guarantee.

Consulting a Financial Advisor, What Is A Variable Annuity And How Does It Work 2024

It is highly recommended to consult with a financial advisor when choosing a variable annuity. A financial advisor can help investors understand the complexities of variable annuities, assess their risk tolerance, and recommend a variable annuity that meets their individual needs.

The interest rates offered on annuities can fluctuate depending on market conditions. Annuity 3 Year Rates 2024 can help you understand the current rates for 3-year annuities.

Types of Variable Annuities

- Traditional Variable Annuities:These annuities offer a variety of investment options and typically include a guaranteed minimum death benefit.

- Indexed Variable Annuities:These annuities link their returns to the performance of a specific index, such as the S&P 500. They offer a potential for growth with some downside protection.

- Variable Annuities with Living Benefits:These annuities provide additional benefits, such as guaranteed income payments or protection against market downturns. They typically have higher fees than traditional variable annuities.

Variable Annuities in 2024

The variable annuity market is constantly evolving, and the current economic climate is having a significant impact on the performance of variable annuities. Investors need to stay informed about the latest trends and developments in the variable annuity market.

Current Market Conditions

The current economic climate is characterized by rising interest rates, inflation, and geopolitical uncertainty. These factors can impact the performance of the underlying investments in variable annuities. Investors should be aware of these risks and adjust their investment strategies accordingly.

Potential for Growth and Risks

The potential for growth in variable annuities will depend on the performance of the underlying investments and the overall economic climate. Investors should consider their risk tolerance and investment goals before investing in a variable annuity. It is important to remember that there is no guarantee of returns, and investors could lose money.

Latest Trends and Developments

The variable annuity market is becoming increasingly competitive, with insurance companies offering a wider range of investment options and guarantees. Investors should stay informed about the latest trends and developments in the variable annuity market to make informed investment decisions.

Summary

In conclusion, variable annuities can be a powerful tool for retirement planning, offering the potential for growth, tax deferral, and guaranteed income streams. However, it is crucial to carefully consider the risks involved, including market volatility, investment losses, and surrender charges.

Annuity funds are a popular way to secure a steady stream of income in retirement. If you’re curious about how they work and how they compare to pensions, you can find more information on Annuity Fund Is 2024.

Before making any investment decisions, it is essential to consult with a qualified financial advisor who can help you understand the nuances of variable annuities and determine if they align with your individual financial goals and risk tolerance.

Top FAQs

What is the difference between a variable annuity and a fixed annuity?

In simple terms, an annuity is a financial product that provides a stream of payments over time. Annuity Meaning In English 2024 offers a clear explanation of this concept.

A fixed annuity provides a guaranteed rate of return, while a variable annuity offers the potential for higher returns but carries the risk of investment losses.

Are variable annuities suitable for everyone?

Variable annuities are not suitable for everyone. They are best suited for individuals with a long-term investment horizon, a higher risk tolerance, and a desire for potential growth.

How do I choose the right variable annuity?

It is essential to consider your investment goals, risk tolerance, and time horizon when choosing a variable annuity. You should also compare fees, investment options, and guarantees offered by different providers.

Are variable annuities subject to taxes?

Withdrawals from a variable annuity are generally subject to income tax, but the growth of the investment is tax-deferred until withdrawal.

Annuity payments can act as a form of pension, providing a consistent source of income after you stop working. To learn more about the connection between annuities and pensions, check out Annuity Is Pension 2024.