Variable Annuity License 2024: Navigating the complex world of variable annuities requires a thorough understanding of the licensing process, regulatory landscape, and ethical considerations. This comprehensive guide delves into the intricacies of obtaining a variable annuity license in 2024, equipping you with the knowledge and insights to navigate this specialized field successfully.

The HP10bii is a financial calculator that can be used to calculate annuities. If you’re using the HP10bii, you can find instructions on how to calculate annuities by visiting this page.

The variable annuity market offers a unique blend of investment growth potential and guaranteed income streams, attracting both investors and financial professionals. However, the complexities of these products necessitate specialized knowledge and adherence to stringent regulatory requirements. Understanding the licensing process, regulatory landscape, and ethical considerations is crucial for individuals seeking to enter this niche market.

Annuity and pension are often confused, but they are not the same thing. While both provide regular income in retirement, they differ in how they are funded and managed. To learn more about the differences between annuities and pensions, check out this article.

Contents List

Variable Annuity License Overview

A variable annuity license is a professional credential that allows individuals to sell variable annuity products to clients. Obtaining this license is crucial for anyone seeking to enter the variable annuity market, as it demonstrates a fundamental understanding of the products and the legal and regulatory framework surrounding them.

The present value of an annuity due is the current value of a series of future payments. To calculate the present value of an annuity due in 2024, visit this helpful resource.

Purpose and Significance

The primary purpose of a variable annuity license is to ensure that individuals selling these complex financial products possess the necessary knowledge, skills, and ethical standards to provide competent advice to clients. This license serves to protect investors by ensuring that they receive accurate and transparent information about variable annuity products, their risks, and potential benefits.

Variable annuities offer a way to potentially grow your retirement savings, but they also have a fixed account component. If you’re considering a variable annuity, it’s important to understand how the fixed account works. Check out this article for more information.

It also helps to maintain public confidence in the financial services industry.

Planning for retirement? Figuring out how much you can withdraw from your annuity each year can be a bit tricky. You can learn how to calculate your annuity withdrawal for 2024 by visiting this helpful resource.

Eligibility Requirements, Variable Annuity License 2024

To be eligible for a variable annuity license in 2024, individuals typically need to meet the following requirements:

- Minimum Age:Most states require applicants to be at least 18 years old.

- Education and Experience:Depending on the state, applicants may need to have a high school diploma or equivalent, as well as some relevant experience in the financial services industry. However, these requirements can vary.

- Criminal Background Check:A thorough criminal background check is usually conducted to ensure the applicant has no history of financial misconduct.

- Fingerprinting:In some states, fingerprinting may be required as part of the licensing process.

- Continuing Education:Once licensed, individuals must typically complete continuing education courses to maintain their license.

Examination and Licensing Process

The process for obtaining a variable annuity license in 2024 typically involves the following steps:

Steps Involved

- Application:Individuals must submit an application to the appropriate licensing body, typically a state insurance department or securities regulator.

- Background Check:The licensing body will conduct a background check to verify the applicant’s identity, criminal history, and any prior regulatory actions.

- Exam Preparation:Applicants must prepare for and pass a standardized exam that covers the principles of variable annuities, product features, regulatory requirements, and ethical considerations.

- Exam Administration:The exam is usually administered by a third-party testing organization.

- License Issuance:Upon successfully passing the exam and meeting all other requirements, the licensing body will issue the variable annuity license.

Specific Exams

The specific exams required for obtaining a variable annuity license can vary by state. However, they typically cover the following areas:

- Variable Annuity Product Features:This section focuses on the different types of variable annuities, their investment options, fees, and guarantees.

- Regulatory Framework:This section covers the relevant laws, rules, and regulations governing variable annuity sales, including the Securities Act of 1933, the Securities Exchange Act of 1934, and the Investment Company Act of 1940.

- Ethical Considerations:This section emphasizes the importance of ethical conduct in the financial services industry, including fiduciary duty, suitability, and disclosure requirements.

Licensing Bodies

The licensing bodies responsible for issuing variable annuity licenses vary by state. In some states, the insurance department handles licensing, while in others, the securities regulator is responsible. The licensing body may also be responsible for enforcing compliance with regulatory requirements and investigating complaints against licensed individuals.

The formula for calculating an annuity can be complex, but there are resources available to help you understand the equation. You can learn more about the annuity equation for 2024 by visiting this page.

Regulatory Landscape and Compliance

The regulatory landscape surrounding variable annuity licenses in 2024 is complex and evolving. Several regulatory bodies play a role in overseeing the industry, each with specific responsibilities and oversight functions.

The Jaiib (Junior Associate of the Indian Institute of Bankers) exam covers a variety of financial topics, including annuities. If you’re preparing for the Jaiib exam, you can learn more about annuities by visiting this page.

Key Regulations and Compliance Requirements

Variable annuity sales are subject to a variety of regulations, including:

- Suitability:This principle requires financial professionals to recommend variable annuities only to clients for whom the product is appropriate based on their investment objectives, risk tolerance, and financial situation.

- Disclosure:Financial professionals must provide clients with clear and concise disclosures about the risks, fees, and potential benefits associated with variable annuities.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements:These regulations aim to prevent financial crimes by requiring financial professionals to verify the identity of their clients and monitor transactions for suspicious activity.

- Sales Practices:State and federal regulators have specific rules regarding sales practices for variable annuities, including restrictions on misleading or deceptive advertising.

Regulatory Bodies and Roles

| Regulatory Body | Role |

|---|---|

| Securities and Exchange Commission (SEC) | Oversees the securities industry, including the sale of variable annuities. |

| Financial Industry Regulatory Authority (FINRA) | Self-regulatory organization that oversees broker-dealers and registered representatives, including those who sell variable annuities. |

| State Insurance Departments | Regulate the insurance industry, including the sale of variable annuities in their respective states. |

| National Association of Insurance Commissioners (NAIC) | Develops model laws and regulations for the insurance industry, including variable annuities. |

Variable Annuity Product Features

Variable annuities are complex financial products that offer a combination of investment growth potential and income guarantees. They are designed to provide retirement income and potential tax-deferred growth.

Annuity calculations can be used to determine the present or future value of a stream of payments. To learn more about calculating annuities in 2024, visit this helpful resource.

Core Features and Characteristics

Key features of variable annuities include:

- Investment Options:Variable annuities typically offer a range of investment options, such as mutual funds, ETFs, and sub-accounts. These options allow investors to allocate their assets based on their risk tolerance and investment goals.

- Death Benefit:Most variable annuities include a death benefit, which guarantees a minimum payout to beneficiaries upon the death of the policyholder. This can provide peace of mind for loved ones.

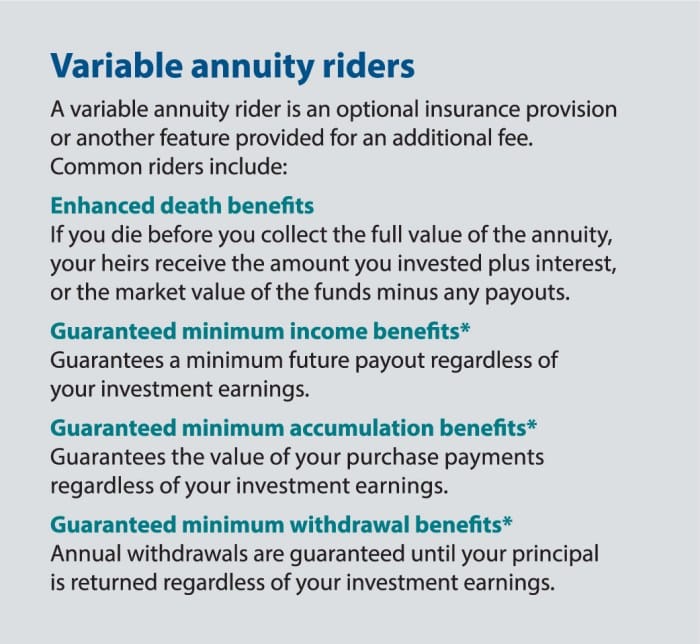

- Living Benefits:Some variable annuities offer living benefits, such as guaranteed minimum income payments or guaranteed minimum withdrawal benefits. These features can provide income protection and financial security during retirement.

- Tax Deferral:Earnings on variable annuities are typically tax-deferred, meaning that taxes are not paid until the funds are withdrawn. This can provide significant tax savings over time.

- Fees:Variable annuities typically have a variety of fees, including administrative fees, mortality and expense charges, and investment management fees. It is important to carefully review these fees before investing.

Types of Variable Annuities

Variable annuities can be categorized into different types, including:

- Fixed-indexed Annuities:These annuities link their returns to the performance of a specific index, such as the S&P 500. They offer the potential for growth but also have a cap on potential returns.

- Equity-Indexed Annuities:Similar to fixed-indexed annuities, equity-indexed annuities link their returns to the performance of a specific stock index. They typically offer higher potential returns but also have higher risks.

- Traditional Variable Annuities:These annuities offer a wide range of investment options and allow investors to allocate their assets to different asset classes, such as stocks, bonds, and real estate.

Key Components

| Component | Description |

|---|---|

| Investment Options | The range of investment choices available within the variable annuity, such as mutual funds, ETFs, or sub-accounts. |

| Fees | Various charges associated with the variable annuity, including administrative fees, mortality and expense charges, and investment management fees. |

| Guarantees | Specific features that provide income protection or minimum payouts, such as death benefits or living benefits. |

| Tax Treatment | The tax implications of earnings and withdrawals from the variable annuity. |

Ethical Considerations and Best Practices

Selling variable annuities involves a significant ethical responsibility, as these products can be complex and carry risks. Financial professionals must prioritize the best interests of their clients and ensure they provide appropriate advice and recommendations.

Calculating an annuity can be a bit tricky, but there are tools and resources available to help you. You can find information on how to calculate an annuity in 2024 by visiting this helpful resource.

Ethical Considerations

- Suitability:It is essential to ensure that variable annuities are suitable for clients based on their investment objectives, risk tolerance, and financial situation.

- Disclosure:Financial professionals must fully disclose all relevant information about variable annuities, including their risks, fees, and potential benefits.

- Transparency:Financial professionals should be transparent about their compensation structure and any potential conflicts of interest.

- Fiduciary Duty:In some cases, financial professionals may have a fiduciary duty to act in the best interests of their clients. This means prioritizing the client’s needs over their own financial gain.

Best Practices

To ensure ethical and responsible sales practices, financial professionals should follow best practices, such as:

- Conducting a thorough needs analysis:This involves understanding the client’s financial situation, investment goals, and risk tolerance.

- Providing clear and concise explanations:Explaining the complexities of variable annuities in a way that clients can understand is crucial.

- Presenting multiple options:Clients should be presented with a range of investment options, including those that may be more suitable than variable annuities.

- Disclosing all relevant information:This includes fees, risks, and potential benefits associated with the product.

- Avoiding conflicts of interest:Financial professionals should be aware of and avoid any potential conflicts of interest that could compromise their objectivity.

Potential Risks and Challenges

Variable annuities can involve several risks and challenges, including:

- Market Risk:The value of the underlying investments in a variable annuity can fluctuate, leading to potential losses.

- Fees and Expenses:Variable annuities typically have a variety of fees that can erode returns over time.

- Complexity:Variable annuities are complex products that can be difficult to understand. Clients may not fully grasp the risks and potential downsides.

- Liquidity Risk:Variable annuities may have surrender charges or restrictions on withdrawals, which can limit liquidity.

Industry Trends and Future Outlook

The variable annuity industry is constantly evolving, influenced by factors such as regulatory changes, market conditions, and investor preferences. Understanding these trends is crucial for individuals seeking to obtain a variable annuity license or work in this industry.

Annuity drawdown is a method of accessing your retirement savings that allows you to withdraw a portion of your funds each year. If you’re considering annuity drawdown, you can learn more about this option by visiting this resource.

Current Trends and Developments

- Increased Regulation:Regulatory scrutiny of variable annuities has intensified in recent years, leading to new rules and compliance requirements.

- Shifting Investor Preferences:Investors are increasingly seeking simpler and more transparent investment products, which may impact the demand for variable annuities.

- Competition from Other Products:Variable annuities face competition from other retirement savings products, such as target-date funds and index-based annuities.

- Technological Advancements:Technology is transforming the financial services industry, with new platforms and tools emerging to support variable annuity sales and distribution.

Impact of Regulatory Changes and Market Conditions

Regulatory changes and market conditions can have a significant impact on the variable annuity industry. For example, new regulations may increase compliance costs for financial professionals, while market volatility can affect the performance of variable annuity investments.

Annuity payouts can be structured in different ways, including over a fixed period of time. If you’re looking for an annuity that pays out over 5 years, you can learn more about these annuities by visiting this article.

Future Outlook

The future outlook for variable annuities is uncertain, but several factors suggest that these products will continue to play a role in retirement planning. The demand for guaranteed income streams and tax-deferred growth may continue to support the variable annuity market.

Conclusive Thoughts: Variable Annuity License 2024

Obtaining a variable annuity license in 2024 is a significant step towards a fulfilling career in financial services. By understanding the licensing process, regulatory landscape, and ethical considerations, you can equip yourself with the knowledge and expertise to provide valuable financial advice and product recommendations to clients.

Excel is a powerful tool for managing your finances, and it can be used to calculate annuity payments. You can find instructions on how to calculate an annuity in Excel for 2024 by visiting this page.

As you embark on this journey, remember to stay informed about industry trends and regulatory updates to ensure your continued success in the evolving world of variable annuities.

FAQ

What are the typical fees associated with variable annuities?

Annuity bonds are a type of investment that can provide regular income in retirement. To learn more about annuity bonds in 2024, visit this resource.

Variable annuities typically have various fees, including mortality and expense charges, administrative fees, and investment management fees. These fees can vary depending on the specific product and provider. It’s crucial to carefully review the fee structure before investing in a variable annuity.

What are the tax implications of variable annuity investments?

The tax implications of variable annuities can be complex and vary depending on the type of annuity and how it is structured. Generally, the earnings from variable annuities are taxed as ordinary income upon withdrawal. However, certain types of annuities may offer tax-deferred growth, meaning that taxes are not paid until withdrawal.

Consulting with a tax advisor is recommended to understand the specific tax implications of your variable annuity investment.

The R programming language can be used to calculate annuities. If you’re familiar with R, you can find information on how to calculate annuities in R by visiting this article.

A compound value annuity factor table is a tool that can be used to calculate the future value of an annuity. You can find a compound value annuity factor table for 2024 by visiting this resource.