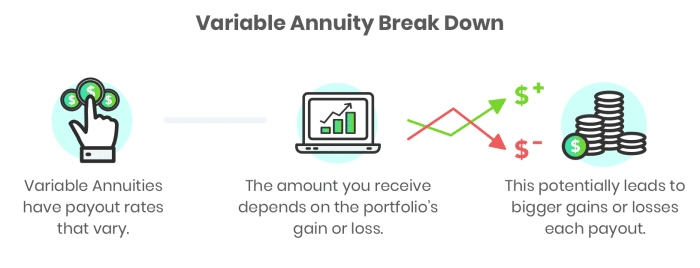

Variable Annuity Market 2024 presents a dynamic landscape where investors seek to navigate the complexities of market fluctuations while securing their financial future. This market, driven by the desire for growth and the need for income guarantees, is characterized by a diverse range of products catering to various

Looking for a guaranteed income stream for a specific period? An annuity with a 5-year guarantee in 2024 might be the right option for you. This article delves into the benefits and considerations of these types of annuities.

risk profiles and financial goals.

Vari

Need help figuring out the best annuity options for you? An annuity calculator can be a valuable tool. This article explores how to use these calculators effectively, providing insights into their features and functionalities.

able annuities offer a unique blend of investment flexibility and income security, allowing individuals to customize their portfolios based on their specific needs and circumstances. The market is constantly evolving, influenced by factors such as interest rates, regulatory changes, and investor sentiment.

Contents List

- 1 Variable Annuity Market Overview

- 2 Product Features and Benefits

- 3 Target Audience and Market Segmentation

- 4 Market Trends and Future Outlook

- 5 Investment Strategies and Risk Management

- 6 Consumer Considerations and Decision-Making

- 7 Case Studies and Examples

- 8 Ending Remarks

- 9 FAQ Explained: Variable Annuity Market 2024

Variable Annuity Market Overview

The variable annuity market is a significant segment of the retirement savings industry, offering investors a blend of growth potential and downside protection. In 2024, the market is expected to continue its steady growth, driven by factors such as an aging population, rising life expectancies, and a growing need for income security in retirement.

Market Size and Growth Trends

The variable annuity market size is substantial, with billions of dollars in assets under management. The market has been experiencing consistent growth in recent years, fueled by the increasing demand for retirement planning solutions and the appeal of variable annuities’ features, such as their potential for higher returns and guaranteed income options.

Variable annuities come in different classes, each with its own set of features and fees. This article on Class B variable annuities in 2024 explores the specific characteristics and considerations associated with this class.

The growth trend is expected to continue in the coming years, driven by factors like the aging population, rising life expectancies, and the growing need for income security in retirement.

Variable annuities offer a unique combination of growth potential and income guarantees. This article on the characteristics of variable annuities in 2024 explores the key features that make them distinct.

Competitive Landscape

The variable annuity market is highly competitive, with a number of major players vying for market share. Some of the key players in the market include:

- Prudential Financial

- MetLife

- Lincoln Financial Group

- TIAA

- AIG

These companies offer a wide range of variable annuity products, each with its own unique features and benefits. The competition in the market is intense, with companies constantly innovating and developing new products to attract investors.

Regulatory Environment

The variable annuity market is subject to a complex regulatory environment, with rules and regulations overseen by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These regulations are designed to protect investors and ensure that variable annuities are sold fairly and transparently.

Product Features and Benefits

Variable annuities are complex financial products that offer a unique blend of growth potential and downside protection. They are designed to help investors accumulate wealth for retirement and provide a steady stream of income in their later years.

Key Features

Variable annuities offer a variety of features that make them attractive to investors, including:

- Growth Potential:Variable annuities allow investors to participate in the growth of the stock market through a variety of investment options, such as mutual funds and exchange-traded funds (ETFs).

- Downside Protection:Variable annuities often include features that provide downside protection, such as guaranteed minimum death benefits (GMDBs) and guaranteed minimum living benefits (GMLBs). These features can help protect investors’ principal from market losses.

- Income Guarantees:Some variable annuities offer income guarantees, which provide a guaranteed stream of income in retirement. These guarantees can be particularly valuable for investors who are concerned about outliving their savings.

Investment Options

Variable annuities typically offer a variety of investment options, allowing investors to customize their portfolios based on their risk tolerance and financial goals. Common investment options include:

- Mutual Funds:Variable annuities often offer access to a wide range of mutual funds, covering various asset classes, such as stocks, bonds, and real estate.

- Exchange-Traded Funds (ETFs):ETFs are a popular investment option for variable annuities, offering diversification and low expense ratios.

- Sub-Accounts:Some variable annuities allow investors to allocate their funds to sub-accounts, which may offer different investment strategies or risk profiles.

Riders and Guarantees

Variable annuities often offer a variety of riders and guarantees, which can enhance the product’s benefits and provide additional protection for investors. Common riders and guarantees include:

- Death Benefit:A death benefit rider guarantees a minimum payout to beneficiaries upon the death of the policyholder, even if the account value has declined.

- Living Benefit:A living benefit rider provides guaranteed income payments to the policyholder during their lifetime, even if the account value has declined.

- Income Guarantee:An income guarantee rider provides a guaranteed stream of income payments in retirement, regardless of the performance of the underlying investments.

Target Audience and Market Segmentation

Variable annuities are designed to meet the needs of a specific target audience, primarily those who are approaching retirement or are already retired. The market for variable annuities can be segmented based on a number of factors, including:

Demographics

The primary target audience for variable annuities includes individuals who are:

- Age 50 and above:Individuals in this age group are typically nearing retirement or are already retired, and they are looking for ways to secure their financial future.

- High-income earners:Variable annuities are often purchased by individuals with a significant amount of wealth who are seeking to grow their assets and protect their principal.

Before investing in a variable annuity, it’s important to understand the associated fees. This article on variable annuity fees in 2024 provides a breakdown of common fees and how they can impact your returns.

Financial Goals

Variable annuities are attractive to individuals with a variety of financial goals, including:

- Retirement planning:Variable annuities can be used to accumulate wealth for retirement and provide a steady stream of income in later years.

- Income generation:Variable annuities can provide a guaranteed stream of income in retirement, which can be helpful for individuals who are concerned about outliving their savings.

- Long-term care:Variable annuities can be used to help fund long-term care expenses, which can be a significant financial burden for many seniors.

Risk Tolerance

Variable annuities are suitable for investors with a moderate to high risk tolerance. They offer the potential for higher returns, but they also carry a greater risk of loss.

Market Trends and Future Outlook

The variable annuity market is constantly evolving, influenced by a number of factors, including interest rates, market volatility, and regulatory changes.

While variable annuities offer potential growth, it’s important to understand their limitations. This article on what variable annuities don’t provide in 2024 provides insights into the potential drawbacks and considerations before investing.

Emerging Trends

Some of the emerging trends shaping the variable annuity market include:

- Rising Interest Rates:Rising interest rates can make it more difficult for insurance companies to offer attractive guaranteed income options, which may impact the popularity of variable annuities.

- Market Volatility:Market volatility can create uncertainty for investors, leading to a decline in demand for variable annuities, particularly those with downside protection features.

- Regulatory Changes:Regulatory changes, such as new disclosure requirements or restrictions on product features, can impact the variable annuity market.

Growth Potential

Despite the challenges, the variable annuity market is expected to continue growing in the coming years. The growth is likely to be driven by factors such as:

- Aging Population:As the baby boomer generation continues to age, the demand for retirement planning solutions, including variable annuities, is expected to increase.

- Rising Life Expectancies:People are living longer, which means they need to save more for retirement and plan for a longer period of income generation.

Future Outlook

The future of the variable annuity market is uncertain, but there are a number of opportunities and challenges that could shape the industry.

- Innovation:Insurance companies are constantly developing new products and features to meet the evolving needs of investors. This innovation could lead to the creation of new and more attractive variable annuity products.

- Competition:The variable annuity market is highly competitive, and companies are constantly vying for market share. This competition could lead to lower fees and more attractive product offerings for investors.

- Regulation:Regulatory changes could impact the variable annuity market, but they could also create opportunities for companies that are able to adapt to the new rules and regulations.

Want to create your own annuity calculator using Visual Basic? This article on creating an annuity calculator with Visual Basic in 2024 offers a step-by-step guide and code examples to help you build your own tool.

Investment Strategies and Risk Management

Investing in variable annuities requires a thoughtful approach to investment strategy and risk management.

Investment Strategies

Effective investment strategies for variable annuities should consider factors such as:

- Risk Tolerance:Investors should choose investment options that align with their risk tolerance, considering their financial goals and time horizon.

- Time Horizon:The time horizon for investing in variable annuities is typically long-term, as investors are aiming to accumulate wealth for retirement.

- Financial Goals:Investors should have clear financial goals in mind when investing in variable annuities, such as retirement planning, income generation, or long-term care.

If you’re a Java programmer looking to calculate annuities, this article on calculating annuities using Java in 2024 is a must-read. It provides code examples and practical insights into how to implement these calculations in your projects.

Asset Allocation and Diversification

Asset allocation and diversification are crucial for managing risk and maximizing returns in variable annuity portfolios. Investors should:

- Diversify Investments:Diversifying investments across different asset classes, such as stocks, bonds, and real estate, can help reduce risk and enhance returns.

- Rebalance Regularly:Regularly rebalancing the portfolio to maintain the desired asset allocation can help ensure that investments remain aligned with the investor’s risk tolerance and financial goals.

Risk Management

Managing risk in variable annuity portfolios is essential to protect investors’ principal and ensure that they achieve their financial goals. Strategies for managing risk include:

- Hedging Techniques:Hedging techniques can be used to mitigate downside risk by offsetting potential losses in the underlying investments.

- Downside Protection:Variable annuities often include features that provide downside protection, such as guaranteed minimum death benefits (GMDBs) and guaranteed minimum living benefits (GMLBs).

Consumer Considerations and Decision-Making

Consumers considering investing in variable annuities should carefully evaluate the product’s features, fees, and potential risks.

Key Factors to Consider

When evaluating variable annuities, consumers should consider:

- Fees and Expenses:Variable annuities can have high fees and expenses, which can erode returns over time. Investors should carefully compare fees and expenses across different products.

- Tax Implications:Variable annuities can have complex tax implications, and investors should understand how taxes will affect their returns.

- Guarantees and Riders:Variable annuities often offer guarantees and riders, but these features can come with a cost. Investors should carefully evaluate the value of these features and whether they are necessary for their financial goals.

Choosing the Right Product

Choosing the right variable annuity product depends on the individual investor’s needs and circumstances. Consumers should consider:

- Risk Tolerance:Investors should choose a product that aligns with their risk tolerance, considering their financial goals and time horizon.

- Financial Goals:Investors should choose a product that meets their specific financial goals, such as retirement planning, income generation, or long-term care.

- Investment Experience:Investors with limited investment experience may want to choose a product with simpler investment options and fewer fees.

Professional Financial Advice

Before investing in variable annuities, consumers should seek professional financial advice from a qualified advisor. A financial advisor can help investors:

- Understand the product:Variable annuities are complex products, and a financial advisor can help investors understand their features, risks, and benefits.

- Develop an investment strategy:A financial advisor can help investors develop an investment strategy that aligns with their financial goals and risk tolerance.

- Choose the right product:A financial advisor can help investors choose the right variable annuity product based on their individual needs and circumstances.

Case Studies and Examples

Variable annuities can be used to achieve a variety of financial goals, depending on the investor’s specific needs and circumstances.

Retirement Planning

Variable annuities can be a valuable tool for retirement planning, providing a combination of growth potential and downside protection. For example, a 55-year-old individual with a $1 million portfolio might invest in a variable annuity to supplement their retirement savings.

Planning for your future income? A monthly annuity of $1000 might be a good starting point. You can learn more about how to achieve this goal with an annuity of $1000 per month in 2024. This article dives into the details and explores the possibilities.

They might allocate a portion of their portfolio to a diversified mix of mutual funds and ETFs, aiming for long-term growth. The variable annuity might also include a guaranteed minimum death benefit (GMDB) to provide a safety net for their beneficiaries in case of their death.

Income Generation, Variable Annuity Market 2024

Variable annuities can provide a guaranteed stream of income in retirement, which can be helpful for individuals who are concerned about outliving their savings. For example, a 65-year-old retiree with a $500,000 portfolio might invest in a variable annuity with a guaranteed minimum living benefit (GMLB).

Choosing between an annuity and an IRA can be a tough decision. This article on annuities versus IRAs in 2024 provides a clear comparison, helping you understand the pros and cons of each option.

This would provide them with a guaranteed income stream for life, even if the account value declines.

If you’re in the UK and considering an annuity, you’ll want to be aware of current annuity rates. This article on annuity rates in the UK in 2024 provides a comprehensive overview of the market and factors influencing rates.

Long-Term Care

Variable annuities can be used to help fund long-term care expenses, which can be a significant financial burden for many seniors. For example, a 70-year-old individual with a $250,000 portfolio might invest in a variable annuity with a long-term care rider.

Turning 70 1/2? It’s a significant milestone, especially when it comes to retirement planning. This article on annuities at age 70 1/2 in 2024 explores how annuities can play a role in your retirement income strategy.

This rider would provide them with a lump sum payment or a stream of income to help cover the costs of long-term care, should they need it.

For those interested in investing in a variable annuity, understanding the nuances of Class B variable annuities in 2024 is crucial. This article breaks down the key characteristics and considerations associated with this type of annuity.

Ending Remarks

As we conclude our exploration of the Variable Annuity Market 2024, it’s clear that this market offers a compelling opportunity for investors seeking a balance between growth potential and guaranteed income. Understanding the intricacies of product features, target audiences, and investment strategies is crucial for making informed decisions.

With careful consideration and expert guidance, variable annuities can play a significant role in achieving long-term financial goals.

FAQ Explained: Variable Annuity Market 2024

What are the tax implications of variable annuities?

The tax implications of variable annuities can be complex and vary depending on the specific product and how it is used. Generally, the earnings within a variable annuity are tax-deferred, meaning they are not taxed until they are withdrawn. However, withdrawals may be subject to ordinary income tax rates, depending on the type of withdrawal and the age of the annuitant.

With a variety of annuity types available, it’s essential to understand the different kinds of annuities in 2024. This article explores the various types, their characteristics, and how they can fit into your financial strategy.

How do variable annuities differ from traditional annuities?

Variable annuities differ from traditional annuities in that they offer the potential for growth based on the performance of underlying investments. In contrast, traditional annuities provide a fixed rate of return, which is typically lower than the potential returns offered by variable annuities.

Variable annuities also come with more investment options and flexibility, but they also carry greater risk.

If you’re looking to understand the ins and outs of the Thrift Savings Plan (TSP), then you’ll want to check out this article on calculating your TSP annuity in 2024. This guide provides a comprehensive overview of the process, helping you make informed decisions about your retirement savings.

Are variable annuities suitable for everyone?

Variable annuities are not suitable for everyone. They are best suited for investors with a long-term investment horizon and a moderate to high risk tolerance. It is essential to consider your financial goals, risk tolerance, and investment experience before investing in a variable annuity.

What are some common risks associated with variable annuities?

Variable annuities carry several risks, including market risk, investment risk, and surrender charges. Market risk refers to the potential for the underlying investments to decline in value. Investment risk is the risk that you may lose money on your investments.

Surrender charges are fees that may be imposed if you withdraw your money from the annuity before a certain period.