Variable Annuity No Surrender Charge 2024 offers a unique approach to retirement planning, eliminating the traditional surrender charges often associated with variable annuities. This opens the door to greater flexibility and control over your retirement funds, allowing you to access your money without the penalty of early withdrawal fees.

But

A compound value annuity factor table can be helpful for calculating the future value of an annuity based on different interest rates and time periods.

Wondering if an annuity is a good or bad investment ? There’s no one-size-fits-all answer, so it’s important to consider your individual circumstances and goals.

Want to learn about the performance of Jackson variable annuities ? It’s important to evaluate the performance of any annuity before making a decision.

, as with any investment, there are nuances to consider, such as potential trade-offs and the importance of carefully evaluating your risk tolerance and investment goals.

This guide delves into the world of variable annuities with no surrender charges, providing insights into their workings, advantages, and potential drawbacks. We’ll explore the key factors to consider in 2024, including market conditions and economic influences, as well as investment strategies and tax implications.

By the end, you’ll have a clear understanding of whether this type of annuity aligns with your individual financial objectives.

Contents List

- 1 Variable Annuities: An Overview

- 2 Surrender Charges and Their Impact

- 3 Variable Annuities with No Surrender Charges

- 4 Factors to Consider in 2024

- 5 Investment Strategies for Variable Annuities

- 6 Tax Considerations

- 7 Comparison to Other Retirement Products

- 8 Consumer Considerations

- 9 Wrap-Up

- 10 FAQ Explained: Variable Annuity No Surrender Charge 2024

Variable Annuities: An Overview

Variable annuities are a type of retirement savings product that offer the potential for growth based on the performance of underlying investments. They combine features of both traditional annuities and mutual funds, allowing investors to customize their portfolio and potentially earn higher returns than fixed annuities.

A fixed annuity can provide a steady stream of income, but the returns are generally lower than variable annuities.

Core Features of Variable Annuities

Variable annuities are investment-driven, meaning their value fluctuates based on the performance of the underlying investments. Investors choose from a variety of sub-accounts, each representing a different investment option, such as stocks, bonds, or mutual funds. The returns generated by these sub-accounts directly impact the value of the variable annuity contract.

Sub-Accounts and Investment Options

Sub-accounts within variable annuities serve as individual investment baskets, allowing investors to diversify their portfolio across various asset classes. Each sub-account has its own investment objective, risk profile, and expense ratio. Common investment options available in sub-accounts include:

- Equity Sub-Accounts:Invest in stocks, offering potential for high growth but also higher risk.

- Fixed Income Sub-Accounts:Invest in bonds, providing more stable income and lower risk compared to equities.

- Money Market Sub-Accounts:Invest in short-term, low-risk instruments, offering liquidity and stability.

- Target Date Funds:Automatically adjust asset allocation over time based on a target retirement date.

Variable Annuity Returns

The returns generated by a variable annuity are directly tied to the performance of the underlying investments within its sub-accounts. If the investments in a sub-account perform well, the value of that sub-account will increase, and vice versa. This means that the value of the variable annuity contract can fluctuate over time, reflecting the performance of the underlying investments.

If your annuity is out of surrender , you may have limited options for accessing your funds. It’s important to understand the terms of your annuity agreement.

Surrender Charges and Their Impact

Surrender charges are fees imposed by insurance companies when an investor withdraws money from a variable annuity before a certain period, typically during the early years of the contract. These charges are designed to protect the insurance company from losses incurred when investors withdraw funds before the annuity has had time to grow.

Surrender Charge Structure

Surrender charges are typically structured as a percentage of the withdrawn amount, declining over time. Common surrender charge structures include:

- Upfront Charges:A significant charge imposed during the first few years of the contract, which then gradually declines.

- Declining Schedules:A predetermined schedule where the surrender charge decreases over time, eventually reaching zero after a certain period.

- Potential Waivers:Some contracts may offer surrender charge waivers under specific circumstances, such as death, disability, or reaching a certain age.

Wondering about the liquidity of variable annuities in 2024 ? This can vary depending on the specific annuity, so it’s essential to research and understand the terms before you invest.

Impact on Withdrawal Strategy

Surrender charges can significantly impact an investor’s withdrawal strategy, especially during the early years of the contract. For example, if an investor needs to withdraw money before the surrender charge period expires, they may have to pay a substantial fee, reducing their overall return.

It’s crucial to consider surrender charges when developing a withdrawal plan and to understand the potential impact on your investment strategy.

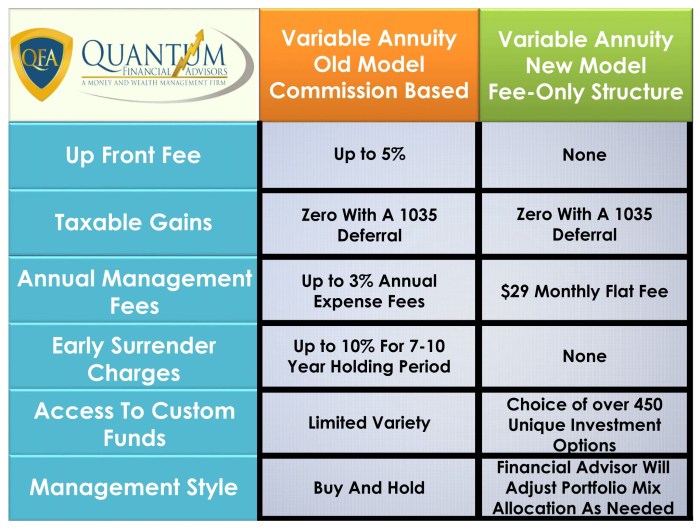

Variable Annuities with No Surrender Charges

Variable annuities with no surrender charges are becoming increasingly popular as they offer investors the flexibility to withdraw funds without facing the traditional surrender charge penalty. However, it’s important to understand the potential trade-offs associated with these products.

The interest rates on variable annuities in 2024 can be influenced by market performance, so it’s crucial to stay informed about current trends.

Advantages and Disadvantages

Variable annuities with no surrender charges offer the following advantages:

- Flexibility:Investors can access their funds without penalty, allowing for greater control over their retirement savings.

- Potential for Growth:Similar to traditional variable annuities, these products offer the potential for growth based on the performance of the underlying investments.

However, there are also potential disadvantages to consider:

- Higher Fees:To compensate for the lack of surrender charges, these annuities may have higher annual fees or other charges.

- Limited Investment Options:The range of investment options available in no-surrender charge annuities may be more limited compared to traditional variable annuities.

Comparison to Traditional Variable Annuities

The key difference between variable annuities with no surrender charges and traditional variable annuities lies in the surrender charge structure. Traditional variable annuities typically have a surrender charge period, while no-surrender charge annuities eliminate this fee. However, no-surrender charge annuities may have higher fees or a more limited selection of investment options.

Need to calculate an annuity? You can use a financial calculator to determine the present or future value of your annuity payments.

Factors to Consider in 2024

The attractiveness of variable annuities in 2024 will be influenced by various market conditions and economic factors. Understanding these factors can help investors make informed decisions about whether variable annuities are the right fit for their retirement planning needs.

If you’re in Canada, you can use an annuity calculator to explore different annuity options and their potential payouts.

Market Conditions and Economic Factors

Several key factors will likely impact the performance of variable annuities in 2024:

- Interest Rate Changes:Rising interest rates can negatively impact bond yields, potentially affecting the performance of fixed income sub-accounts within variable annuities.

- Inflation:High inflation can erode purchasing power and make it challenging to maintain the real value of retirement savings, potentially impacting the growth of variable annuities.

- Market Volatility:Fluctuations in the stock market can create uncertainty and risk for equity-based sub-accounts within variable annuities.

Regulatory Landscape

The regulatory landscape surrounding variable annuities is constantly evolving. Investors should stay informed about any potential changes in regulations that might impact their investments.

A variable annuity calculator can help you estimate the potential growth of your annuity based on different market scenarios.

Investment Strategies for Variable Annuities

Developing a sound investment strategy is essential for maximizing the potential returns from variable annuities. This involves considering factors such as asset allocation, risk management, and long-term financial planning.

Asset Allocation

Asset allocation involves determining the percentage of your portfolio that will be invested in different asset classes, such as stocks, bonds, and cash. A well-diversified portfolio can help mitigate risk and potentially enhance returns over the long term.

Risk Management

Risk management involves identifying and mitigating potential risks that could impact your investments. This includes considering your risk tolerance, investment time horizon, and the potential impact of market fluctuations.

Long-Term Financial Planning

Long-term financial planning is crucial for ensuring that your retirement savings are sufficient to meet your needs. This involves setting realistic goals, developing a comprehensive plan, and regularly reviewing and adjusting your strategy as needed.

Choosing between a variable annuity and a mutual fund depends on your risk tolerance and investment goals.

Hypothetical Portfolio Example

A hypothetical portfolio for a variable annuity with no surrender charges might include:

- 60% Equity Sub-Accounts:Invested in a mix of large-cap and small-cap stocks, offering potential for growth and diversification.

- 30% Fixed Income Sub-Accounts:Invested in a mix of investment-grade bonds and high-yield bonds, providing income and diversification.

- 10% Money Market Sub-Accounts:Invested in short-term, low-risk instruments, offering liquidity and stability.

Tax Considerations

Variable annuities have unique tax implications that investors should understand. It’s important to consider the tax treatment of withdrawals and distributions when making investment decisions.

Be aware of potential early withdrawal penalties if you withdraw funds from a variable annuity before the designated period.

Tax Implications, Variable Annuity No Surrender Charge 2024

Withdrawals from variable annuities are generally taxed as ordinary income, similar to withdrawals from traditional IRAs. However, there are some exceptions to this rule, such as tax-free withdrawals for certain expenses, such as qualified education expenses.

Tax Advantages of No Surrender Charges

Variable annuities with no surrender charges can offer potential tax advantages, such as tax deferral and the ability to access tax-free withdrawals. Tax deferral allows your investments to grow tax-free until you withdraw them, potentially resulting in higher after-tax returns.

Tax Treatment of Withdrawals

The following table Artikels the tax treatment of different types of withdrawals from variable annuities:

| Type of Withdrawal | Tax Treatment |

|---|---|

| Before Age 59 1/2 | Taxed as ordinary income, plus a 10% penalty |

| After Age 59 1/2 | Taxed as ordinary income |

| Qualified Education Expenses | Tax-free |

| Medical Expenses | Tax-free |

Comparison to Other Retirement Products

Variable annuities are just one of many retirement savings options available to investors. It’s essential to compare variable annuities with other products to determine which one best suits your individual needs and financial goals.

Comparison with Traditional IRAs, Roth IRAs, and 401(k)s

Variable annuities offer several advantages and disadvantages compared to other retirement products:

- Traditional IRAs:Offer tax-deductible contributions and tax-deferred growth, but withdrawals are taxed as ordinary income.

- Roth IRAs:Offer tax-free withdrawals in retirement, but contributions are not tax-deductible.

- 401(k)s:Offer employer-sponsored retirement savings plans with potential for matching contributions.

Key Features and Tax Implications

The following table summarizes the key features, fees, and tax implications of different retirement products:

| Product | Key Features | Fees | Tax Implications |

|---|---|---|---|

| Variable Annuity | Investment-driven, potential for growth, tax deferral | Surrender charges, annual fees, expense ratios | Withdrawals taxed as ordinary income |

| Traditional IRA | Tax-deductible contributions, tax-deferred growth | Annual fees, expense ratios | Withdrawals taxed as ordinary income |

| Roth IRA | Tax-free withdrawals in retirement | Annual fees, expense ratios | Contributions not tax-deductible |

| 401(k) | Employer-sponsored, potential for matching contributions | Administrative fees, expense ratios | Tax-deferred growth, withdrawals taxed as ordinary income |

Considering a hedging strategy for your variable annuity ? This can help mitigate potential losses, but it’s important to understand the risks and rewards involved.

Consumer Considerations

When considering variable annuities with no surrender charges, it’s crucial to understand your investment goals, risk tolerance, and time horizon. It’s also important to seek advice from a qualified financial advisor.

Looking to understand the ins and outs of an Annuity 401k Plan in 2024 ? It’s a popular retirement savings option, but you’ll want to weigh the pros and cons before making a decision.

Understanding Your Investment Goals

Before investing in any retirement product, it’s essential to define your investment goals. What are you hoping to achieve with your retirement savings? How much money do you need to retire comfortably?

Risk Tolerance

Your risk tolerance is a measure of your willingness to accept potential losses in exchange for the possibility of higher returns. Are you comfortable with the potential for fluctuations in the value of your investments?

Time Horizon

Your investment time horizon is the length of time you plan to invest your money. A longer time horizon allows you to ride out market fluctuations and potentially earn higher returns over time.

Financial Advisor

A qualified financial advisor can help you understand the complexities of variable annuities and determine if they are the right fit for your financial situation. Ask potential advisors about their experience with variable annuities, their fee structure, and their investment philosophy.

Checklist of Questions

Here are some questions to ask potential financial advisors before making a decision:

- What is your experience with variable annuities?

- What are the fees associated with this product?

- What are the potential risks and rewards?

- How will you help me manage my investments?

- What are your qualifications and credentials?

Wrap-Up

Variable annuities with no surrender charges present a compelling option for those seeking greater flexibility and control over their retirement funds. However, it’s crucial to approach this investment with a clear understanding of its features, potential trade-offs, and the importance of aligning your investment strategy with your individual goals and risk tolerance.

By carefully considering all aspects, you can make an informed decision about whether this type of annuity fits into your overall retirement plan.

FAQ Explained: Variable Annuity No Surrender Charge 2024

What are the potential downsides of variable annuities with no surrender charges?

Looking for a reliable annuity calculator in New Zealand ? This can help you estimate your future income stream based on your contributions.

While offering flexibility, these annuities may have higher fees compared to traditional variable annuities, or they might have limited investment options. It’s essential to compare the overall cost and features of different products.

How do I choose a suitable variable annuity with no surrender charge?

Consult with a qualified financial advisor who can help you evaluate your individual needs, risk tolerance, and investment goals. They can guide you through the process of comparing different products and selecting the one that best aligns with your financial objectives.

Are there any tax advantages to variable annuities with no surrender charges?

Similar to traditional variable annuities, these products offer tax deferral on earnings, allowing your investments to grow tax-deferred until withdrawal. However, it’s essential to consult with a tax advisor to understand the specific tax implications of your individual situation.