Variable Annuity Nationwide 2024: A Comprehensive Guide delves into the intricate world of variable annuities, exploring their potential benefits and drawbacks in the current market landscape. This guide will unravel the complexities of variable annuities, empowering you with the knowledge needed to make informed investment decisions.

One of the key advantages of annuities is their flexibility. This article, Is Annuity Flexible 2024 , delves into the different ways annuities can be customized to meet your individual needs.

Variable annuities, unlike their fixed counterparts, offer the potential for higher returns but also come with increased risk. This guide will explore the key considerations for investors, including investment options, risk tolerance, fees, and tax implications. Whether you’re seeking to enhance your retirement savings or diversify your investment portfolio, understanding the nuances of variable annuities is essential.

To determine the right annuity for your needs, it’s crucial to understand how different payment structures impact the overall value. This article, Calculate Annuity With Different Payments 2024 , provides insights on calculating annuities with varying payment options.

Contents List

- 1 Variable Annuity Basics

- 2 Variable Annuity Nationwide Landscape in 2024

- 3 Key Considerations for Variable Annuity Investors

- 4 Understanding Variable Annuity Fees and Charges

- 5 Tax Implications of Variable Annuities

- 6 Variable Annuities and Retirement Planning: Variable Annuity Nationwide 2024

- 7 Variable Annuity Illustrations and Examples

- 8 Closing Notes

- 9 Commonly Asked Questions

Variable Annuity Basics

A variable annuity is a type of insurance contract that provides a stream of income for life, but the amount of the payments varies depending on the performance of the underlying investments. This type of annuity offers the potential for higher returns than a fixed annuity, but it also carries more risk.

Annuities and perpetuities are both long-term investment vehicles, but they differ in their payout structure. This article, Annuity Vs Perpetuity 2024 , explains the key distinctions between annuities and perpetuities.

Core Features of Variable Annuities

Variable annuities are complex financial products with several key features:

- Investment Options:Variable annuities allow investors to choose from a variety of investment options, such as mutual funds, stocks, and bonds. These investments are typically held within a separate account, and the value of the account fluctuates based on the performance of the underlying investments.

- Death Benefit:Most variable annuities include a death benefit, which guarantees a minimum payout to the beneficiary upon the death of the annuitant. This benefit can be a lump sum payment or a stream of income.

- Guaranteed Minimum Income:Some variable annuities offer a guaranteed minimum income benefit, which ensures that the annuitant will receive a certain minimum amount of income each year, regardless of the performance of the underlying investments.

- Living Benefits:Variable annuities may also include living benefits, such as long-term care protection or income protection in the event of a long-term illness or disability.

Difference Between Fixed and Variable Annuities

The main difference between fixed and variable annuities lies in the way the payments are calculated:

- Fixed Annuities:Fixed annuities provide a guaranteed rate of return, which is typically lower than the potential return of a variable annuity. The payments are fixed for the life of the contract, and the amount of the payments is not affected by the performance of the underlying investments.

- Variable Annuities:Variable annuities do not guarantee a specific rate of return. The payments are based on the performance of the underlying investments, so the amount of the payments can fluctuate over time. This means that the payments could be higher or lower than expected, depending on how the investments perform.

Benefits and Drawbacks of Investing in Variable Annuities

Variable annuities offer several potential benefits, but they also come with some drawbacks:

- Potential for Higher Returns:Variable annuities offer the potential for higher returns than fixed annuities, as the payments are tied to the performance of the underlying investments.

- Tax Deferral:The earnings on a variable annuity are not taxed until they are withdrawn, which can provide a tax advantage over other investments.

- Protection from Market Volatility:Some variable annuities offer guaranteed minimum income benefits, which can help to protect investors from market volatility.

- Risk of Loss:The value of a variable annuity can decline if the underlying investments perform poorly, which could result in lower payments than expected.

- Fees and Expenses:Variable annuities typically come with higher fees and expenses than fixed annuities, which can impact the overall return on the investment.

- Complexity:Variable annuities are complex financial products that require a thorough understanding of the investment options, fees, and other features.

Variable Annuity Nationwide Landscape in 2024

The variable annuity market in the US is experiencing a period of both growth and change, driven by several factors. Investors are increasingly seeking products that offer both growth potential and downside protection, making variable annuities a popular choice. However, regulatory changes and evolving investor preferences are also shaping the landscape.

Joint and survivor annuities ensure that income continues even after one partner passes away. This article, Annuity Joint And Survivor 2024 , explains the features and benefits of joint and survivor annuities.

Market Trends for Variable Annuities

Here are some key trends in the variable annuity market:

- Growing Demand for Guaranteed Income:As individuals seek to secure their retirement income, there is a growing demand for variable annuities with guaranteed minimum income benefits.

- Increased Focus on Transparency:Regulators are pushing for greater transparency in the variable annuity market, with a focus on disclosure of fees and expenses.

- Innovation in Product Design:Variable annuity providers are innovating with new product designs that offer features like living benefits and enhanced death benefits.

Factors Influencing Demand for Variable Annuities

Several factors are influencing the demand for variable annuities in 2024:

- Low Interest Rates:Low interest rates have made it difficult for investors to earn a decent return on traditional fixed-income investments, leading some to seek out higher-yielding options like variable annuities.

- Aging Population:As the population ages, the demand for retirement income solutions is increasing, making variable annuities an attractive option for many individuals.

- Market Volatility:Market volatility has made investors more cautious about their investments, leading some to seek out products with downside protection, such as variable annuities with guaranteed minimum income benefits.

Major Variable Annuity Providers Nationwide

Several major insurance companies offer variable annuities in the US, including:

- Prudential Financial

- MetLife

- New York Life

- AIG

- Transamerica

- Lincoln Financial Group

- Principal Financial Group

- MassMutual

Each provider offers a range of variable annuity products with different features and fees. It’s important to compare different options carefully before making a decision.

Reversionary annuities provide income to a beneficiary after the original annuitant passes away. This article, Annuity Is Reversionary 2024 , provides a comprehensive overview of reversionary annuities.

Key Considerations for Variable Annuity Investors

Choosing the right variable annuity product requires careful consideration of your individual needs, risk tolerance, and investment goals. Here are some key factors to consider:

Investment Options Within Variable Annuities

Variable annuities offer a wide range of investment options, allowing investors to tailor their portfolios to their specific needs and risk tolerance. The investment options typically include:

- Mutual Funds:Mutual funds provide diversification by investing in a basket of securities. They offer a range of investment styles, from conservative to aggressive, allowing investors to choose options that align with their risk profile.

- Stocks:Stocks offer the potential for higher returns but also carry greater risk. Investors can choose from individual stocks or invest in stock mutual funds.

- Bonds:Bonds are generally considered less risky than stocks and offer a steady stream of income. Variable annuities may offer bond funds or allow investors to invest in individual bonds.

Understanding Risk Tolerance and Investment Goals

It’s crucial to understand your risk tolerance and investment goals before investing in a variable annuity. Your risk tolerance reflects your ability and willingness to accept potential losses in exchange for the possibility of higher returns. Your investment goals define your financial objectives, such as saving for retirement or funding a college education.

A compound value annuity factor table is a valuable tool for calculating the future value of annuity payments. This article, Compound Value Annuity Factor Table 2024 , explains how to use and interpret compound value annuity factor tables.

Choosing the Right Variable Annuity Product

To choose the right variable annuity product, consider these factors:

- Fees and Expenses:Compare the fees and expenses charged by different variable annuity providers, as these can significantly impact the overall return on your investment.

- Investment Options:Ensure the variable annuity product offers a range of investment options that align with your risk tolerance and investment goals.

- Guaranteed Minimum Income Benefits:If you desire downside protection, consider variable annuities with guaranteed minimum income benefits, which can provide a minimum level of income even if the underlying investments perform poorly.

- Living Benefits:Explore variable annuities that offer living benefits, such as long-term care protection or income protection in the event of a long-term illness or disability.

- Death Benefit:Consider the death benefit offered by the variable annuity, which can provide financial security for your beneficiaries upon your death.

Understanding Variable Annuity Fees and Charges

Variable annuities are complex financial products that come with various fees and charges. Understanding these fees is crucial to making informed investment decisions.

Calculating annuity payments can be complex, but online calculators can simplify the process. This article, Calculate Annuity Online 2024 , provides a guide to using online annuity calculators.

Types of Fees Associated with Variable Annuities

Here are some common fees associated with variable annuities:

- Mortality and Expense Risk Charges (M&E):These charges cover the insurer’s costs of providing the death benefit and other guarantees. They are typically expressed as a percentage of the account value.

- Administrative Fees:These fees cover the insurer’s costs of managing the variable annuity contract, such as record-keeping and customer service. They are typically charged as a flat fee or a percentage of the account value.

- Investment Fees:These fees are charged by the underlying investments, such as mutual funds or ETFs. They can include expense ratios, management fees, and transaction fees.

- Surrender Charges:These charges are imposed if you withdraw funds from the variable annuity before a certain period. They are typically expressed as a percentage of the account value and decline over time.

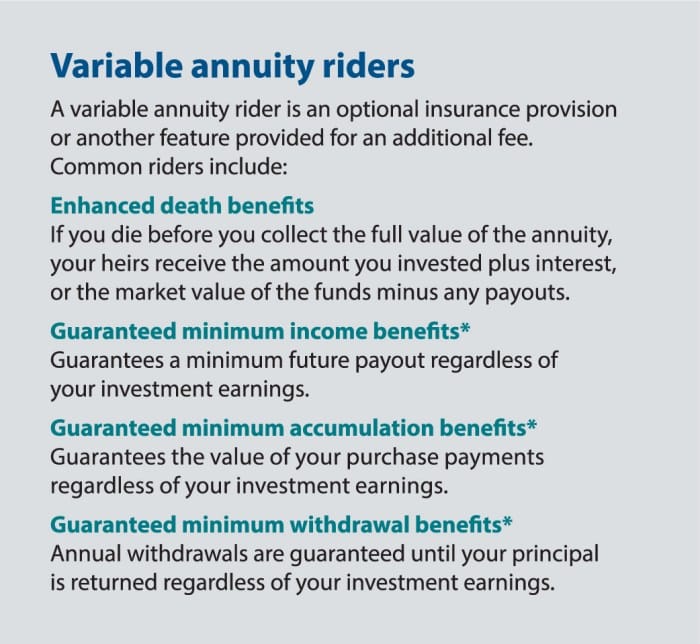

- Rider Fees:Some variable annuities offer optional riders, such as guaranteed minimum income benefits or long-term care protection, which come with additional fees.

Impact of Fees on Overall Investment Returns

Fees can significantly impact the overall return on your variable annuity investment. High fees can erode your returns over time, making it difficult to achieve your financial goals. It’s important to compare the fees charged by different variable annuity providers to find a product that offers a competitive fee structure.

Nationwide’s Destination B Variable Annuity is a popular option for those seeking a balance of growth potential and guaranteed income. This article, Nationwide Destination B Variable Annuity Prospectus 2024 , provides a detailed prospectus for this specific annuity.

Comparison of Fees Charged by Different Variable Annuity Providers

The fees charged by different variable annuity providers can vary significantly. It’s important to compare the fees charged by different providers before making a decision. Consider factors such as the M&E charges, administrative fees, investment fees, surrender charges, and rider fees.

Variable annuities offer a unique blend of features, but it’s important to understand their characteristics before making a decision. This article, Variable Annuity Characteristics 2024 , outlines the key features and potential risks associated with variable annuities.

Tax Implications of Variable Annuities

The tax treatment of variable annuity distributions can be complex and depends on several factors, including the type of distribution, the age of the annuitant, and the investment options within the variable annuity.

Rolling over your 401(k) into an annuity can be a strategic move for retirement planning. This article, Annuity 401k Rollover 2024 , explores the benefits and considerations involved in an annuity 401(k) rollover.

Tax Treatment of Variable Annuity Distributions

Here’s a general overview of the tax treatment of variable annuity distributions:

- Growth on Investment Options:The growth on the underlying investment options within a variable annuity is not taxed until it is withdrawn.

- Withdrawals Before Age 59 1/2:Withdrawals from a variable annuity before age 59 1/2 are generally subject to a 10% penalty, in addition to ordinary income tax.

- Withdrawals After Age 59 1/2:Withdrawals from a variable annuity after age 59 1/2 are taxed as ordinary income.

- Annuity Payments:Annuity payments are typically taxed as a combination of ordinary income and return of principal. The portion of the payment that represents a return of principal is not taxed, while the portion that represents earnings is taxed as ordinary income.

Variable annuities are often offered by life insurance companies, and it’s essential to understand the offerings of different providers. This article, Variable Annuity Life Insurance Co 2024 , provides insights into variable annuities offered by life insurance companies.

Potential Tax Advantages and Disadvantages of Variable Annuities

Variable annuities offer some potential tax advantages, but they also come with potential disadvantages:

- Tax Deferral:The earnings on a variable annuity are not taxed until they are withdrawn, which can provide a tax advantage over other investments.

- Taxable Withdrawals:When you withdraw funds from a variable annuity, the withdrawals are typically taxed as ordinary income, which can be higher than the tax rate on capital gains.

Minimizing Tax Liabilities Related to Variable Annuities

Here are some strategies to minimize tax liabilities related to variable annuities:

- Withdraw Funds Strategically:Consider withdrawing funds from your variable annuity after age 59 1/2 to avoid the 10% early withdrawal penalty.

- Use Qualified Distributions:If you withdraw funds for qualified purposes, such as medical expenses or education expenses, you may be able to avoid the 10% early withdrawal penalty.

- Consider Annuities with Tax-Deferred Growth:Some variable annuities offer tax-deferred growth on the investment options, which can help to reduce your tax liability.

Variable Annuities and Retirement Planning: Variable Annuity Nationwide 2024

Variable annuities can be a valuable tool for retirement planning, offering both growth potential and income security. However, it’s important to understand their potential benefits and drawbacks in the context of your overall retirement savings strategy.

Variable Annuities as Part of a Retirement Savings Strategy

Variable annuities can play a role in a retirement savings strategy by providing:

- Growth Potential:Variable annuities allow investors to participate in the growth of the stock market through their investment options.

- Income Security:Some variable annuities offer guaranteed minimum income benefits, which can provide a steady stream of income during retirement.

- Tax Deferral:The earnings on a variable annuity are not taxed until they are withdrawn, which can provide a tax advantage over other investments.

Potential Benefits and Drawbacks of Using Variable Annuities for Retirement Income

Here are some potential benefits and drawbacks of using variable annuities for retirement income:

- Benefits:

- Potential for higher returns than fixed annuities.

- Tax-deferred growth on earnings.

- Guaranteed minimum income benefits can provide downside protection.

- Living benefits can offer protection against long-term care expenses.

- Drawbacks:

- Risk of loss if the underlying investments perform poorly.

- High fees and expenses can erode returns.

- Complex financial products that require careful consideration.

- Withdrawals before age 59 1/2 are subject to penalties.

Examples of How Variable Annuities Can Be Integrated into Different Retirement Plans, Variable Annuity Nationwide 2024

Here are some examples of how variable annuities can be integrated into different retirement plans:

- 401(k) Plans:Variable annuities can be offered as an investment option within a 401(k) plan, allowing employees to diversify their retirement savings.

- IRAs:Variable annuities can be held within a traditional IRA or a Roth IRA, providing tax advantages and growth potential.

- Annuities as a Supplement to Social Security:Variable annuities can supplement Social Security income, providing additional income during retirement.

Variable Annuity Illustrations and Examples

To illustrate the potential benefits and risks of variable annuities, consider these examples:

Table Comparing Different Variable Annuity Products

| Variable Annuity Product | Investment Options | Fees | Guaranteed Minimum Income | Living Benefits | Death Benefit |

|---|---|---|---|---|---|

| Product A | Mutual funds, stocks, bonds | High | Yes | Yes | Guaranteed principal |

| Product B | Mutual funds, ETFs | Medium | No | No | Lump sum payout |

| Product C | Stocks, bonds | Low | Yes | Yes | Income stream |

This table provides a simplified comparison of three hypothetical variable annuity products. It highlights the key features to consider when choosing a product, such as investment options, fees, guaranteed minimum income, living benefits, and death benefit.

Annuity is a financial product that offers a steady stream of income for a specific period, and it’s a great option for those seeking financial security in 2024. You can learn more about the benefits of annuities in this article, Annuity Is Good 2024.

Hypothetical Scenario Demonstrating the Potential Growth of a Variable Annuity Investment

Assume an investor invests $100,000 in a variable annuity with an average annual return of 7%. After 10 years, the investment could grow to approximately $196,715, assuming no fees or expenses. However, it’s important to note that this is just a hypothetical scenario and actual returns may vary.

If you’re in Singapore and looking to explore annuity options, using an annuity calculator can be a valuable tool. This article, Annuity Calculator Singapore 2024 , provides information on annuity calculators available in Singapore.

Examples of How Variable Annuities Can Be Used to Address Specific Financial Goals

Here are some examples of how variable annuities can be used to address specific financial goals:

- Retirement Income:A variable annuity with a guaranteed minimum income benefit can provide a steady stream of income during retirement, even if the underlying investments perform poorly.

- Long-Term Care:A variable annuity with long-term care protection can help to cover the costs of long-term care in the event of a chronic illness or disability.

- Legacy Planning:A variable annuity with a death benefit can provide financial security for beneficiaries upon the death of the annuitant.

Closing Notes

As you navigate the ever-evolving financial landscape, a thorough understanding of variable annuities is paramount. By carefully considering the factors Artikeld in this guide, you can make well-informed decisions about whether variable annuities align with your investment goals and risk tolerance.

Remember, seeking professional financial advice tailored to your unique circumstances is crucial before making any investment decisions.

Commonly Asked Questions

What are the risks associated with variable annuities?

Variable annuities carry market risk, meaning the value of your investment can fluctuate based on the performance of the underlying investments. Additionally, they may have surrender charges, which are penalties for withdrawing your money before a certain period.

Are variable annuities suitable for everyone?

Growing annuities offer the potential for increased payments over time, but understanding how they work is essential. This article, How To Calculate A Growing Annuity 2024 , provides a step-by-step guide to calculating growing annuities.

Variable annuities are not a one-size-fits-all solution. They are generally suitable for investors with a long-term investment horizon and a moderate to high risk tolerance. It’s essential to consult with a financial advisor to determine if variable annuities are right for you.

Hartford’s Director M Variable Annuity is a popular choice for those seeking a mix of growth potential and guaranteed income. You can find detailed information about this specific annuity in this article, Hartford Director M Variable Annuity 2024.

How do variable annuities work in relation to inflation?

Variable annuities do not offer guaranteed protection against inflation. The value of your investment may not keep pace with rising inflation, potentially diminishing your purchasing power over time.