Annuity Vs Variable Annuity 2024 takes center stage, as individuals seek financial security and retirement planning strategies. Annuities, in their traditional and variable forms, offer distinct approaches to managing your savings and generating income during retirement. This guide delves into the intricacies of each type, exploring their advantages, drawbacks, and considerations for the year ahead.

A 3-year annuity is a type of annuity that provides payments for a period of three years. These annuities can be helpful for short-term income needs or to supplement other retirement income sources. You can learn more about 3-year annuities here: How Does A 3 Year Annuity Work 2024.

Understanding the nuances of annuities, their guaranteed payments, and investment potential is crucial for making informed decisions that align with your financial goals.

Traditional annuities provide a steady stream of guaranteed payments, while variable annuities offer the potential for growth through market investments. Both types come with unique features, tax implications, and risks. This comprehensive exploration will equip you with the knowledge to determine which option best suits your needs and risk tolerance.

An annuity with an 8% return can be a great way to grow your savings, but it’s important to understand the risks and potential rewards. This article provides more information on 8% annuities and how they work: Annuity 8 Percent 2024.

Contents List

- 1 Annuities vs. Variable Annuities: A Comprehensive Guide for 2024

- 1.1 Introduction: Defining Annuities and Variable Annuities

- 1.2 How Annuities Work

- 1.3 Variable Annuities: Navigating the Market

- 1.4 Comparing and Contrasting

- 1.5 Factors to Consider When Choosing

- 1.6 Potential Risks and Considerations

- 1.7 Annuity Regulations and Considerations for 2024, Annuity Vs Variable Annuity 2024

- 2 Epilogue: Annuity Vs Variable Annuity 2024

- 3 FAQ Section

Annuities vs. Variable Annuities: A Comprehensive Guide for 2024

In the realm of retirement planning, annuities have emerged as a popular financial tool, offering individuals a stream of guaranteed income during their golden years. However, with the introduction of variable annuities, investors now have a wider array of options to choose from, each with its own set of features, benefits, and risks.

HSBC offers variable annuities that can provide a potential for growth, but it’s important to understand the risks involved. This article provides more information on HSBC variable annuities: Variable Annuity Hsbc 2024.

This comprehensive guide delves into the intricacies of both traditional annuities and variable annuities, providing a clear understanding of their workings, key differences, and factors to consider when making an informed decision.

Microsoft Excel can be a helpful tool for calculating annuity payments. There are several formulas and functions available in Excel that can help you with these calculations. You can find more information on using Excel for annuity calculations here: Calculating Annuity Excel 2024.

Introduction: Defining Annuities and Variable Annuities

Annuities are financial contracts that provide a stream of payments to an individual over a specified period of time. They are designed to offer a sense of financial security during retirement, ensuring a steady flow of income even after individuals stop working.

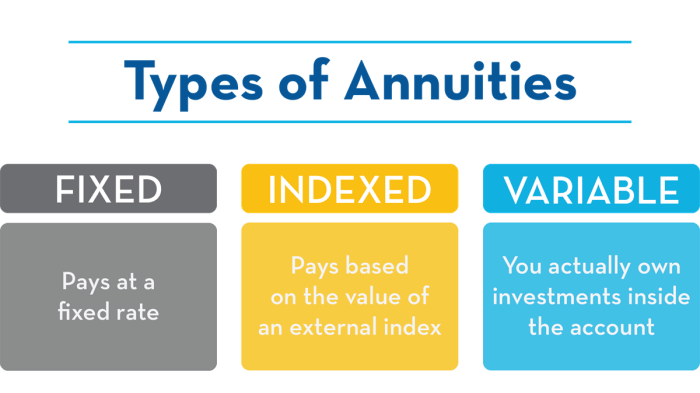

Traditionally, annuities have been categorized into two main types: traditional annuities and variable annuities. While both share the common goal of providing income, they differ significantly in their investment structure, risk profile, and potential returns.

Traditional annuities, also known as fixed annuities, provide guaranteed payments based on a predetermined interest rate. These payments are fixed for the duration of the annuity contract, offering a predictable and stable income stream. On the other hand, variable annuities offer the potential for higher returns but also come with greater risk.

These annuities invest in a portfolio of sub-accounts, which fluctuate in value based on the performance of underlying investments, such as stocks, bonds, or mutual funds.

The history of annuities can be traced back to ancient times, with early forms of annuities being used to provide financial support for individuals in their later years. The concept of variable annuities emerged in the 1950s as a response to the growing demand for investment options that could potentially offer higher returns than traditional fixed annuities.

Over the years, both traditional and variable annuities have evolved, incorporating new features and investment strategies to meet the evolving needs of investors.

How Annuities Work

Annuities are structured to provide a stream of guaranteed payments to an individual over a specified period. This income stream can be structured in various ways, depending on the individual’s needs and preferences. Here’s a breakdown of how annuities work:

- Guaranteed Payments:Traditional annuities offer guaranteed payments, meaning the amount of income received each period is fixed and predetermined. This predictability provides financial security, especially for individuals seeking a reliable source of income during retirement. The guaranteed payments are based on the initial investment amount and the interest rate agreed upon in the annuity contract.

- Payout Options:Annuities offer different payout options, allowing individuals to choose the structure that best suits their financial needs. Some common payout options include:

- Lump Sum:Individuals can choose to receive their annuity payments as a single lump sum, which provides flexibility but may not be suitable for those seeking a long-term income stream.

- Fixed Income:This option provides a fixed amount of income for a specified period, ensuring a predictable and reliable income stream. The payments are typically made monthly or annually.

- Life Income:This option provides payments for the lifetime of the annuitant, ensuring a lifelong income stream. The payments may be adjusted for inflation to maintain purchasing power over time.

- Tax Implications:The tax implications of annuity payouts depend on the type of annuity and the payout option chosen. In general, the portion of the annuity payment that represents the return of the original investment is not taxed, while the portion representing interest or investment gains is taxable as ordinary income.

However, specific tax rules may apply, and it’s essential to consult with a tax professional for personalized advice.

Variable annuities offer a different approach to retirement planning, allowing individuals to participate in market growth while still receiving a stream of income. Here’s a detailed explanation of how variable annuities work:

- Investment Structure:Variable annuities differ from traditional annuities in their investment structure. Instead of guaranteeing a fixed interest rate, variable annuities invest in a portfolio of sub-accounts. These sub-accounts offer a range of investment options, such as stocks, bonds, or mutual funds, allowing individuals to choose investments that align with their risk tolerance and investment goals.

The “Annuity 59 1/2 Rule” refers to the age at which individuals can start receiving annuity payments without penalty. This rule is an important factor to consider when planning for retirement. You can learn more about the 59 1/2 Rule and its implications here: Annuity 59 1/2 Rule 2024.

- Sub-Accounts:Variable annuity sub-accounts act like separate investment accounts within the annuity contract. Each sub-account is managed by a professional investment manager who seeks to generate returns for the account holders. The performance of each sub-account fluctuates based on the performance of the underlying investments, which can lead to both growth and losses.

- Growth Potential:Variable annuities offer the potential for higher returns than traditional annuities, as they are tied to the performance of the underlying investments. If the market performs well, the value of the sub-accounts can increase, leading to higher annuity payments. However, it’s important to note that the value of the sub-accounts can also decrease if the market declines, potentially reducing the amount of income received.

- Risk:Variable annuities carry greater risk than traditional annuities due to the volatility of the market. The value of the sub-accounts can fluctuate significantly, and there is no guarantee of a specific return. Individuals should carefully consider their risk tolerance and investment goals before investing in a variable annuity.

Comparing and Contrasting

To gain a clearer understanding of the key differences between traditional annuities and variable annuities, it’s helpful to compare and contrast their features:

| Feature | Traditional Annuity | Variable Annuity |

|---|---|---|

| Guaranteed Payments | Yes, fixed interest rate | No, payments fluctuate based on investment performance |

| Investment Growth Potential | Limited, based on fixed interest rate | Potential for higher returns, tied to market performance |

| Risk Level | Low, guaranteed payments | High, value of sub-accounts can fluctuate |

| Tax Implications | Taxed as ordinary income | Taxed as ordinary income |

| Fees and Expenses | Typically lower than variable annuities | Higher fees and expenses, including investment management fees, mortality and expense charges |

Factors to Consider When Choosing

Choosing between a traditional annuity and a variable annuity requires careful consideration of individual factors, such as risk tolerance, investment goals, and financial situation. Here are some key factors to consider:

- Risk Tolerance:Individuals with a low risk tolerance may prefer traditional annuities, as they offer guaranteed payments and a predictable income stream. Those with a higher risk tolerance and a longer investment horizon may consider variable annuities, as they offer the potential for higher returns.

The UK government offers various annuity calculators to help individuals plan for retirement. These calculators can help you determine the best annuity option for your needs and circumstances. You can find more information on these calculators here: Annuity Calculator Uk Gov 2024.

- Investment Goals:The choice between a traditional annuity and a variable annuity should align with investment goals. If the primary goal is to ensure a steady stream of income during retirement, a traditional annuity may be more suitable. If the goal is to potentially grow wealth over time, a variable annuity may be a better option.

An annuity is a financial product that provides regular payments over a set period of time. It can be a valuable tool for retirement planning and income security. This article explains the meaning of an annuity in more detail: Annuity Is Meaning 2024.

- Financial Situation:Financial situation, including income, assets, and debt, should be considered when making a decision. Individuals with a substantial amount of savings may be more comfortable taking on the risk of a variable annuity, while those with limited savings may prefer the stability of a traditional annuity.

The “annuity number” refers to a specific type of annuity product that may have unique features or terms. It’s important to understand the specific details of any annuity product before making a decision. This article provides more information on annuity numbers: Annuity Number 2024.

Here are some scenarios where each type of annuity might be more suitable:

- Scenario 1: Retirement Income Security:A retired individual with a modest income and a need for a guaranteed income stream may opt for a traditional annuity to provide financial stability.

- Scenario 2: Long-Term Growth Potential:An individual with a longer investment horizon and a higher risk tolerance may choose a variable annuity to potentially grow their wealth over time.

Determining risk tolerance and investment goals is crucial for making an informed decision. Risk tolerance refers to an individual’s ability and willingness to accept potential losses in pursuit of higher returns. Investment goals should be clearly defined, outlining the desired financial outcomes, such as retirement income, wealth accumulation, or estate planning.

The annuity rate is the interest rate that is applied to your annuity payments. It’s important to understand the different annuity rates available and how they can affect your overall returns. This article provides more information on annuity rates: Annuity Rate Is 2024.

Potential Risks and Considerations

While annuities offer a range of benefits, it’s important to understand the potential risks associated with both traditional and variable annuities:

- Surrender Charges:Many annuity contracts include surrender charges, which are fees assessed if the annuity is withdrawn before a certain period. These charges can significantly impact returns, especially if the annuity is surrendered early. It’s crucial to carefully review the terms and conditions of any annuity contract to understand the surrender charge structure.

- Investment Risk:Variable annuities carry investment risk, as the value of the sub-accounts can fluctuate based on market performance. If the market declines, the value of the sub-accounts may decrease, potentially reducing the amount of income received. Individuals should carefully consider their risk tolerance and investment goals before investing in a variable annuity.

Calculating annuity growth can be helpful for planning your retirement and understanding how much you’ll have in the future. There are several methods for calculating annuity growth, which you can learn more about here: Calculate Annuity Growth 2024.

- Inflation Risk:Traditional annuities offer fixed payments, which may not keep pace with inflation. As the cost of living increases, the purchasing power of the annuity payments can decline over time. It’s essential to consider inflation risk when choosing an annuity, especially for individuals with a long retirement horizon.

Canada offers a variety of annuity calculators to help individuals plan for retirement. These calculators can help you determine the best annuity option for your needs and circumstances. You can find more information on Canadian annuity calculators here: Annuity Calculator Canada 2024.

Thorough research and understanding of the terms and conditions of any annuity contract are essential. It’s advisable to consult with a financial advisor to discuss specific needs and investment goals, as well as to understand the intricacies of different annuity options.

Annuity Regulations and Considerations for 2024, Annuity Vs Variable Annuity 2024

The regulatory landscape for annuities is constantly evolving, with changes implemented to protect consumers and ensure the financial stability of the industry. It’s essential to stay informed about any relevant changes in annuity regulations in 2024, as these changes can impact the availability, features, and costs of annuities.

The current economic climate can also significantly influence annuity investments. Factors such as interest rates, inflation, and market volatility can impact the performance of both traditional and variable annuities. It’s crucial to consider the broader economic context when making decisions about annuities.

Annuity payments can be structured in many ways, but one common option is a single sum payment. If you’re considering a single sum annuity, it’s helpful to research the different types and options available to you. This article provides more information on single sum annuities: Annuity Is A Single Sum 2024.

Consulting with a financial advisor is highly recommended before making any decisions about annuities. A financial advisor can provide personalized guidance based on individual circumstances, risk tolerance, and investment goals. They can help navigate the complexities of annuity contracts, assess potential risks and rewards, and recommend the most suitable annuity option.

Epilogue: Annuity Vs Variable Annuity 2024

As we navigate the complexities of annuities in 2024, remember that careful consideration, informed decision-making, and professional guidance are essential. Whether you prioritize guaranteed income or seek potential growth, understanding the fundamental differences between traditional and variable annuities empowers you to make choices that align with your financial aspirations.

A growing annuity calculator can help you determine the present value of your future payments. This can be helpful for planning your retirement and understanding how much you’ll need to save. Learn more about growing annuities and present value calculations here: Growing Annuity Calculator Present Value 2024.

By weighing the pros and cons, assessing your risk tolerance, and consulting with a financial advisor, you can confidently navigate the path towards a secure and fulfilling retirement.

FAQ Section

What is the difference between a fixed annuity and a variable annuity?

When deciding between an annuity and a lump sum, it’s helpful to use an annuity calculator to compare the potential returns. This tool can help you determine which option is best for your individual circumstances. For a more detailed comparison, you can read this article: Annuity Calculator Vs Lump Sum 2024.

A fixed annuity provides guaranteed payments, while a variable annuity offers the potential for growth through market investments. Fixed annuities are less risky, but their returns are typically lower. Variable annuities carry more risk, but they also have the potential for higher returns.

Are annuities a good investment for everyone?

Variable annuities can be a good investment option for some people, but it’s important to understand the risks and potential rewards before investing. To learn more about the pros and cons of variable annuities, check out this article: Is A Variable Annuity A Good Investment 2024.

Annuities can be a good investment for some people, but not everyone. It’s important to carefully consider your individual financial situation, risk tolerance, and investment goals before deciding whether an annuity is right for you.

What are the tax implications of annuities?

The tax implications of annuities can be complex and vary depending on the type of annuity and how it is structured. It’s essential to consult with a tax advisor to understand the tax implications of your specific annuity.