Variable Annuity Payout Options 2024 offer a unique blend of investment potential and guaranteed income streams, catering to diverse retirement planning needs. This guide delves into the various payout options available, shedding light on their benefits, drawbacks, and the factors to consider when making your choice.

Understanding the nuances of variable annuities is crucial for maximizing your retirement income. From traditional lump-sum payouts to guaranteed lifetime income options, this guide provides a comprehensive overview of the landscape, empowering you to make informed decisions.

Contents List

- 1 Introduction to Variable Annuities

- 2 Variable Annuity Payout Options in 2024

- 3 Guaranteed Lifetime Income Options

- 4 Considerations for Choosing a Payout Option

- 5 Tax Implications of Payout Options

- 6 Illustrative Examples of Payout Options: Variable Annuity Payout Options 2024

- 7 Ending Remarks

- 8 Question & Answer Hub

Introduction to Variable Annuities

Variable annuities are a type of insurance product that combines investment and income features. They allow you to invest in a variety of sub-accounts, offering potential for growth, while also providing income guarantees. The investment returns in variable annuities are not guaranteed and are subject to market fluctuations.

Key Features of Variable Annuities

Variable annuities are complex financial products, but their key features can be summarized as follows:

- Investment Options:Variable annuities offer a wide range of investment options, including mutual funds, ETFs, and other investment vehicles. You can choose the investments that align with your risk tolerance and financial goals.

- Potential for Growth:The investment returns in variable annuities are not guaranteed and are subject to market fluctuations. The potential for growth depends on the performance of the chosen investments.

- Income Guarantees:Some variable annuities offer income guarantees, such as guaranteed lifetime withdrawal benefits, which provide a stream of income for life.

- Tax Deferral:The earnings and growth in a variable annuity are tax-deferred until they are withdrawn. This can be a significant advantage for long-term investors.

- Death Benefit:Most variable annuities offer a death benefit, which pays a lump sum to your beneficiaries upon your death.

Tax Implications of Variable Annuities

Variable annuities are subject to certain tax rules.

If you’re considering a specific type of annuity, you might be looking for information about annuity M or trying to understand what an annuity is in general.

- Growth is Tax-Deferred:Earnings and growth in a variable annuity are not taxed until withdrawn. This means you don’t have to pay taxes on the growth until you start taking distributions.

- Withdrawals are Taxable:When you withdraw money from a variable annuity, the withdrawals are taxed as ordinary income.

- Tax Implications of Death Benefit:The death benefit paid to your beneficiaries is generally not taxable to them.

Variable Annuity Payout Options in 2024

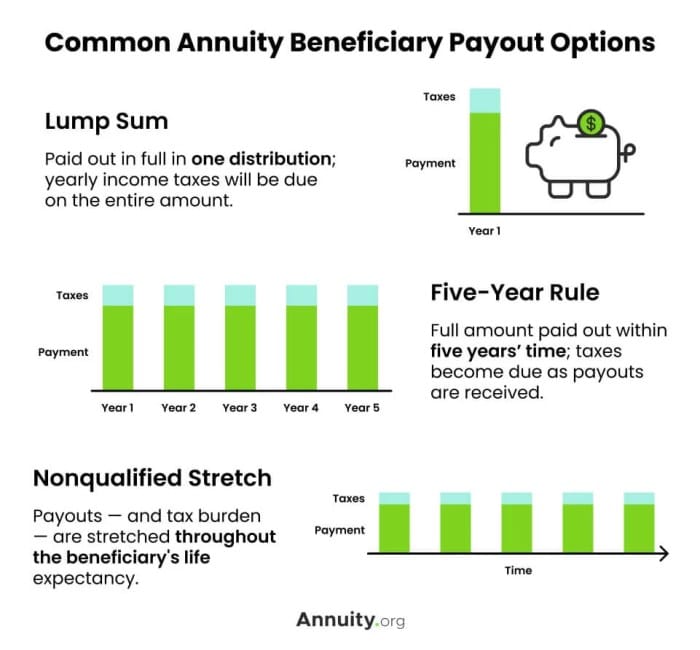

Once you reach retirement age, you have various options for receiving income from your variable annuity. The payout option you choose will impact the amount of income you receive, the duration of the income stream, and the tax implications.

Knowing how to calculate annuity payments can be useful. If you’re looking for a tool to help you, you might want to try the annuity calculator from Schwab.

Payout Options for Variable Annuities

Here are some common payout options available in 2024:

- Lump Sum:You can receive your entire annuity balance as a lump sum payment. This option provides immediate access to your funds, but you will lose the potential for future growth.

- Fixed Annuity:This option provides a guaranteed stream of income for a specified period, often for life. The amount of income is fixed and does not fluctuate with market performance.

- Life Annuity:This option provides a guaranteed stream of income for life, but the amount of income is not fixed. It is typically based on your age, gender, and the value of your annuity.

- Joint Life Annuity:This option provides a guaranteed stream of income for the lifetime of two individuals, such as a couple. The income stream continues until the last surviving individual passes away.

- Guaranteed Minimum Income Benefit (GMIB):This option provides a guaranteed minimum income payment for a specified period, even if the value of your annuity declines.

- Guaranteed Lifetime Withdrawal Benefit (GLWB):This option provides a guaranteed minimum income payment for life, even if the value of your annuity declines.

Comparing Payout Options

The best payout option for you will depend on your individual circumstances and financial goals. Here is a comparison of some common payout options, including their benefits and drawbacks:

| Payout Option | Benefits | Drawbacks |

|---|---|---|

| Lump Sum | Immediate access to funds, flexibility in how to use the money. | Loss of potential for future growth, may not provide a guaranteed income stream. |

| Fixed Annuity | Guaranteed stream of income, predictable payments. | Limited growth potential, income may not keep pace with inflation. |

| Life Annuity | Guaranteed stream of income for life, potential for higher income payments. | Income is not fixed, may not provide a sufficient income stream in the early years. |

| Joint Life Annuity | Guaranteed stream of income for the lifetime of two individuals, provides income security for a couple. | Income payments may be lower than a single life annuity. |

| GMIB | Provides a guaranteed minimum income payment, protects against market downturns. | May have a lower guaranteed income payment than a fixed annuity. |

| GLWB | Provides a guaranteed minimum income payment for life, protects against market downturns. | May have a higher initial cost than other payout options. |

Guaranteed Lifetime Income Options

Guaranteed lifetime income options, such as GLWBs, provide a guaranteed minimum income payment for life, regardless of the performance of your annuity investments. These options can provide peace of mind and financial security in retirement, ensuring a steady stream of income for life.

Benefits of Guaranteed Lifetime Income Options

- Guaranteed Income:These options provide a guaranteed minimum income payment for life, ensuring you have a steady stream of income, regardless of market fluctuations.

- Longevity Protection:They help protect against the risk of outliving your savings. Even if your annuity investments decline in value, you will still receive the guaranteed income payment.

- Financial Security:They can provide peace of mind and financial security in retirement, knowing that you have a guaranteed income stream for life.

Risks of Guaranteed Lifetime Income Options

- Higher Cost:Guaranteed lifetime income options typically have a higher initial cost than other payout options.

- Limited Growth Potential:The guaranteed income payment may not keep pace with inflation, reducing the purchasing power of your income over time.

- Potential for Lower Income:The guaranteed income payment may be lower than the income you could receive from other payout options, such as a life annuity, if your investments perform well.

Considerations for Choosing a Payout Option

The best payout option for you will depend on your individual circumstances and financial goals. Consider the following factors when making your decision:

Factors to Consider

- Age:If you are younger, you may have a longer time horizon and may be more willing to take on risk. You may choose a payout option with a higher potential for growth. If you are older, you may prioritize income security and choose a payout option with a guaranteed income stream.

For those interested in variable annuities, you might want to learn about variable annuity licenses or how to calculate annuity lump sums.

- Health:If you have health concerns, you may want to consider a payout option with a guaranteed income stream, such as a life annuity or a GLWB.

- Financial Goals:What are your financial goals in retirement? Do you need a steady stream of income for life, or do you have other sources of income?

- Risk Tolerance:How comfortable are you with risk? Are you willing to take on the risk of market fluctuations, or do you prefer a guaranteed income stream?

- Tax Implications:Consider the tax implications of different payout options. Some options may result in higher taxes than others.

Decision-Making Process

Here is a flowchart illustrating the decision-making process for selecting a payout option:

- Assess Your Financial Goals:What are your income needs in retirement? What are your financial goals?

- Consider Your Age and Health:How long do you expect to live? Do you have any health concerns?

- Evaluate Your Risk Tolerance:How comfortable are you with market fluctuations?

- Compare Payout Options:Research the different payout options available and compare their features, benefits, and risks.

- Consult with a Financial Advisor:A financial advisor can help you understand the different payout options and choose the one that is right for you.

Tax Implications of Payout Options

The tax implications of different payout options can vary significantly. It is important to understand the tax rules that apply to your chosen payout option.

It’s also crucial to know how annuity is taxed to make informed financial decisions. And, before you commit, it’s worth asking yourself: is an annuity a good idea for you?

Taxation of Payout Options

- Lump Sum:If you receive a lump sum payment, you will be taxed on the entire amount as ordinary income in the year you receive it.

- Fixed Annuity:The income payments from a fixed annuity are taxed as ordinary income in the year you receive them.

- Life Annuity:The income payments from a life annuity are taxed as ordinary income in the year you receive them.

- Guaranteed Minimum Income Benefit (GMIB):The income payments from a GMIB are taxed as ordinary income in the year you receive them.

- Guaranteed Lifetime Withdrawal Benefit (GLWB):The income payments from a GLWB are taxed as ordinary income in the year you receive them.

Minimizing Tax Liability

There are strategies you can use to minimize your tax liability on variable annuity income.

- Tax-Efficient Withdrawals:Consider withdrawing funds from your annuity in a way that minimizes your tax liability. For example, you may want to withdraw only the amount you need to cover your expenses and leave the rest in the annuity to continue growing tax-deferred.

For those exploring variable annuities, you might be looking for information about variable annuity GMIB riders.

- Tax-Loss Harvesting:If you have investments in your annuity that have lost value, you may be able to sell those investments and use the losses to offset capital gains from other investments. This can reduce your overall tax liability.

- Roth Conversions:If you have a traditional IRA or 401(k), you may be able to convert some or all of your account balance to a Roth IRA. This can provide tax-free withdrawals in retirement.

Illustrative Examples of Payout Options: Variable Annuity Payout Options 2024

Here are three hypothetical scenarios demonstrating how different payout options might work in practice.

Scenario 1: Lump Sum Payout, Variable Annuity Payout Options 2024

Suppose you have a variable annuity with a balance of $500,000. You choose to receive a lump sum payout. You will receive the entire $500,000 and will be taxed on the entire amount as ordinary income in the year you receive it.

This option provides immediate access to your funds, but you will lose the potential for future growth.

There are many annuity income secrets to uncover, including how to calculate an annuity.

Scenario 2: Fixed Annuity Payout

Suppose you have a variable annuity with a balance of $500,000. You choose to receive a fixed annuity payout of $30,000 per year for life. You will receive $30,000 per year for the rest of your life, and the payments are guaranteed.

The income payments will be taxed as ordinary income in the year you receive them. This option provides a guaranteed income stream, but the income payments are fixed and may not keep pace with inflation.

Scenario 3: Guaranteed Lifetime Withdrawal Benefit (GLWB)

Suppose you have a variable annuity with a balance of $500,000. You choose to receive a GLWB with a guaranteed minimum income payment of $25,000 per year for life. You will receive at least $25,000 per year for the rest of your life, even if the value of your annuity declines.

Thinking about annuities in 2024? There are many different annuity options available, so it’s important to understand your needs and goals. You might want to consider if an annuity is immediate or if you need to wait for payments to start.

The income payments will be taxed as ordinary income in the year you receive them. This option provides a guaranteed income stream and protects against market downturns, but it may have a higher initial cost than other payout options.

You might also be interested in understanding variable annuity M&E fees or whether annuity is counted as income.

Ending Remarks

Navigating the complex world of variable annuity payout options requires careful consideration of your individual circumstances, financial goals, and risk tolerance. This guide has provided a framework for understanding the key considerations, empowering you to choose a payout option that aligns with your unique retirement aspirations.

Question & Answer Hub

What is the difference between a fixed annuity and a variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns are tied to the performance of underlying investments, offering potential for higher growth but also greater risk.

Can I change my payout option once I’ve chosen one?

The ability to change your payout option depends on the specific annuity contract. It’s essential to review the terms and conditions carefully before making a decision.

Are there any fees associated with variable annuity payout options?

Yes, variable annuities typically have fees, including administrative fees, mortality and expense charges, and investment management fees. These fees can impact your overall returns, so it’s crucial to understand them before investing.