Variable Annuity Payments 2024: Navigating the Complexities of Retirement Income. Variable annuities are a popular retirement savings tool that offers the potential for growth and income security. However, with market volatility and changing regulations, understanding the nuances of variable annuity payments in 2024 is crucial for investors seeking to maximize their retirement income.

Omni Calculator offers a variety of financial calculators, including one specifically for annuities. This article provides a guide to using the Omni Calculator Annuity tool: Omni Calculator Annuity 2024.

This guide provides a comprehensive overview of variable annuity payments, exploring how they work, their benefits and risks, and key factors to consider when choosing a variable annuity. We’ll also delve into the latest market trends and predictions for variable annuity payments in 2024, offering insights to help you make informed decisions about your retirement planning.

Variable annuities offer a unique investment strategy, combining potential growth with income generation. Discover how variable annuities work and their key features: How Variable Annuity Works 2024.

Contents List

Variable Annuity Payments: An Overview

Variable annuity payments are a type of retirement income stream that offers the potential for growth based on the performance of underlying investments. These payments are designed to provide a steady stream of income during retirement, while also allowing for the possibility of higher returns if the investments perform well.

Key Features and Characteristics

Variable annuity payments are characterized by a number of key features:

- Investment Choice:Variable annuities allow you to choose from a variety of investment options, such as stocks, bonds, and mutual funds. This gives you control over your investment portfolio and the potential for growth.

- Guaranteed Minimum Payments:Some variable annuities offer a guaranteed minimum payment, which ensures that you will receive a certain amount of income each month, regardless of the performance of your investments.

- Tax-Deferred Growth:Earnings on your variable annuity investments grow tax-deferred, meaning that you won’t have to pay taxes on them until you withdraw them in retirement.

- Lifetime Income:Variable annuities can provide lifetime income, meaning that you will continue to receive payments for as long as you live.

Comparison with Other Retirement Income Options

Variable annuity payments offer several advantages over other retirement income options, such as traditional pensions and fixed annuities:

- Potential for Higher Returns:Variable annuities have the potential to generate higher returns than fixed annuities, which offer a fixed rate of return. This is because variable annuities are linked to the performance of the underlying investments.

- Flexibility:Variable annuities offer more flexibility than traditional pensions, which often have strict rules about when and how you can access your benefits.

- Tax Advantages:Variable annuities offer tax-deferred growth, which can help to reduce your overall tax burden in retirement.

However, variable annuities also come with some risks, such as the potential for investment losses.

The variable annuity market is constantly evolving. This article explores the current trends and dynamics within the variable annuity market: Variable Annuity Market 2024.

How Variable Annuity Payments Work

Variable annuity payments are calculated based on the performance of the underlying investments. The amount of your payment will vary depending on how well your investments perform.

Accurately calculating the payout from an annuity is vital for financial planning. This article provides a guide on how to calculate annuity payouts: Calculating Annuity Payout 2024.

Calculating Variable Annuity Payments, Variable Annuity Payments 2024

The calculation of variable annuity payments is a complex process that involves several factors:

- Initial Investment:The amount of your initial investment will determine the size of your annuity payments.

- Investment Performance:The performance of your investments will directly impact the amount of your annuity payments. If your investments grow, your payments will increase. If your investments decline, your payments will decrease.

- Withdrawal Rate:The withdrawal rate you choose will also affect the amount of your annuity payments. A higher withdrawal rate will result in larger payments, but it will also deplete your annuity balance more quickly.

- Fees and Expenses:Variable annuities come with fees and expenses, which can reduce the amount of your annuity payments. These fees can include administrative fees, investment management fees, and surrender charges.

Impact of Market Fluctuations

Market fluctuations can have a significant impact on variable annuity payments. If the market goes down, your investment portfolio will lose value, and your annuity payments may decrease. Conversely, if the market goes up, your investment portfolio will grow, and your annuity payments may increase.

Variable annuities are a popular investment option in Japan, offering a potential for growth while providing income in retirement. Learn more about the intricacies of variable annuities in Japan and their current landscape in this article: Variable Annuity Japan 2024.

It is important to note that variable annuity payments are not guaranteed. They are subject to the ups and downs of the market.

Benefits of Variable Annuity Payments

Variable annuity payments offer a number of potential benefits for retirement planning:

Income Security and Growth Potential

Variable annuities can provide a steady stream of income during retirement, while also offering the potential for growth. This is because the payments are linked to the performance of the underlying investments.

Mergers and acquisitions (M&A) activity in the variable annuity market is on the rise. This article examines the current M&A landscape in the variable annuity sector: Variable Annuity M&A 2024.

Tax Advantages

Variable annuities offer tax-deferred growth, which means that you won’t have to pay taxes on your earnings until you withdraw them in retirement. This can help to reduce your overall tax burden.

Variable annuities offer various options for investors, each with its own set of features and benefits. This article explores the different options available within variable annuities: Variable Annuity Options 2024.

Other Potential Benefits

Variable annuities can also offer other potential benefits, such as:

- Guaranteed Minimum Payments:Some variable annuities offer a guaranteed minimum payment, which ensures that you will receive a certain amount of income each month, regardless of the performance of your investments.

- Death Benefit:Many variable annuities offer a death benefit, which guarantees a payment to your beneficiaries if you die before your annuity payments are exhausted.

- Living Benefits:Some variable annuities offer living benefits, which can provide additional income or protection against market downturns.

Risks Associated with Variable Annuity Payments: Variable Annuity Payments 2024

While variable annuities offer a number of potential benefits, they also come with some risks.

The future of annuities is uncertain, with various factors influencing their long-term viability. This article delves into the uncertainties surrounding annuities: Annuity Uncertain 2024. It’s important to stay informed about these developments to make informed decisions about your financial future.

Market Downturns

One of the biggest risks associated with variable annuities is the potential for investment losses due to market downturns. If the market goes down, your investment portfolio will lose value, and your annuity payments may decrease.

Annuity products are not bonds. This article clarifies the difference between annuities and bonds: Is Annuity Bond 2024. Understanding the distinctions is crucial for making informed investment choices.

Fees and Expenses

Variable annuities come with fees and expenses, which can reduce the amount of your annuity payments. These fees can include administrative fees, investment management fees, and surrender charges.

Other Risks

Other risks associated with variable annuities include:

- Investment Risk:You are responsible for choosing the investments in your variable annuity, and the performance of these investments will directly impact the amount of your annuity payments.

- Liquidity Risk:Variable annuities are not as liquid as other investments, such as stocks or bonds. This means that it may be difficult to access your money quickly if you need it.

- Inflation Risk:Variable annuity payments are not inflation-protected. This means that the purchasing power of your payments could decline over time if inflation rises.

Choosing a Variable Annuity

Choosing a variable annuity is a major financial decision. It is important to carefully consider your financial goals and risk tolerance before making a decision.

Before investing in a variable annuity, it’s essential to review the prospectus, which outlines the product’s details and risks. This article discusses the importance of understanding the variable annuity prospectus: Variable Annuity Prospectus 2024.

Factors to Consider

When choosing a variable annuity, there are a number of factors to consider:

- Investment Options:The variable annuity should offer a variety of investment options that align with your investment goals and risk tolerance.

- Fees and Expenses:The fees and expenses associated with the variable annuity should be reasonable and transparent.

- Guarantees:Some variable annuities offer guarantees, such as a guaranteed minimum payment or a death benefit. These guarantees can provide additional security and peace of mind.

- Customer Service:The variable annuity provider should have a strong reputation for customer service.

Seeking Professional Financial Advice

It is highly recommended to seek professional financial advice when choosing a variable annuity. A financial advisor can help you understand your options and choose a variable annuity that is right for you.

Kathy’s annuity is currently experiencing a challenging situation, highlighting the importance of understanding the potential risks and complexities of annuity investments. This article delves into the specific challenges Kathy’s annuity is facing: Kathy’s Annuity Is Currently Experiencing 2024.

Variable Annuity Payments in 2024

The variable annuity market is constantly evolving. In 2024, there are a number of factors that could impact variable annuity payments.

Market Conditions

The performance of the stock market and other asset classes will have a significant impact on variable annuity payments in 2024. If the market goes up, annuity payments are likely to increase. Conversely, if the market goes down, annuity payments are likely to decrease.

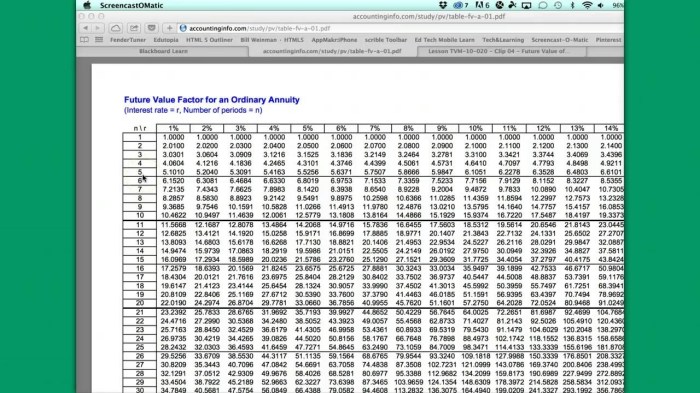

For accountants, understanding how annuities are calculated and recorded is essential. This article provides a comprehensive guide on calculating annuities in accounting: Calculating Annuity In Accounting 2024. This information is vital for accurate financial reporting and analysis.

Regulations and Changes

There may be new regulations or changes in the variable annuity market in 2024 that could affect payments. For example, new regulations could impact the fees and expenses associated with variable annuities.

Key Trends and Predictions

Some key trends and predictions for variable annuity payments in 2024 include:

- Increased Demand for Income Security:As people live longer and retirement savings become more important, there is likely to be an increased demand for income security products like variable annuities.

- Focus on Low-Cost Options:Consumers are becoming increasingly price-sensitive, and there is likely to be a growing demand for low-cost variable annuity options.

- Growth of Living Benefits:Variable annuities with living benefits, such as guaranteed minimum income benefits, are likely to become more popular as people seek to protect their retirement income against market downturns.

Epilogue

As you navigate the world of variable annuities, remember that seeking professional financial advice is essential. An experienced advisor can help you understand your individual needs and goals, and guide you toward a variable annuity that aligns with your specific financial situation.

With careful planning and informed decision-making, variable annuities can play a valuable role in securing your retirement income and achieving your long-term financial objectives.

It’s crucial to understand the potential penalties associated with withdrawing funds from an annuity early. This article explores the 10% penalty that may apply to early withdrawals: Annuity 10 Penalty 2024. Before making any decisions, be sure to carefully consider the potential implications.

Q&A

What is the minimum withdrawal amount for a variable annuity?

John Hancock is a well-known provider of annuities. Learn more about the specific annuity products offered by John Hancock and their features: Annuity John Hancock 2024. This information can be helpful for those considering John Hancock annuities as a potential investment.

The minimum withdrawal amount for a variable annuity varies depending on the specific contract. Some contracts may have a minimum withdrawal amount, while others may allow for withdrawals of any amount. It’s important to review the terms of your contract to understand the minimum withdrawal requirements.

Annuity payments can be calculated using a specific formula, which you can find detailed information about in this article: How Do You Calculate Annuity Payments 2024. Understanding how to calculate annuity payments is crucial for both individuals and financial institutions to ensure proper financial planning and investment decisions.

How are taxes treated on variable annuity withdrawals?

Withdrawals from a variable annuity are generally taxed as ordinary income. However, there may be some tax-advantaged options available, such as withdrawals from the annuity’s “death benefit” or “living benefit” provisions. It’s important to consult with a tax advisor to understand the tax implications of your specific situation.

Can I withdraw money from my variable annuity before retirement?

You may be able to withdraw money from your variable annuity before retirement, but there may be penalties associated with early withdrawals. It’s important to review the terms of your contract to understand the withdrawal rules and any potential penalties.