Variable Annuity Rollover To IRA 2024 takes center stage, offering individuals a strategic opportunity to potentially enhance their retirement savings. This guide delves into the intricacies of this financial maneuver, exploring the benefits, risks, and considerations involved in transitioning your variable annuity to an IRA.

Variable annuities have a rich history and have evolved over time. Delve into the variable annuity history to understand their development and potential advantages.

We’ll navigate the complexities of the rollover process, discuss potential tax implications, and provide insights into how market conditions and regulatory changes may influence your decision.

Calculating annuity values involves various factors, including interest rates, payment periods, and future values. Explore different methods for calculating annuity values to make informed financial decisions.

Whether you’re seeking greater investment flexibility, lower fees, or a potential path to higher returns, understanding the nuances of this financial move is crucial. This guide serves as a starting point for your research, empowering you to make informed decisions about your retirement planning.

A $2 million annuity can provide a significant income stream for retirement. Find out how much a $2 million annuity will pay to understand the potential benefits of this type of investment.

Contents List

Understanding Variable Annuities and IRAs

Variable annuities and IRAs are popular retirement savings vehicles, each offering unique features and benefits. Before considering a rollover from a variable annuity to an IRA, it’s essential to understand the core aspects of both.

Variable Annuities

Variable annuities are insurance products that offer a combination of investment growth potential and guaranteed income. They allow investors to choose from a variety of sub-accounts, each with different investment strategies, such as stocks, bonds, or mutual funds. The value of the annuity fluctuates based on the performance of the chosen sub-accounts.

One key feature of variable annuities is the potential for tax-deferred growth. Earnings within the annuity are not taxed until they are withdrawn in retirement. This can lead to significant tax savings over time, especially for individuals in higher tax brackets.

Variable annuities also often include death benefit guarantees, which ensure that a beneficiary will receive a minimum payout even if the account value declines.

Traditional and Roth IRAs

Individual Retirement Accounts (IRAs) are retirement savings plans that offer tax advantages and flexibility. There are two main types of IRAs: Traditional IRAs and Roth IRAs.

Excel can be a valuable tool for calculating annuity values. Learn how to calculate annuity value in Excel to streamline your financial calculations.

Traditional IRAs allow for pre-tax contributions, which reduces your taxable income in the year you contribute. However, withdrawals in retirement are taxed as ordinary income.

Roth IRAs, on the other hand, require you to contribute after-tax dollars. However, qualified withdrawals in retirement are tax-free. This can be particularly beneficial for individuals who expect to be in a higher tax bracket in retirement.

Variable annuities often come with management and expense fees, which can impact your overall returns. It’s essential to understand the variable annuity M&E fees associated with your annuity.

Tax Advantages and Disadvantages

The tax implications of variable annuities and IRAs differ significantly. Variable annuities offer tax-deferred growth, meaning that earnings are not taxed until withdrawal. However, withdrawals in retirement are taxed as ordinary income, and there may be additional taxes or penalties depending on the specific type of annuity and the age of the annuitant.

Annuity payments don’t always have to be the same amount. Learn how to calculate an annuity with different payments to explore the possibilities of customizing your income stream.

Traditional IRAs offer a tax deduction for contributions, but withdrawals in retirement are taxed as ordinary income. Roth IRAs offer tax-free withdrawals in retirement, but contributions are not tax-deductible.

Charles Schwab offers a comprehensive annuity calculator that can help you estimate potential payouts and explore different annuity options. You can learn more about the annuity calculator Charles Schwab provides to assist you in your financial planning.

The Rollover Process: Variable Annuity Rollover To Ira 2024

Rolling over a variable annuity to an IRA involves transferring the funds from the annuity to an IRA account. This process can be complex and may involve various steps and considerations.

Nationwide is a reputable provider of variable annuities. Discover more about variable annuity Nationwide offers to find the right investment solution for your needs.

Steps Involved

The specific steps involved in a variable annuity rollover can vary depending on the annuity provider and the chosen IRA custodian. However, the general process typically includes:

- Contacting the annuity provider to initiate the rollover process.

- Completing the necessary paperwork, including a rollover request form and beneficiary information.

- Choosing an IRA custodian to hold the funds.

- Transferring the funds from the annuity to the IRA account.

Tax Implications

Rolling over a variable annuity to an IRA can have tax implications. In most cases, the rollover is tax-free, meaning that you won’t have to pay taxes on the funds transferred. However, there may be certain circumstances where taxes or penalties apply, such as if you withdraw funds from the IRA before age 59 1/2.

Predicting your future income stream from an annuity is crucial for financial planning. Utilize an annuity withdrawal calculator to estimate your potential payouts and ensure your retirement goals are met.

Factors to Consider

Several factors should be considered when deciding whether to roll over a variable annuity to an IRA, including:

- Investment goals: Do you want more investment flexibility or prefer the guaranteed income features of the variable annuity?

- Tax bracket: Are you currently in a lower tax bracket and expect to be in a higher tax bracket in retirement? If so, a Roth IRA might be more beneficial.

- Time horizon: How long do you plan to keep the money invested? If you need access to the funds in the short term, a variable annuity might be a better option.

Considerations for 2024

The IRA contribution limits and tax rules are subject to change each year. It’s important to stay informed about any updates that may affect your rollover decision.

Annuity payments are often reported on Form 1099. Learn more about annuity 1099 and how it relates to your tax obligations.

Changes to IRA Contribution Limits

The contribution limits for traditional and Roth IRAs are adjusted annually for inflation. For 2024, the maximum contribution limit for individuals is $6,500, and for those aged 50 and over, the catch-up contribution is $1,000, bringing the total to $7,500.

Variable annuities can be subject to market fluctuations, but there are strategies to mitigate risk. Explore variable annuity hedging strategies to help protect your investment and potentially enhance your returns.

These limits may change in future years.

Annuity due payments are made at the beginning of each period, which can impact the overall value of your investment. Learn how to calculate an annuity due to ensure you understand the nuances of this type of annuity.

Market Conditions and Economic Forecasts

Market conditions and economic forecasts can significantly impact variable annuity performance and IRA investment strategies. It’s crucial to consider the current economic environment and potential future trends when making a rollover decision.

New or Updated Regulations

The Department of Labor and the Internal Revenue Service (IRS) may issue new or updated regulations regarding variable annuity rollovers. It’s essential to stay informed about any changes to ensure you comply with all applicable rules.

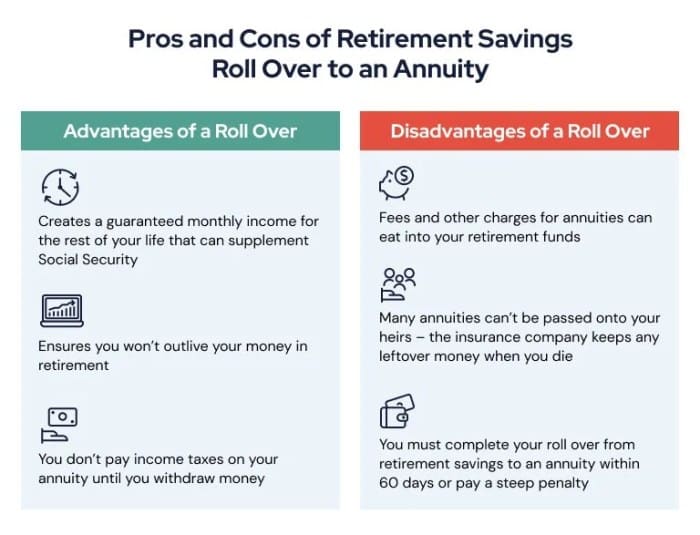

Potential Risks and Benefits

Rolling over a variable annuity to an IRA can present both potential risks and benefits. It’s crucial to weigh these factors carefully before making a decision.

Excel is a powerful tool for financial calculations, including annuity calculations. Explore the FV annuity Excel function to efficiently determine the future value of your annuity.

Potential Risks

The potential risks associated with rolling over a variable annuity to an IRA include:

- Market volatility: The value of your investments can fluctuate, potentially leading to losses.

- Loss of guarantees: Variable annuities often include guarantees, such as death benefits or minimum payout amounts. These guarantees may be lost when you roll over to an IRA.

- Tax liabilities: While rollovers are generally tax-free, there may be certain circumstances where taxes or penalties apply.

Potential Benefits

The potential benefits of rolling over a variable annuity to an IRA include:

- Greater investment flexibility: IRAs offer a wider range of investment options than variable annuities.

- Lower fees: IRA accounts typically have lower fees than variable annuities.

- Potentially higher returns: The potential for higher returns with an IRA depends on your investment choices and market performance.

Comparison Table, Variable Annuity Rollover To Ira 2024

| Feature | Variable Annuity | IRA |

|---|---|---|

| Investment Options | Limited to sub-accounts offered by the annuity provider | Wide range of investment options, including stocks, bonds, mutual funds, and ETFs |

| Fees | Typically higher than IRA fees | Generally lower fees |

| Tax Implications | Tax-deferred growth, but withdrawals are taxed as ordinary income | Traditional IRA: Tax-deductible contributions, but withdrawals are taxed as ordinary income. Roth IRA: Tax-free withdrawals, but contributions are not tax-deductible. |

| Guarantees | May include death benefits or minimum payout amounts | No guarantees |

| Risk | Lower risk due to guarantees, but potential for lower returns | Higher risk due to market volatility, but potential for higher returns |

Seeking Professional Advice

It’s essential to consult with a qualified financial advisor before making any decisions regarding variable annuity rollovers. A financial advisor can help you understand your individual financial situation and goals and develop a personalized plan that meets your needs.

For those unfamiliar with annuities, understanding the basics is essential. Explore the concept of annuity kya hai to gain insights into this type of financial product.

Key Questions to Ask

When meeting with a financial advisor, be sure to ask questions such as:

- What is your experience with variable annuities and IRAs?

- What are the potential risks and benefits of rolling over my variable annuity to an IRA?

- What investment options are available in an IRA that are suitable for my goals and risk tolerance?

- What are the tax implications of rolling over my variable annuity to an IRA?

- What are your fees and how are they structured?

Finding a Reputable Advisor

To find a reputable and experienced financial advisor, you can:

- Ask for referrals from friends, family, or colleagues.

- Check the advisor’s credentials and experience with organizations such as the Certified Financial Planner Board of Standards or the National Association of Personal Financial Advisors.

- Read online reviews and testimonials from previous clients.

Last Point

The decision to roll over a variable annuity to an IRA in 2024 requires careful consideration, balancing potential benefits with inherent risks. A thorough understanding of your individual financial situation, investment goals, and tax implications is paramount. Consulting with a qualified financial advisor can provide personalized guidance, ensuring your choices align with your long-term retirement objectives.

Determining the rate of return on your annuity can be a complex process, but it’s crucial for understanding your investment’s performance. You can find valuable information on calculating annuity rate of return to help you make informed decisions about your financial future.

Question Bank

What are the main advantages of rolling over a variable annuity to an IRA?

Rolling over a variable annuity to an IRA can offer greater investment flexibility, potentially lower fees, and potentially higher returns.

What are the potential drawbacks of rolling over a variable annuity to an IRA?

Potential drawbacks include the loss of certain guarantees associated with variable annuities, potential tax liabilities, and exposure to market volatility.

How do I find a qualified financial advisor to help me with this decision?

Seek referrals from trusted sources, such as friends, family, or other professionals. You can also use online resources, such as the Certified Financial Planner Board of Standards (CFP Board) or the National Association of Personal Financial Advisors (NAPFA) to find advisors in your area.