Variable Annuity Rmd 2024 – Variable Annuity RMDs 2024: A Guide is a crucial topic for anyone with a variable annuity approaching retirement. This guide will delve into the intricacies of required minimum distributions (RMDs) for variable annuities, explaining how they work, how to calculate them, and the tax implications involved.

Annuity payments can vary significantly depending on the type and amount invested. Annuity 250k 2024 may generate a different payment stream compared to a $750,000 annuity. Understanding how inherited annuities are taxed How Is Inherited Annuity Taxed 2024 is essential if you receive one as part of an inheritance.

Understanding RMDs is essential for effective retirement planning. Failing to take your RMDs can lead to penalties, and knowing how to withdraw your funds strategically can help you maximize your retirement income and minimize your tax burden. This guide will provide you with the information you need to navigate these complex issues confidently.

Contents List

Variable Annuities

Variable annuities are a type of retirement savings product that offers the potential for growth through investments in the stock market. They combine features of both traditional annuities and mutual funds, allowing individuals to accumulate wealth over time and potentially receive a stream of income in retirement.

Variable Annuity Basics

Variable annuities are investment-oriented products that offer the potential for growth but also carry investment risk. The key feature of a variable annuity is its investment component, which allows you to choose from a variety of investment options, such as mutual funds, sub-accounts, or separate accounts.

Calculating annuity due payments Calculating Annuity Due 2024 involves a slightly different formula than calculating ordinary annuities. It’s essential to understand the nuances of these calculations to ensure you are making informed decisions about your financial future.

The value of your annuity is tied to the performance of the underlying investments you select.

Annuity payments are often structured as a series of regular payments. Annuity Is Payment 2024 can be monthly, quarterly, or annually, depending on the terms of the contract. If you’re considering a fixed annuity within an IRA, Fixed Annuity In Ira 2024 may be an option, but you should consult with a tax professional to understand the implications.

The potential for growth in a variable annuity is directly related to the performance of your chosen investments. If the market performs well, your annuity’s value can increase. However, if the market declines, the value of your annuity can also decrease.

This is a key distinction from traditional fixed annuities, which guarantee a fixed rate of return.

Annuity payments can be made into various accounts. Annuity Is Which Account 2024 will depend on the specific type of annuity and your individual circumstances. While annuities are not life insurance policies, Is Annuity A Life Insurance Policy 2024 is a common misconception.

It’s important to understand the distinction between the two.

The performance of your chosen investments will determine the returns you receive from your variable annuity. If you choose investments that perform well, you’ll likely see higher returns. However, if your investments perform poorly, your returns will be lower, and you may even lose money.

Required Minimum Distributions (RMDs)

RMDs are minimum amounts that individuals must withdraw from their retirement accounts, including variable annuities, starting at age 72. This is designed to ensure that individuals use their retirement savings during their lifetime and prevent the accumulation of large sums of money that are never distributed.

In 2024, the specific rules governing RMDs for variable annuities remain largely unchanged. You are required to start taking RMDs by April 1st of the year following the year you turn 72. The amount you must withdraw is based on your account balance as of December 31st of the previous year.

Failing to take your required distributions by the deadline can result in a 50% penalty on the amount not withdrawn. This penalty can be significant, so it’s important to understand your RMD obligations and plan accordingly.

Annuity options for individuals over 85 years old Annuity 85 Years Old 2024 may differ from those available to younger individuals. For instance, a 7% return Annuity 7 Percent 2024 may be difficult to achieve with a fixed annuity at that age.

It’s essential to consult with a financial advisor to determine the best course of action.

Calculating RMDs for Variable Annuities, Variable Annuity Rmd 2024

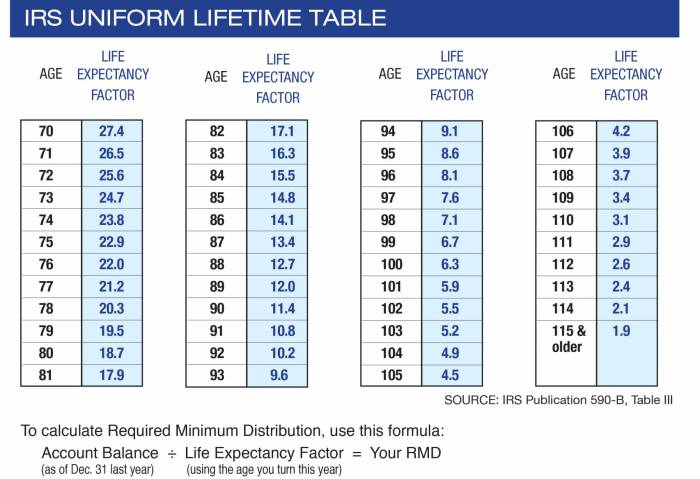

Calculating your RMD for a variable annuity involves a straightforward process. You’ll need to determine your account balance as of December 31st of the previous year and then use the appropriate RMD factor based on your age. The IRS provides tables with these factors.

The factor is multiplied by your account balance to determine your RMD amount.

Your age is a crucial factor in calculating your RMD. The older you are, the higher your RMD factor, which means you’ll need to withdraw a larger amount from your annuity. This reflects the IRS’s intention to ensure that individuals utilize their retirement savings during their lifetime.

If you’re considering an annuity of $750,000 in 2024, it’s crucial to understand the different types available and how they work. Annuity 750k 2024 can be a complex topic, so using a financial calculator to assess your options can be helpful.

Financial Calculator Annuity 2024 can provide valuable insights into potential returns and risks.

For example, let’s say your variable annuity account balance is $500,000 on December 31st of the previous year. You turn 73 in2024. Using the IRS’s RMD tables, the factor for a 73-year-old is 0. 03848. Your RMD would be calculated as follows: $500,000 x 0.03848 = $19,240.

RMD Withdrawal Options

You have several options for withdrawing your RMD from a variable annuity. The choice you make will depend on your individual circumstances and financial goals. Here are some common withdrawal options:

- Direct Withdrawal:You can simply withdraw the RMD amount directly from your annuity account. This is the most straightforward option, and you have control over how you use the funds.

- Annuitization:You can choose to annuitize a portion of your annuity, which converts your account balance into a guaranteed stream of income for life. This can be a good option if you’re seeking guaranteed income in retirement.

- Systematic Withdrawals:You can set up systematic withdrawals to receive regular payments from your annuity. This can help you manage your income stream and ensure you’re taking out your required distributions.

Each withdrawal method has its own tax implications. Direct withdrawals are generally taxed as ordinary income, while annuitization may involve a combination of tax-free and taxable income. It’s essential to consult with a financial advisor to understand the tax consequences of each option.

Variable annuities offer potential for growth but also carry higher risks. O Share Variable Annuity 2024 is one such option, and understanding the associated fees is crucial. Variable Annuity M&E Fees 2024 can impact your overall returns, so make sure you factor them into your calculations.

Tax Considerations for RMDs

RMDs from variable annuities are generally taxed as ordinary income. The specific tax treatment will depend on the type of annuity you have and the investment options you’ve chosen. If your annuity is a traditional IRA or 401(k) rollover, your RMD will be taxed at your ordinary income tax rate.

It’s possible to minimize your tax liability related to RMD withdrawals. One strategy is to adjust your investment allocations in anticipation of your RMDs. For example, you might consider shifting some of your investments from higher-taxed accounts to lower-taxed accounts.

The Knights of Columbus offers various annuity options, including K Of C Annuity 2024 , which may be suitable for certain individuals. However, it’s important to compare different annuity options and consider your financial goals before making a decision. For example, a $200,000 annuity Annuity 200k 2024 might be a more appropriate starting point for some.

Planning for RMDs

Incorporating RMDs into your retirement income planning is essential to avoid penalties and maximize the benefits of your retirement savings. Here are some key strategies to consider:

- Review your investment allocations:Make sure your investments are aligned with your RMD obligations and overall retirement goals.

- Consider tax-efficient withdrawal strategies:Explore options like annuitization or systematic withdrawals to minimize your tax liability.

- Consult with a financial advisor:A qualified professional can provide personalized guidance on RMD planning and help you develop a comprehensive retirement income strategy.

Final Conclusion: Variable Annuity Rmd 2024

As you approach retirement, understanding your RMDs is crucial for ensuring a secure and comfortable financial future. This guide has provided you with the knowledge you need to navigate this aspect of retirement planning, empowering you to make informed decisions about your variable annuity.

Remember, seeking personalized financial advice from a qualified professional can help you tailor your retirement plan to your specific needs and goals.

FAQ Section

What happens if I don’t take my RMD?

Failing to take your RMD by the deadline results in a 50% penalty on the amount you should have withdrawn. This penalty can be quite substantial, so it’s essential to ensure you take your RMDs on time.

Can I choose to take more than my RMD?

Yes, you can choose to withdraw more than your RMD if you wish. This may be beneficial if you need additional income in retirement or want to reduce your future RMDs.

Can I withdraw my RMD from my variable annuity before age 72?

No, RMDs are generally required to start at age 72. However, if you are still working and are covered by a retirement plan, you may be able to delay taking RMDs until age 73. This rule was changed in 2020.

How often do I need to take my RMD?

You must take your RMD each year, starting in the year you turn 72. You can choose to take your RMD all at once, or you can spread it out over the year.