Convert Variable Annuity To Roth IRA 2024: A Guide to Tax-Free Retirement – Are you considering a Roth IRA conversion for your variable annuity? This strategy could unlock tax-free withdrawals in retirement, but it’s essential to understand the nuances before making a decision.

To calculate annuity payments, you may need to use a calculator specifically designed for this purpose. The NSDL offers a calculator that can help you determine your annuity payments. You can find information about the NSDL annuity calculator online, such as Annuity Calculator Nsdl 2024 , to explore its features and how it can assist you in your financial planning.

Converting your variable annuity to a Roth IRA involves a trade-off between potential tax benefits and the loss of certain annuity features. This guide explores the advantages and disadvantages of this strategy, providing valuable insights for those seeking a secure and tax-efficient retirement.

A common question regarding annuities is whether the payments are taxable. The tax implications of annuity payments can vary depending on the type of annuity and other factors. To understand the taxability of annuity payments, you can find resources online, such as Is Annuity Payments Taxable 2024 , which can provide you with clear information about the tax implications.

This guide will delve into the key features of variable annuities and Roth IRAs, outlining the tax implications of each. We’ll discuss the potential benefits of converting a variable annuity to a Roth IRA, including tax-free withdrawals and estate planning advantages.

If you’re using a financial calculator like the BA II Plus, you’ll need to understand how to calculate the annuity factor. This factor is essential for determining the present value or future value of an annuity. There are resources available online that explain how to calculate the annuity factor on the BA II Plus, such as Calculate Annuity Factor On Ba Ii Plus 2024.

Understanding this process can help you make more informed financial decisions.

However, we’ll also address the potential drawbacks, such as the tax liability upon conversion and the loss of certain annuity benefits. By examining the conversion process and considering the financial and tax implications, this guide will equip you with the information you need to make an informed decision.

If you’re a federal employee, you might be interested in calculating your annuity payments under the FERS program. The FERS program offers retirement benefits for federal employees. You can find resources online that explain how to calculate your FERS annuity, such as Calculate Annuity Fers 2024 , to help you plan for your retirement.

Contents List

Understanding Variable Annuities and Roth IRAs: Convert Variable Annuity To Roth Ira 2024

Variable annuities and Roth IRAs are both retirement savings vehicles, but they differ in their tax treatment and investment options. Understanding the key features of each can help you determine if converting a variable annuity to a Roth IRA is the right strategy for you.

For those looking for specific examples of annuity calculations, you can find resources that focus on particular scenarios, such as a 6% annuity. Online resources, like 6 Percent Annuity 2024 , can provide you with practical examples and insights into how annuities work in different situations.

Variable Annuities

Variable annuities are insurance contracts that combine investment growth potential with income guarantees. They allow you to invest in a range of sub-accounts, similar to mutual funds, and your returns fluctuate based on the performance of those investments.

Annuities are commonly used as a way to provide a steady stream of income during retirement. They can be a valuable tool for financial planning, helping to ensure you have a reliable source of income in your later years. To learn more about how annuities can be used to provide income, you can find resources online, such as Annuity Is Primarily Used To Provide 2024 , which can provide you with valuable insights into the benefits of annuities.

- Investment Options:Variable annuities offer a diverse range of investment options, including stocks, bonds, and mutual funds, allowing you to tailor your portfolio to your risk tolerance and investment goals.

- Potential for Growth:The potential for growth is tied to the performance of your chosen investments. If your investments perform well, your annuity value can grow significantly.

- Tax Implications:Variable annuities are generally taxed as ordinary income when withdrawn in retirement. However, the growth in the annuity is tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw them.

Roth IRAs

Roth IRAs are retirement savings accounts that offer tax-free withdrawals in retirement. Contributions to a Roth IRA are made with after-tax dollars, but qualified withdrawals in retirement are tax-free.

Understanding the basics of annuities is essential for making informed financial decisions. There are numerous resources available online that can provide you with general information about annuities, such as Annuity General 2024 , which can help you gain a comprehensive understanding of this financial product.

- Tax-Free Withdrawals:One of the key benefits of a Roth IRA is that qualified withdrawals in retirement are tax-free. This means you can enjoy your retirement savings without having to pay taxes on the distributions.

- Tax Treatment:Contributions to a Roth IRA are made with after-tax dollars, so you don’t receive a tax deduction for contributions. However, withdrawals in retirement are tax-free, making it a potentially attractive option for those anticipating a higher tax bracket in retirement.

When considering annuities, you’ll encounter different types, including variable annuities. These annuities have unique features and tax implications. Understanding the difference between qualified and non-qualified variable annuities is crucial for financial planning. You can find information on this topic online, such as Variable Annuity Qualified Non Qualified 2024 , to help you make informed choices.

Tax Treatment Comparison

| Account Type | Contribution | Withdrawal |

|---|---|---|

| Variable Annuity | Tax-deferred | Taxed as ordinary income |

| Roth IRA | After-tax | Tax-free |

Reasons for Converting a Variable Annuity to a Roth IRA

Converting a variable annuity to a Roth IRA can offer several advantages, but it’s essential to weigh the potential benefits against the drawbacks.

The R programming language is a powerful tool for statistical analysis and can be used to calculate annuities. If you’re familiar with R, you can find resources online that demonstrate how to calculate annuities using R, such as R Calculate Annuity 2024 , which can help you leverage the capabilities of R for financial planning.

Potential Advantages, Convert Variable Annuity To Roth Ira 2024

- Tax-Free Withdrawals:Converting to a Roth IRA allows you to access your retirement savings tax-free in retirement, potentially saving you significant taxes.

- Potential Tax Savings:If you anticipate a higher tax bracket in retirement, converting to a Roth IRA can help you avoid paying higher taxes on your withdrawals.

- Estate Planning Benefits:Roth IRAs can be passed on to beneficiaries tax-free, making them a valuable tool for estate planning.

Potential Drawbacks

- Tax Liability Upon Conversion:Converting a variable annuity to a Roth IRA can trigger a taxable event, meaning you may have to pay taxes on the value of the annuity at the time of conversion.

- Loss of Potential Annuity Benefits:Converting to a Roth IRA may mean losing the potential benefits of your variable annuity, such as guaranteed income payments or death benefits.

- Impact on Investment Strategies:Converting to a Roth IRA may require adjustments to your investment strategy, as the tax treatment of withdrawals is different.

Beneficial Situations

Converting a variable annuity to a Roth IRA may be a beneficial strategy in certain situations, such as:

- High Income Tax Bracket:If you are currently in a high income tax bracket and anticipate being in a lower tax bracket in retirement, converting to a Roth IRA can help you avoid paying higher taxes on your withdrawals.

- Anticipating Higher Income in Retirement:If you anticipate a higher income in retirement, converting to a Roth IRA can help you avoid paying taxes on your withdrawals at a higher tax rate.

Ultimate Conclusion

Converting a variable annuity to a Roth IRA can be a complex financial decision. While it offers the potential for tax-free withdrawals in retirement, it’s crucial to weigh the pros and cons carefully. This guide has provided a comprehensive overview of the conversion process, including the tax implications, investment strategies, and considerations for different situations.

If you’re looking to understand how annuities work and how to calculate their value, there are plenty of resources available online. For example, you can find helpful videos on YouTube that explain the basics of annuity calculation, such as Annuity Calculation Youtube 2024.

These videos can provide a good starting point for understanding the concept and how to calculate annuities.

Ultimately, the decision to convert should be based on your individual circumstances and financial goals. Seeking professional advice from a qualified financial advisor is essential to ensure that this strategy aligns with your long-term financial plan.

Once you have a grasp on the fundamentals of annuity calculation, you can delve into more specific aspects, such as determining the amount you can withdraw from your annuity. There are calculators and resources available online that can help you determine your potential annuity withdrawal, like How To Calculate Annuity Withdrawal 2024.

These tools can provide you with valuable insights into your financial planning.

Top FAQs

What is the difference between a variable annuity and a Roth IRA?

A variable annuity is an insurance product that offers investment options, while a Roth IRA is a retirement savings account with tax-free withdrawals in retirement. Variable annuities may have fees and surrender charges, while Roth IRAs have contribution limits.

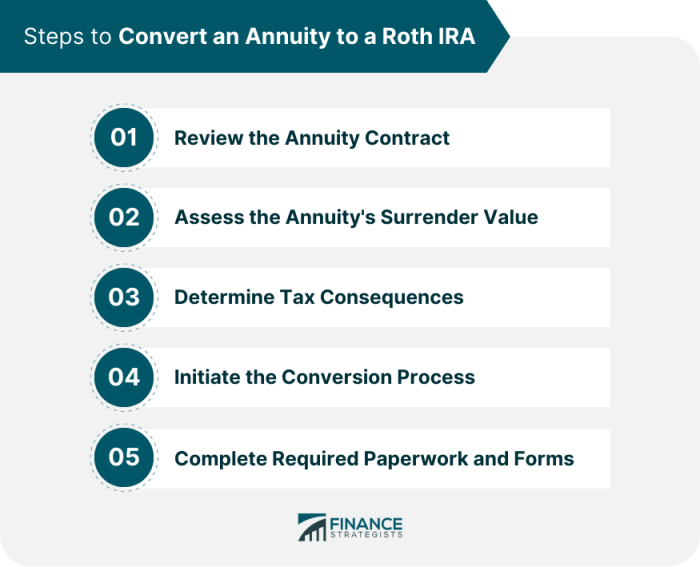

How does the conversion process work?

To convert a variable annuity to a Roth IRA, you’ll need to withdraw the funds from the annuity and roll them over into a Roth IRA. This will trigger taxable income in the year of conversion.

What are the tax implications of a conversion?

You’ll be taxed on the amount of the conversion at your current income tax rate. This could result in a large tax bill in the year of conversion.

Are there any investment strategies specific to a Roth IRA?

Yes, Roth IRAs are designed for tax-free growth, so it’s important to consider investments that can potentially grow tax-free over the long term.

When should I seek professional advice?

It’s always advisable to seek advice from a qualified financial advisor before making any significant financial decisions, including converting a variable annuity to a Roth IRA.

Calculating the present value of an annuity is crucial for financial planning. There are various online calculators available that can help you determine the present value of an annuity, such as Pv Calculator Annuity 2024. These calculators can provide you with valuable insights into the present value of your annuity, helping you make informed decisions about your financial future.

When you withdraw money from an annuity, you may need to consider the tax implications. There are online tools available that can help you calculate the tax on your annuity withdrawals, such as Annuity Withdrawal Tax Calculator 2024. These calculators can help you understand the tax implications of your withdrawals and plan accordingly.

Variable annuities are a type of annuity that offers the potential for growth but also carries some risk. Understanding how variable annuity payments work is essential for making informed financial decisions. You can find resources online that explain variable annuity payments, such as Variable Annuity Payments 2024 , to help you understand the mechanics of these annuities.

Determining the appropriate annuity rate for your financial goals is a key aspect of financial planning. There are resources available online that can help you calculate the annuity rate, such as Calculating An Annuity Rate 2024. These resources can provide you with valuable tools and insights to help you calculate the annuity rate that best suits your needs.