Variable Annuity Versus Fixed Annuity 2024 takes center stage as retirement planning strategies evolve. Annuities, often viewed as retirement income solutions, come in two primary forms: variable and fixed. Variable annuities, tied to market performance, offer potential for growth but also carry inherent risks.

Did you know that annuities can be used for home loans? Annuity Home Loan 2024 explores how annuities can help you finance your dream home.

Fixed annuities, on the other hand, provide guaranteed interest rates and predictable income streams, but may offer lower returns compared to variable annuities. Understanding the nuances of each type is crucial for making informed decisions about your retirement future.

There are many types of annuities out there! Learn about 7 Annuities 2024 to discover which one might be right for you.

This article aims to provide a comprehensive guide to variable and fixed annuities, exploring their key features, advantages, disadvantages, and real-world applications. By examining the intricacies of each type, we aim to empower you with the knowledge needed to make informed decisions that align with your unique financial goals and risk tolerance.

Wondering if your annuity will last a lifetime? Check out this article on Is Annuity Lifetime 2024 to learn more about how annuities work and how long they can last.

Contents List

Variable Annuities Versus Fixed Annuities in 2024: Variable Annuity Versus Fixed Annuity 2024

Annuities are financial products designed to provide a stream of income, often during retirement. While both variable and fixed annuities offer this benefit, they differ significantly in how they operate and the risks and rewards they present. This article will delve into the key features of variable and fixed annuities, highlighting their advantages and disadvantages to help you make an informed decision for your retirement planning in 2024.

Looking for a user-friendly annuity calculator? Annuity Calculator Bankrate 2024 is a great resource to help you understand the potential of your annuity.

Understanding Variable Annuities

Variable annuities are investment-oriented products that tie your returns to the performance of the stock market. You have the flexibility to choose from a variety of investment options, such as mutual funds or separate accounts, allowing you to tailor your portfolio to your risk tolerance and financial goals.

Want to know how annuities relate to present value? This article on Annuity Is Present Value 2024 will break down the connection for you.

The growth potential of variable annuities is directly linked to the performance of your chosen investments. If the market performs well, your annuity value can increase significantly. However, it’s important to note that the value of your annuity can also decline if the market experiences a downturn.

Are you considering converting your variable annuity to a Roth IRA? Convert Variable Annuity To Roth Ira 2024 will help you explore this option.

This means that your retirement income could be affected by market fluctuations.

An annuity is often called the “flip side” of something else. Read An Annuity Is Sometimes Called The Flip Side Of 2024 to learn more about this concept.

Variable annuities typically utilize sub-accounts, which are individual investment accounts within the annuity. These sub-accounts allow you to diversify your investments across different asset classes, potentially mitigating risk and enhancing returns.

It can be confusing to figure out if an annuity is a single sum or a series of payments. You can find the answer in this article: Annuity Is A Single Sum 2024.

Understanding Fixed Annuities

Fixed annuities, in contrast to variable annuities, offer a guaranteed interest rate on your investment. This means that you’ll receive a predictable stream of income throughout the annuity’s term, regardless of market fluctuations. Fixed annuities provide stability and peace of mind, knowing that your income will remain consistent, even if the stock market experiences volatility.

Want to simplify your annuity calculations? Annuity Calculator Xls 2024 offers a convenient Excel spreadsheet to help you plan your annuity.

The guaranteed interest rate in fixed annuities is typically lower than the potential returns offered by variable annuities. This is because the insurance company bears the risk of market fluctuations in fixed annuities. As a result, you might receive lower returns compared to variable annuities, especially in periods of strong market performance.

If you live in South Africa, you can find a helpful annuity calculator here: Annuity Calculator South Africa 2024.

Key Considerations for Choosing an Annuity

Choosing between a variable and fixed annuity requires careful consideration of your individual circumstances and financial goals. Here are some key factors to weigh:

- Risk Tolerance:Variable annuities are suitable for individuals with a higher risk tolerance, willing to accept the potential for market fluctuations in exchange for the possibility of higher returns. Fixed annuities are more appropriate for those seeking stability and predictable income, even if it means potentially lower returns.

Calculating the present value factor for an annuity can seem tricky, but this article, How To Calculate Annuity Pv Factor 2024 , will walk you through the process.

- Time Horizon:Variable annuities are typically better suited for longer time horizons, as they provide more time to recover from market downturns. Fixed annuities may be a better option for shorter time horizons, especially if you need a guaranteed income stream within a shorter period.

Thinking about annuities for your retirement? Annuity 60 Year Old Man 2024 will help you learn more about how annuities can provide income for your golden years.

- Financial Goals:If your goal is to maximize potential growth and accumulate wealth, a variable annuity might be more appealing. However, if you prioritize guaranteed income and principal protection, a fixed annuity could be a better choice.

- Tax Implications:Both variable and fixed annuities can offer tax advantages, but the specific tax implications vary depending on the type of annuity and your individual circumstances. It’s crucial to consult with a tax advisor to understand the tax implications of your chosen annuity.

Annuity due is a specific type of annuity. Calculate Annuity Due Future Value 2024 will help you understand how to calculate its future value.

Variable Annuities: Deeper Dive, Variable Annuity Versus Fixed Annuity 2024

Variable annuities offer several potential benefits, including:

- Potential for Higher Returns:The potential for higher returns is a significant advantage of variable annuities, as your investment is directly tied to the performance of the stock market.

- Flexibility and Control:You have the flexibility to choose from a variety of investment options within variable annuities, allowing you to tailor your portfolio to your risk tolerance and financial goals.

- Guaranteed Minimum Death Benefits:Some variable annuities offer guaranteed minimum death benefits, which ensure that your beneficiaries will receive a minimum payout, even if your annuity value declines. This can provide peace of mind for your loved ones.

- Living Benefits:Certain variable annuities offer living benefits, such as guaranteed income riders, that provide a minimum income stream during your lifetime, regardless of market performance. This can help protect your retirement income from market volatility.

However, variable annuities also carry certain risks:

- Market Volatility:The value of your variable annuity can fluctuate significantly with market movements, potentially leading to losses.

- Potential for Loss:If the market performs poorly, your annuity value can decline, potentially impacting your retirement income.

- Fees and Expenses:Variable annuities typically have higher fees and expenses compared to fixed annuities, which can erode your returns over time.

Fixed Annuities: Deeper Dive

Fixed annuities offer a range of potential benefits:

- Guaranteed Income Streams:Fixed annuities provide a guaranteed stream of income, offering stability and peace of mind during retirement.

- Principal Protection:The principal invested in a fixed annuity is typically protected from market losses, ensuring that you won’t lose your initial investment.

- Predictability:The guaranteed interest rate in fixed annuities provides predictable income streams, making it easier to budget for your retirement expenses.

However, fixed annuities also have potential limitations:

- Potential for Low Returns:The guaranteed interest rate in fixed annuities is typically lower than the potential returns offered by variable annuities, potentially leading to lower returns over time.

- Limited Flexibility:Once you invest in a fixed annuity, you typically have limited flexibility to change your investment choices or withdraw your funds without incurring penalties.

- Inflation Risk:The fixed interest rate in fixed annuities may not keep pace with inflation, potentially reducing the purchasing power of your retirement income over time.

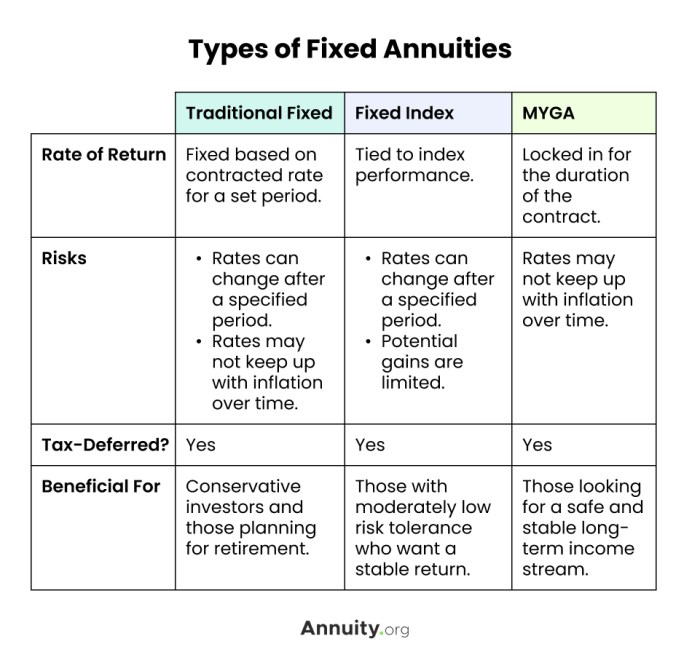

Fixed annuities come in various forms, including:

- Immediate Annuities:These annuities begin paying out income immediately after you invest. They are often used for immediate income needs, such as covering living expenses or supplementing retirement income.

- Deferred Annuities:These annuities provide income payments at a future date, allowing you to accumulate funds for retirement. They offer flexibility in choosing your payout start date and can be tailored to your specific retirement planning needs.

Closing Summary

Ultimately, the choice between a variable annuity and a fixed annuity hinges on individual circumstances and financial objectives. While variable annuities offer the potential for higher returns, they also expose you to market volatility and potential for loss. Fixed annuities provide stability and predictable income streams, but may offer lower returns.

If you’re considering a variable annuity, you have several options to choose from. Variable Annuity Options 2024 explains the different types of variable annuities available.

Consulting with a financial advisor is essential to assess your risk tolerance, time horizon, and financial goals to determine the most suitable annuity type for your specific situation.

As you navigate the complex world of retirement planning, remember that understanding your options is crucial. This article has shed light on the key distinctions between variable and fixed annuities, equipping you with the knowledge needed to make informed decisions about your financial future.

Question & Answer Hub

What is the difference between a variable annuity and a fixed annuity?

A variable annuity’s returns are tied to the performance of underlying investments, typically stocks or mutual funds, while a fixed annuity guarantees a specific interest rate for a set period.

Variable annuities can be complex, but a calculator can help you understand your potential returns. Variable Annuity Calculator 2024 will help you see how your investment might grow over time.

What are the advantages and disadvantages of each type of annuity?

Variable annuities offer potential for higher returns but carry market risk. Fixed annuities provide stability and predictable income streams but may offer lower returns.

How do I choose the right annuity for my needs?

Consider your risk tolerance, time horizon, and financial goals. Consulting with a financial advisor is recommended to make an informed decision.

What are the tax implications of annuities?

Withdrawals from annuities are generally taxed as ordinary income. Consult with a tax advisor for specific guidance.