Variable Annuity With GMWB 2024 represents a unique investment strategy, combining the potential for growth with the security of a guaranteed minimum withdrawal benefit. This type of annuity allows investors to participate in market gains while offering protection against market downturns.

By carefully navigating the intricacies of sub-accounts, investment options, and fee structures, individuals can tailor a strategy that aligns with their financial goals and risk tolerance.

Understanding the nuances of GMWB, particularly the significant changes expected in 2024, is crucial for investors seeking to maximize returns while mitigating potential risks. This guide delves into the key aspects of variable annuities with GMWB, providing insights into investment strategies, tax implications, and suitability considerations.

Annuity due is a type of annuity where payments are made at the beginning of each period. Calculating an annuity due involves adjusting the formula to account for the timing of the payments. Annuity payments can be structured in different ways, such as a 5-year payout, which provides a fixed income for a set period.

Annuity 5-year payouts can be a good option for those who want a predictable income stream for a shorter period. It’s important to consider the tax implications of annuities, as they can vary depending on the type of annuity and the country’s tax laws.

Is an annuity a qualified plan? This depends on the specific annuity and the country’s tax laws.

Contents List

Variable Annuities with GMWB

Variable annuities are complex financial products that offer the potential for growth through investment in the stock market while providing downside protection through a guaranteed minimum withdrawal benefit (GMWB). Understanding the intricacies of variable annuities, especially those with GMWB features, is crucial for investors seeking a balanced approach to retirement planning.

This article will delve into the key aspects of variable annuities with GMWB, covering their core features, the role of GMWB, and the potential impact of changes in 2024. Additionally, we will discuss investment considerations, fees, tax implications, and suitability factors to help investors make informed decisions.

Variable Annuity Basics

A variable annuity is a type of insurance contract that allows investors to accumulate funds for retirement while providing potential growth through investments in sub-accounts. These sub-accounts offer a range of investment options, including mutual funds, ETFs, and other securities, providing flexibility to tailor the portfolio to individual risk tolerance and investment goals.

- Core Features: Variable annuities typically offer tax-deferred growth, meaning that earnings on investments are not taxed until withdrawn. They also provide death benefit protection, ensuring that beneficiaries receive a certain amount upon the death of the annuitant. The key distinction between variable annuities and fixed annuities lies in the investment component.

While fixed annuities offer a guaranteed rate of return, variable annuities link returns to the performance of the underlying investments.

- Sub-Accounts and Investment Options: Variable annuities typically provide access to a variety of sub-accounts, each representing a different investment strategy. Investors can allocate their funds among these sub-accounts, creating a diversified portfolio. The investment options within sub-accounts can range from conservative bond funds to more aggressive equity funds, offering a spectrum of risk and return profiles.

- Fixed vs. Variable Annuities: The main difference between fixed and variable annuities lies in the investment component. Fixed annuities offer a guaranteed rate of return, while variable annuities link returns to the performance of the underlying investments. Fixed annuities provide stability and predictability, while variable annuities offer the potential for higher returns but also carry greater risk.

The choice between fixed and variable annuities depends on individual risk tolerance, investment goals, and time horizon.

Guaranteed Minimum Withdrawal Benefit (GMWB)

A GMWB is a rider that can be added to a variable annuity, providing a guaranteed minimum amount that can be withdrawn each year, regardless of the performance of the underlying investments. This feature offers protection against market downturns, ensuring a stream of income during retirement.

Annuity calculators can help you estimate the potential income you might receive from your annuity. Annuity calculators in Hong Kong can provide personalized estimates based on your specific circumstances. Is an annuity a qualified plan? The answer depends on the specific annuity and the country’s tax laws.

It’s important to consult with a financial advisor to understand the tax implications of annuities. Is an annuity a good investment? The answer depends on your individual financial goals and risk tolerance. Annuity payments can provide a stable income stream, but it’s crucial to consider the potential risks and limitations before making a decision.

- Purpose of GMWB: GMWBs are designed to provide downside protection and income certainty in retirement. They guarantee a minimum withdrawal amount, even if the value of the annuity contract declines. This feature can be particularly valuable for individuals who are concerned about outliving their savings or who need a guaranteed income stream.

- Protection Against Market Downturns: GMWBs act as a safety net during market downturns. Even if the value of the annuity contract falls, the guaranteed withdrawal amount remains intact. This provides peace of mind and ensures that investors can continue to access a stream of income during retirement, regardless of market volatility.

- Types of GMWB Options: There are different types of GMWB options available, each with its own features and benefits. Some common options include:

- Step-up GMWB: This type of GMWB allows the guaranteed withdrawal amount to increase periodically, typically based on the performance of the annuity contract.

If you’re looking for a way to secure a steady income stream in retirement, you might be considering an annuity. Annuity rates in the UK for 2024 are influenced by a variety of factors, including interest rates and life expectancy.

Understanding the different types of annuities, like variable annuities, can help you determine the best fit for your financial goals. Variable annuities offer potential growth but also come with risks. It’s essential to carefully consider the advantages and disadvantages before making a decision.

Variable annuity advantages include the ability to potentially grow your investment, while disadvantages include the risk of losing money. To make an informed choice, you can use an annuity calculator to see how much income you might receive. Annuity calculators can help you estimate your potential payouts based on your life expectancy.

This can provide additional protection against inflation and market fluctuations.

- Lifetime Withdrawal GMWB: This type of GMWB guarantees a minimum withdrawal amount for the lifetime of the annuitant. This provides a secure stream of income that cannot be outlived.

- Step-up GMWB: This type of GMWB allows the guaranteed withdrawal amount to increase periodically, typically based on the performance of the annuity contract.

GMWB 2024, Variable Annuity With Gmwb 2024

The year 2024 marks a significant period for GMWBs, as insurers are reevaluating their offerings and making adjustments to pricing and features. These changes are driven by factors such as interest rate movements, market volatility, and regulatory updates.

- Significance of 2024: The year 2024 is significant because it coincides with a period of potential interest rate increases and continued market volatility. These factors can influence the cost of providing GMWBs and may lead to changes in pricing and features.

- Changes or Updates to GMWB Offerings: Insurers may adjust the terms and conditions of their GMWB offerings in 2024. These changes could include:

- Increased Fees: Insurers may increase the fees associated with GMWBs to offset the increased costs of providing this protection.

- Modified Withdrawal Rates: The guaranteed withdrawal rates may be adjusted, potentially leading to lower annual income streams.

- New GMWB Options: Insurers may introduce new GMWB options with different features and benefits to cater to evolving investor needs.

- Potential Impact on Investors: The changes to GMWB offerings in 2024 could have a significant impact on investors. Those who are considering purchasing a variable annuity with GMWB should carefully evaluate the new terms and conditions before making a decision. It is important to understand how the changes might affect the cost, benefits, and overall value of the annuity.

Closing Notes: Variable Annuity With Gmwb 2024

Variable annuities with GMWB offer a compelling combination of growth potential and downside protection. While these products can be complex, a thorough understanding of their features, fees, and tax implications is essential for informed decision-making. Consulting with a qualified financial advisor can help investors navigate the intricacies of this investment strategy and tailor a solution that aligns with their unique circumstances and financial objectives.

Annuity payouts can be structured in various ways, such as a 5-year payout, which provides a fixed income for a set period. Annuity 5-year payouts can be a good option for those who want a predictable income stream for a shorter period.

It’s important to understand the difference between fixed and variable annuities. Is an annuity fixed income? The answer depends on the type of annuity. Fixed annuities provide a guaranteed rate of return, while variable annuities offer the potential for growth but also carry risks.

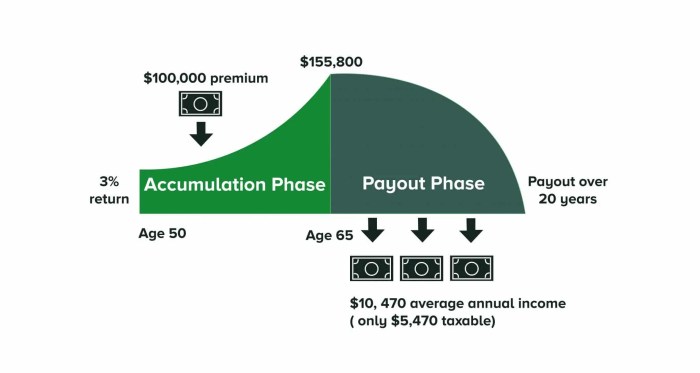

Calculating the payout of a deferred annuity requires specific calculations. Calculating a deferred annuity involves considering factors like the initial investment amount, interest rates, and the length of the deferral period. Calculating an annuity pension involves similar principles, taking into account the pension amount and the expected payout period.

Top FAQs

What are the potential risks associated with variable annuities with GMWB?

While GMWB provides downside protection, it’s important to note that the growth potential of the investment is linked to the performance of the underlying sub-accounts. Market downturns can impact the value of your investment, potentially limiting your withdrawal options. Additionally, fees associated with GMWB can impact overall returns.

An annuity is a financial product that provides a stream of regular payments over a specified period of time. An annuity definition is fairly straightforward: it’s a contract where you exchange a lump sum of money for a series of payments.

There are different types of annuities, such as variable annuities, which offer potential growth but also carry risks. Variable annuity pension plans are often chosen by individuals looking for a way to grow their retirement savings. However, it’s important to remember that these investments are not guaranteed, and their value can fluctuate.

Inheriting a variable annuity can come with its own set of considerations, as you’ll need to understand the terms and conditions of the contract.

How does the GMWB benefit work?

The GMWB guarantees a minimum withdrawal amount each year, typically based on a percentage of your initial investment. This protection ensures you can withdraw a certain amount, even if your investment value declines. The specific terms and conditions of the GMWB will vary depending on the product.

Is a variable annuity with GMWB suitable for everyone?

Variable annuities with GMWB are best suited for investors who are seeking both growth potential and downside protection. However, it’s crucial to consider your risk tolerance, time horizon, and financial goals before making a decision. Consulting with a financial advisor can help you determine if this type of investment aligns with your individual needs.