Variable Annuity Withdrawal Age 2024 takes center stage as individuals approach a pivotal year in their retirement planning. Understanding the nuances of variable annuities, particularly the withdrawal options and rules, is crucial for making informed financial decisions. This article explores the complexities of variable annuities and provides insights into the strategies that can help maximize retirement income.

Variable annuities offer a unique blend of investment growth potential and guaranteed income streams, making them a popular choice for retirement savings. However, the withdrawal options and rules can be complex, and navigating them effectively requires careful planning and consideration.

This article delves into the intricacies of variable annuity withdrawals, focusing on the year 2024, a significant milestone for many individuals approaching retirement.

Contents List

- 1 Variable Annuity Basics: Variable Annuity Withdrawal Age 2024

- 2 Withdrawal Options and Rules

- 3 Withdrawal Strategies for Age 2024

- 4 Considerations for Retirement Planning

- 5 Impact of Market Volatility

- 5.1 Potential Impact of Market Volatility on Variable Annuity Withdrawals

- 5.2 Mitigating Risk and Protecting Accumulated Wealth during Market Fluctuations

- 5.3 Case Study Demonstrating the Effect of Market Volatility on Withdrawal Strategies

- 5.4 Importance of Diversification and Asset Allocation within Variable Annuities

- 6 Last Word

- 7 Questions and Answers

Variable Annuity Basics: Variable Annuity Withdrawal Age 2024

Variable annuities are insurance products that combine investment growth potential with lifetime income guarantees. These products offer a unique blend of risk and reward, making them a complex investment option. Understanding the intricacies of variable annuities is crucial before considering them as part of your financial portfolio.

Understanding how annuities are taxed is essential for financial planning. Is Annuity Counted As Income 2024 addresses this question and provides clarity on the tax implications of annuities.

Key Features of Variable Annuities

Variable annuities offer a range of features designed to cater to diverse investment goals and risk tolerance levels. Some of the key features include:

- Investment Growth Potential:The value of your annuity contract is tied to the performance of the underlying investment options you choose, offering the potential for growth over time.

- Lifetime Income Guarantee:Variable annuities typically include a guaranteed minimum death benefit or a guaranteed minimum living benefit, which ensures a minimum payout to you or your beneficiaries.

- Tax Deferral:Earnings from variable annuities are not taxed until you withdraw them, offering tax-deferred growth potential.

- Flexibility:You have the flexibility to choose from a range of investment options, adjust your investment allocation, and withdraw funds as needed.

Investment Options within Variable Annuities

Variable annuities allow you to invest in a variety of underlying assets, including:

- Mutual Funds:These funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Exchange-Traded Funds (ETFs):ETFs are similar to mutual funds but are traded on stock exchanges like individual stocks.

- Sub-accounts:Some variable annuity providers offer sub-accounts that allow you to invest in specific sectors, asset classes, or investment strategies.

Fees Associated with Variable Annuities

Variable annuities typically involve several fees, which can impact your overall returns. These fees include:

- Mortality and Expense (M&E) Charges:These fees cover the insurance component of the annuity and administrative expenses.

- Investment Management Fees:These fees are charged by the fund managers for managing the underlying investments within your annuity.

- Surrender Charges:These charges may apply if you withdraw funds from your annuity before a certain period.

- Administrative Fees:These fees cover the costs of maintaining your annuity contract.

Potential Risks and Benefits of Variable Annuities

Variable annuities offer both potential benefits and risks. It is crucial to weigh these factors carefully before investing.

- Benefits:

- Growth Potential:The potential for investment growth can help you accumulate wealth over time.

- Lifetime Income Guarantee:The guaranteed minimum benefits provide a safety net and protect your principal.

- Tax Deferral:Tax-deferred growth allows your investments to compound more quickly.

- Risks:

- Market Volatility:The value of your annuity can fluctuate with market performance, leading to potential losses.

- Fees:High fees can significantly reduce your overall returns.

- Complexity:Understanding the intricacies of variable annuities can be challenging.

- Limited Liquidity:Withdrawals from variable annuities may be subject to surrender charges.

Withdrawal Options and Rules

Variable annuities offer a range of withdrawal options, each with its own rules and tax implications. Understanding these options is crucial for maximizing your retirement income and minimizing your tax burden.

Knowing the duration of your annuity payments is crucial. Calculate Annuity Years 2024 provides guidance on how to determine the number of years your annuity will last.

Withdrawal Options for Variable Annuities

Variable annuity contracts typically allow for various withdrawal options, including:

- Fixed Withdrawals:You can withdraw a predetermined amount of money at regular intervals, providing a predictable income stream.

- Variable Withdrawals:You have the flexibility to withdraw varying amounts based on your needs and market conditions.

- Lump-Sum Withdrawals:You can withdraw your entire annuity balance in a single lump sum, subject to surrender charges and tax implications.

- Annuities Certain:This option provides guaranteed payments for a specific period, regardless of your lifespan.

- Life Annuities:These annuities provide payments for the rest of your life, with no guaranteed period.

Impact of Age on Withdrawal Options and Rules

Your age can significantly impact your withdrawal options and rules. Generally, you are allowed to start withdrawing funds from a variable annuity after the accumulation period, typically at age 59 1/2. However, early withdrawals before age 59 1/2 may be subject to penalties.

Additionally, the minimum required distribution (MRD) rules for retirement accounts like variable annuities apply based on your age. These rules dictate the minimum amount you must withdraw annually to avoid tax penalties.

Tax Implications of Withdrawals from Variable Annuities

Withdrawals from variable annuities are generally taxed as ordinary income, which can result in a higher tax liability compared to withdrawals from Roth IRAs or other tax-advantaged accounts. However, the tax implications can vary depending on the type of withdrawal, your age, and the specific provisions of your annuity contract.

Understanding how to calculate annuities is a key skill for financial planning. Calculating The Annuity 2024 offers a comprehensive explanation of annuity calculations.

Minimum Required Distributions (MRDs) for Variable Annuities

The IRS mandates minimum required distributions (MRDs) for retirement accounts, including variable annuities. These rules ensure that retirees eventually withdraw their funds from these accounts and pay taxes on the accumulated earnings. The MRD is calculated based on your age and the account balance.

The following table Artikels the minimum required distributions for different age brackets:

| Age | Minimum Required Distribution Percentage |

|---|---|

| 72 | 3.65% |

| 73 | 3.85% |

| 74 | 4.06% |

| 75 | 4.28% |

| 76 | 4.51% |

| 77 | 4.75% |

| 78 | 5.00% |

| 79 | 5.26% |

| 80 and above | 5.53% |

It is important to note that these percentages are subject to change and are based on current IRS regulations. You should consult with a qualified tax advisor for personalized advice regarding MRDs and other tax implications related to variable annuities.

Variable annuities can be complex, but they offer the potential for growth. Variable Annuity Contracts 2024 provides a comprehensive overview of these contracts and their key features.

Withdrawal Strategies for Age 2024

Individuals turning 2024 in the year 2024 will be facing a unique set of financial circumstances and market conditions. Developing a withdrawal strategy that aligns with their individual needs and goals is crucial for maximizing retirement income and minimizing risk.

Annuity concepts are often explored in financial textbooks. Chapter 9 Annuities 2024 provides a detailed overview of annuities and their applications.

Financial Landscape and Economic Projections for 2024, Variable Annuity Withdrawal Age 2024

The economic outlook for 2024 is uncertain, with factors like inflation, interest rates, and geopolitical tensions potentially impacting market performance. It is essential to consider these factors when formulating a withdrawal strategy. For instance, if inflation remains high, you may need to withdraw more funds from your variable annuity to maintain your purchasing power.

Conversely, if interest rates rise, you might consider withdrawing less and investing a portion of your withdrawals in fixed-income securities to generate a higher yield.

A PV calculator can help you determine the present value of an annuity. Pv Calculator Annuity 2024 provides a guide to using this calculator.

Withdrawal Strategies for Individuals Turning 2024

Individuals turning 2024 in 2024 have several withdrawal strategy options, each with its own potential benefits and drawbacks. Some common strategies include:

- Early Withdrawals:This strategy involves withdrawing a significant portion of your annuity balance early in retirement to cover immediate expenses or invest in other opportunities. The potential benefits of this approach include access to funds when needed and the potential for higher returns if invested wisely.

However, early withdrawals can also deplete your annuity balance faster, potentially reducing your long-term income stream and exposing you to greater risk.

- Delayed Withdrawals:This strategy involves delaying withdrawals until later in retirement, allowing your annuity balance to grow further and potentially generating a larger income stream. The potential benefits of this approach include a higher income stream and potentially lower tax liability. However, delayed withdrawals may not provide enough income to cover immediate expenses or may be less advantageous if market performance deteriorates.

- Gradual Withdrawals:This strategy involves withdrawing a moderate amount of money each year, striking a balance between immediate needs and long-term financial security. This approach can provide a steady income stream while allowing your annuity balance to continue growing.

Potential Benefits and Drawbacks of Early versus Later Withdrawals

The decision to withdraw funds early or later in retirement involves a trade-off between immediate needs and long-term financial security. Early withdrawals offer immediate access to funds, but they can deplete your annuity balance faster and potentially reduce your long-term income stream.

An annuity calculator can simplify the process of calculating annuity payments. Annuity Calculator Nsdl 2024 offers a helpful tool for this purpose.

Conversely, delayed withdrawals allow your annuity balance to grow further, potentially generating a larger income stream, but they may not provide enough income to cover immediate expenses or may be less advantageous if market performance deteriorates. It is crucial to carefully consider your individual needs and circumstances before making a decision.

Variable annuities have both advantages and disadvantages. Variable Annuity Pros And Cons 2024 provides a balanced perspective on these financial products.

Decision-Making Process for Withdrawal Timing

The decision of when to withdraw funds from your variable annuity is a complex one, requiring careful consideration of your financial goals, risk tolerance, and market conditions. The following flowchart illustrates a simplified decision-making process:

- Step 1: Assess Your Financial Goals and Needs:Determine your immediate and long-term financial goals, including retirement income needs, healthcare expenses, travel plans, and any other major expenses.

- Step 2: Analyze Your Risk Tolerance:Evaluate your comfort level with market volatility and potential losses. If you have a low risk tolerance, you may prefer to withdraw less and invest in more conservative investments.

- Step 3: Evaluate Market Conditions:Consider the current economic outlook, interest rates, and market performance. If market conditions are favorable, you may be more inclined to delay withdrawals and allow your annuity balance to grow further. However, if market conditions are uncertain, you may prefer to withdraw more to protect your principal.

- Step 4: Consult with a Financial Advisor:Seek advice from a qualified financial advisor who can help you develop a personalized withdrawal strategy that aligns with your individual needs and goals.

Considerations for Retirement Planning

Variable annuities can play a significant role in retirement planning, offering potential for growth, lifetime income guarantees, and tax-deferred accumulation. However, it is crucial to consider how withdrawal strategies can impact your long-term financial security.

Role of Variable Annuities in Retirement Planning

Variable annuities can serve as a valuable component of a diversified retirement portfolio. They offer the potential for growth through investment in a variety of underlying assets, while also providing a safety net with guaranteed minimum benefits. The tax-deferred growth feature can help your investments compound more quickly, potentially maximizing your retirement savings.

Staying informed about current variable annuity rates is essential for making informed decisions. Variable Annuity Rates Today 2024 provides up-to-date information on these rates.

Impact of Withdrawal Strategies on Long-Term Financial Security

Your withdrawal strategy can significantly impact your long-term financial security. If you withdraw funds too quickly, you may deplete your annuity balance faster, potentially reducing your retirement income stream and exposing you to greater risk. Conversely, if you delay withdrawals too long, you may not have enough income to cover immediate expenses or may be less advantageous if market performance deteriorates.

It is crucial to strike a balance between immediate needs and long-term financial security.

Using a calculator to calculate annuities can be a convenient option. How To Calculate Annuity On Casio Calculator 2024 provides step-by-step instructions for doing so.

Hypothetical Scenario Showcasing Potential Outcomes of Different Withdrawal Strategies

Let’s consider a hypothetical scenario to illustrate the potential outcomes of different withdrawal strategies. Assume a 65-year-old individual with a variable annuity balance of $500,000. If they choose to withdraw 5% annually, they would receive $25,000 per year. However, if market performance is poor, their annuity balance could decline, reducing their future income stream.

Tax implications are a key consideration when dealing with variable annuities. Variable Annuity Taxable Income 2024 provides insights into the taxability of these annuities.

Conversely, if they choose to withdraw 2% annually, they would receive $10,000 per year, but their annuity balance would grow more slowly, potentially limiting their future income potential.

Tips for Maximizing Retirement Income from Variable Annuities

To maximize your retirement income from variable annuities, consider the following tips:

- Develop a Comprehensive Retirement Plan:Create a detailed plan that Artikels your financial goals, income needs, and investment strategies.

- Diversify Your Portfolio:Invest in a variety of asset classes, including stocks, bonds, and real estate, to reduce risk and potentially enhance returns.

- Monitor Your Investments:Regularly review your investment portfolio and adjust your allocation as needed to align with your risk tolerance and market conditions.

- Consider Using a Guaranteed Minimum Living Benefit (GMLB):A GMLB can provide a safety net by guaranteeing a minimum payout even if your annuity balance declines.

- Consult with a Qualified Financial Advisor:Seek advice from a financial professional who can help you develop a personalized withdrawal strategy and manage your variable annuity investments effectively.

Impact of Market Volatility

Market volatility can significantly impact the value of your variable annuity and, consequently, your withdrawal strategy. Understanding how market fluctuations can affect your retirement income is crucial for mitigating risk and protecting your accumulated wealth.

Potential Impact of Market Volatility on Variable Annuity Withdrawals

Market volatility can cause the value of your annuity to fluctuate, potentially reducing your withdrawal options and income stream. For example, if the market experiences a downturn, the value of your investments within your annuity could decline, resulting in a lower balance and potentially forcing you to withdraw less than anticipated.

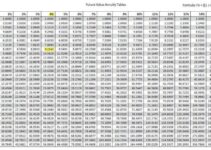

Calculating future values is a key aspect of annuity planning. Problem 6-24 Calculating Annuity Future Values 2024 walks you through the steps and formulas involved in this calculation.

Conversely, if the market performs well, your annuity balance could increase, allowing you to withdraw more or potentially delay withdrawals to further enhance your long-term growth potential.

Mitigating Risk and Protecting Accumulated Wealth during Market Fluctuations

To mitigate the risk of market volatility and protect your accumulated wealth, consider the following strategies:

- Diversify Your Portfolio:Invest in a variety of asset classes, including stocks, bonds, and real estate, to reduce risk and potentially enhance returns. A diversified portfolio can help mitigate losses during market downturns.

- Adjust Your Asset Allocation:Regularly review your investment portfolio and adjust your allocation as needed to align with your risk tolerance and market conditions. If you are approaching retirement, you may want to shift your portfolio towards more conservative investments, such as bonds, to reduce volatility.

- Consider Using a Guaranteed Minimum Living Benefit (GMLB):A GMLB can provide a safety net by guaranteeing a minimum payout even if your annuity balance declines. This feature can help protect your principal and ensure a minimum income stream during market downturns.

- Withdraw Funds Gradually:Avoid withdrawing large sums of money during market downturns, as this can deplete your annuity balance faster and potentially reduce your long-term income stream.

Case Study Demonstrating the Effect of Market Volatility on Withdrawal Strategies

Consider a hypothetical scenario where an individual has a variable annuity balance of $500,000. If the market experiences a 20% downturn, their annuity balance would decline to $400,000. If they were planning to withdraw 5% annually, they would only receive $20,000 per year instead of the anticipated $25,000.

A deferred annuity is a type of annuity that begins payments at a later date. Calculating A Deferred Annuity 2024 explains how to calculate the future value of a deferred annuity.

This demonstrates how market volatility can significantly impact your withdrawal options and income stream.

Importance of Diversification and Asset Allocation within Variable Annuities

Diversification and asset allocation are crucial for managing risk and potentially enhancing returns within variable annuities. By investing in a variety of asset classes, you can reduce the impact of market volatility on your portfolio. Additionally, adjusting your asset allocation based on your risk tolerance and market conditions can help protect your principal and maximize your long-term growth potential.

A PV Annuity of 1 Table is a helpful tool for annuity calculations. Pv Annuity Of 1 Table 2024 explains how to use this table to determine the present value of an annuity.

Last Word

As you navigate the complexities of variable annuity withdrawals, remember that planning is key. Understanding the rules, considering your financial goals, and seeking professional advice can help you make informed decisions that maximize your retirement income and secure your financial future.

If you’re looking to maximize your retirement income, understanding the ins and outs of annuities is crucial. 8 Annuity Income Secret 2024 offers valuable insights on how to make the most of these financial products.

By carefully strategizing your withdrawals, you can unlock the full potential of your variable annuity and enjoy a comfortable and fulfilling retirement.

Questions and Answers

What are the tax implications of variable annuity withdrawals?

Withdrawals from variable annuities are generally taxed as ordinary income. However, if you withdraw funds from your annuity’s “annuitization” portion, the payments are considered qualified annuity payments and may be taxed at a lower rate.

What are the potential risks of investing in variable annuities?

Variable annuities carry investment risk, as the value of your investments can fluctuate. You could lose money if your investments underperform. Additionally, there are fees associated with variable annuities, which can impact your returns.

What are the benefits of variable annuities?

Variable annuities offer the potential for investment growth, as well as the opportunity to generate a guaranteed income stream in retirement. They also provide tax-deferred growth and may offer death benefit protection.

How do I choose the right withdrawal strategy for my variable annuity?

The best withdrawal strategy for you will depend on your individual circumstances, financial goals, and risk tolerance. It’s important to consult with a financial advisor to determine the most appropriate strategy for your situation.