Variable Annuity 1035 Exchange 2024 presents a unique opportunity for investors to potentially enhance their retirement savings strategies. This exchange mechanism allows individuals to transfer assets from one annuity to another, potentially unlocking tax benefits and exploring new investment horizons.

Understanding the intricacies of this process, its potential advantages, and the factors to consider is crucial for informed decision-making.

A 1035 exchange, specifically focused on variable annuities, involves transferring funds from an existing variable annuity to a new one, either within the same insurance company or with a different provider. This process is often undertaken to capitalize on favorable features of a new annuity contract, such as enhanced investment options, lower fees, or greater death benefit guarantees.

To effectively plan for your financial future, it’s crucial to understand how to calculate annuity future values. This involves considering factors such as the initial investment amount, interest rate, and payment period.

However, it’s essential to carefully weigh the pros and cons of such a move, taking into account individual financial goals, risk tolerance, and time horizon.

Contents List

Variable Annuities Explained

Variable annuities are insurance contracts that offer a combination of investment growth potential and tax-deferred income accumulation. They are designed for individuals seeking a long-term investment strategy with the potential for higher returns than traditional fixed annuities, but also carrying a higher level of risk.

Core Features of Variable Annuities

Variable annuities differ from traditional fixed annuities in several key ways. Here are some of their core features:

- Investment Options:Variable annuities allow you to invest in a range of sub-accounts, similar to mutual funds. These sub-accounts may include stocks, bonds, or other investment options. Your investment choices determine the potential for growth and risk associated with your annuity.

If you’re looking for information about variable annuity life insurance company phone numbers , it’s best to contact the specific company directly. This will ensure you receive the most accurate and up-to-date information.

- Tax-Deferred Growth:One of the key advantages of variable annuities is that earnings and investment gains grow tax-deferred. This means you won’t have to pay taxes on the growth until you withdraw the money in retirement.

- Guaranteed Death Benefit:Variable annuities often include a guaranteed death benefit, which ensures that your beneficiary will receive a minimum payout, even if your investment performance is poor.

- Living Benefits:Some variable annuities offer living benefits, such as guaranteed minimum income payments or protection against market losses. These features provide a level of security and income stability during retirement.

Benefits of Variable Annuities

Variable annuities offer several potential benefits, including:

- Potential for Higher Returns:By investing in a range of sub-accounts, you have the potential to earn higher returns than with a fixed annuity. However, it’s important to remember that this potential comes with increased risk.

- Tax-Deferred Growth:Tax-deferred growth allows your investment to compound faster, as you’re not paying taxes on earnings until you withdraw the money. This can lead to significant tax savings over time.

- Income Protection:Some variable annuities offer living benefits that can provide a guaranteed income stream during retirement, even if your investments experience losses.

Risks of Variable Annuities

It’s important to understand the risks associated with variable annuities before investing. Some of the key risks include:

- Market Volatility:The value of your investment can fluctuate with market conditions, which can lead to losses. Your investment choices, including the sub-accounts you select, will significantly impact your risk exposure.

- Potential for Loss of Principal:Unlike fixed annuities, which guarantee a minimum return, variable annuities do not protect you from losing principal. If your investment performance is poor, you may not recover your initial investment.

- Fees and Expenses:Variable annuities often have higher fees and expenses than traditional fixed annuities. These fees can eat into your returns over time.

1035 Exchange Basics

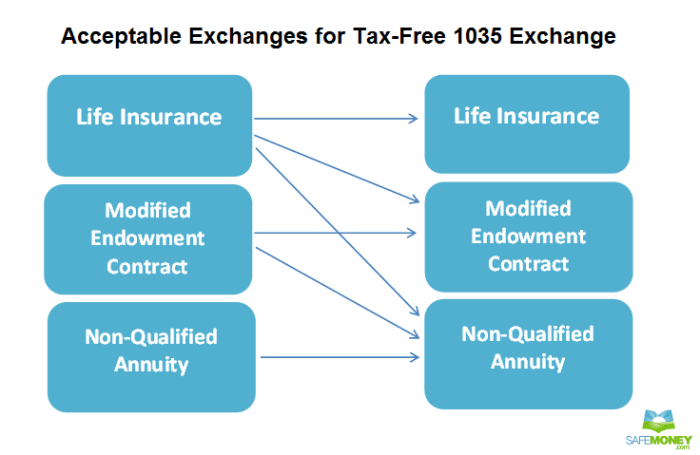

A 1035 exchange is a tax-advantaged transaction that allows you to transfer the value of a life insurance policy or annuity contract to another similar policy or contract without triggering a taxable event.

The calculation of an annuity depends on several factors, including the type of annuity, the interest rate, and the payment period. It’s important to consult with a financial professional to understand the intricacies of annuity calculations.

Purpose and Eligibility Requirements

The primary purpose of a 1035 exchange is to allow you to change your investment strategy or move to a policy with more favorable features without incurring immediate tax liabilities. To be eligible for a 1035 exchange, the following requirements must be met:

- Same Type of Policy:The exchange must be between two similar types of policies, such as an annuity to another annuity, life insurance to life insurance, or an annuity to life insurance.

- Direct Transfer:The proceeds from the old policy must be transferred directly to the new policy. You cannot receive the proceeds and then invest them in the new policy.

- No Cash Withdrawal:You cannot withdraw any cash from the old policy before transferring it to the new policy.

Tax Advantages of a 1035 Exchange

The main tax advantage of a 1035 exchange is that it allows you to defer paying taxes on the accumulated earnings and gains in the old policy. This is because the transfer is considered a tax-free exchange. However, it’s important to note that you will still have to pay taxes on the earnings and gains when you eventually withdraw the money from the new policy.

Chapter 9 of a finance textbook often covers annuities , providing a comprehensive overview of their different types, calculations, and applications.

Types of 1035 Exchanges

There are three main types of 1035 exchanges:

- Annuity to Annuity:This type of exchange allows you to transfer the value of an existing annuity to a new annuity with different features, such as a higher interest rate, different investment options, or more favorable death benefits.

- Annuity to Life Insurance:You can transfer the value of an annuity to a life insurance policy. This may be beneficial if you want to increase your death benefit or obtain a policy with more favorable features.

- Annuity to a Qualified Retirement Plan:In some cases, you can transfer the value of an annuity to a qualified retirement plan, such as a 401(k) or IRA. This can be a strategic move if you want to consolidate your retirement savings and take advantage of tax-deferred growth within the retirement plan.

Variable Annuity 1035 Exchange in 2024: Variable Annuity 1035 Exchange 2024

In 2024, 1035 exchanges continue to be a valuable tool for individuals seeking to optimize their retirement savings and investment strategies. However, it’s essential to understand the current tax implications and regulations surrounding these exchanges.

Understanding variable annuity L share CDSC can be complex. It’s important to consult with a financial advisor to determine if this type of investment is right for your individual circumstances.

Current Tax Implications and Regulations

As of 2024, the IRS regulations governing 1035 exchanges remain largely unchanged. The exchange itself is still considered a tax-free event, meaning that you won’t have to pay taxes on the accumulated earnings and gains in the old policy at the time of the transfer.

An IRR calculator can help you determine the internal rate of return on an annuity, which can be useful for comparing different investment options.

However, it’s important to remember that you will still have to pay taxes on these earnings and gains when you eventually withdraw the money from the new policy.

Potential Changes to Tax Code or Regulations

While the current tax code is relatively stable, there’s always the possibility of changes in the future. It’s essential to stay informed about any proposed legislation or regulatory changes that could impact 1035 exchanges. These changes could potentially affect the tax treatment of the exchange, the types of policies eligible for exchange, or the eligibility requirements for the exchange.

If you’re in the UK and looking for a annuity calculator , Money Saving Expert offers a helpful resource to estimate potential payments and compare different annuity options.

Market Conditions and 1035 Exchanges

Recent market conditions can play a significant role in the decision to perform a 1035 exchange. For example, if interest rates are rising, it might be advantageous to exchange a fixed annuity for a variable annuity with higher growth potential.

The tax implications of annuities can be complex. It’s important to consult with a tax professional to determine if your annuity is exempt from tax and how it will be treated for tax purposes.

Conversely, if market volatility is high, you might consider exchanging a variable annuity for a more conservative investment option.

A variable annuity open-ended offers flexibility in terms of investment options and withdrawal strategies. However, it’s essential to carefully consider the potential risks and rewards before making a decision.

Considerations for a 1035 Exchange

Before making a decision about a 1035 exchange, there are several factors to consider carefully.

An annuity of $50,000 can provide a significant income stream, but the specific amount of payments will depend on factors such as the type of annuity and the interest rate.

Investment Goals, Risk Tolerance, and Time Horizon

Your investment goals, risk tolerance, and time horizon will all play a role in determining whether a 1035 exchange is right for you. If you’re seeking higher growth potential, a variable annuity might be a good option. However, if you’re more risk-averse, a fixed annuity or a more conservative investment strategy might be a better fit.

Understanding how to calculate a deferred annuity is crucial for those who want to defer their income payments to a later date. This involves considering the growth potential of the investment and the timing of future payments.

Fees and Surrender Charges

It’s crucial to consider the fees and surrender charges associated with both the old and new policies. These charges can significantly impact the overall profitability of the exchange. You should carefully compare the fees and charges of both policies to ensure that the exchange makes financial sense.

An annuity can be a valuable tool for retirement planning, providing a guaranteed income stream that can help supplement other retirement savings.

Table Comparing Annuity Types

| Annuity Type | Growth Potential | Risk Level | Fees |

|---|---|---|---|

| Fixed Annuity | Low | Low | Low |

| Variable Annuity | High | High | High |

| Indexed Annuity | Moderate | Moderate | Moderate |

Potential Strategies for a 1035 Exchange

A 1035 exchange can be a strategic tool for achieving specific financial goals. Here are some examples of how it can be used:

Tax Diversification

A 1035 exchange can be used to diversify your tax exposure by transferring assets from one type of tax-deferred account to another. For example, you could exchange a traditional IRA for a Roth IRA, which allows for tax-free withdrawals in retirement.

An annuity calculator can be a valuable tool for estimating future payments and understanding the potential returns of an annuity. However, it’s important to remember that these calculators provide estimates only.

Income Generation, Variable Annuity 1035 Exchange 2024

A 1035 exchange can be used to generate income during retirement. You could exchange an existing annuity for an annuity that offers a guaranteed income stream, such as a fixed indexed annuity.

Addressing Financial Challenges

A 1035 exchange can be a valuable tool for addressing specific financial challenges. For example, if you need to change your investment strategy or increase your income during retirement, a 1035 exchange can help you achieve these goals.

When deciding between a variable annuity vs fixed annuity , it’s important to consider your risk tolerance and investment goals. A variable annuity offers the potential for higher returns but also carries greater risk, while a fixed annuity provides guaranteed income payments.

Seeking Professional Advice

It’s essential to seek professional financial advice before making any decisions regarding a 1035 exchange. A qualified financial advisor can help you understand the complexities of the exchange, evaluate your specific circumstances, and develop a strategy that aligns with your financial goals and risk tolerance.

Final Conclusion

Navigating the complex world of variable annuities and 1035 exchanges requires careful consideration and expert guidance. By understanding the potential benefits, risks, and strategies involved, investors can make informed decisions that align with their long-term financial objectives. Remember, consulting with a qualified financial advisor is crucial before undertaking any 1035 exchange, as they can provide personalized advice tailored to your unique circumstances and help you navigate the complexities of this process effectively.

FAQ Guide

What are the potential downsides of a 1035 exchange?

While 1035 exchanges offer tax advantages, they can also come with certain drawbacks. These include potential surrender charges, which may be imposed by the original annuity provider if you withdraw funds before a certain period. Additionally, the new annuity may have different investment options, fees, or guarantees compared to the original contract, which could impact your overall returns.

How long does a 1035 exchange typically take?

An annuity certain is a type of annuity that guarantees payments for a specific period, regardless of the annuitant’s lifespan. This provides a predictable income stream, which can be particularly valuable for those seeking financial security in retirement.

The timeframe for a 1035 exchange can vary depending on the complexity of the transaction and the involved parties. Generally, it can take anywhere from a few weeks to a couple of months. It’s important to consult with your financial advisor and the insurance company to understand the estimated processing time for your specific situation.