John Hancock Venture 3 Variable Annuity 2024 presents a compelling opportunity for investors seeking a diversified and potentially high-growth retirement solution. This variable annuity offers a range of investment options, tailored to different risk profiles, allowing individuals to customize their portfolio based on their financial goals and risk tolerance.

Variable annuities can be a good option for those looking for a way to grow their retirement savings, and you can find more information about them on this page: Variable Annuity Usa 2024.

The product’s flexibility and potential for growth make it an attractive option for those seeking to maximize their retirement savings.

Beyond investment options, John Hancock Venture 3 Variable Annuity 2024 provides valuable features designed to enhance financial security. These include death benefit options that protect beneficiaries, living benefit riders that offer guaranteed income streams, and tax advantages that can help maximize returns.

If you’re interested in a career in the annuity industry, you can find information about available jobs here: Variable Annuity Jobs 2024.

Understanding the nuances of this product is crucial for investors to make informed decisions about its suitability for their specific needs.

Variable annuities have a unique structure, combining features of both traditional annuities and investments. This article explores this: A Variable Annuity Is Both An Annuity And A 2024.

Contents List

- 1 John Hancock Venture 3 Variable Annuity Overview: John Hancock Venture 3 Variable Annuity 2024

- 2 Investment Options

- 3 Fees and Expenses

- 4 Death Benefit and Living Benefits

- 5 Tax Implications

- 6 Suitability for Different Investors

- 7 Comparison with Other Annuities

- 8 Potential Risks and Considerations

- 9 Closure

- 10 Top FAQs

John Hancock Venture 3 Variable Annuity Overview: John Hancock Venture 3 Variable Annuity 2024

The John Hancock Venture 3 Variable Annuity is a retirement savings product that offers a range of investment options and potential growth opportunities. It’s designed to provide income during retirement and to help protect against inflation.

Wondering how much monthly income you could receive from a $80,000 annuity? This article can help you calculate: How Much Does A 80 000 Annuity Pay Per Month 2024.

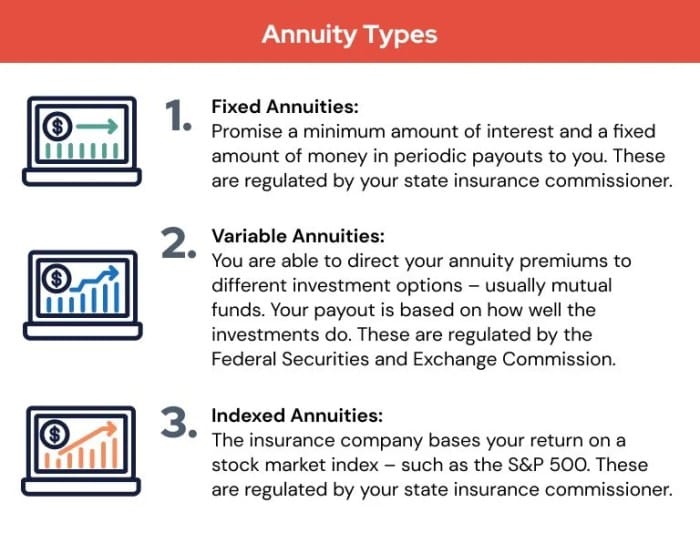

Variable annuities are contracts that allow investors to allocate their funds among a variety of sub-accounts, each tied to a specific investment strategy. The value of the annuity fluctuates with the performance of the underlying investments.

Variable annuities allow for withdrawals, but it’s important to understand the rules and potential tax implications. Check out this article for more information: Variable Annuity Withdrawals 2024.

Key Features of the John Hancock Venture 3 Variable Annuity

- Investment Options:The annuity offers a wide selection of investment options, including mutual funds, ETFs, and managed accounts, allowing investors to customize their portfolio based on their risk tolerance and investment goals.

- Death Benefit:The annuity provides a death benefit that can be used to cover funeral expenses or provide financial support for beneficiaries.

- Living Benefits:The annuity offers various living benefit riders, such as guaranteed minimum income and guaranteed minimum withdrawal benefits, designed to protect against market downturns and provide a guaranteed stream of income during retirement.

- Tax Advantages:The annuity’s growth is tax-deferred, meaning that taxes are not paid until withdrawals are made in retirement.

Target Audience

The John Hancock Venture 3 Variable Annuity is suitable for individuals who are looking for:

- Long-term growth potential:The annuity’s investment options offer the potential for higher returns than fixed annuities, although they also carry greater risk.

- Retirement income security:The living benefit riders provide a safety net for retirees, ensuring a guaranteed stream of income even if market conditions are unfavorable.

- Tax-efficient savings:The tax-deferred growth of the annuity can help to reduce the overall tax burden on retirement income.

Investment Options

The John Hancock Venture 3 Variable Annuity offers a wide range of investment options, allowing investors to tailor their portfolio to their individual needs and risk tolerance. These options can be categorized into different asset classes, each with its own risk and return profile.

Available Investment Options

- Equity Funds:These funds invest in stocks, offering the potential for high returns but also greater volatility.

- Bond Funds:Bond funds invest in fixed-income securities, providing a more conservative investment option with lower risk.

- Target-Date Funds:These funds automatically adjust their asset allocation over time, becoming more conservative as retirement approaches.

- Money Market Funds:Money market funds invest in short-term debt securities, offering a low-risk option for preserving capital.

- Managed Accounts:Investors can choose to have their portfolio managed by professional advisors, who can provide customized investment strategies based on individual needs.

Risk Profiles

The risk associated with each investment option varies depending on the underlying investments. For example, equity funds are generally considered higher risk than bond funds, as the value of stocks can fluctuate more dramatically than the value of bonds. Investors should carefully consider their risk tolerance before making any investment decisions.

Performance History

The performance history of the available investment options can be accessed through the John Hancock website or by contacting a financial advisor. It’s important to note that past performance is not necessarily indicative of future results.

Fees and Expenses

The John Hancock Venture 3 Variable Annuity comes with a range of fees and expenses that can impact potential returns. Understanding these costs is crucial for evaluating the overall value proposition of the annuity.

Fees Associated with the Annuity

- Mortality and Expense (M&E) Charges:These charges cover the cost of the death benefit and other administrative expenses.

- Investment Management Fees:These fees are charged by the underlying investment funds.

- Surrender Charges:These charges may apply if the annuity is surrendered before a certain period.

- Administrative Fees:These fees cover the cost of managing the annuity contract.

Expense Ratio

The expense ratio is a measure of the annual cost of owning the annuity. It’s expressed as a percentage of the assets under management. The expense ratio for the John Hancock Venture 3 Variable Annuity can vary depending on the investment options selected.

Impact of Fees on Potential Returns

Fees and expenses can significantly impact the overall returns of the annuity. Higher fees can erode investment gains, leading to lower returns over time. Investors should carefully consider the impact of fees before making any investment decisions.

Death Benefit and Living Benefits

The John Hancock Venture 3 Variable Annuity offers a range of death benefit and living benefit options designed to provide financial protection and income security for investors.

If you’re considering an annuity, you might be interested in learning about how payouts work over a set period of time, like five years. Check out this article for more details: Annuity 5 Year Payout 2024.

Death Benefit Options

- Basic Death Benefit:This option provides a death benefit equal to the account value at the time of death.

- Guaranteed Death Benefit:This option guarantees a minimum death benefit, even if the account value declines.

- Joint and Survivor Death Benefit:This option provides a death benefit that continues to be paid to the surviving spouse.

Living Benefit Riders

Living benefit riders are optional features that can be added to the annuity contract to provide additional protection and income security.

- Guaranteed Minimum Income Benefit:This rider guarantees a minimum annual income payment for life, even if the account value declines.

- Guaranteed Minimum Withdrawal Benefit:This rider allows investors to withdraw a certain percentage of their account value each year, regardless of market performance.

Examples of Benefit Utilization

For example, a guaranteed minimum income benefit could provide a retiree with a guaranteed stream of income, even if the market experiences a downturn. A guaranteed minimum withdrawal benefit could provide a retiree with a predictable source of income to cover essential expenses.

If you’re considering a lump sum payout from an annuity, you might find this resource helpful: Calculate Annuity Lump Sum 2024.

Tax Implications

The John Hancock Venture 3 Variable Annuity offers tax advantages that can help investors maximize their retirement savings.

Understanding whether annuity payments are considered earned income can be important for tax purposes. This article can help you understand: Is Annuity Earned Income 2024.

Tax Treatment of Withdrawals

Withdrawals from the annuity are taxed as ordinary income. However, the growth of the annuity is tax-deferred, meaning that taxes are not paid until withdrawals are made.

Tax Implications of the Death Benefit

The death benefit is generally not subject to income tax. However, it may be subject to estate taxes, depending on the size of the estate.

YouTube is a great resource for learning about variable annuities. You can find helpful videos here: Variable Annuity Youtube 2024.

Potential Tax Advantages

The tax-deferred growth of the annuity can help to reduce the overall tax burden on retirement income. This can be particularly beneficial for individuals in higher tax brackets.

Excel can be a useful tool for calculating annuities. Here’s a guide to get you started: Calculating Annuity In Excel 2024.

Suitability for Different Investors

The John Hancock Venture 3 Variable Annuity can be a suitable investment for a variety of investors, but it’s essential to carefully consider the product’s features and potential drawbacks before making any investment decisions.

Types of Investors Who Might Benefit

- Individuals seeking long-term growth potential:The annuity’s investment options offer the potential for higher returns than fixed annuities, although they also carry greater risk.

- Individuals seeking retirement income security:The living benefit riders provide a safety net for retirees, ensuring a guaranteed stream of income even if market conditions are unfavorable.

- Individuals seeking tax-efficient savings:The tax-deferred growth of the annuity can help to reduce the overall tax burden on retirement income.

Potential Drawbacks for Certain Investor Profiles

- Investors with a low risk tolerance:The annuity’s investment options can be volatile, and the value of the annuity can fluctuate significantly.

- Investors with a short-term investment horizon:The annuity is designed for long-term savings and may not be suitable for short-term investment goals.

- Investors who need immediate access to their funds:The annuity may have surrender charges that can make it difficult to access funds early.

Factors to Consider When Evaluating Suitability

- Risk tolerance:The annuity’s investment options carry a range of risks, so investors should carefully consider their risk tolerance before making any investment decisions.

- Investment horizon:The annuity is designed for long-term savings, so investors should only consider it if they have a long-term investment horizon.

- Financial goals:The annuity can be used to achieve a variety of financial goals, such as retirement savings, income generation, and legacy planning.

- Tax situation:The annuity’s tax advantages can be beneficial for individuals in different tax brackets.

Comparison with Other Annuities

The John Hancock Venture 3 Variable Annuity is one of many variable annuity products available in the market. Comparing this product to similar offerings can help investors make informed decisions.

Key Differences in Fees, Investment Options, and Benefits

- Fees:The fees associated with variable annuities can vary significantly from one product to another. Investors should compare the expense ratios and other fees before making a decision.

- Investment Options:The range of investment options available can also vary depending on the annuity product. Investors should choose an annuity that offers a variety of investment options that align with their risk tolerance and investment goals.

- Benefits:The death benefit and living benefit options offered by variable annuities can also vary. Investors should choose an annuity that provides the features and benefits that they need.

Comparison Table of Key Features

| Feature | John Hancock Venture 3 | Competitor 1 | Competitor 2 |

|---|---|---|---|

| Expense Ratio | [Insert expense ratio] | [Insert expense ratio] | [Insert expense ratio] |

| Investment Options | [Insert investment options] | [Insert investment options] | [Insert investment options] |

| Death Benefit | [Insert death benefit options] | [Insert death benefit options] | [Insert death benefit options] |

| Living Benefits | [Insert living benefit options] | [Insert living benefit options] | [Insert living benefit options] |

Potential Risks and Considerations

Variable annuities, while offering potential growth opportunities, also come with inherent risks that investors should be aware of.

Potential Risks Associated with Variable Annuities

- Market Volatility:The value of the annuity can fluctuate significantly based on market conditions. This means that investors could lose money if the market declines.

- Loss of Principal:Investors could lose some or all of their principal if the underlying investments perform poorly.

- Fees and Expenses:Fees and expenses can erode investment gains, leading to lower returns over time.

- Surrender Charges:Investors may have to pay surrender charges if they withdraw funds from the annuity before a certain period.

Impact of Market Volatility on Investment Returns

Market volatility can significantly impact the performance of variable annuities. In a bull market, the annuity’s value is likely to increase. However, in a bear market, the annuity’s value could decline significantly.

While annuities can be part of a retirement plan, it’s important to understand if they qualify for specific tax advantages. Learn more here: Is An Annuity A Qualified Retirement Plan 2024.

Potential for Loss of Principal, John Hancock Venture 3 Variable Annuity 2024

Investors should be aware that they could lose some or all of their principal if the underlying investments perform poorly. This risk is greater for investment options with higher growth potential, such as equity funds.

An annuity estimator can help you get a better idea of what your potential payments might look like. This resource can help you: Annuity Estimator 2024.

Closure

John Hancock Venture 3 Variable Annuity 2024 offers a unique blend of investment flexibility, potential for growth, and financial protection. By carefully considering the product’s features, potential risks, and suitability for your individual circumstances, you can determine whether it aligns with your retirement planning goals.

Remember to consult with a financial advisor to receive personalized guidance and ensure that this annuity aligns with your overall investment strategy.

Top FAQs

What are the minimum investment requirements for the John Hancock Venture 3 Variable Annuity 2024?

The minimum initial investment amount varies depending on the specific investment options chosen. It’s best to consult with a financial advisor or refer to the product’s prospectus for detailed information.

Financial calculators can be very helpful for understanding annuities. Learn how to use one here: How To Calculate Annuity In Financial Calculator 2024.

Are there any surrender charges associated with withdrawing funds from the annuity before a certain period?

Variable annuities offer different death benefit options, and an enhanced death benefit can provide extra protection for your loved ones. Here’s a page with more details: Variable Annuity Enhanced Death Benefit 2024.

Yes, there are typically surrender charges associated with early withdrawals. The specific surrender charge structure and duration vary depending on the contract terms. It’s crucial to understand these charges before making any withdrawal decisions.

It’s important to understand the tax implications of inherited annuities. This resource can help you learn more: I Inherited An Annuity Is It Taxable 2024.

How does the John Hancock Venture 3 Variable Annuity 2024 compare to other similar products in the market?

The product’s competitiveness depends on factors such as fees, investment options, and benefits. It’s recommended to compare it with other variable annuities, taking into account your individual needs and investment goals.