October 2024 Stimulus Check sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The potential for a stimulus check in October 2024 is a complex issue, influenced by a multitude of economic and political factors.

This exploration delves into the intricate web of forces that could potentially lead to the issuance of a stimulus check, examining historical precedents, potential triggers, and the anticipated impact on the economy and society.

The analysis begins by considering the prevailing economic conditions in the United States, specifically focusing on key indicators like unemployment rates, inflation, and GDP growth. The political landscape is also scrutinized, analyzing the potential influence of the 2024 presidential election and the stance of different political parties on economic stimulus measures.

The exploration then delves into the potential triggers for a stimulus check, including economic factors like recessionary fears, inflation, and unemployment, as well as political factors like public sentiment and the government budget.

Contents List

- 1 The Political Landscape in October 2024

- 2 Economic Conditions in October 2024

- 3 Historical Precedents for Stimulus Checks

- 4 4. Potential Triggers for a Stimulus Check in October 2024

- 5 5. Potential Eligibility Criteria and Distribution Methods

- 6 6. Potential Impact of a Stimulus Check

- 7 Alternative Economic Policy Options: October 2024 Stimulus Check

- 8 Public Opinion and Sentiment

- 9 The Role of the Federal Reserve

- 10 10. Long-Term Economic Implications

- 11 International Perspective

- 12 12. The Role of Technology and Innovation

- 13 The Future of Economic Policy

- 14 Epilogue

- 15 Frequently Asked Questions

The Political Landscape in October 2024

October 2024 will be a pivotal month in the US political landscape, with the presidential election just a few weeks away. The political climate is likely to be highly charged, with both parties vying for every vote. The outcome of the election will have a significant impact on the direction of the country, including the potential for another stimulus check.

Potential Impact on Stimulus Checks

The political landscape in October 2024 will likely influence the likelihood of a stimulus check. If the incumbent president is seeking re-election, they may be more inclined to support a stimulus package to boost the economy and improve their chances of winning.

Conversely, if the challenger is leading in the polls, they may be less likely to support a stimulus check, as it could be seen as a political move by the incumbent.

Stances of Different Political Parties

The two major political parties in the US, the Democrats and Republicans, have historically held different views on economic stimulus measures. Generally, Democrats have been more supportive of stimulus packages, while Republicans have been more hesitant.

“Democrats tend to favor government intervention in the economy, while Republicans prefer a more hands-off approach.”

Source

The ukulele is a fun and easy instrument to learn, and the Acoustic Ukulele Music 2024 article offers a glimpse into the world of ukulele music.

[Insert source here]

This difference in ideology is likely to be reflected in the 2024 election. The Democratic candidate is likely to advocate for a stimulus check as a way to help working families and stimulate the economy. The Republican candidate, on the other hand, may argue that a stimulus check is unnecessary or that it would be better to focus on other economic policies.

Key Figures and Their Stances

The positions of key figures in both parties will also be crucial in determining the fate of a stimulus check. For example, if the Democratic candidate is a strong supporter of stimulus packages, they may be able to sway other members of their party to support such a measure.

Conversely, if the Republican candidate is opposed to stimulus checks, they may be able to block such a measure from being passed.

Examples of Past Stimulus Measures

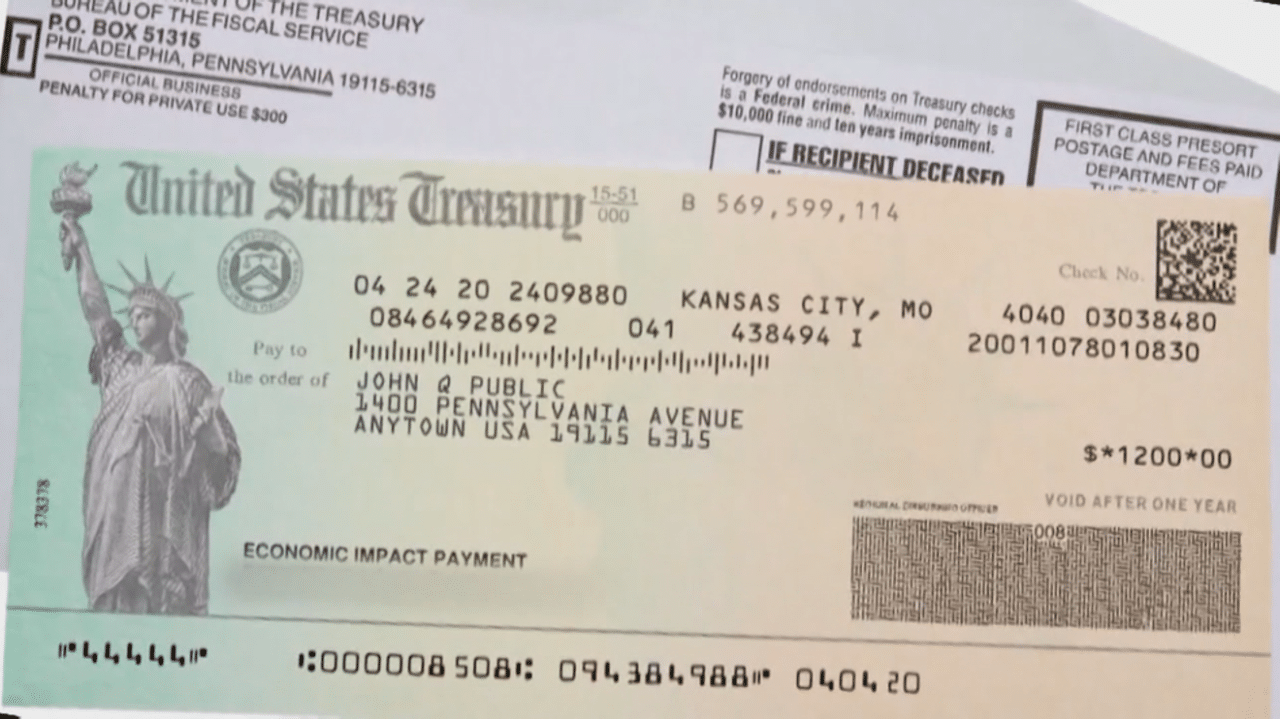

The past few years have seen several examples of economic stimulus measures, including the CARES Act in 2020 and the American Rescue Plan Act in 2021. These measures provided direct payments to individuals, expanded unemployment benefits, and provided funding for businesses.

The impact of these measures on the economy is still being debated, but they demonstrate the potential for stimulus packages to influence the economy.

Economic Conditions in October 2024

The economic landscape in October 2024 will be a critical factor in determining whether a stimulus check is necessary. Several key indicators will be closely monitored, including unemployment rates, inflation, and GDP growth. These metrics will provide insights into the health of the economy and the potential need for government intervention.

Unemployment Rates

Unemployment rates are a significant indicator of economic health. A high unemployment rate suggests a weak economy, potentially leading to a decrease in consumer spending and business investment. Conversely, a low unemployment rate signifies a strong economy with more job opportunities and higher consumer confidence.

Inflation

Inflation is another critical factor to consider. High inflation erodes purchasing power, making it more expensive for consumers to buy goods and services. This can lead to a decline in economic activity and potentially necessitate a stimulus package to mitigate the impact.

GDP Growth

Gross Domestic Product (GDP) growth is a measure of the overall value of goods and services produced in a country. A healthy GDP growth rate indicates a thriving economy with increased production and employment. However, a declining GDP growth rate could signal an economic slowdown, potentially necessitating government intervention.

Potential Economic Challenges

The US economy in October 2024 could face several challenges, including:

- Rising Interest Rates:The Federal Reserve’s efforts to control inflation could lead to higher interest rates, making it more expensive for businesses to borrow money and potentially slowing economic growth.

- Supply Chain Disruptions:Ongoing supply chain disruptions caused by global events could continue to impact the availability of goods and services, potentially leading to higher prices and slower economic growth.

- Geopolitical Tensions:Global geopolitical tensions could negatively impact the US economy through trade disruptions, investment uncertainty, and increased volatility in financial markets.

Potential Economic Opportunities

Despite the potential challenges, the US economy could also benefit from several opportunities, including:

- Technological Advancements:Continued advancements in technology could lead to increased productivity, innovation, and economic growth.

- Strong Consumer Demand:Consumer spending remains a significant driver of the US economy, and continued strong consumer demand could support economic growth.

- Government Infrastructure Investments:Government investments in infrastructure projects could create jobs, stimulate economic activity, and improve long-term economic growth.

Global Economic Events

Global economic events can significantly impact the US economy. For example, a recession in a major trading partner could lead to a decrease in US exports and potentially slow economic growth. Conversely, strong economic growth in other countries could boost US exports and stimulate the economy.

Historical Precedents for Stimulus Checks

The use of stimulus checks as a tool to stimulate economic activity has a long history in the United States, with notable instances during the Great Recession and the COVID-19 pandemic. These periods provide valuable insights into the motivations, economic context, and effectiveness of stimulus measures.

Examining these historical precedents can offer valuable context for understanding the potential impact of a stimulus check in October 2024.

The American Recovery and Reinvestment Act of 2009

The American Recovery and Reinvestment Act of 2009 (ARRA) was a massive economic stimulus package passed in response to the Great Recession. The Act included a provision for stimulus checks, known as “Economic Impact Payments,” to be distributed to individuals and families.

The primary motivation for including stimulus checks in the ARRA was to provide immediate relief to consumers and boost aggregate demand. The economic context surrounding the ARRA was one of severe economic downturn, with high unemployment rates, declining consumer spending, and a shrinking economy.

The stimulus checks aimed to counter these negative trends by providing a direct injection of cash into the hands of consumers, who could then use it to purchase goods and services, thereby stimulating economic activity.

Comparison of Stimulus Measures During the Great Recession and the COVID-19 Pandemic

The stimulus checks issued during the Great Recession and the COVID-19 pandemic shared the common goal of mitigating the economic impact of crises, but they differed in their economic context and political motivations. The Great Recession was characterized by a decline in housing prices, a financial crisis, and a subsequent contraction in economic activity.

The D Minor Acoustic Guitar 2024 article explores the nuances of playing in this key. It’s a great resource for guitarists looking to expand their musical vocabulary.

The stimulus checks during this period aimed to bolster consumer spending and prevent a deeper economic downturn. The COVID-19 pandemic, on the other hand, led to widespread business closures, job losses, and a sharp decline in economic activity due to public health measures aimed at containing the virus.

The stimulus checks during this period were primarily focused on providing immediate financial relief to individuals and families affected by the pandemic and supporting businesses.

Effectiveness of the Economic Stimulus Act of 2008

The Economic Stimulus Act of 2008 was a smaller stimulus package passed in response to the early stages of the financial crisis. It included tax rebates for individuals and families, as well as tax breaks for businesses. While the Act provided some short-term relief, its long-term impact on mitigating the financial crisis is debated.

The 5 Strings Acoustic Bass 2024 article provides an overview of the latest developments in this area. It’s a great resource for anyone interested in learning more about these unique instruments.

Some economists argue that the Act helped to prevent a deeper recession, while others contend that its impact was minimal. The effectiveness of the Act was likely influenced by factors such as the timing of its implementation, the size of the stimulus, and the broader economic context.

Summary of Stimulus Packages

| Stimulus Package | Year | Motivations | Economic Context |

|---|---|---|---|

| American Recovery and Reinvestment Act | 2009 | Provide immediate relief to consumers, boost aggregate demand | Severe economic downturn, high unemployment, declining consumer spending, shrinking economy |

| Economic Stimulus Act | 2008 | Provide tax relief to individuals and businesses, stimulate economic activity | Early stages of financial crisis, declining stock market, rising unemployment |

| CARES Act | 2020 | Provide financial relief to individuals and families affected by the pandemic, support businesses | Widespread business closures, job losses, sharp decline in economic activity due to pandemic |

4. Potential Triggers for a Stimulus Check in October 2024

The possibility of a stimulus check in October 2024 hinges on a complex interplay of economic indicators, political pressures, and public sentiment. A confluence of these factors could lead to calls for government intervention to bolster the economy and provide relief to struggling households.

Economic Triggers

Economic indicators play a pivotal role in determining the likelihood of a stimulus check. The health of the economy, particularly in the months leading up to October 2024, will be a key determinant of whether such a measure is deemed necessary.

- Recessionary Fears: A significant downturn in economic activity could trigger calls for a stimulus check. Key indicators to watch include:

- Gross Domestic Product (GDP) Growth: A sustained decline in GDP growth could signal a recession. A negative GDP growth rate for two consecutive quarters is often used as a benchmark for a recession.

The Q Acoustics 300 series is known for its high-quality sound, and the Q Acoustic 300 2024 release promises to be even better. You can find out more about the latest features and improvements in this article.

- Unemployment Rate: A sharp increase in the unemployment rate, particularly if it reaches levels considered alarming, could be a strong indicator of economic distress.

- Consumer Confidence: A decline in consumer confidence can indicate a weakening economy, as consumers become less likely to spend. This can lead to a downward spiral in economic activity.

- Inflation: High inflation can erode purchasing power and lead to economic uncertainty. If inflation remains stubbornly high, it could exacerbate recessionary fears and trigger calls for a stimulus check.

The likelihood of a recession in the lead-up to October 2024 will depend on various factors, including monetary policy, global economic conditions, and the trajectory of inflation. If economic forecasts point to a recession, the pressure for a stimulus check could intensify.

A recession can have a significant impact on the economy and public sentiment. It can lead to job losses, reduced consumer spending, and a decline in business investment. This can create a sense of economic insecurity and increase calls for government intervention to stimulate economic activity.

- Gross Domestic Product (GDP) Growth: A sustained decline in GDP growth could signal a recession. A negative GDP growth rate for two consecutive quarters is often used as a benchmark for a recession.

- Inflation: High inflation can erode consumer purchasing power, making it difficult for households to afford basic necessities.

- Consumer Price Index (CPI): The CPI is a widely used measure of inflation. A sustained rise in the CPI, particularly if it exceeds the Federal Reserve’s target rate, could indicate a problem that requires government intervention.

- Core Inflation: Core inflation excludes volatile food and energy prices, providing a more accurate picture of underlying inflationary pressures. A persistent rise in core inflation could indicate that inflation is becoming entrenched in the economy.

If inflation remains high, it could create pressure for a stimulus check to mitigate its effects on consumer spending and economic growth. A stimulus check could provide households with some temporary relief from the rising cost of living, helping to maintain consumer demand and support economic activity.

- Unemployment: A significant rise in unemployment can have a devastating impact on individuals, families, and the economy as a whole.

- Unemployment Rate: The unemployment rate measures the percentage of the labor force that is unemployed but actively seeking work.

A significant increase in the unemployment rate could indicate a weakening labor market and a need for government intervention to support job creation.

- Job Openings: A decline in job openings could indicate a weakening labor market and a potential for future job losses. This could lead to increased economic uncertainty and a need for government intervention to support job creation.

A stimulus check could provide temporary financial assistance to unemployed individuals, helping to support their livelihoods and maintain consumer spending. It could also stimulate job creation by providing businesses with incentives to hire new workers.

- Unemployment Rate: The unemployment rate measures the percentage of the labor force that is unemployed but actively seeking work.

- Energy Prices: Volatile energy prices can have a significant impact on the economy, particularly if they rise sharply.

- Crude Oil Prices: A sustained increase in crude oil prices can lead to higher gasoline prices, which can impact consumer spending and transportation costs.

- Natural Gas Prices: A surge in natural gas prices can impact the cost of electricity and heating, particularly for households.

High energy prices can contribute to inflation and economic hardship, potentially leading to calls for a stimulus check to provide relief. A stimulus check could help households offset the increased cost of energy, providing some temporary financial support and helping to maintain consumer spending.

5. Potential Eligibility Criteria and Distribution Methods

The eligibility criteria and distribution methods for a stimulus check in October 2024 will be crucial in determining the effectiveness and fairness of the program. It’s important to consider factors like income levels, employment status, and dependents, as well as the most efficient and secure ways to distribute the funds.

5.1 Eligibility Criteria

Eligibility criteria for a stimulus check will likely be based on a combination of factors, including income, employment status, and dependents. These criteria are designed to ensure that the funds are distributed to those who need them most.

5.1.1 Income Level

The income thresholds for eligibility will be a key factor in determining who receives a stimulus check. A sliding scale based on household size and income level could be implemented, with lower income households receiving a larger payment. For example, a household with an annual income of $40,000 or less could receive the full amount of the stimulus check, while households with an income between $40,000 and $60,000 could receive a reduced amount.

A phase-out period for individuals exceeding the income limit could be implemented to ensure that the benefits are targeted towards those with the greatest need. This could involve gradually reducing the amount of the stimulus check as income increases, until it reaches a certain threshold where the individual is no longer eligible.Income verification could be achieved through various methods, such as using tax returns, bank statements, or payroll records.

5.1.2 Employment Status

The eligibility criteria could consider individuals who are unemployed, underemployed, or self-employed. Specific requirements could be established for employment status, such as a minimum duration of unemployment or self-employment. This would ensure that the stimulus check is targeted towards individuals who are facing genuine financial hardship.

5.1.3 Dependents

Dependents could be considered for eligibility, with the amount of the stimulus check adjusted based on the number of dependents. This could involve providing an additional amount for each dependent, ensuring that families with children receive greater support. The number of dependents could be verified through tax returns or other official documentation.

5.2 Distribution Methods

The distribution method for a stimulus check will have a significant impact on its efficiency, security, and accessibility. Different methods, such as direct deposit, mailed checks, and debit cards, each have their own advantages and disadvantages.

5.2.1 Direct Deposit

Direct deposit is a fast and efficient method for distributing stimulus checks. It involves transferring funds directly into recipients’ bank accounts, reducing the risk of delays or lost checks. To facilitate direct deposit, recipients would need to provide their bank account information, including their account number and routing number.

Direct deposit is a highly secure and efficient method for distributing funds, as it eliminates the need for physical checks and reduces the risk of fraud. However, it requires recipients to have a bank account, which may not be accessible to everyone.

5.2.2 Mailed Checks

Mailed checks are a traditional method for distributing stimulus checks. This method involves sending physical checks to recipients’ addresses. To ensure proper delivery, recipients would need to provide their accurate mailing address.

Mailed checks offer a more traditional approach to distribution, but they can be slower and less secure than other methods. They are also susceptible to loss or theft, and may not be suitable for recipients who are homeless or lack a stable address.

5.2.3 Debit Cards

Debit cards are another option for distributing stimulus checks. These cards would be pre-loaded with the stimulus amount and could be used to make purchases or withdraw cash. Recipients would need to provide their personal information to activate the debit cards.

Debit cards offer a convenient and secure method for distributing stimulus checks. They can be used for a variety of transactions and can be easily tracked and managed. However, they may not be accessible to individuals who lack a bank account or who are unfamiliar with using debit cards.

5.3 Challenges and Benefits, October 2024 Stimulus Check

Each distribution method has its own set of challenges and benefits, which should be carefully considered when choosing the most effective approach.

Direct Deposit* Benefits:Fast, efficient, secure, reduces risk of fraud

Challenges

Looking for some live acoustic music? The Acoustic Music Live 2024 article can help you find upcoming events and artists in your area.

Requires bank account, may not be accessible to everyone Mailed Checks* Benefits:Traditional method, familiar to recipients

Challenges

Slow, less secure, susceptible to loss or theft, may not be suitable for everyone Debit Cards* Benefits:Convenient, secure, can be used for various transactions

Challenges

Requires activation, may not be accessible to everyone, unfamiliar to some recipients

The most effective and feasible distribution method will depend on a variety of factors, including the cost, efficiency, security, accessibility, and potential for fraud. A combination of methods could be used to ensure that the stimulus check is distributed to as many eligible individuals as possible.

The Acoustic Music Archive 2024 is a great resource for finding rare and forgotten acoustic music. It’s a treasure trove for music lovers of all kinds.

6. Potential Impact of a Stimulus Check

A stimulus check, if implemented in October 2024, could have significant economic, social, and political implications. Analyzing these potential impacts is crucial to understand the potential benefits and drawbacks of such a policy.

Economic Impact

A stimulus check could potentially have a mixed impact on the economy, depending on factors such as the size of the stimulus, the state of the economy, and the spending patterns of recipients.

Consumer Spending

A stimulus check could boost consumer spending, leading to increased demand for goods and services. This could be particularly beneficial for sectors like retail, hospitality, and entertainment, which have been significantly impacted by economic downturns.

- Increased Demand:A stimulus check could provide households with additional disposable income, leading to increased spending on essential goods and services, potentially boosting demand in various sectors.

- Sector-Specific Impact:Sectors like retail, hospitality, and entertainment, which rely heavily on consumer spending, could experience a significant boost in demand due to increased disposable income from a stimulus check.

- Savings Rate:While a stimulus check could increase spending, some households, especially those with lower incomes, might choose to save a portion of the funds, potentially contributing to a higher savings rate.

Job Creation

A stimulus check could potentially lead to job creation by increasing demand for goods and services, encouraging businesses to hire more workers. However, the effectiveness of this impact depends on various factors.

- Demand-Driven Employment:A stimulus check could lead to increased demand for goods and services, prompting businesses to hire more workers to meet the rising demand. This effect would be more pronounced in sectors directly impacted by consumer spending.

- Investment and Expansion:The additional funds from a stimulus check could encourage businesses to invest in expansion, leading to the creation of new jobs in various sectors. However, this effect might be less immediate and depend on the overall economic climate.

- Temporary vs. Permanent Jobs:The job creation impact of a stimulus check might be temporary, as businesses could reduce staffing levels once the stimulus effect wears off. The sustainability of job creation would depend on the long-term impact of the stimulus on the economy.

Inflation

A stimulus check could potentially contribute to inflation, especially if the economy is already experiencing high demand and limited supply.

- Increased Demand:A stimulus check could lead to increased demand for goods and services, putting upward pressure on prices, especially for goods and services in high demand.

- Supply Constraints:If the economy is already experiencing supply constraints, a stimulus check could exacerbate inflationary pressures by increasing demand without a corresponding increase in supply.

- Negligible Impact:If the economy is experiencing low demand and ample supply, a stimulus check might have a negligible impact on inflation, as the increased demand would be absorbed by existing supply.

Alternative Economic Policy Options: October 2024 Stimulus Check

A stimulus check isn’t the only way to boost the economy. Policymakers have a range of other tools at their disposal, each with its own potential benefits and drawbacks. These alternatives aim to stimulate economic growth by addressing specific areas of the economy, such as consumer spending, business investment, or infrastructure development.

Tax Cuts

Tax cuts can stimulate the economy by increasing disposable income for individuals and businesses. This can lead to increased consumer spending and business investment, boosting economic growth.

For example, a reduction in income tax rates could leave individuals with more money to spend, while a cut in corporate tax rates could encourage businesses to invest and expand.

However, tax cuts can also lead to increased budget deficits, which could have negative long-term consequences for the economy. The effectiveness of tax cuts also depends on how they are implemented and targeted.

Infrastructure Spending

Investing in infrastructure, such as roads, bridges, and public transportation, can create jobs and stimulate economic growth. Infrastructure projects can also improve productivity and efficiency in the long term.

For example, investing in high-speed rail could create jobs in construction, manufacturing, and transportation, while also improving connectivity and reducing travel times.

However, infrastructure spending can be expensive and time-consuming, and it may not always have an immediate impact on the economy. The success of infrastructure projects also depends on careful planning and execution.

Targeted Aid Programs

Targeted aid programs, such as unemployment benefits or subsidies for specific industries, can provide direct support to those most in need. This can help to stabilize the economy and prevent a recession.

For example, unemployment benefits can provide a safety net for those who have lost their jobs, while subsidies for renewable energy companies can support the development of new technologies and create jobs.

The Acoustic Tunes Youtube 2024 channel is dedicated to showcasing the best acoustic music on Youtube. They have a wide variety of genres and artists to choose from.

However, targeted aid programs can be costly and may not always be effective in stimulating long-term economic growth. They can also create moral hazard, where individuals or businesses become reliant on government support.

Public Opinion and Sentiment

Public opinion and sentiment towards stimulus checks in October 2024 will be a significant factor influencing policy decisions. The public’s perception of the economy, the effectiveness of past stimulus measures, and the perceived need for additional support will shape the political landscape and impact the likelihood of a stimulus package being approved.

Public Sentiment Towards Stimulus Checks

Public sentiment towards stimulus checks is likely to be influenced by several factors, including the current economic conditions, the perceived effectiveness of past stimulus measures, and the level of public confidence in the government’s ability to address economic challenges.

- Economic Conditions:If the economy is struggling in October 2024, with high unemployment, inflation, and a stagnant economy, public support for stimulus checks is likely to be strong. Conversely, if the economy is performing well, public support for stimulus measures may be less robust.

If you’re looking for some relaxing acoustic music to listen to before bed, the Youtube 3am Acoustic 2024 playlist might be just what you need.

- Effectiveness of Past Stimulus Measures:The public’s perception of the effectiveness of past stimulus measures will also influence their support for future stimulus packages. If past stimulus checks are perceived to have been successful in boosting the economy and providing relief to struggling families, public support for additional stimulus measures is likely to be higher.

If you’re an acoustic guitar player, the Acoustic Guitar Music Pack 1 2024 might be something you’re interested in. It’s a collection of music that’s perfect for practicing and improving your skills.

Conversely, if past stimulus measures are seen as ineffective or wasteful, public support may be weaker.

- Public Confidence in Government:Public confidence in the government’s ability to address economic challenges is also a key factor influencing public sentiment towards stimulus checks. If the public trusts the government to effectively manage the economy and distribute stimulus funds fairly, support for stimulus measures is likely to be higher.

Conversely, if the public lacks confidence in the government’s ability to handle economic issues, support for stimulus checks may be weaker.

Impact of Public Opinion on Policy Decisions

Public opinion plays a significant role in shaping policy decisions, including those related to stimulus measures. Elected officials are generally responsive to the views of their constituents, and public support for stimulus checks can influence their willingness to support such measures.

- Electoral Considerations:Elected officials may be more likely to support stimulus measures if they believe it will benefit their constituents and help them win re-election. In a highly contested election year like 2024, the potential political ramifications of supporting or opposing stimulus checks will be a key consideration for elected officials.

- Public Pressure:Public pressure can also influence policy decisions. If a large segment of the population is demanding stimulus checks, elected officials may feel compelled to act, even if they have reservations about the effectiveness of such measures.

Public Concerns and Expectations

Public concerns and expectations regarding stimulus checks are likely to be varied and complex. Some individuals may support stimulus checks as a means of providing immediate relief to struggling families, while others may be concerned about the potential long-term economic consequences of such measures.

- Targeted Distribution:Some individuals may argue that stimulus checks should be targeted to specific groups, such as low-income families, unemployed workers, or those most affected by economic hardship. Others may argue that a broad-based stimulus check, reaching all citizens, is necessary to provide widespread economic relief.

- Impact on Inflation:Some individuals may be concerned that stimulus checks could contribute to inflation, particularly if the economy is already experiencing high levels of price increases. They may argue that alternative economic policies, such as targeted tax cuts or increased government spending on infrastructure projects, would be more effective in stimulating the economy without exacerbating inflationary pressures.

- Long-Term Economic Consequences:Some individuals may be concerned about the long-term economic consequences of stimulus checks. They may argue that such measures could lead to increased government debt, reduced economic growth, and a decrease in incentives for individuals to work and save. They may favor alternative economic policies that focus on long-term economic growth and fiscal responsibility.

Youtube is a great place to find acoustic covers of popular songs, and the Youtube Acoustic Covers Of Popular Songs 2024 article provides some great recommendations.

The Role of the Federal Reserve

The Federal Reserve (Fed) plays a crucial role in influencing economic conditions and shaping policy decisions related to stimulus checks. The Fed’s monetary policy tools, such as adjusting interest rates and implementing quantitative easing, can significantly impact the effectiveness of a stimulus package.

Interest Rates

The Federal Reserve can adjust interest rates to complement or counteract the effects of a stimulus check.

- Lowering interest ratescan encourage borrowing and investment, stimulating economic activity. This would amplify the effects of a stimulus check by making it easier for businesses and consumers to access credit and spend more.

- Raising interest rates, on the other hand, can slow down economic growth by making borrowing more expensive. This could partially offset the impact of a stimulus check by reducing consumer spending and business investment.

The Fed would need to carefully consider the economic situation and the potential impact of a stimulus check before adjusting interest rates to ensure a balanced and effective response.

Quantitative Easing

Quantitative easing (QE) is a monetary policy tool that involves the Fed purchasing assets, such as government bonds, to increase the money supply. This can lower long-term interest rates and stimulate economic activity.

- Implementing QEin conjunction with a stimulus check could further boost economic growth by providing additional liquidity to the financial system and encouraging borrowing and investment. This could make the stimulus check more effective by increasing the amount of money available for spending and investment.

A Silent Piano is a great option for practicing without disturbing others. The article explores the benefits and features of these unique instruments.

- QE’s impacton the stimulus check’s effectiveness would depend on the specific details of the QE program and the overall economic conditions. If QE is implemented effectively, it could amplify the positive effects of the stimulus check. However, if it is not well-coordinated or if the economy is already experiencing high inflation, QE could lead to unintended consequences, such as exacerbating inflation or asset bubbles.

Communication

Effective communication between the Fed and the public is crucial to ensure a coordinated response to a stimulus package.

- Clear and transparent communicationfrom the Fed about its policy intentions and rationale can help to stabilize financial markets and build confidence in the economy. This can also help to ensure that the stimulus check is implemented effectively and achieves its intended goals.

- The Fed can communicate its policy stancethrough press releases, speeches, and testimony before Congress. It can also use its website and social media channels to disseminate information and engage with the public. By communicating clearly and transparently, the Fed can help to build public trust and ensure that its actions are understood and supported.

10. Long-Term Economic Implications

A stimulus check, while potentially providing short-term relief, can have significant long-term economic implications. It’s crucial to analyze its impact on national debt, inflation, economic growth, future policy decisions, and the risk of creating economic dependency.

The K Acoustic Guitar 2024 article discusses the latest models and innovations in this popular brand. It’s a great resource for anyone looking to buy a new acoustic guitar.

Stimulus Check Impact on National Debt

A stimulus check, particularly if substantial in size, will inevitably increase the national debt. The government will need to borrow money to finance the program, adding to the existing debt burden.

- Increased debt burden: The stimulus check will add to the national debt, which already stands at a historically high level. This increased debt burden will require the government to allocate more resources towards interest payments, potentially limiting spending on other essential programs.

- Higher interest rates: A higher national debt can lead to increased borrowing costs for the government. As investors perceive a higher risk associated with government bonds, they may demand higher interest rates, making it more expensive for the government to borrow money.

If you’re looking for a new acoustic guitar, the Music Zone Acoustic Guitar 2024 article might be a good place to start. It features a wide range of guitars from different brands.

- Reduced government spending: The need to service the increased debt can lead to reduced government spending on other programs. This can impact areas like infrastructure, education, and healthcare, potentially hindering long-term economic growth.

- Impact on future generations: The increased debt burden will be passed on to future generations, who will need to pay it back through higher taxes or reduced government services.

Inflationary Effects of a Stimulus Check

A stimulus check can potentially fuel inflation, especially if the economy is already experiencing strong demand and limited supply.

- Increased consumer demand: A stimulus check will put more money into the hands of consumers, potentially leading to increased demand for goods and services.

- Potential for “demand-pull” inflation: If supply cannot keep up with the increased demand, prices may rise, leading to “demand-pull” inflation. This can erode the purchasing power of consumers and increase the cost of living.

- Reduced purchasing power: Inflation erodes the value of money, meaning consumers can buy less with the same amount of money. This can negatively impact their standard of living.

- Increased cost of living: Rising prices for essential goods and services, such as food, energy, and housing, can increase the overall cost of living for consumers.

Stimulus Check and Economic Growth

A stimulus check can potentially boost economic growth in the short term by increasing consumer spending and business investment. However, the long-term effects are less clear.

- Short-term boost: A stimulus check can provide a temporary boost to economic activity by increasing consumer spending, leading to increased production and employment.

- Potential for “sugar high” effect: The economic boost from a stimulus check may be temporary, as consumers may spend the money quickly, leading to a decline in economic activity once the funds are depleted.

- Long-term impact on economic activity: The long-term impact of a stimulus check on economic growth depends on how it is implemented and how consumers and businesses respond. If it leads to increased investment and productivity, it can have a positive long-term effect.

- Potential for “crowding-out” effect: If the government uses borrowed funds to finance the stimulus check, it can lead to a “crowding-out” effect, where government spending displaces private investment. This can happen if higher interest rates make it more expensive for businesses to borrow money.

Impact on Future Economic Policy Decisions

A stimulus check can set a precedent for future economic policy interventions, potentially influencing the design and implementation of future policies.

- Precedent for government intervention: A stimulus check can reinforce the idea that the government should intervene in the economy to address economic downturns. This can lead to increased expectations for government intervention in the future.

- Increased expectations: Consumers and businesses may come to expect government intervention during economic downturns, potentially reducing their willingness to take risks and invest in the future.

- Influence on future policy design and implementation: The success or failure of a stimulus check can influence the design and implementation of future economic policies. If it is perceived as successful, it may encourage the use of similar measures in the future.

Economic Dependency and Market Distortion

A stimulus check can potentially create a culture of economic dependency among recipients, leading to distortions in market mechanisms.

- Potential for creating a culture of dependency: A stimulus check, if perceived as a regular entitlement, can create a culture of dependency among recipients, potentially reducing their motivation to work and save.

- Distorted market mechanisms: A stimulus check can artificially increase demand for goods and services, potentially leading to price distortions and misallocation of resources. This can happen if the stimulus check is not targeted at specific sectors or industries in need.

- Disincentivized work and savings: A stimulus check can disincentivize work and savings if recipients perceive it as a replacement for income. This can have negative long-term consequences for individual financial well-being and economic productivity.

International Perspective

The global economic landscape plays a significant role in shaping the decision-making process for a stimulus check in October 2024. The interconnectedness of the global economy means that any economic policy decision in the United States can have ripple effects worldwide, influencing trade relations, international cooperation, and the overall health of the global economy.

If you’re a fan of acoustic music, you should definitely check out the Acoustic Trench Youtube 2024 channel. They have a great selection of acoustic covers and original music.

Impact of a Stimulus Check on US Trade Relations and International Economic Cooperation

The potential impact of a stimulus check on US trade relations and international economic cooperation is a complex issue with both potential benefits and risks. A stimulus check could potentially boost US consumer spending, leading to increased demand for imported goods and services.

This could benefit trading partners, particularly those with strong export ties to the US. However, if the stimulus check leads to a significant increase in the US trade deficit, it could also strain trade relations with countries that perceive the US as unfairly benefiting from their exports.Additionally, the timing and size of the stimulus check could influence international economic cooperation.

If the stimulus check is perceived as being too large or too long-lasting, it could raise concerns among other countries about the US contributing to global inflation. This could lead to tensions and make it more difficult to achieve coordinated economic policies among major economies.

Comparison of Economic Policies of Other Countries

The US is not alone in facing economic challenges. Many countries around the world are grappling with inflation, supply chain disruptions, and the lingering effects of the COVID-19 pandemic. Several countries have implemented economic policies similar to those considered in the US, including:

- Direct payments to households:Many countries, such as Canada, the UK, and Germany, have provided direct payments to households as part of their economic stimulus packages. These payments have aimed to boost consumer spending and support businesses during periods of economic downturn.

- Tax cuts:Several countries, including Japan, South Korea, and Australia, have implemented tax cuts to stimulate economic growth. These tax cuts can provide businesses with more resources to invest and create jobs, while also boosting consumer spending.

- Increased government spending:Many countries, including France, Italy, and Spain, have increased government spending on infrastructure projects, social programs, and other initiatives to stimulate the economy. This approach aims to create jobs, boost demand, and support vulnerable populations.

The effectiveness of these policies has varied across countries, depending on factors such as the specific design of the policies, the state of the economy, and the political context. It is important to consider the experiences of other countries when evaluating the potential impact of a stimulus check in the US.

12. The Role of Technology and Innovation

The rapid evolution of technology is a defining characteristic of the 21st century, profoundly impacting every facet of human life, including the economic landscape. Technological advancements have consistently driven economic growth, creating new industries, transforming existing ones, and reshaping the global marketplace.

This section explores the intricate relationship between technology and economic prosperity, examining how technological innovation can be harnessed to address economic challenges and accelerate recovery.

Technology’s Impact on Economic Landscape

Technological advancements have played a pivotal role in shaping the economic landscape, leading to significant shifts in industries, employment patterns, and global trade. The impact of technology on the economy is multifaceted, encompassing both positive and negative consequences.

- Increased Productivity and Efficiency:Technological innovations have dramatically increased productivity and efficiency across various sectors. Automation, robotics, and artificial intelligence (AI) have streamlined production processes, reducing labor costs and increasing output. For instance, the automotive industry has witnessed significant productivity gains due to the adoption of robotics and advanced manufacturing techniques.

- New Industries and Market Opportunities:Technological breakthroughs have fostered the emergence of entirely new industries, creating unprecedented market opportunities. The rise of the internet and mobile technology has led to the growth of e-commerce, social media, and digital advertising, generating significant economic activity and employment opportunities.

- Globalization and Interconnectedness:Technology has facilitated globalization by connecting businesses and individuals across borders, enabling seamless communication and trade. The internet, telecommunications, and transportation advancements have fostered a more interconnected global economy, expanding market reach and promoting international collaboration.

- Job Displacement and Skills Gap:While technology has created new jobs, it has also led to job displacement in certain sectors. Automation and AI have replaced human labor in repetitive tasks, raising concerns about unemployment and the need for workers to adapt to new skill sets.

The rapid pace of technological change has created a skills gap, where the demand for highly skilled workers exceeds the supply, posing challenges for workforce development.

| Technological Advancement | Economic Effect |

|---|---|

| Internet and Mobile Technology | Growth of e-commerce, digital advertising, and social media; increased global interconnectedness. |

| Automation and Robotics | Increased productivity and efficiency; job displacement in manufacturing and other sectors. |

| Artificial Intelligence (AI) | Advancements in data analysis, healthcare, and finance; potential for job displacement in knowledge-based professions. |

| Biotechnology and Genetic Engineering | Development of new pharmaceuticals and agricultural products; potential for ethical and social implications. |

| Renewable Energy Technologies | Growth of the clean energy sector; reduction in carbon emissions and environmental impact. |

Stimulus Check and Technological Innovation

In the context of a rapidly evolving technological landscape, a stimulus check can play a crucial role in fostering innovation and accelerating economic recovery. By strategically allocating stimulus funds to technology-driven initiatives, governments can stimulate investment, create jobs, and enhance long-term economic competitiveness.

- Investing in Research and Development (R&D):A stimulus package can provide funding for research and development in emerging technologies, such as AI, biotechnology, and renewable energy. This investment can accelerate innovation, create new products and services, and drive economic growth. For instance, increased R&D funding could support the development of advanced battery technologies for electric vehicles or the creation of new AI-powered diagnostic tools in healthcare.

- Supporting Small and Medium-Sized Enterprises (SMEs):Stimulus funds can be directed towards supporting SMEs that are developing innovative technologies. Grants, loans, and tax incentives can help these businesses scale up their operations, create jobs, and contribute to economic growth. By fostering a vibrant ecosystem of technology-driven SMEs, governments can encourage entrepreneurship and innovation.

- Developing Digital Infrastructure:A stimulus package can invest in the development of robust digital infrastructure, such as broadband networks and data centers. This investment can enhance connectivity, improve access to digital services, and create opportunities for new businesses and industries. For example, expanding broadband access in rural areas can unlock economic potential by enabling remote work, online education, and telehealth services.

Technological Advancements and Job Creation

The relationship between technological advancements and job creation is complex and multifaceted. While automation and AI can lead to job displacement in certain sectors, they also create new opportunities in other areas, requiring a workforce with specialized skills.

- Reskilling and Upskilling:To address the challenges of job displacement, governments and businesses need to invest in reskilling and upskilling programs. These programs can help workers acquire new skills that are in demand in the changing job market. For example, training programs in data analysis, software development, and cybersecurity can prepare workers for the growing tech industry.

- Focus on High-Growth Sectors:Governments should prioritize investment in high-growth sectors that are driving technological innovation, such as renewable energy, biotechnology, and artificial intelligence. These sectors are expected to create significant job opportunities in the future. By fostering growth in these areas, governments can ensure a thriving economy and a robust workforce.

- Collaboration Between Education and Industry:Collaboration between educational institutions and industry is essential for preparing the workforce for the changing job market. Universities and colleges can develop curricula that align with the skills needed in the tech industry, while businesses can provide internships and apprenticeships to students.

Leveraging Technology for Stimulus Effectiveness

Technology can be leveraged to enhance the effectiveness of a stimulus package, ensuring targeted spending, increased transparency, and efficient distribution of funds.

- Data Analytics and Targeting:Data analytics can be used to identify specific sectors and individuals who would benefit most from stimulus spending. This targeted approach can maximize the impact of the stimulus package by directing funds to where they are most needed. For example, data analytics can help identify businesses that are struggling due to the pandemic and provide them with targeted support.

Triple M is known for its eclectic mix of music, and their Triple M Acoustic Music 2024 playlist features some of the best acoustic tracks from around the world.

- Digital Platforms and Transparency:Digital platforms can be used to streamline the application and distribution of stimulus funds, making the process more efficient and transparent. Online portals can provide real-time updates on the status of applications and disbursements, increasing accountability and reducing fraud.

- Blockchain Technology:Blockchain technology can be used to create a secure and transparent system for distributing stimulus funds. Blockchain can ensure that funds are transferred directly to recipients without intermediaries, reducing the risk of fraud and corruption.

The Future of Economic Policy

The potential for a stimulus check in October 2024 raises crucial questions about the future trajectory of economic policy. Examining potential trends in economic policy, the impact of evolving challenges, and strategies for sustainable growth will provide valuable insights into the role of stimulus measures in the future.

Potential Future Trends in Economic Policy

The future of economic policy will likely be shaped by a complex interplay of factors, including technological advancements, demographic shifts, and global economic trends.

- Increased Focus on Long-Term Growth:Policymakers may prioritize policies aimed at promoting long-term economic growth, such as investments in education, infrastructure, and research and development. This could involve a shift away from short-term stimulus measures towards more sustainable initiatives.

- Greater Emphasis on Inequality:Growing concerns about income inequality and social mobility could lead to policies aimed at reducing disparities, such as progressive taxation, expanded social safety nets, and targeted job training programs.

- Adaptation to Automation and AI:The rapid adoption of automation and artificial intelligence (AI) will require policies that address the potential job displacement and economic disruption these technologies could cause. This might involve retraining programs, investment in new industries, and adjustments to social safety nets.

- Climate Change Mitigation:The need to address climate change will likely drive policies that promote sustainable energy sources, green infrastructure, and carbon pricing mechanisms. These policies could have significant economic implications, both in terms of investment and potential job creation.

Impact of Evolving Economic Challenges

The evolving economic landscape will continue to present challenges that could influence the need for future stimulus packages.

Looking for some inspiring quotes about acoustic music? Check out the Acoustic Music Quotation 2024 article for some insightful words on the power of this genre.

- Inflationary Pressures:Persistent inflation could require policymakers to consider tightening monetary policy, which could slow economic growth and potentially necessitate stimulus measures to mitigate the impact.

- Geopolitical Instability:Global conflicts and trade tensions could disrupt supply chains, increase energy prices, and create economic uncertainty, potentially necessitating stimulus measures to support businesses and consumers.

- Cybersecurity Threats:Increasingly sophisticated cyberattacks could disrupt critical infrastructure and financial systems, requiring government intervention and potential stimulus to address the economic fallout.

Strategies for Sustainable Economic Growth

Promoting sustainable economic growth will require a multifaceted approach that addresses both short-term challenges and long-term trends.

- Investment in Human Capital:Investing in education, training, and skills development will be crucial for equipping workers with the skills needed for the evolving economy. This could involve expanding access to affordable higher education, providing job training programs, and promoting lifelong learning opportunities.

- Infrastructure Development:Investing in modern infrastructure, including transportation, energy, and communication networks, can boost productivity, create jobs, and enhance competitiveness.

- Innovation and Technology:Fostering innovation and technological advancements will be essential for driving economic growth and creating new industries and jobs. This could involve government support for research and development, tax incentives for innovation, and promoting collaboration between academia and industry.

- Environmental Sustainability:Addressing climate change and promoting environmental sustainability will be crucial for long-term economic well-being. This could involve investing in renewable energy sources, implementing carbon pricing mechanisms, and promoting sustainable business practices.

Epilogue

In conclusion, the likelihood of a stimulus check in October 2024 hinges on a delicate balance of economic and political factors. While the need for economic support might be present, the political climate and the potential impact on national debt could pose significant challenges.

The effectiveness and long-term implications of a stimulus check remain subject to debate, underscoring the importance of a comprehensive and nuanced analysis of the issue. As the 2024 presidential election approaches, the debate surrounding a stimulus check is likely to intensify, prompting further discussion and analysis of the potential benefits and drawbacks of such a measure.

Frequently Asked Questions

What are the potential benefits of a stimulus check?

A stimulus check could boost consumer spending, create jobs, reduce poverty and inequality, and improve access to essential services. However, it could also lead to inflation, temporary job creation, economic dependency, and political polarization.

What are the potential drawbacks of a stimulus check?

A stimulus check could increase national debt, fuel inflation, create a culture of economic dependency, and distort market mechanisms. It could also lead to a temporary “sugar high” effect followed by a decline in economic activity, and a “crowding-out” effect where government spending displaces private investment.

How will the eligibility criteria for a stimulus check be determined?

The eligibility criteria for a stimulus check will likely be based on factors such as income level, employment status, and dependents. Specific income thresholds and requirements for employment status may be established, and income verification methods will be implemented.

What are the potential distribution methods for a stimulus check?

Potential distribution methods for a stimulus check include direct deposit, mailed checks, and debit cards. Each method has its own advantages and disadvantages in terms of cost, efficiency, security, accessibility, and potential for fraud.

How will the Federal Reserve’s actions influence the effectiveness of a stimulus check?

The Federal Reserve’s monetary policy decisions, such as adjusting interest rates and implementing quantitative easing, can significantly impact the effectiveness of a stimulus check. Coordination between fiscal policy and monetary policy is crucial to ensure a consistent and effective response to economic challenges.