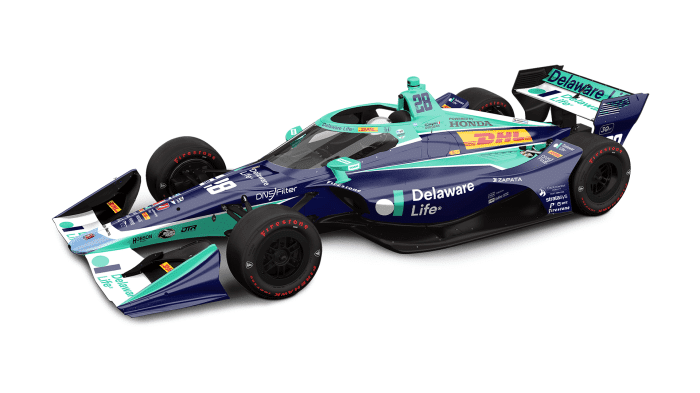

Delaware Life Compass 2 Variable Annuity 2024 offers a compelling investment opportunity for individuals seeking to grow their wealth and secure their financial future. This annuity provides a range of investment options, tailored to various risk appetites, and includes features designed to protect your principal and generate potential growth.

Whether you’re seeking income in retirement, aiming to build a substantial nest egg, or simply looking for a way to diversify your portfolio, the Delaware Life Compass 2 Variable Annuity might be a suitable option.

Annuity and IRA are different investment vehicles, but they both aim to provide income in retirement. Is Annuity The Same As Ira 2024 explains their key differences, while the Formula For Calculating The Annuity Payment 2024 helps you understand how much you’ll receive in retirement.

The Delaware Life Compass 2 Variable Annuity is designed to meet the needs of a diverse range of investors. It offers a flexible investment approach, allowing you to choose from a variety of sub-accounts, each with its own investment strategy and risk profile.

This allows you to customize your investment strategy to align with your individual financial goals and risk tolerance.

Contents List

- 1 Delaware Life Compass 2 Variable Annuity Overview

- 1.1 Key Features and Benefits

- 1.2 Sub-Accounts and Investment Strategies

- 1.3 Contractual Provisions

- 1.4 Death Benefit Options, Delaware Life Compass 2 Variable Annuity 2024

- 1.5 Tax Treatment of Withdrawals and Distributions

- 1.6 Tax Treatment of Death Benefits

- 1.7 Tax Planning Considerations

- 1.8 Key Differences and Similarities

- 1.9 Investor Profiles and Financial Goals

- 2 Final Thoughts: Delaware Life Compass 2 Variable Annuity 2024

- 3 Clarifying Questions

Delaware Life Compass 2 Variable Annuity Overview

The Delaware Life Compass 2 Variable Annuity is a versatile retirement savings product designed to help individuals accumulate and protect their wealth. It offers a combination of features that cater to various investor needs and financial goals. This annuity allows you to invest in a variety of sub-accounts, offering potential for growth while providing downside protection through various living benefit riders.

Key Features and Benefits

- Investment Flexibility:The Delaware Life Compass 2 Variable Annuity provides a wide range of investment options, allowing you to tailor your portfolio to your risk tolerance and financial goals. You can choose from a variety of sub-accounts, including mutual funds, ETFs, and managed accounts, offering exposure to different asset classes and investment strategies.

- Living Benefit Riders:The annuity offers various living benefit riders that provide downside protection and guaranteed income streams. These riders can help ensure that you have a guaranteed income stream in retirement, even if your investments underperform. Common riders include guaranteed minimum withdrawal benefits (GMWB), guaranteed lifetime withdrawal benefits (GLWB), and guaranteed income benefits (GIB).

- Death Benefit Options:The Delaware Life Compass 2 Variable Annuity includes death benefit options that can provide financial protection for your beneficiaries. You can choose from various options, such as a lump sum payment, a monthly income stream, or a combination of both.

While annuities are primarily for retirement income, Annuity Health Insurance 2024 explores a niche application in the health insurance market.

- Tax Advantages:The annuity offers tax-deferred growth, meaning that you don’t have to pay taxes on investment earnings until you withdraw them in retirement. This can help you accumulate wealth more quickly and efficiently.

The Delaware Life Compass 2 Variable Annuity is well-suited for individuals who:

- Seek investment flexibility and potential growth:The annuity provides a wide range of investment options, allowing you to tailor your portfolio to your risk tolerance and financial goals.

- Desire downside protection and guaranteed income:The annuity offers various living benefit riders that can provide guaranteed income streams and protect your principal from market losses.

- Are nearing retirement or are in retirement:The annuity can provide a steady stream of income in retirement and help you manage your assets during this important life stage.

- Are seeking tax advantages:The annuity offers tax-deferred growth, which can help you accumulate wealth more quickly and efficiently.

The Delaware Life Compass 2 Variable Annuity offers a diverse range of investment options, allowing you to construct a portfolio aligned with your risk tolerance and financial goals. These investment options are managed through various sub-accounts, each employing distinct investment strategies and carrying different risk levels.

There are many types of annuities, each with its own set of features and benefits. 5 Annuity 2024 and 4 Annuity 2024 are just two examples, and understanding the nuances of each type is crucial before making a decision.

Sub-Accounts and Investment Strategies

The Delaware Life Compass 2 Variable Annuity typically offers sub-accounts that cover a wide spectrum of investment styles, including:

- Equity Sub-Accounts:These sub-accounts invest primarily in stocks, offering the potential for higher returns but also greater volatility. They may focus on specific sectors, market capitalizations, or investment styles, such as growth or value.

- Fixed Income Sub-Accounts:These sub-accounts invest in bonds, which are generally considered less risky than stocks. They provide a steady stream of income and can help to diversify your portfolio. Fixed income sub-accounts may focus on different maturities, credit ratings, or types of bonds, such as government or corporate bonds.

- Balanced Sub-Accounts:These sub-accounts aim to strike a balance between growth and stability by investing in a mix of stocks and bonds. They can provide a more moderate level of risk and return, making them suitable for investors with a balanced risk tolerance.

- Target-Date Funds:These sub-accounts are designed to automatically adjust their asset allocation over time, becoming more conservative as you approach retirement. They provide a convenient way to manage your portfolio as your investment needs evolve.

- Managed Accounts:These sub-accounts are professionally managed by experienced financial advisors who tailor investment strategies to your individual goals and risk tolerance. Managed accounts offer personalized investment guidance and can be particularly beneficial for investors who prefer a hands-off approach.

The risk levels associated with each investment option within the Delaware Life Compass 2 Variable Annuity vary depending on the underlying investments. Generally:

- Equity sub-accountscarry the highest risk, as stock prices can fluctuate significantly. However, they also have the potential for higher returns over the long term.

- Fixed income sub-accountsare considered less risky than equity sub-accounts, as bonds generally offer more stability. However, their potential for growth is also lower.

- Balanced sub-accountsstrike a balance between risk and return, making them suitable for investors with a moderate risk tolerance.

- Target-date fundsgenerally become more conservative as you approach retirement, reducing risk over time.

- Managed accountsoffer customized investment strategies, tailored to your individual risk tolerance and financial goals.

The Delaware Life Compass 2 Variable Annuity, like any financial product, comes with specific contractual provisions and associated fees. Understanding these aspects is crucial for making informed decisions.

Contractual Provisions

The contract Artikels the terms and conditions of the annuity, including:

- Investment Options:The contract specifies the available investment options, including the sub-accounts, investment strategies, and minimum investment requirements.

- Living Benefit Riders:The contract details the various living benefit riders available, including their features, conditions, and limitations.

- Death Benefit Options:The contract Artikels the death benefit options available, such as lump sum payments, income streams, or a combination of both.

- Fees:The contract specifies the various fees associated with the annuity, including annual expenses, surrender charges, and other applicable fees.

- Withdrawal Provisions:The contract Artikels the rules and restrictions regarding withdrawals, including minimum withdrawal amounts, surrender charges, and tax implications.

- Contract Duration:The contract specifies the duration of the annuity contract, including any surrender charges or penalties for early termination.

The Delaware Life Compass 2 Variable Annuity typically involves various fees, which can be categorized as follows:

- Annual Expenses:These are ongoing fees charged annually to cover the costs of managing the annuity, including administrative expenses, investment management fees, and mortality charges. The annual expense ratio is typically expressed as a percentage of the account value.

- Surrender Charges:These fees are charged when you withdraw funds from the annuity before a certain period, typically within the first few years of the contract. Surrender charges are designed to discourage early withdrawals and can vary depending on the contract terms and the time of withdrawal.

- Other Fees:The annuity may also include other fees, such as account maintenance fees, transfer fees, or fees for specific services, such as the purchase of living benefit riders.

The fee structure of the Delaware Life Compass 2 Variable Annuity should be compared to other variable annuities in the market to ensure it is competitive. Consider factors such as:

- Annual Expense Ratio:Compare the annual expense ratio of the Delaware Life Compass 2 to other variable annuities with similar features and investment options.

- Surrender Charges:Analyze the surrender charge structure of the Delaware Life Compass 2 and compare it to other annuities in terms of the duration and amount of charges.

- Other Fees:Consider any additional fees associated with the Delaware Life Compass 2, such as account maintenance fees or transfer fees, and compare them to other variable annuities.

The Delaware Life Compass 2 Variable Annuity offers various death benefit and living benefit options to address diverse needs and circumstances.

Death Benefit Options, Delaware Life Compass 2 Variable Annuity 2024

The Delaware Life Compass 2 Variable Annuity typically offers the following death benefit options:

- Lump Sum Payment:Upon the death of the annuitant, the beneficiary receives a lump sum payment equal to the account value at the time of death.

- Monthly Income Stream:The beneficiary can choose to receive a monthly income stream for a specified period or for life, based on the account value at the time of death.

- Combination of Lump Sum and Income Stream:The beneficiary can receive a portion of the account value as a lump sum payment and the remaining balance as a monthly income stream.

The Delaware Life Compass 2 Variable Annuity offers various living benefit riders that provide guaranteed income streams and downside protection, ensuring a steady income stream in retirement, even if investments underperform. Common riders include:

- Guaranteed Minimum Withdrawal Benefit (GMWB):This rider guarantees a minimum amount that you can withdraw each year from your annuity, regardless of the performance of your investments. It provides downside protection and ensures a consistent income stream in retirement.

- Guaranteed Lifetime Withdrawal Benefit (GLWB):This rider guarantees a lifetime income stream, ensuring that you receive a regular income for as long as you live. It provides a high level of security and peace of mind in retirement.

- Guaranteed Income Benefit (GIB):This rider guarantees a specific income stream for a specified period, such as 10 or 20 years. It can provide a steady source of income for a defined period, regardless of market fluctuations.

Each living benefit rider comes with specific conditions and limitations, including:

- Cost:Living benefit riders typically come with an additional cost, which can be expressed as a percentage of the account value or a fixed fee.

- Withdrawal Restrictions:Some riders may restrict the amount you can withdraw from your annuity each year or impose penalties for early withdrawals.

- Activation Requirements:Certain riders may require a specific minimum account value or age to be activated.

- Benefit Period:The guaranteed income period or the lifetime withdrawal period may vary depending on the rider and the terms of the contract.

Understanding the tax implications of investing in the Delaware Life Compass 2 Variable Annuity is crucial for maximizing your after-tax returns.

Tax Treatment of Withdrawals and Distributions

Withdrawals from a variable annuity are generally taxed as ordinary income, subject to the same tax rates as your other income. This is because the earnings within the annuity grow tax-deferred, meaning that you don’t pay taxes on them until you withdraw them.

Tax Treatment of Death Benefits

Death benefits from a variable annuity are generally taxed as ordinary income to the beneficiary, unless the beneficiary is a surviving spouse. In that case, the death benefit may qualify for a stepped-up basis, meaning that the beneficiary inherits the annuity at its fair market value at the time of the annuitant’s death, potentially reducing future capital gains taxes.

Variable annuities offer potential for growth, but they also come with risks. Variable Annuity Japan 2024 highlights how this type of annuity functions in a specific market, while Variable Annuity Tax Deferred 2024 explains the tax benefits they offer.

Tax Planning Considerations

To minimize your tax liability, consider the following tax planning strategies:

- Withdrawals in Retirement:Strategically withdraw funds from your annuity in retirement to minimize your tax burden. Consider withdrawing funds during years when your income is lower to take advantage of lower tax brackets.

- Tax-Loss Harvesting:If you have experienced losses in your variable annuity, you may be able to use tax-loss harvesting to offset capital gains from other investments. This strategy involves selling losing investments to realize the losses and offsetting them against capital gains, reducing your overall tax liability.

Online tools can help you make informed decisions about annuities. Annuity Calculator Hk 2024 is a valuable resource for those in Hong Kong, while Annuity Calculator Edward Jones 2024 offers a different perspective.

- Estate Planning:Consult with a qualified financial advisor or estate planning attorney to explore strategies for minimizing estate taxes. You may be able to use the annuity as part of your estate plan to pass on wealth to your beneficiaries tax-efficiently.

The Delaware Life Compass 2 Variable Annuity should be compared to other variable annuities in the market to ensure it aligns with your needs and goals.

Understanding the Formula Annuity Loan 2024 is crucial when considering an annuity-based loan. What’s Variable Annuity 2024 explains the basics of this investment product.

Key Differences and Similarities

When comparing the Delaware Life Compass 2 to other variable annuities, consider key factors such as:

- Investment Options:Compare the range of investment options, including the sub-accounts, investment strategies, and minimum investment requirements.

- Living Benefit Riders:Analyze the availability and features of living benefit riders, including guaranteed minimum withdrawal benefits (GMWB), guaranteed lifetime withdrawal benefits (GLWB), and guaranteed income benefits (GIB).

- Death Benefit Options:Compare the death benefit options, such as lump sum payments, income streams, or a combination of both.

- Fees:Compare the annual expense ratio, surrender charges, and other fees associated with the annuity.

- Contractual Provisions:Analyze the contract terms, including withdrawal provisions, surrender charges, and contract duration.

Each variable annuity has its own strengths and weaknesses. Consider the following when comparing the Delaware Life Compass 2 to other products:

- Investment Flexibility:Assess the breadth and depth of investment options offered by the Delaware Life Compass 2 compared to other variable annuities.

- Living Benefit Rider Options:Compare the availability and features of living benefit riders offered by the Delaware Life Compass 2 to other products.

- Fee Structure:Evaluate the annual expense ratio, surrender charges, and other fees associated with the Delaware Life Compass 2 and compare them to other variable annuities.

- Customer Service and Reputation:Research the reputation of Delaware Life and its customer service track record.

The suitability of the Delaware Life Compass 2 Variable Annuity depends on individual investor profiles, financial goals, and risk tolerance.

Investor Profiles and Financial Goals

The Delaware Life Compass 2 Variable Annuity can be suitable for investors who:

- Seek investment flexibility and potential growth:The annuity provides a wide range of investment options, allowing you to tailor your portfolio to your risk tolerance and financial goals.

- Desire downside protection and guaranteed income:The annuity offers various living benefit riders that can provide guaranteed income streams and protect your principal from market losses.

- Are nearing retirement or are in retirement:The annuity can provide a steady stream of income in retirement and help you manage your assets during this important life stage.

- Are seeking tax advantages:The annuity offers tax-deferred growth, which can help you accumulate wealth more quickly and efficiently.

The Delaware Life Compass 2 Variable Annuity can accommodate investors with varying risk tolerances:

- Conservative Investors:Investors with a low risk tolerance may prefer fixed income sub-accounts or balanced sub-accounts, which offer more stability and less volatility.

- Moderate Investors:Investors with a moderate risk tolerance may choose a mix of equity and fixed income sub-accounts, aiming for a balance between growth and stability.

- Aggressive Investors:Investors with a high risk tolerance may prefer equity sub-accounts, which offer the potential for higher returns but also greater volatility.

The Delaware Life Compass 2 Variable Annuity can be a suitable option for investors who:

- Are nearing retirement or are in retirement:The annuity can provide a steady stream of income in retirement and help you manage your assets during this important life stage.

- Seek downside protection and guaranteed income:The annuity offers various living benefit riders that can provide guaranteed income streams and protect your principal from market losses.

- Desire investment flexibility:The annuity provides a wide range of investment options, allowing you to tailor your portfolio to your risk tolerance and financial goals.

- Are seeking tax advantages:The annuity offers tax-deferred growth, which can help you accumulate wealth more quickly and efficiently.

The information provided in this article is for educational purposes only and is not intended as financial advice. The Delaware Life Compass 2 Variable Annuity is a complex financial product, and it is essential to consult with a qualified financial advisor to determine if it is suitable for your individual circumstances.For more information about the Delaware Life Compass 2 Variable Annuity, please contact Delaware Life or a qualified financial advisor.

Final Thoughts: Delaware Life Compass 2 Variable Annuity 2024

The Delaware Life Compass 2 Variable Annuity presents a comprehensive solution for individuals seeking to grow their wealth while enjoying the peace of mind that comes with guaranteed income and death benefit options. Its flexible investment approach, tailored to various risk appetites, combined with its robust features and competitive fees, makes it a compelling option for a wide range of investors.

There are different ways to structure annuity payments. Variable Annuity Non Qualified Stretch 2024 discusses one specific option, while Calculate Annuity With Different Payments 2024 offers a broader overview.

By understanding the details of this product and considering your individual financial goals, you can make an informed decision about whether the Delaware Life Compass 2 Variable Annuity is the right fit for you.

Clarifying Questions

What are the minimum investment requirements for the Delaware Life Compass 2 Variable Annuity?

The minimum investment requirements for the Delaware Life Compass 2 Variable Annuity vary depending on the specific sub-account you choose. It’s best to consult the product prospectus or speak with a financial advisor for detailed information.

Annuity and pension are not the same, though they share similarities. Is Annuity The Same As Pension 2024 clarifies these differences. Variable Annuity Annuitization 2024 discusses the process of converting a variable annuity into a guaranteed stream of income.

How do I access the investment options available within the Delaware Life Compass 2 Variable Annuity?

You can access the investment options available within the Delaware Life Compass 2 Variable Annuity through your online account or by contacting your financial advisor. You can also find detailed information about the available sub-accounts and their investment strategies in the product prospectus.

What are the potential risks associated with investing in the Delaware Life Compass 2 Variable Annuity?

As with any investment, there are risks associated with investing in the Delaware Life Compass 2 Variable Annuity. The value of your investment may fluctuate, and you may lose some or all of your principal. It’s important to carefully consider your risk tolerance and financial goals before investing in this product.