Annuity 8 Percent 2024: Planning for Retirement Income – A captivating journey into the world of annuities, this exploration delves into the potential for 8% returns in 2024, analyzing historical trends, current economic factors, and expert predictions. This guide provides valuable insights into annuity strategies for maximizing returns and navigating the complexities of retirement planning in a dynamic market.

An annuity is a financial product that provides a stream of payments for a set period of time. If you want a more in-depth explanation, check out this link: An Annuity Is Quizlet 2024.

Annuities, financial instruments that offer guaranteed income streams for a specific period, are becoming increasingly popular as individuals seek to secure their retirement futures. With a focus on 8% returns in 2024, this exploration examines the factors influencing annuity rates, including interest rate fluctuations, inflation, and market volatility.

Whether or not annuity is counted as income can depend on various factors. You can find more details on this topic here: Is Annuity Counted As Income 2024.

Understanding these dynamics is crucial for making informed decisions about annuity investments.

A variable annuity is a type of annuity that pays out a variable amount of money each year, depending on the performance of the underlying investments. If you’re curious about its characteristics, you can read more about it here: A Variable Annuity Has Which Of The Following Characteristics 2024.

Contents List

Introduction to Annuities

An annuity is a financial product that provides a stream of regular payments for a set period of time. These payments can be used to supplement retirement income, provide a guaranteed stream of income for life, or even be used to create a legacy for loved ones.

A variable annuity is a type of annuity that allows you to invest in a variety of sub-accounts, which are similar to mutual funds. You can learn more about it by checking out this link: What Is A Variable Annuity And How Does It Work 2024.

Annuities can be a valuable tool for retirement planning, offering potential benefits such as guaranteed income, tax-deferred growth, and protection against market volatility.

IFRS 17 is a new accounting standard that affects the accounting for insurance contracts, including variable annuities. You can find more information about it here: Variable Annuity Ifrs 17 2024.

Key Features of Annuities

Annuities offer a range of features that can be tailored to individual needs and financial goals. Here are some of the key aspects of annuities:

- Guaranteed Payments:A significant advantage of annuities is their ability to provide guaranteed income payments for a specific period or even for life. This can provide peace of mind and financial security during retirement.

- Tax Implications:The tax treatment of annuity payments can vary depending on the type of annuity and the investment strategy. Some annuities offer tax-deferred growth, meaning that taxes are not paid until the payments are received.

- Potential Risks:While annuities offer potential benefits, it’s important to understand the risks associated with them. These risks can include potential loss of principal, market volatility, and interest rate fluctuations.

Types of Annuities

Annuities come in a variety of forms, each with its own characteristics and benefits. Some common types of annuities include:

- Fixed Annuities:These annuities offer a guaranteed rate of return, providing predictable income payments. The downside is that fixed annuities may not keep pace with inflation.

- Variable Annuities:These annuities offer the potential for higher returns, but also carry higher risk. The investment returns are tied to the performance of underlying mutual funds or other investments.

- Indexed Annuities:These annuities offer a return that is linked to the performance of a specific index, such as the S&P 500. They provide potential for growth while offering some protection against market downturns.

8 Percent Return in 2024: Annuity 8 Percent 2024

The potential for an 8% return on annuities in 2024 is a complex issue that depends on various economic factors. Historical performance, current market conditions, and expert predictions all play a role in shaping expectations for annuity rates.

You can actually receive an annuity and still work! It’s not mutually exclusive. If you want to learn more about this, check out this link: Can You Receive Annuity And Still Work 2024.

Historical Performance of Annuity Rates

Analyzing historical annuity rates can provide insights into potential future returns. However, past performance is not necessarily indicative of future results. Over the past decade, annuity rates have fluctuated significantly, influenced by factors such as interest rate changes, economic growth, and inflation.

Nationwide is a well-known insurance company that offers variable annuities. If you’re interested in learning more about their offerings, you can check out this link: Variable Annuity Nationwide 2024.

Current Economic Environment and its Impact on Annuity Rates

The current economic environment, characterized by rising inflation, interest rate hikes, and geopolitical uncertainty, has a direct impact on annuity rates. As interest rates rise, annuity providers can offer higher returns to attract investors. However, inflation can erode the purchasing power of annuity payments, offsetting potential gains.

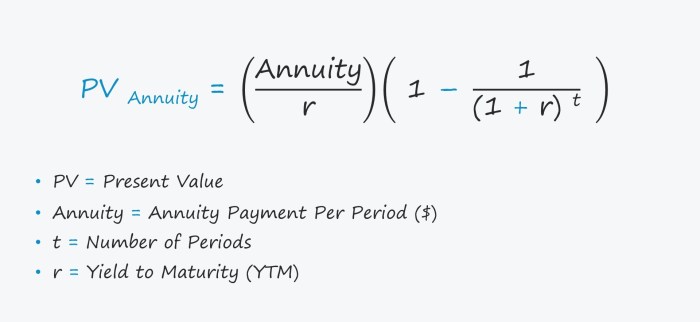

The annuity formula is a mathematical formula used to calculate the present value or future value of an annuity. You can find more information about it here: Annuity Formula Jaiib 2024.

Expert Opinions and Predictions Regarding Potential Annuity Rates in 2024, Annuity 8 Percent 2024

Experts have varying opinions regarding potential annuity rates in 2024. Some anticipate continued interest rate hikes, which could lead to higher annuity returns. Others are more cautious, citing potential economic headwinds that could dampen growth.

Annuity Health is a type of annuity that is designed to help people pay for their healthcare expenses in retirement. Learn more about it by clicking this link: Annuity Health 2024.

It’s important to note that these predictions are based on current economic conditions and may change as the market evolves.

Variable annuities don’t typically have a fixed maturity date. You can find more information about it by checking out this link: Variable Annuity Maturity Date 2024.

Annuity Strategies for 2024

Maximizing returns from annuities in 2024 requires careful planning and strategic decision-making.

Delaware Life Compass 2 is a variable annuity product offered by Delaware Life. You can find more information about it by checking out this link: Delaware Life Compass 2 Variable Annuity 2024.

Comparing Different Annuity Options

| Annuity Type | Features | Risks | Potential Returns |

|---|---|---|---|

| Fixed Annuity | Guaranteed rate of return, predictable income | May not keep pace with inflation, limited growth potential | Lower, but predictable returns |

| Variable Annuity | Potential for higher returns, investment flexibility | Market volatility, potential loss of principal | Higher potential returns, but also higher risk |

| Indexed Annuity | Linked to market index, potential for growth, downside protection | Limited upside potential, may not fully participate in market gains | Moderate returns with some downside protection |

Strategies for Maximizing Returns

- Timing of Investments:Timing can play a crucial role in maximizing returns. Investing in annuities during periods of rising interest rates can potentially lead to higher guaranteed payments.

- Diversification:Diversifying annuity investments across different types and investment strategies can help mitigate risk and potentially enhance returns.

Decision-Making Process for Choosing the Right Annuity

The decision-making process for choosing the right annuity involves considering individual circumstances, financial goals, and risk tolerance.

Annuity 3 is a type of annuity that pays out a fixed amount of money each year for a set period of time. You can learn more about it by checking out this link: Annuity 3 2024.

Here’s a flowchart illustrating the process:

[Illustrative flowchart outlining the decision-making process, considering factors like risk tolerance, income needs, and time horizon. The flowchart should guide users through a series of questions and decision points to determine the most suitable annuity type for their specific circumstances.]

Calculating an annuity due is slightly different from a regular annuity. If you want to learn how to calculate an annuity due, you can check out this link: How To Calculate An Annuity Due 2024.

Considerations for 2024

While annuities can offer potential benefits for retirement planning, it’s crucial to consider the impact of inflation and potential risks associated with them.

A variable annuity is an open-ended investment product. You can learn more about it by checking out this link: Variable Annuity Open Ended 2024.

Impact of Inflation on Annuity Payments

Inflation can erode the purchasing power of annuity payments over time. As the cost of goods and services rises, the value of annuity payments may decrease, reducing their real value.

Potential Risks Associated with Annuities

- Market Volatility:Variable annuities are subject to market volatility, which can impact investment returns and the value of annuity payments.

- Interest Rate Changes:Interest rate changes can affect the value of annuities, particularly fixed annuities. Rising interest rates can make fixed annuities less attractive, while falling interest rates can lead to lower returns.

Advantages and Disadvantages of Annuities

Annuities have both advantages and disadvantages compared to other retirement savings options.

- Advantages:Guaranteed income, tax-deferred growth, potential for higher returns, protection against market volatility.

- Disadvantages:Potential loss of principal, limited flexibility, fees, potential for lower returns compared to other investments.

Final Review

As we conclude our exploration of Annuity 8 Percent 2024: Planning for Retirement Income, it’s evident that annuities can be a powerful tool for securing a comfortable retirement. By carefully considering the various annuity options, analyzing market trends, and consulting with financial advisors, individuals can make informed decisions that align with their unique retirement goals.

The pursuit of 8% returns in 2024 is an ambitious endeavor, but with a proactive approach and a deep understanding of the nuances of annuities, it’s a goal within reach.

FAQs

What are the different types of annuities?

Annuity Nps is a type of annuity that is specifically designed for retirement planning. You can find more information about it here: Annuity Nps 2024.

Annuities come in various forms, including fixed, variable, and indexed annuities, each offering different features and risk profiles. Fixed annuities provide guaranteed interest rates, while variable annuities offer potential for higher returns but also carry market risk. Indexed annuities link returns to a specific index, such as the S&P 500.

How do I choose the right annuity for my needs?

Selecting the right annuity requires careful consideration of your risk tolerance, time horizon, and financial goals. Consult with a financial advisor to determine the best annuity option for your individual circumstances.

What are the tax implications of annuities?

Annuities can have complex tax implications, depending on the type of annuity and how it is structured. It’s essential to consult with a tax professional to understand the tax implications of your specific annuity investment.