How To Read A Variable Annuity Statement 2024 can be a daunting task, but understanding its intricacies is crucial for making informed decisions about your financial future. Variable annuities are complex investment products that offer potential growth but also come with unique features and risks.

Annuities can be either certain or uncertain. To learn more about the concept of Is Annuity Certain 2024 , you can explore online resources or consult with a financial professional.

This guide will demystify the key components of a variable annuity statement, empowering you to interpret its information and make sound financial choices.

If you have a Jackson Variable Annuity and need to make a partial withdrawal or surrender request, you can find information about the process in the article on Jackson Variable Annuity Partial Withdrawal/Surrender Request 2024.

Variable annuities are a type of insurance contract that combines investment growth with tax-deferred savings and potential lifetime income. Unlike traditional annuities, which provide a fixed rate of return, variable annuities invest your money in a variety of sub-accounts that fluctuate in value based on market performance.

One common question about annuities is whether the interest earned is taxable. To find out more about Is Annuity Interest Taxable 2024 , you can consult with a financial advisor or research online.

This means your investment returns can potentially grow faster than with a fixed annuity, but also carry the risk of losing value.

An annuity can be a valuable financial tool, but it’s essential to understand its nature. To learn more about the question “Is Annuity Insurance 2024”, check out the article at Is Annuity Insurance 2024.

Contents List

Understanding Variable Annuity Statements

Variable annuity statements provide a comprehensive overview of your variable annuity account, detailing its performance, fees, and other key features. Understanding these statements is crucial for making informed decisions about your investment and ensuring your financial goals are met.

The HP12C is a popular financial calculator that can help you calculate annuities. To learn how to use it for this purpose, check out the guide on Calculate Annuity Hp12c 2024. It’s a valuable tool for anyone working with annuities.

A variable annuity is a type of insurance contract that allows you to invest your money in a variety of sub-accounts, typically mutual funds. The value of your investment is tied to the performance of the underlying funds, meaning it can fluctuate based on market conditions.

When looking for an annuity with a specific principal amount, you might be interested in an Annuity 250k 2024. Understanding the features and potential benefits of such an annuity is important.

Unlike traditional fixed annuities, variable annuities offer the potential for higher returns but also carry a higher level of risk.

Variable annuities can fluctuate based on market conditions. If you’re interested in understanding the rates associated with these types of annuities, you can check out the article on Variable Annuity Rates 2021 2024.

Key features that distinguish variable annuities from other investment products include:

- Growth potential:Variable annuities offer the potential for higher returns than fixed annuities, as your investment is tied to the performance of the market.

- Tax deferral:Earnings within a variable annuity are tax-deferred, meaning you won’t have to pay taxes on them until you withdraw the money.

- Death benefit:Many variable annuities offer a death benefit, which guarantees a minimum payout to your beneficiaries upon your death.

- Flexibility:Variable annuities allow you to choose from a variety of investment options to align with your risk tolerance and investment goals.

Key Components of a Variable Annuity Statement

Variable annuity statements typically include several sections that provide detailed information about your account. Understanding the content of each section is essential for tracking your investment’s performance and making informed decisions.

The BA II Plus is another popular financial calculator that can be used to calculate annuities. To find out how to use it, explore the guide on Calculate Annuity With Ba Ii Plus 2024.

| Section | Key Components |

|---|---|

| Account Summary |

|

| Investment Performance |

|

| Fees and Expenses |

|

| Death Benefit and Withdrawal Options |

|

Account Value and Performance, How To Read A Variable Annuity Statement 2024

The variable annuity statement clearly displays your current account value, which represents the total market value of your investment. It also details the performance of your account, including the returns generated over the statement period. You can use this information to calculate your account’s performance by comparing the current account value to the beginning account value and factoring in any contributions or withdrawals made during the period.

If you’re considering an annuity with a principal amount of 300,000, you might want to explore the details of Annuity 300 000 2024. Understanding the terms and conditions of such an annuity is crucial before making any decisions.

It’s also helpful to compare your account’s performance against relevant benchmarks, such as the S&P 500 or other broad market indices, to understand how your investment is performing relative to the overall market.

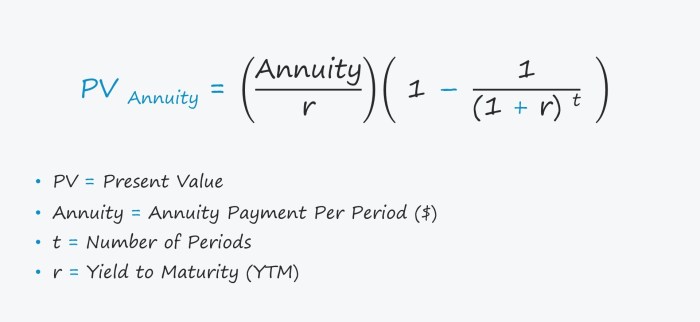

If you’re looking to understand the value of an annuity over a three-year period, you’ll need to know the 3 Year Annuity Factor 2024. This factor helps you determine the present value of a series of future payments.

Fees and Expenses

Variable annuities come with various fees and expenses that can impact your overall investment return. Understanding these fees is crucial for making informed decisions about your investment. Your variable annuity statement should provide a detailed breakdown of all fees and expenses associated with your account.

Calculating annuities can be done on various calculators, including the Casio. For step-by-step instructions on How To Calculate Annuity On Casio Calculator 2024 , you can find a comprehensive guide online.

| Fee Type | Description |

|---|---|

| Annual Expense Ratio | This fee covers the costs of managing the sub-accounts within your variable annuity. It is typically expressed as a percentage of your account value and is deducted from your investment returns. |

| Mortality and Expense Risk Charges | These charges are designed to cover the insurer’s costs associated with providing the death benefit and managing the risk of the variable annuity. |

| Administrative Fees | These fees cover the insurer’s administrative costs, such as record-keeping and customer service. |

| Withdrawal Fees | These fees may apply if you withdraw money from your variable annuity before a certain age or time period. |

Carefully analyze the fee structure to identify potential areas for cost optimization. You may want to consider consolidating your investments into fewer sub-accounts to minimize the annual expense ratio or explore other investment options with lower fees.

Last Recap

Navigating the world of variable annuities can be complex, but by understanding the key components of your statement and seeking professional advice when needed, you can gain control of your investment journey. Remember, your variable annuity statement is more than just a document; it’s a window into your financial future.

By carefully reviewing and understanding its contents, you can make informed decisions that align with your investment goals and ensure a secure financial future.

FAQ: How To Read A Variable Annuity Statement 2024

What is the difference between a fixed annuity and a variable annuity?

A fixed annuity guarantees a set rate of return, while a variable annuity’s returns fluctuate based on the performance of the underlying investments. Fixed annuities offer more predictable income, while variable annuities have the potential for higher growth but also carry greater risk.

How often should I review my variable annuity statement?

It’s generally recommended to review your variable annuity statement at least annually, or more frequently if there are significant changes in your financial situation or market conditions.

What are the tax implications of withdrawing from a variable annuity?

Withdrawals from a variable annuity are generally taxed as ordinary income, but the specific tax treatment can vary depending on the type of withdrawal and the age of the annuitant. It’s important to consult with a tax advisor to understand the tax implications of your specific situation.

Can I change my investment options within a variable annuity?

Yes, you can typically change your investment options within a variable annuity, although there may be limitations or fees associated with making changes. It’s important to review the terms of your contract and consult with a financial advisor before making any changes.

Fixed annuities offer a guaranteed rate of return. If you’re considering a fixed annuity, you might want to research 4 Fixed Annuity 2024 to understand its features and potential benefits.

Variable annuities can be categorized into different classes, including Class B. For more information about Class B Variable Annuity 2024 , you can consult with a financial advisor or research online.

The annuity discount factor is a crucial element in annuity calculations. To learn how to calculate it, you can refer to the guide on Calculate Annuity Discount Factor 2024.

The Director 6 Variable Annuity is a product offered by Hartford. For more details about The Director 6 Variable Annuity Hartford 2024 , you can visit the Hartford website or consult with a financial advisor.