Finra Variable Annuity 7 Day Rule 2024, a crucial regulation for investors, provides a seven-day “cooling-off” period to reconsider variable annuity contracts. This rule, implemented by the Financial Industry Regulatory Authority (FINRA), empowers investors to make informed decisions about these complex financial products.

The rule’s significance lies in its ability to protect investors from hasty decisions and potential financial losses.

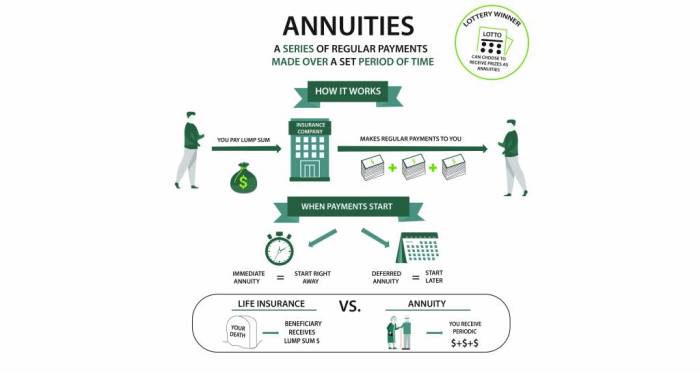

The 7-Day Rule is a cornerstone of investor protection in the variable annuity market. It allows individuals to carefully review the terms and conditions of a contract, consult with financial advisors, and assess the suitability of the investment before making a final commitment.

Variable annuities are a popular investment option in the United States. Get a comprehensive overview of Variable Annuity Usa 2024 , including their advantages and disadvantages.

This “free look” period grants investors the opportunity to rescind the contract within seven days without penalty, ensuring a level of security and control over their financial decisions.

If you’re considering a variable annuity, understanding the different classes is crucial. Learn more about the features and risks of Class C Variable Annuity 2024 to make an informed decision.

Contents List

- 1 FINRA’s Variable Annuity 7-Day Rule

- 1.1 Overview of FINRA’s Variable Annuity 7-Day Rule, Finra Variable Annuity 7 Day Rule 2024

- 1.2 Key Components of the 7-Day Rule

- 1.3 Procedures and Requirements for Applying the Rule

- 1.4 Exceptions and Limitations to the Rule

- 1.5 Implications for Investors and Financial Professionals

- 1.6 Recent Developments and Future Trends

- 2 Closing Notes

- 3 Top FAQs: Finra Variable Annuity 7 Day Rule 2024

FINRA’s Variable Annuity 7-Day Rule

The FINRA 7-Day Rule, formally known as the “Right of Rescission,” is a critical consumer protection measure within the variable annuity market. This rule grants investors a seven-day “cooling-off” period during which they can cancel their variable annuity contract without penalty.

Annuity options are available in New Zealand. Explore the specifics of Annuity Nz 2024 to understand how they work in the New Zealand market.

This article provides a comprehensive overview of the FINRA 7-Day Rule, exploring its purpose, key components, procedures, exceptions, and implications for both investors and financial professionals.

Annuity and pension are often used interchangeably, but they have distinct differences. Learn about the key differences between Is Annuity The Same As Pension 2024 to make informed decisions.

Overview of FINRA’s Variable Annuity 7-Day Rule, Finra Variable Annuity 7 Day Rule 2024

The FINRA 7-Day Rule is a federal regulation enforced by the Financial Industry Regulatory Authority (FINRA) that allows investors to cancel a variable annuity contract within seven days of signing it. This rule is designed to protect investors from making hasty decisions and ensure they have ample time to understand the complex features and potential risks associated with variable annuities.

Annuity is a term that can be confusing, but it’s actually quite simple. Learn more about Annuity 7 Letters 2024 and its implications for your retirement savings.

The purpose of the rule is to give investors a “free look” period to review the contract and consult with financial advisors or other professionals before committing to the investment. It allows investors to assess the contract’s terms, fees, and investment options, ensuring they make an informed decision.

This rule is particularly significant for investors who may be unfamiliar with variable annuities and their complexities.

When calculating the present value of an annuity, factoring in growth is important. Discover how to determine the Pv Annuity With Growth 2024 for more accurate financial planning.

The 7-Day Rule has its roots in the Securities Act of 1933, which aimed to protect investors by providing them with sufficient information and a reasonable period to consider their investment decisions. The rule has evolved over time to address changes in the variable annuity market and the increasing complexity of these products.

Key Components of the 7-Day Rule

The FINRA 7-Day Rule encompasses several key components that define its application and impact on investors.

Variable annuities provide quarterly statements that outline your account’s performance. Learn more about Variable Annuity Quarterly Statement 2024 and how to interpret the information.

- 7-Day Cooling-Off Period:The rule mandates a seven-day period from the date the investor signs the variable annuity contract, during which they can rescind the contract without penalty. This period provides investors with sufficient time to review the contract and consult with advisors.

Understanding the tax implications of annuities is essential. Learn about the taxability of annuity interest by checking out Is Annuity Interest Taxable 2024 for more information.

- Free Look Period:The 7-Day Rule is closely linked to the concept of a “free look” period, which is a broader concept allowing investors to review and potentially cancel certain insurance policies, including variable annuities, within a specific timeframe. The 7-Day Rule is essentially the “free look” period for variable annuities, providing investors with the right to cancel the contract without penalty within seven days.

Need to calculate the present value of an annuity in Excel? Check out this helpful guide on Calculating Annuity Present Value In Excel 2024 for a step-by-step walkthrough. It covers the PV function and provides examples for different scenarios.

- Covered Contracts:The 7-Day Rule applies to all variable annuity contracts issued by insurance companies and sold through registered representatives. These contracts are subject to the rule’s rescission provisions, ensuring investors have the right to cancel them within the seven-day period.

Procedures and Requirements for Applying the Rule

To exercise their right of rescission under the 7-Day Rule, investors must follow specific procedures and provide necessary documentation. The steps involved in this process are:

- Notification:The investor must notify the insurance company in writing within the seven-day period that they intend to rescind the contract. The notification must be sent by certified mail or another method that provides proof of delivery.

- Documentation:The investor must return the original variable annuity contract to the insurance company. This is crucial to formally rescind the contract and ensure that the insurance company acknowledges the cancellation.

- Timeframes and Deadlines:The seven-day period for rescission begins on the date the investor signs the variable annuity contract. The investor must send the written notification and return the contract within this timeframe. If the notification and contract are not received by the insurance company within seven days, the rescission right may be forfeited.

In times of financial hardship, you may be able to withdraw funds from your annuity. Explore the details of Annuity Hardship Withdrawal 2024 to see if you qualify.

Exceptions and Limitations to the Rule

While the FINRA 7-Day Rule provides a valuable protection for investors, there are certain exceptions and limitations to its application.

An annuity is essentially a stream of regular payments. Understand the basics of An Annuity Is A Stream Of 2024 to make informed financial decisions.

- Exclusions:The 7-Day Rule does not apply to certain types of variable annuity contracts, such as those purchased through an employer-sponsored retirement plan (e.g., 401(k)). These contracts may have different rescission provisions or may not be subject to the rule.

Variable annuities offer optional living benefits that can provide income guarantees and protection against market downturns. Explore the details of Variable Annuity Optional Living Benefits 2024 to see if they align with your retirement goals.

- Consequences of Violation:If an investor violates the 7-Day Rule by failing to follow the proper procedures or exceeding the seven-day timeframe, they may forfeit their right to rescind the contract. The insurance company may also pursue legal action to enforce the contract.

- FINRA Enforcement:FINRA plays a critical role in enforcing the 7-Day Rule. They investigate complaints and take disciplinary actions against firms or individuals who violate the rule. This ensures that the rule is effectively implemented and protects investors from unfair practices.

Implications for Investors and Financial Professionals

The FINRA 7-Day Rule has significant implications for both investors and financial professionals involved in the variable annuity market.

An annuity is a financial product that provides a steady stream of income. Discover what an annuity is and how it works by visiting Annuity Is What 2024.

- Benefits and Risks for Investors:The 7-Day Rule provides investors with a valuable opportunity to reconsider their investment decision and avoid potential financial losses. However, it is crucial for investors to understand the rule’s limitations and ensure they follow the proper procedures for exercising their right of rescission.

If you’re considering an annuity, you might need to calculate its value based on half-yearly payments. Learn about the Annuity Formula Half Yearly 2024 for a clear understanding.

Investors should also be aware of the potential risks associated with variable annuities, including market volatility, investment fees, and surrender charges.

- Ethical Considerations for Financial Professionals:Financial professionals have an ethical obligation to provide clients with clear and accurate information about variable annuities, including the 7-Day Rule. They must ensure that clients understand the complexities of these products and their rights under the rule. Financial professionals should also avoid making misleading or exaggerated claims about variable annuities, as this could lead to ethical violations and regulatory scrutiny.

- Comparison with Other Regulatory Provisions:The FINRA 7-Day Rule is one of several regulatory provisions that govern the variable annuity market. It complements other rules, such as those related to suitability, disclosure, and sales practices, to ensure investor protection. Financial professionals must be familiar with all applicable regulations and ensure they comply with them in their dealings with clients.

Recent Developments and Future Trends

The FINRA 7-Day Rule is a dynamic regulation that may be subject to changes and updates in response to evolving market conditions and investor needs. Recent developments in the variable annuity market have led to increased scrutiny of these products and their potential risks.

This has prompted regulators to consider potential revisions to the 7-Day Rule to enhance investor protection and ensure fair market practices.

Need to calculate the Internal Rate of Return (IRR) for an annuity? This guide on Irr Calculator Annuity 2024 explains how to use an IRR calculator for annuities.

Future trends in the variable annuity industry, such as the increasing popularity of variable annuities with guaranteed lifetime withdrawal benefits (GLWBs), may also influence the application and interpretation of the 7-Day Rule. Regulators will likely continue to monitor these developments and adapt the rule to address emerging challenges and protect investors.

Closing Notes

Understanding the Finra Variable Annuity 7 Day Rule 2024 is essential for anyone considering investing in variable annuities. By providing investors with a seven-day window to review and potentially reverse their decision, the rule promotes informed decision-making and protects individuals from potentially unfavorable investments.

The rule serves as a critical safeguard, ensuring that investors have the necessary time and resources to make well-considered choices about their financial future.

Top FAQs: Finra Variable Annuity 7 Day Rule 2024

What happens if I exercise my right of rescission within the 7-day period?

If you choose to rescind the contract within the 7-day period, you must notify the insurance company in writing. The company will then return any premiums paid and cancel the contract.

Does the 7-day rule apply to all types of variable annuities?

The rule applies to most types of variable annuities, but there may be exceptions for certain specialized contracts. It’s important to consult with a financial advisor to determine if the rule applies to your specific situation.

What are the potential consequences of violating the 7-day rule?

Violating the 7-day rule can result in fines and other penalties for both the insurance company and the financial professional involved. It is crucial to comply with the rule’s requirements to avoid any legal ramifications.