Variable Annuity Examples 2024: In today’s complex financial landscape, understanding different investment options is crucial. Variable annuities, with their potential for growth and tax advantages, are a popular choice for many investors. This guide explores the intricacies of variable annuities, providing real-world examples and insights to help you make informed decisions.

Variable annuities offer a unique blend of investment growth and income security, making them an attractive option for individuals seeking to diversify their portfolios and plan for retirement. They allow investors to participate in the stock market while providing downside protection through guaranteed minimum death benefits and living benefit riders.

Variable annuities come with various guarantees. Find out what guarantees are typically included in variable annuity contracts in 2024 to ensure your investment is protected.

This guide delves into the workings of variable annuities, highlighting their features, benefits, and risks, and providing a comprehensive understanding of their role in modern investment strategies.

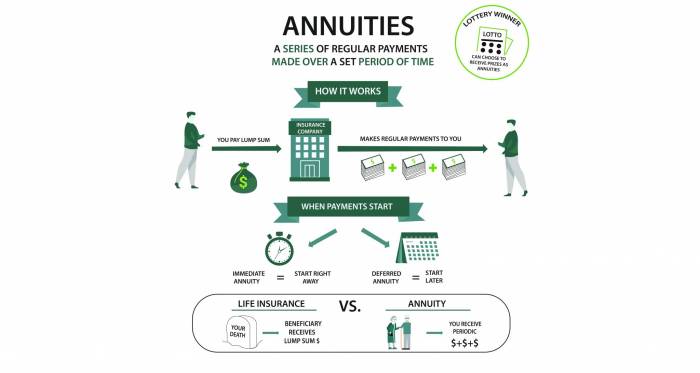

Annuity can be a complex topic, but understanding the basics is essential. Find a simple explanation of annuities in 2024 to get started.

Contents List

- 1 What is a Variable Annuity?

- 2 How Variable Annuities Work

- 3 Key Features of Variable Annuities

- 4 Variable Annuity Examples in 2024

- 5 Considerations Before Investing in a Variable Annuity: Variable Annuity Examples 2024

- 6 Variable Annuities vs. Other Investment Options

- 7 Final Conclusion

- 8 Questions and Answers

What is a Variable Annuity?

A variable annuity is a type of insurance contract that provides income for life, but unlike a fixed annuity, the amount of income you receive can fluctuate based on the performance of the underlying investments.

Deferred variable annuities offer flexibility in starting income payments. Learn about the definition of a deferred variable annuity in 2024 to explore this option.

Variable Annuities vs. Fixed Annuities

Unlike fixed annuities, which guarantee a fixed rate of return, variable annuities offer the potential for higher returns but also carry the risk of losing money.

If you’re looking for information on variable annuities in Kannada, you can find a translation of the meaning of variable annuities in Kannada in 2024 to understand the concept in your preferred language.

The key difference lies in how the investment is managed. Fixed annuities invest in conservative assets like bonds, guaranteeing a specific interest rate. Variable annuities, on the other hand, invest in a variety of assets, including stocks, bonds, and mutual funds, allowing for greater potential growth but also higher risk.

One of the key benefits of annuities is the guarantee of income. Learn if annuities are truly guaranteed in 2024 to understand the level of security they offer.

History of Variable Annuities

Variable annuities first emerged in the 1950s as a way for individuals to access the stock market through a tax-deferred vehicle. The concept of a variable annuity was introduced to offer a more flexible alternative to traditional fixed annuities, providing investors with the opportunity to participate in market growth.

Over the years, variable annuities have evolved with the introduction of features like guaranteed minimum death benefits and living benefit riders, making them more attractive to a wider range of investors.

How Variable Annuities Work

Variable annuities work by allowing you to invest your money in a variety of sub-accounts, each representing a different investment strategy. You can choose from a range of investment options, such as mutual funds, ETFs, or individual stocks, based on your risk tolerance and investment goals.

Investment Options within Variable Annuities

- Mutual Funds:Offer diversification by investing in a basket of stocks, bonds, or other assets. They are managed by professional fund managers.

- Exchange-Traded Funds (ETFs):Similar to mutual funds, but they trade on stock exchanges like individual stocks, providing more flexibility.

- Individual Stocks:Offer the potential for higher returns but also carry greater risk.

- Bonds:Provide income and are generally considered less risky than stocks.

Investment Performance and Annuity Value, Variable Annuity Examples 2024

The value of your variable annuity fluctuates based on the performance of your chosen investments. If your investments perform well, the value of your annuity will increase, and you will receive higher income payments. Conversely, if your investments perform poorly, the value of your annuity will decrease, and your income payments may be lower.

Sub-Accounts and Growth Potential

Each sub-account within a variable annuity represents a separate investment. You can allocate your money across different sub-accounts based on your risk tolerance and investment goals. The growth potential of each sub-account will depend on the underlying investments and their performance.

Variable annuities offer the potential for growth but also carry some risk. Understanding the separate account aspect of variable annuities in 2024 is crucial for making informed investment choices.

Key Features of Variable Annuities

Variable annuities offer several key features designed to enhance their appeal to investors.

Guaranteed Minimum Death Benefit (GMDB)

A GMDB guarantees a minimum payout to your beneficiaries upon your death, even if the value of your annuity has decreased. This feature provides peace of mind, ensuring your beneficiaries will receive a certain amount regardless of market performance.

Living Benefit Riders

Living benefit riders provide additional guarantees, such as a minimum income stream or a guaranteed growth rate. They can help protect your principal and provide a safety net during periods of market volatility. The specific features and benefits of living benefit riders vary depending on the provider and the policy.

Putnam Capital Manager 5 is a popular variable annuity option. You can learn more about the Putnam Capital Manager 5 Variable Annuity in 2024 to see if it’s a good fit for your investment needs.

Advantages and Disadvantages of Variable Annuities

Advantages:

- Tax-Deferred Growth:Earnings within a variable annuity are not taxed until they are withdrawn, allowing your investment to grow tax-deferred.

- Potential for Higher Returns:The potential for higher returns compared to fixed annuities is a major advantage.

- Flexibility:Variable annuities offer a variety of investment options to suit different risk tolerances and investment goals.

- Income for Life:Variable annuities can provide income for life, providing financial security during retirement.

Disadvantages:

- Risk of Loss:The value of your annuity can decrease if your investments perform poorly, and you may lose money.

- High Fees:Variable annuities typically carry higher fees than fixed annuities, including administrative fees, investment management fees, and surrender charges.

- Complexity:Variable annuities can be complex to understand and manage, requiring a higher level of financial literacy.

Variable Annuity Examples in 2024

Here is a table comparing three variable annuity products from different providers. Please note that this is for illustrative purposes and specific features and fees may vary depending on the provider and the policy.

Variable Annuity Product Comparison

| Provider | Minimum Investment | Investment Options | Fees | Living Benefit Riders | Other Features |

|---|---|---|---|---|---|

| Provider A | $5,000 | Mutual Funds, ETFs, Individual Stocks | 1.25% Annual Fee, 2% Surrender Charge | Guaranteed Lifetime Withdrawal Benefit, Guaranteed Minimum Income Benefit | Death Benefit, Tax-Deferred Growth |

| Provider B | $10,000 | Mutual Funds, ETFs, Managed Accounts | 1.50% Annual Fee, 1% Surrender Charge | Guaranteed Minimum Income Benefit, Enhanced Death Benefit | Tax-Deferred Growth, Long-Term Care Rider |

| Provider C | $25,000 | Mutual Funds, ETFs, Individual Stocks, Annuities | 1.00% Annual Fee, 3% Surrender Charge | Guaranteed Minimum Income Benefit, Guaranteed Minimum Death Benefit | Tax-Deferred Growth, Rollover Options |

Hypothetical Scenario

Imagine you invest $100,000 in a variable annuity with a hypothetical average annual return of 7%. Over a 20-year period, your investment could grow to approximately $386,968, assuming a 7% annual return. However, it’s important to note that this is a hypothetical example, and actual returns may vary based on market conditions.

Tax Implications

Variable annuities offer tax-deferred growth, meaning earnings are not taxed until they are withdrawn. However, withdrawals from a variable annuity are taxed as ordinary income, which can be higher than capital gains tax rates. This is a key difference compared to other investments like traditional IRAs or 401(k)s, where withdrawals are taxed as ordinary income, while withdrawals from Roth IRAs are tax-free.

Understanding the tax implications of variable annuities is important. You can find information on the tax treatment of variable annuities in 2024 to make informed financial decisions.

Considerations Before Investing in a Variable Annuity: Variable Annuity Examples 2024

Before investing in a variable annuity, it’s essential to consider several factors to ensure it aligns with your financial goals.

Suitability for Your Financial Goals

- Risk Tolerance:Variable annuities carry a higher risk of loss than fixed annuities. Consider your risk tolerance and whether you are comfortable with the potential for market fluctuations.

- Time Horizon:Variable annuities are generally best suited for long-term investments, as they offer the potential for higher returns over time.

- Investment Goals:Determine whether a variable annuity aligns with your investment goals, such as retirement planning, income generation, or estate planning.

Potential Returns vs. Other Investment Options

Compare the potential returns of a variable annuity to other investment options, such as mutual funds, ETFs, or individual stocks. Consider the fees associated with each investment and the potential for growth.

While annuities are often associated with regular payments, some types are based on a single lump sum. Discover whether an annuity can be a single payment in 2024 to explore different options.

Diversification within a Portfolio

Variable annuities can be used as part of a diversified investment portfolio. They can provide a source of income and potential growth while diversifying your investments across different asset classes.

Knowing how much you’ll receive from an annuity is crucial. Learn how to calculate the payout of an annuity in 2024 to plan for your future financial security.

Variable Annuities vs. Other Investment Options

Variable annuities can be compared to other investment options, such as traditional mutual funds and ETFs.

Variable Annuities vs. Mutual Funds and ETFs

Variable Annuities

- Advantages:Tax-deferred growth, potential for higher returns, income for life, death benefit, living benefit riders.

- Disadvantages:High fees, risk of loss, complexity.

Mutual Funds and ETFs

- Advantages:Lower fees, diversification, transparency, liquidity.

- Disadvantages:Taxable income, no guaranteed income, no death benefit, no living benefit riders.

Choosing the Best Investment Strategy

The best investment strategy depends on your individual financial needs and goals. Consider factors such as your risk tolerance, time horizon, investment goals, and tax situation. Consult with a financial advisor to determine the most suitable investment option for your circumstances.

Final Conclusion

By carefully evaluating your financial goals, risk tolerance, and investment horizon, you can determine if variable annuities are a suitable addition to your portfolio. This guide has provided a framework for understanding the intricacies of variable annuities, empowering you to make informed decisions and navigate the complex world of financial planning.

Variable annuity sales have been fluctuating in recent years. You can find data on variable annuity sales from 2020 to 2024 to get a sense of the market trend.

Questions and Answers

What are the potential risks associated with variable annuities?

If you’re 65 and looking for a steady stream of income, an annuity might be a good option. You can find out more about annuities for 65-year-old males in 2024 and see if it’s right for you.

Variable annuities carry investment risk, as the value of your investment can fluctuate based on market performance. Additionally, they may have high fees and complex features that can make them difficult to understand.

To determine the true value of an annuity, you need to know the interest rate. Learn how to calculate the interest rate of an annuity in 2024 to understand your potential returns.

How do I choose the right variable annuity for my needs?

When considering an annuity, it’s important to understand the present value of your investment. Learn how to calculate the present value of an annuity in 2024 to make informed decisions.

Consider your investment goals, risk tolerance, and time horizon. Compare different products from reputable providers, focusing on features, fees, and potential returns.

Annuity jokes can be funny, but understanding the basics is essential. You can find some lighthearted annuity jokes for 2024 to help you learn more about this financial product.

Are variable annuities suitable for everyone?

Variable annuities may not be appropriate for all investors. They are best suited for individuals with a long-term investment horizon and a willingness to accept market risk.

What are the tax implications of variable annuities?

Withdrawals from variable annuities are generally taxed as ordinary income. However, there may be tax advantages associated with certain features, such as guaranteed minimum death benefits and living benefit riders.