Immediate Annuity Rates 2024 offer a compelling solution for individuals seeking a steady stream of income during retirement. These annuities, which provide guaranteed payments starting immediately, have become increasingly popular in recent years as investors seek to mitigate market volatility and secure their financial future.

Determining how much annuity you can receive for a specific amount, such as $100,000, requires a careful calculation. The amount of annuity you receive will depend on several factors, including your age, gender, interest rates, and the type of annuity you choose.

You can use an online calculator or consult with a financial advisor to determine how much annuity you can receive for $100,000.

This guide delves into the intricacies of immediate annuities, exploring the factors influencing their rates, the various types available, and the key considerations for choosing the right option. We’ll also discuss the advantages and disadvantages, tax implications, and frequently asked questions to help you navigate this important financial decision.

In simple terms, a variable annuity is a type of insurance contract that combines investment features with income guarantees. It allows you to invest your money in a variety of sub-accounts, which are typically mutual funds, while providing some protection against market downturns.

Contents List

- 1 Introduction to Immediate Annuities

- 2 Factors Influencing Immediate Annuity Rates in 2024

- 3 Types of Immediate Annuities: Immediate Annuity Rates 2024

- 4 Understanding Annuity Rate Quotes

- 5 Considerations When Choosing an Immediate Annuity

- 6 Advantages and Disadvantages of Immediate Annuities

- 7 Tax Implications of Immediate Annuities

- 8 Summary

- 9 FAQ Insights

Introduction to Immediate Annuities

An immediate annuity is a financial product that provides a guaranteed stream of income payments starting immediately after you purchase it. You essentially exchange a lump sum of money for a series of regular payments, providing a predictable and secure income stream for the rest of your life or for a specific period.

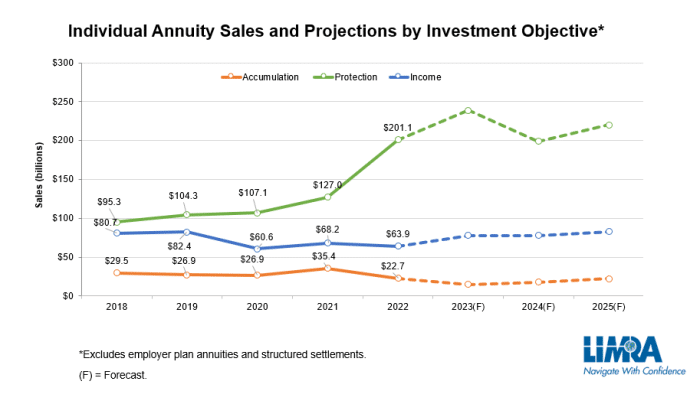

Variable annuities are a type of investment that has been growing in popularity in recent years. The sales of variable annuities have been increasing, as more investors seek to diversify their portfolios and potentially increase their returns.

Immediate annuities are popular for retirees seeking a reliable source of income and individuals looking to protect themselves against outliving their savings.

One of the factors to consider when investing in a variable annuity is the sales charge. This charge is a fee that is typically paid when you purchase the annuity. The sales charge can vary depending on the specific annuity you choose, so it’s important to compare different options before making a decision.

Immediate vs. Deferred Annuities

The key difference between immediate and deferred annuities lies in the timing of the income payments. An immediate annuity starts paying out right away, while a deferred annuity has a delay period before payments begin. Deferred annuities are often used for long-term financial planning, while immediate annuities are typically chosen for immediate income needs.

The Current Annuity Market

The annuity market has experienced significant growth in recent years, driven by factors such as low interest rates, increasing life expectancy, and growing demand for retirement income solutions. However, the market is constantly evolving, influenced by factors like economic conditions, regulatory changes, and consumer preferences.

The Hartford Director 7 Variable Annuity is a popular choice for those seeking a variable annuity with potential for growth. However, it’s important to understand the features and risks of the Hartford Director 7 Variable Annuity before investing. This will help you determine if it’s the right fit for your investment goals.

Factors Influencing Immediate Annuity Rates in 2024

Immediate annuity rates are influenced by various factors that can affect the returns you receive. Understanding these factors is crucial for making informed decisions about purchasing an annuity.

Interest Rates

Interest rates play a significant role in determining annuity rates. When interest rates rise, annuity providers can offer higher rates to attract investors. Conversely, when interest rates fall, annuity rates tend to decline. The Federal Reserve’s monetary policy decisions and overall economic conditions heavily influence interest rate movements.

Fidelity offers a range of variable annuities, including the Fidelity Variable Annuity. If you’re considering investing in a variable annuity from Fidelity, it’s important to research the Fidelity Variable Annuity to understand its features, fees, and risks. This will help you determine if it’s the right investment for your needs.

Inflation and Economic Conditions

Inflation erodes the purchasing power of money over time. Annuity providers consider inflation rates when setting annuity rates to ensure that payments maintain their value. Economic conditions, such as employment levels, consumer spending, and overall economic growth, can also impact annuity rates.

Regulatory Changes

The insurance industry is subject to various regulations that can affect annuity products. Changes in regulations, such as new requirements for capital reserves or changes in tax treatment, can influence annuity rates. Staying informed about relevant regulatory changes is important for annuity investors.

Variable annuities with downside protection can provide some protection against market downturns. These annuities typically have a guaranteed minimum return, which can help to limit your losses. If you’re looking for a variable annuity with downside protection, it’s important to research the specific features and risks of these annuities to determine if they’re right for you.

Market Demand for Annuities

The demand for annuities can also influence rates. When demand for annuities is high, providers may offer more competitive rates to attract investors. Conversely, low demand can lead to lower rates.

Types of Immediate Annuities: Immediate Annuity Rates 2024

Immediate annuities come in various forms, each with its unique features and benefits. Choosing the right type of annuity depends on your individual financial goals and risk tolerance.

Fixed Annuities

Fixed annuities provide a guaranteed rate of return for the life of the contract. This means your payments will remain consistent, regardless of market fluctuations. Fixed annuities are ideal for those seeking predictable income and protecting against investment risk.

Variable Annuities

Variable annuities offer the potential for higher returns but also carry more risk. Your payments are tied to the performance of underlying investments, such as stocks or mutual funds. Variable annuities can be suitable for those with a longer investment horizon and a higher risk tolerance.

A PV Annuity of 1 table is a helpful tool for calculating the present value of an annuity. This table can be used to determine the present value of a stream of future payments, which can be useful for making financial decisions.

You can find a PV Annuity of 1 table online or in financial textbooks.

Indexed Annuities

Indexed annuities offer a combination of guaranteed income and potential growth. Your payments are linked to the performance of a specific index, such as the S&P 500. Indexed annuities provide downside protection against market losses while offering the opportunity to participate in market gains.

Understanding Annuity Rate Quotes

An annuity rate quote provides a detailed breakdown of the terms and conditions of an annuity contract. Understanding the key components of a rate quote is crucial for comparing different annuity options.

Annuity income can provide a steady stream of income during retirement, but it’s important to understand how it works. There are many secrets to maximizing your annuity income. These secrets can help you make the most of your annuity investment and ensure you receive the maximum amount of income possible.

Key Components of an Annuity Rate Quote

- Interest Rate:The interest rate determines the amount of your annuity payments.

- Payment Frequency:You can choose to receive payments monthly, quarterly, annually, or at other intervals.

- Death Benefit:Some annuities include a death benefit, which guarantees a payout to your beneficiaries upon your death.

Factors Influencing Rate Variations

Annuity rates can vary significantly between providers due to factors such as:

- Provider’s Financial Strength:Providers with strong financial stability and a history of sound investment practices may offer more competitive rates.

- Annuity Type:Fixed, variable, and indexed annuities have different risk profiles and return potential, which can influence their rates.

- Payment Options:The frequency of payments, the length of the payout period, and other payment options can impact the annuity rate.

Interpreting and Comparing Annuity Rate Quotes

When comparing annuity rate quotes, it’s essential to consider factors such as:

- Interest Rate:Compare the interest rates offered by different providers.

- Fees and Charges:Look for hidden fees or charges that can affect your overall returns.

- Guarantees:Assess the guarantees offered, such as death benefits, guaranteed minimum income, or protection against market losses.

Considerations When Choosing an Immediate Annuity

Selecting the right immediate annuity requires careful consideration of several factors to ensure it aligns with your financial goals and risk tolerance.

Variable annuities are a type of investment that can offer potential for growth, but they also come with risks. To understand these risks, it’s important to know the characteristics of variable annuities. These characteristics include the fact that the value of your investment can fluctuate based on the performance of the underlying investments, and that you may be subject to fees and expenses.

Essential Factors to Consider, Immediate Annuity Rates 2024

- Financial Goals:What are you hoping to achieve with an annuity? Are you seeking a guaranteed income stream, longevity protection, or a combination of both?

- Risk Tolerance:How comfortable are you with investment risk? Do you prefer a fixed annuity with guaranteed returns or a variable annuity with the potential for higher returns but also greater risk?

- Time Horizon:How long do you need the income stream to last? Consider your life expectancy and any potential future financial needs.

Researching Provider Financial Stability and Reputation

It’s crucial to research the financial stability and reputation of potential annuity providers. Look for providers with strong financial ratings, a history of sound investment practices, and a commitment to customer service.

Deciding between an annuity and an IRA can be a tough choice. Both offer tax advantages, but they have different features and benefits. Understanding the differences between an annuity and an IRA can help you choose the option that best aligns with your financial goals.

Comparing Annuity Contracts and Terms

Carefully compare the terms and conditions of different annuity contracts. Pay attention to factors such as interest rates, fees, guarantees, and payment options. Seek professional financial advice to ensure you understand the complexities of annuity contracts and make an informed decision.

Advantages and Disadvantages of Immediate Annuities

Immediate annuities offer both potential benefits and drawbacks. It’s essential to weigh these factors carefully before deciding if an immediate annuity is right for you.

Potential Benefits

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income, offering financial security and peace of mind.

- Longevity Protection:Immediate annuities can help protect you against outliving your savings, ensuring a steady income stream throughout your retirement years.

- Tax Advantages:Depending on the type of annuity and your individual circumstances, annuity payments may be tax-deferred or tax-free.

Potential Drawbacks

- Limited Flexibility:Once you purchase an immediate annuity, you generally cannot access your principal or change the payment terms.

- Potential for Lower Returns:Immediate annuity rates may be lower than other investment options, especially in a low-interest rate environment.

- Inflation Risk:Fixed annuities may not keep pace with inflation, eroding the purchasing power of your payments over time.

Comparison to Other Investment Options

Immediate annuities should be compared to other investment options, such as stocks, bonds, and real estate, to determine if they align with your financial goals and risk tolerance.

Variable annuities can offer potential for growth, but they also come with risks. Understanding the risks associated with variable annuities is crucial for making informed investment decisions. These risks can include market volatility, fees and expenses, and the potential for loss of principal.

Tax Implications of Immediate Annuities

The tax treatment of annuity payments and distributions can vary depending on the type of annuity and your individual circumstances. Understanding the tax implications of immediate annuities is crucial for maximizing your returns.

O Share Variable Annuities often have a surrender period, which is a period of time during which you may be subject to penalties if you withdraw your money. It’s important to understand the surrender period of an O Share Variable Annuity before investing to avoid any unexpected fees.

Tax Treatment of Annuity Payments and Distributions

In general, the portion of your annuity payments that represents a return of your principal is tax-free. However, the portion of your payments that represents interest or earnings is taxable as ordinary income.

Potential Tax Benefits and Drawbacks

- Tax-Deferred Growth:Some annuities offer tax-deferred growth, meaning that earnings are not taxed until they are withdrawn.

- Tax-Free Distributions:Certain types of annuities, such as qualified longevity annuity contracts (QLACs), may allow for tax-free distributions.

- Potential Tax Penalties:Early withdrawals from an annuity may be subject to tax penalties.

It’s essential to consult with a tax professional to understand the tax implications of immediate annuities in your specific situation. They can help you navigate the tax rules and maximize your potential tax benefits.

Summary

As you approach retirement, understanding the nuances of immediate annuities is crucial for making informed decisions. By carefully considering the factors discussed, you can choose an annuity that aligns with your financial goals and provides the level of income security you desire.

Annuity drawdown is a way to withdraw money from an annuity over time. It can be a useful option for retirees who want to access their savings while preserving the potential for growth. However, it’s important to understand the rules and regulations surrounding annuity drawdown to ensure you’re making informed decisions.

Remember, consulting with a financial advisor can help you tailor your strategy and ensure you’re making the most of this powerful retirement planning tool.

FAQ Insights

What are the risks associated with immediate annuities?

While immediate annuities offer guaranteed income, they also come with some risks. The primary risk is that interest rates may rise after you purchase an annuity, potentially leading to a lower return on your investment compared to other options. Additionally, annuity payouts may not keep pace with inflation, reducing the purchasing power of your income over time.

How do I compare annuity rates from different providers?

When comparing annuity rates, consider factors such as the interest rate, payment frequency, death benefit, and any additional features offered. Look for providers with a strong financial track record and a reputation for transparency. You can use online comparison tools or consult with a financial advisor to help you evaluate different options.

Annuity calculations can be complex, but understanding the basics is crucial for making informed financial decisions. If you’re looking to learn more about calculating an annuity in 2024 , there are many resources available online. These resources can help you understand the factors that influence annuity payments, such as interest rates, investment performance, and the length of the payout period.

Can I withdraw my principal from an immediate annuity?

Generally, immediate annuities are designed to provide a steady stream of income and do not allow for withdrawals of the principal. However, some annuities may offer limited withdrawal options, which can be subject to penalties or restrictions.