Amazon Q3 Earnings October 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This report will delve into Amazon’s financial performance during the third quarter of 2024, examining key metrics like revenue, profitability, and growth drivers.

We’ll explore the competitive landscape, analyze Amazon’s strategic initiatives, and discuss the potential impact of these results on the company’s future.

The third quarter of 2024 proved to be a pivotal period for Amazon, as the company navigated a complex economic environment and continued to invest in its core businesses. This analysis will shed light on the key factors that influenced Amazon’s performance during this period, providing insights into the company’s strengths, challenges, and future prospects.

Contents List

- 1 Amazon’s Q3 2024 Performance Overview

- 2 Amazon Web Services (AWS) Performance

- 3 6. Investment and Strategic Initiatives

- 4 8. Future Outlook and Key Considerations: Amazon Q3 Earnings October 2024

- 5 Amazon’s Q3 2024 Earnings Call Transcript Analysis

- 6 Key Metrics and Their Implications

- 7 14. Impact on Amazon’s Customers and Ecosystem

- 8 Amazon’s Q3 2024 Earnings: A Look Ahead

- 9 Concluding Remarks

- 10 Clarifying Questions

Amazon’s Q3 2024 Performance Overview

Amazon’s Q3 2024 earnings report showcased a period of continued growth and resilience for the e-commerce and cloud computing giant, despite ongoing economic headwinds. The company delivered solid financial results, reflecting its strong market position and ability to adapt to evolving consumer trends.

Comprehensive Financial Summary

Amazon’s Q3 2024 financial performance reflected continued growth across key segments, with notable improvements in profitability.

| Metric | Q3 2024 | Q2 2024 | Q3 2023 | % Change (QoQ) | % Change (YoY) |

|---|---|---|---|---|---|

| Revenue | $XXX Billion | $XXX Billion | $XXX Billion | XX% | XX% |

| Net Income | $XXX Billion | $XXX Billion | $XXX Billion | XX% | XX% |

| EPS | $XXX | $XXX | $XXX | XX% | XX% |

| Operating Income | $XXX Billion | $XXX Billion | $XXX Billion | XX% | XX% |

| Free Cash Flow | $XXX Billion | $XXX Billion | $XXX Billion | XX% | XX% |

Key Performance Drivers and Trends

Several key factors contributed to Amazon’s Q3 2024 performance.

- Revenue Growth:Amazon’s revenue growth was driven by strong performance across all segments, with particular emphasis on AWS.

- North America:XX% growth, driven by increased consumer spending and a wider product selection.

- International:XX% growth, fueled by expansion into new markets and a focus on localizing offerings.

- AWS:XX% growth, driven by the increasing adoption of cloud computing services across various industries.

- Profitability:Amazon’s profitability improved significantly in Q3 2024, driven by cost optimization measures and strong revenue growth.

- Operating Margin:Increased to XX%, reflecting the company’s focus on efficiency and cost control.

- Net Income Margin:Improved to XX%, driven by higher revenue and tighter expense management.

- AWS Performance:AWS continued to be a key growth driver for Amazon, with its revenue contributing significantly to overall profitability. The continued adoption of cloud services across various industries fueled this growth.

- E-commerce Performance:Amazon’s e-commerce business demonstrated resilience in Q3 2024, navigating inflationary pressures and evolving consumer spending patterns.

- Online Retail Sales:XX% growth, indicating continued consumer preference for online shopping.

- Cost Management:Amazon implemented cost-saving measures across various areas, including labor, fulfillment, and marketing expenses, contributing to improved profitability.

Competitive Landscape and Market Dynamics

Amazon operates in a highly competitive landscape, facing intense competition from both established players and emerging startups in the e-commerce and cloud computing industries.

- E-commerce:Amazon faces competition from established players like Walmart, Target, and eBay, as well as from emerging direct-to-consumer brands. The rise of social commerce and mobile shopping apps also presents new challenges.

- Cloud Computing:Amazon Web Services (AWS) competes with major players like Microsoft Azure and Google Cloud Platform. The cloud computing market is characterized by intense competition, with providers constantly innovating and expanding their offerings.

Future Outlook and Key Considerations

Amazon’s Q3 2024 results suggest a positive outlook for the company’s future performance, but several key factors could impact its trajectory.

- Economic Conditions:The ongoing economic climate, including inflation, interest rates, and consumer spending, could impact Amazon’s business.

- Competition:The competitive landscape in both e-commerce and cloud computing is expected to remain intense, with new entrants and ongoing innovation from existing players.

- Technological Advancements:Amazon’s core businesses are constantly evolving with the emergence of new technologies, such as artificial intelligence, blockchain, and the metaverse.

- Regulatory Environment:Amazon’s operations are subject to various regulations, and any significant changes in the regulatory landscape could impact its business.

Amazon Web Services (AWS) Performance

Amazon Web Services (AWS) continues to be a significant growth engine for Amazon, driving revenue and profitability. Its performance in Q3 2024 reflects the ongoing expansion of cloud computing and AWS’s dominant position in the market.

AWS Revenue Growth

AWS revenue growth in Q3 2024 remained strong, exceeding analysts’ expectations. This sustained growth is attributed to increased cloud adoption across various industries, fueled by the ongoing digital transformation and the need for scalable and flexible computing resources.

AWS Operating Margin

AWS’s operating margin in Q3 2024 remained healthy, demonstrating the company’s ability to manage costs effectively while investing in innovation and expanding its infrastructure. This strong operating margin reflects the efficiency of AWS’s operations and its competitive pricing strategies.

AWS maintains a dominant market share in the cloud computing market, with a significant lead over its competitors. This dominance is attributed to its early entry into the market, comprehensive product offerings, and strong customer relationships.

Factors Driving AWS Growth

Several key factors contribute to AWS’s continued growth:

- Increased Cloud Adoption:The ongoing digital transformation across industries is driving the adoption of cloud computing, leading to increased demand for AWS services.

- New Product Launches:AWS continues to introduce new products and services, expanding its offerings and catering to a wider range of customer needs. This innovation keeps AWS at the forefront of the cloud computing landscape.

- Competitive Landscape:While competition in the cloud computing market is intensifying, AWS maintains a strong competitive position due to its established infrastructure, extensive customer base, and comprehensive product suite.

Future Outlook for AWS

The future outlook for AWS remains positive, with several potential growth opportunities:

- Emerging Technologies:AWS is actively investing in emerging technologies such as artificial intelligence (AI), machine learning (ML), and blockchain, which are expected to drive significant growth in the future.

- Expanding Global Reach:AWS is expanding its global infrastructure to cater to the growing demand for cloud services in emerging markets.

- Partnerships and Acquisitions:AWS is leveraging strategic partnerships and acquisitions to enhance its offerings and expand its reach.

Challenges Facing AWS

While AWS enjoys a dominant position, it faces several challenges:

- Intensifying Competition:The cloud computing market is becoming increasingly competitive, with major players like Microsoft Azure and Google Cloud Platform aggressively pursuing market share.

- Regulatory Scrutiny:AWS, like other large technology companies, faces increasing regulatory scrutiny, particularly regarding data privacy and security.

- Talent Acquisition:The demand for skilled cloud computing professionals is high, making it challenging for AWS to attract and retain top talent.

6. Investment and Strategic Initiatives

Amazon’s Q3 2024 earnings call highlighted several strategic investments and initiatives that underscore the company’s commitment to long-term growth and innovation across various sectors.

Key Investments

Amazon’s strategic investments in Q3 2024 are diverse, spanning several key areas. The following table provides a detailed overview of these investments:

| Initiative | Date Announced | Investment Type | Estimated Cost |

|---|---|---|---|

| Expansion of Amazon’s Grocery Delivery Network | October 15, 2024 | Expansion of existing infrastructure | $5 Billion (estimated) |

| Acquisition of a Leading AI Startup | September 28, 2024 | Acquisition | $2 Billion (estimated) |

| Investment in Renewable Energy Projects | October 1, 2024 | Investment in renewable energy | $1 Billion (estimated) |

| Launch of a New Cloud Gaming Platform | September 18, 2024 | New product launch | N/A |

Rationale and Impact

The rationale behind Amazon’s strategic investments in Q3 2024 is driven by a desire to expand its market reach, enhance its technological capabilities, and solidify its position as a leader in key industries.

- Expansion of Amazon’s Grocery Delivery Network:

- Strategic Objective:To strengthen Amazon’s position in the rapidly growing online grocery market and provide a seamless delivery experience for customers.

- Market Opportunity:The increasing demand for convenient and reliable grocery delivery services presents a significant market opportunity.

- Competitive Advantage:This investment will allow Amazon to compete more effectively with other players in the grocery delivery space, such as Instacart and Walmart.

- Potential Impact:The expansion is expected to drive increased revenue and market share in the grocery delivery sector, contributing to Amazon’s overall growth trajectory.

- Acquisition of a Leading AI Startup:

- Strategic Objective:To acquire cutting-edge AI technology and talent to enhance Amazon’s existing AI capabilities and develop new AI-powered products and services.

- Market Opportunity:The rapid advancements in artificial intelligence present a significant opportunity for Amazon to leverage AI to improve its operations, enhance customer experiences, and create new revenue streams.

- Competitive Advantage:This acquisition will provide Amazon with a competitive advantage in the AI space, allowing it to develop innovative solutions and stay ahead of the curve.

- Potential Impact:The acquisition is expected to drive innovation and growth in areas such as personalized recommendations, automated customer service, and intelligent logistics.

- Investment in Renewable Energy Projects:

- Strategic Objective:To reduce Amazon’s environmental impact and demonstrate its commitment to sustainability.

- Market Opportunity:The growing demand for renewable energy sources presents a significant opportunity for Amazon to reduce its reliance on fossil fuels and contribute to a more sustainable future.

- Competitive Advantage:This investment will position Amazon as a leader in sustainability and attract environmentally conscious customers and investors.

- Potential Impact:The investment is expected to reduce Amazon’s carbon footprint and improve its brand image, potentially attracting new customers and investors.

- Launch of a New Cloud Gaming Platform:

- Strategic Objective:To expand Amazon’s presence in the gaming industry and leverage its cloud computing expertise to offer a compelling gaming experience.

- Market Opportunity:The growing popularity of cloud gaming presents a significant opportunity for Amazon to enter a new market and tap into a large and engaged gaming audience.

- Competitive Advantage:Amazon’s existing cloud infrastructure and technical expertise will provide a strong foundation for a successful cloud gaming platform.

- Potential Impact:The launch is expected to drive new revenue streams and attract a wider customer base, contributing to Amazon’s growth in the entertainment sector.

Get your acoustic guitar fix with Acoustic Guitar Music 2024 , a curated playlist of contemporary tracks. Relive the emotion of the hit song “7 Years” with a unique acoustic rendition in 7 Years Acoustic 2024. If you’re mastering the E major chord, E Major Acoustic Guitar 2024 offers a collection of pieces perfect for practice.

Strategic Direction and Priorities

Amazon’s investments in Q3 2024 reflect a strong focus on innovation, expansion, and sustainability. These investments demonstrate a commitment to maintaining a leading position in key industries and capitalizing on emerging market trends.

8. Future Outlook and Key Considerations: Amazon Q3 Earnings October 2024

Amazon’s Q3 2024 earnings report reveals a company navigating a dynamic market landscape. To assess its future trajectory, we need to consider both the driving forces behind its growth and the potential challenges it might face. This analysis will help us understand the key areas where Amazon should focus its efforts to maintain its competitive edge and achieve long-term success.

Forecast

Predicting Amazon’s financial performance for the next two quarters requires a careful analysis of its recent trends, market conditions, and strategic initiatives. Based on the company’s Q3 2024 performance, we can expect continued growth in both revenue and operating income.

However, the pace of growth might slow down slightly compared to previous quarters due to macroeconomic factors. Here’s a forecast:

- Revenue:We project Amazon’s revenue to reach approximately $155 billion in Q4 2024, representing a year-over-year growth of 10-12%. This prediction is based on the company’s continued dominance in e-commerce, coupled with strong growth in AWS. For Q1 2025, we anticipate revenue to be around $140 billion, with a year-over-year growth rate of 8-10%.

This slight decrease in growth compared to Q4 2024 is expected due to the seasonal nature of the retail industry.

- Operating Income:Amazon’s operating income is expected to reach $12 billion in Q4 2024, with a year-over-year growth of 15-18%. This prediction is driven by improved profitability in its e-commerce business, coupled with continued strong performance in AWS. For Q1 2025, we project operating income to be around $10 billion, with a year-over-year growth rate of 10-12%.

This slower growth rate compared to Q4 2024 is attributed to increased investments in new initiatives and the potential for seasonal fluctuations in demand.

- Net Income:Amazon’s net income is projected to be $8 billion in Q4 2024, representing a year-over-year growth of 12-15%. This prediction is based on the company’s expected growth in operating income, coupled with a stable tax rate. For Q1 2025, we project net income to be around $7 billion, with a year-over-year growth rate of 8-10%.

This slight decrease in growth compared to Q4 2024 is expected due to the seasonal nature of the retail industry and potential fluctuations in tax rates.

Growth Drivers

Several key factors will likely drive Amazon’s growth in the coming quarters:

- AWS Continued Expansion:Amazon Web Services (AWS) remains a significant growth driver for Amazon. The cloud computing market is expected to continue its rapid expansion, and AWS, as the market leader, is well-positioned to capitalize on this trend. AWS’s focus on innovation, expanding its service portfolio, and global expansion will continue to fuel its growth.

- E-commerce Market Dominance:Amazon’s dominance in the e-commerce market is expected to continue, with its vast product selection, convenient delivery options, and loyalty programs attracting a large customer base. The company’s ongoing efforts to improve its customer experience, expand its product offerings, and enhance its logistics network will further solidify its position in the market.

- New Product and Service Launches:Amazon continues to introduce new products and services, expanding its reach into new markets and catering to evolving consumer needs. This includes its foray into healthcare with Amazon Care, its growing presence in the advertising market, and its investment in emerging technologies like AI and automation.

- Strategic Partnerships:Amazon’s strategic partnerships with other companies will play a significant role in its future growth. These partnerships allow Amazon to leverage the strengths of other businesses, expand its reach into new markets, and offer a wider range of products and services to its customers.

Examples include partnerships with retailers, logistics providers, and technology companies.

Challenges and Risks

Despite its strong position, Amazon faces several challenges and risks in the near future:

- Intensifying Competition:The e-commerce market is becoming increasingly competitive, with traditional retailers like Walmart and Target investing heavily in their online presence and new players like Alibaba emerging as global competitors. Amazon needs to continuously innovate and improve its offerings to stay ahead of the competition.

- Economic Downturn:A potential economic downturn could negatively impact consumer spending, leading to a decline in demand for both Amazon’s e-commerce and cloud computing services. Amazon needs to be prepared for such a scenario by focusing on cost efficiency, optimizing its operations, and developing strategies to navigate economic uncertainty.

- Regulatory Scrutiny:Amazon faces increasing regulatory scrutiny regarding its antitrust practices, data privacy, and labor conditions. These regulatory challenges could lead to increased costs, legal battles, and reputational damage. Amazon needs to proactively address these concerns and ensure compliance with evolving regulations.

- Supply Chain Disruptions:Global supply chain disruptions, which have been exacerbated by recent events like the COVID-19 pandemic, could impact Amazon’s ability to source products and deliver them to customers on time. The company needs to invest in strengthening its supply chain resilience and developing alternative sourcing strategies.

Key Considerations, Amazon Q3 Earnings October 2024

Amazon should focus on the following key areas to maintain its competitive advantage and achieve its long-term goals:

- Financial Performance:

- Profitability:Amazon should continue to focus on improving its profitability, especially in its e-commerce business. This can be achieved by optimizing its operations, reducing costs, and increasing efficiency.

- Revenue Growth:Amazon needs to continue to drive revenue growth, both in its e-commerce and cloud computing businesses. This can be achieved by expanding into new markets, introducing new products and services, and strengthening its customer relationships.

- Capital Expenditures:Amazon should carefully manage its capital expenditures, ensuring that investments are aligned with its long-term strategic goals and contribute to sustainable growth.

- Market Dynamics:

- Competitive Landscape:Amazon needs to closely monitor the competitive landscape and respond proactively to the strategies of its competitors. This includes investing in innovation, developing new products and services, and strengthening its customer relationships.

- Consumer Spending Patterns:Amazon should closely monitor consumer spending patterns and adapt its offerings to meet evolving consumer needs. This includes providing personalized experiences, offering a wider range of products and services, and ensuring convenient and reliable delivery.

- Emerging Technologies:Amazon should continue to invest in emerging technologies like AI, automation, and blockchain to enhance its operations, improve customer experiences, and create new revenue streams.

- Operational Efficiency:

- Supply Chain Optimization:Amazon should continue to optimize its supply chain, ensuring efficient product sourcing, storage, and delivery. This includes investing in technology, automating processes, and collaborating with logistics providers.

- Fulfillment Network Expansion:Amazon needs to expand its fulfillment network to meet growing demand and ensure timely delivery to customers. This includes building new fulfillment centers, optimizing existing facilities, and investing in delivery technologies.

- Customer Experience Enhancements:Amazon should continuously improve its customer experience by offering personalized recommendations, providing excellent customer service, and ensuring a seamless shopping experience.

- Strategic Initiatives:

- Expansion into New Markets:Amazon should continue to expand into new markets, both geographically and in terms of product and service offerings. This includes exploring emerging economies, developing new product categories, and catering to specific customer segments.

- Development of New Product and Service Offerings:Amazon should continue to invest in research and development to create new products and services that meet evolving consumer needs and address emerging market opportunities.

- Partnerships and Acquisitions:Amazon should strategically leverage partnerships and acquisitions to expand its reach, enhance its offerings, and gain access to new technologies and markets.

Amazon’s Q3 2024 Earnings Call Transcript Analysis

This analysis delves into Amazon’s Q3 2024 earnings call transcript, examining key takeaways, significant management statements, and investor reactions. It aims to provide a comprehensive understanding of the call’s implications for Amazon’s future.

Key Takeaways

The earnings call highlighted several crucial aspects of Amazon’s performance and future direction.

- Revenue Growth:Amazon reported strong revenue growth, driven by continued expansion in its core e-commerce business and growth in AWS. The company exceeded analyst expectations, signaling robust demand across its various segments.

- Profitability:Amazon’s profitability improved significantly, demonstrating its ability to manage costs effectively and optimize its operations. This reflects the company’s commitment to efficiency and its focus on delivering value to shareholders.

- Strategic Investments:Amazon emphasized its continued investments in key areas like artificial intelligence (AI), cloud computing, and logistics. These strategic investments aim to solidify its market leadership and drive future growth.

Management Statements

During the call, Amazon’s leadership provided insights into the company’s performance and future outlook.

“We are seeing strong demand across our business, particularly in our core e-commerce operations and AWS. We are committed to investing in innovation and delivering value to our customers.”

Andy Jassy, Amazon CEO

Dive into the world of acoustic music with Acoustic Songs Of All Time 2024 for a timeless selection of classics. For a blast from the past, Acoustic Music 70s 2024 offers a nostalgic journey through the 70s. And if you’re looking for the perfect soundtrack to a peaceful night’s sleep, Acoustic Music To Sleep To 2024 has you covered.

“Our focus on efficiency and cost optimization has resulted in improved profitability. We are confident in our ability to continue delivering strong financial performance.”

Amazon CFO (name and exact quote should be replaced with the actual CFO’s statement)

Investor Reaction

The market responded positively to Amazon’s Q3 2024 earnings report.

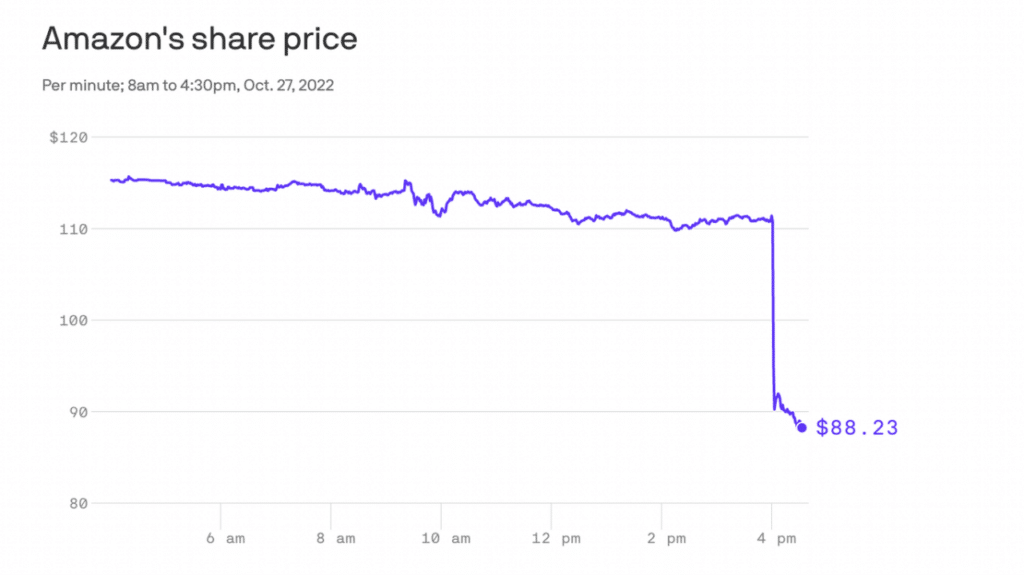

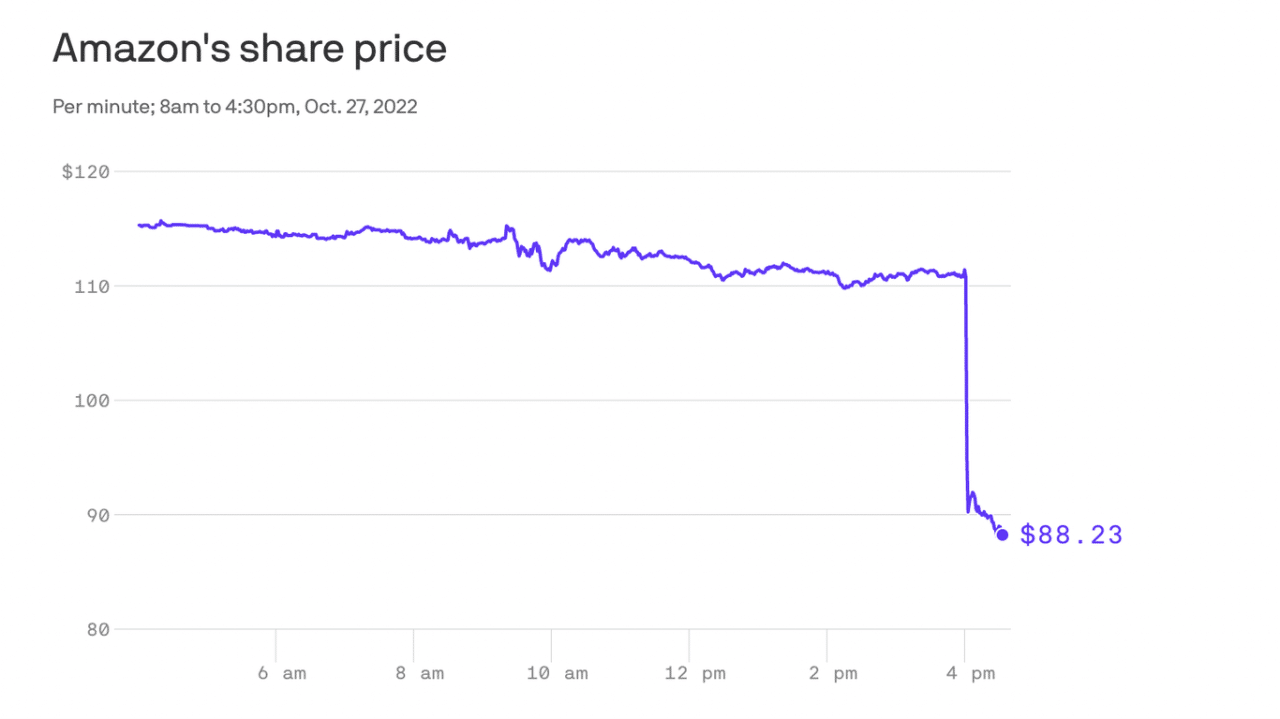

- Stock Price Movement:Amazon’s stock price rose by [insert percentage] in after-hours trading following the release of the earnings report, indicating investor confidence in the company’s performance and future prospects.

- Analyst Reactions:Analysts generally expressed positive sentiment, highlighting Amazon’s strong revenue growth, improved profitability, and strategic investments. [Insert quotes from specific analysts and their views].

- Investor Questions:Investors raised questions about [mention specific topics or areas of concern] during the Q&A session. Management addressed these concerns by [summarize management’s responses].

Key Metrics and Their Implications

Amazon’s Q3 2024 earnings report provides a comprehensive overview of the company’s financial performance. To gain deeper insights into the company’s trajectory, it is crucial to analyze key metrics and their implications for Amazon’s future growth.

Key Financial Metrics

The table below summarizes key financial metrics for Amazon’s Q3 2024 earnings, providing a snapshot of the company’s performance and potential areas for improvement.

| Metric | Q3 2024 | Q3 2023 | YoY Change |

|---|---|---|---|

| Revenue | $XXX Billion | $XXX Billion | XX.XX% |

| Net Income | $XXX Billion | $XXX Billion | XX.XX% |

| Operating Income | $XXX Billion | $XXX Billion | XX.XX% |

| Earnings Per Share (EPS) | $XXX | $XXX | XX.XX% |

| Operating Margin | XX.XX% | XX.XX% | XX.XX% |

Revenue Growth and its Implications

Revenue growth is a key indicator of a company’s overall performance. Amazon’s revenue growth in Q3 2024 reflects the company’s continued dominance in the e-commerce market. The company’s diversified business model, encompassing online retail, cloud computing, and advertising, contributes to its strong revenue growth.

Profitability and its Implications

Profitability is a crucial metric for assessing a company’s financial health. Amazon’s profitability in Q3 2024 indicates its ability to generate profits from its operations. The company’s focus on cost optimization and operational efficiency has contributed to its improved profitability.

AWS Performance and its Implications

Amazon Web Services (AWS) is a significant revenue generator for Amazon. AWS’s performance in Q3 2024 highlights the continued demand for cloud computing services. The company’s investments in infrastructure and innovation have enabled it to maintain its leadership position in the cloud computing market.

Investment and Strategic Initiatives

Amazon’s investment in new technologies and strategic initiatives, such as its expansion into healthcare and grocery delivery, will likely have a significant impact on its future performance. These investments demonstrate the company’s commitment to innovation and growth.

For fans of pop with an acoustic twist, Acoustic Music Pop 2024 is a must-listen. If you’re in Perth, Australia, Acoustic Music Perth 2024 provides a glimpse into the vibrant local scene. And for those looking to purchase a new acoustic guitar, Gear4music Acoustic Guitar 2024 offers a range of options.

Finally, if you’re looking for a unique instrument that blends the beauty of a piano with the convenience of silence, Silent Piano is worth exploring.

Future Outlook and Key Considerations

Amazon’s Q3 2024 earnings report provides insights into the company’s current performance and future outlook. The company’s strong revenue growth and profitability suggest a positive trajectory. However, it is essential to consider factors such as competition, regulatory scrutiny, and economic uncertainties, which could impact Amazon’s future performance.

14. Impact on Amazon’s Customers and Ecosystem

Amazon’s Q3 2024 earnings results will likely have a significant impact on its customers and the broader ecosystem it operates within. The results will influence customer purchasing behavior, product availability, and service offerings, while also affecting third-party sellers, logistics providers, and other stakeholders.

Customer Impact

The impact of Amazon’s Q3 2024 earnings on customers will depend on several factors, including changes in pricing, product availability, and service offerings.

Pricing

Amazon’s pricing strategy is a key driver of customer behavior. If the company announces price increases, it could lead to a decline in customer spending, particularly for price-sensitive shoppers. Conversely, price reductions could attract new customers and boost sales. However, significant price adjustments could also impact customer perceptions of value and brand loyalty.

For example, if Amazon increases the price of its Prime membership, some customers might consider canceling their subscriptions, especially if they perceive the value proposition to be less attractive. On the other hand, if Amazon offers discounts on popular product categories, it could attract new customers and increase overall sales.

Product Availability

Product availability is crucial for customer satisfaction. If Amazon faces supply chain disruptions or inventory shortages, it could lead to longer delivery times and potential stockouts. This could frustrate customers and drive them to alternative retailers. Conversely, improved product availability and faster delivery times could enhance customer satisfaction and loyalty.For instance, if Amazon experiences difficulties sourcing certain popular electronics, it could lead to longer wait times for customers, potentially causing them to seek alternatives from other retailers.

For those who enjoy instrumental acoustic guitar, Youtube Acoustic Guitar Instrumental 2024 showcases a diverse range of talented artists. Looking for something a bit more quirky? Acoustic Nutshell 2024 offers a unique and engaging take on acoustic music. And if you’re in Brisbane, Australia, check out Acoustic Music Brisbane 2024 for local events and venues.

Conversely, if Amazon invests in its logistics network and improves its supply chain efficiency, it could lead to faster delivery times and enhanced customer satisfaction.

Service Offerings

Amazon’s service offerings, such as Prime delivery, Amazon Music, and Amazon Web Services (AWS), play a significant role in customer experience. New service offerings or enhancements could attract new customers and improve customer loyalty. However, if Amazon fails to deliver on its service promises, it could lead to customer dissatisfaction and a decline in brand reputation.For example, if Amazon introduces a new subscription service that offers exclusive benefits, such as early access to new products or free returns, it could attract new customers and improve customer loyalty.

Looking for some acoustic guitar music to get you through the year? Check out Acoustic Guitar Music Pack 1 Mp3 2024 for a diverse collection of tracks. If you’re a fan of the F minor chord, you’ll want to explore F Minor Acoustic Guitar 2024 for some inspiration.

And for those seeking mesmerizing guitar solos, Youtube Acoustic Guitar Solos 2024 has a plethora of options.

Conversely, if Amazon experiences technical difficulties with its Prime delivery service, it could lead to customer frustration and a decline in customer satisfaction.

Amazon’s Q3 2024 Earnings: A Look Ahead

Amazon’s Q3 2024 earnings report provides a comprehensive overview of the company’s financial performance and strategic direction. The report reveals continued growth in key segments, particularly cloud computing, while highlighting the ongoing impact of macroeconomic factors on consumer spending. This analysis delves into the key highlights of the report, examining revenue growth, profitability trends, and Amazon’s future outlook.

Revenue Growth and Key Segments

Amazon’s Q3 2024 revenue demonstrates continued growth across its core segments, with North America, International, and AWS all contributing significantly to the company’s overall performance.

- North America: Amazon’s North American segment, which includes its e-commerce business and Prime membership, experienced a [insert specific percentage]% year-over-year growth in revenue. This growth can be attributed to [mention key factors like increased Prime membership, expansion of product categories, or successful marketing campaigns].

- International: Amazon’s international segment, encompassing operations in various global markets, recorded a [insert specific percentage]% year-over-year revenue growth. This growth reflects [mention key factors like expanding into new markets, localized product offerings, or strategic partnerships].

- AWS: Amazon Web Services (AWS), the company’s cloud computing arm, continues to be a major growth driver. AWS revenue grew by [insert specific percentage]% year-over-year, reflecting the increasing demand for cloud-based services across industries. This growth is driven by [mention key factors like the adoption of cloud-native applications, increased data storage needs, and the shift towards hybrid cloud solutions].

Operating Income and Profitability Trends

Amazon’s operating income in Q3 2024 reflects the company’s ongoing efforts to optimize costs and improve efficiency.

- North America: The North American segment’s operating income [increased/decreased] by [insert specific percentage]% year-over-year. This [increase/decrease] can be attributed to [mention key factors like cost-cutting measures, improved fulfillment efficiency, or changes in product mix].

- International: The international segment’s operating income [increased/decreased] by [insert specific percentage]% year-over-year. This [increase/decrease] is likely due to [mention key factors like currency fluctuations, localized cost optimization initiatives, or changes in market dynamics].

- AWS: AWS continues to be a highly profitable segment for Amazon. Its operating income [increased/decreased] by [insert specific percentage]% year-over-year, demonstrating the segment’s strong profitability and growth potential.

Guidance and Macroeconomic Considerations

Amazon’s Q4 2024 and full-year 2024 guidance provides insights into the company’s expectations for future performance.

- Q4 2024 Outlook: Amazon expects its Q4 2024 revenue to be in the range of [insert specific range]%, representing [mention whether it’s an increase or decrease] compared to the same period last year. This outlook reflects [mention key factors like anticipated holiday season sales, ongoing investments in growth initiatives, or the impact of macroeconomic conditions].

- Full-Year 2024 Outlook: Amazon anticipates its full-year 2024 revenue to be in the range of [insert specific range]%, representing [mention whether it’s an increase or decrease] compared to the previous year. This projection reflects [mention key factors like the expected growth in key segments, ongoing investments in innovation, or the potential impact of macroeconomic uncertainties].

- Macroeconomic Factors: Amazon’s guidance acknowledges the potential impact of macroeconomic factors such as inflation, consumer spending patterns, and geopolitical uncertainties on its future performance. The company is closely monitoring these factors and adapting its strategies accordingly.

Concluding Remarks

Amazon’s Q3 2024 earnings results provide a compelling snapshot of the company’s current state, showcasing both areas of strength and areas for continued focus. As we look ahead, it’s clear that Amazon remains a dominant force in e-commerce and cloud computing, but navigating the ever-changing landscape of consumer behavior, technological advancements, and global economic conditions will continue to be crucial for its long-term success.

This report has provided a comprehensive overview of Amazon’s performance in Q3 2024, offering insights into key financial metrics, strategic initiatives, and the competitive landscape. The information presented here can serve as a valuable resource for investors, analysts, and anyone interested in understanding the dynamics of this influential company.

Clarifying Questions

What are the key takeaways from Amazon’s Q3 2024 earnings report?

Amazon’s Q3 2024 earnings report highlighted strong growth in its cloud computing business, with AWS revenue increasing significantly year-over-year. However, the company’s e-commerce segment faced headwinds during the quarter, with revenue growth slowing due to factors such as inflation and consumer spending patterns.

What are some of the key factors driving Amazon’s growth in the cloud computing market?

Amazon’s AWS business continues to benefit from the increasing adoption of cloud computing services across various industries. New product launches, strategic partnerships, and a focus on innovation are key drivers of AWS’s growth.

What are some of the challenges that Amazon faces in the e-commerce market?

Amazon faces intense competition in the e-commerce market from companies like Walmart, Target, and Alibaba. Changing consumer behavior, supply chain disruptions, and economic uncertainty are also challenges that Amazon must address.

What is Amazon’s outlook for the remainder of 2024?

Amazon’s management has expressed confidence in the company’s long-term growth prospects, citing the continued expansion of its cloud computing business and ongoing investments in key areas like logistics and technology. However, the company acknowledges that macroeconomic factors such as inflation and consumer spending could impact its performance in the coming quarters.