D Acoustic Guitar Chord 2024: This ubiquitous chord, a cornerstone of countless melodies, has a rich history and versatile application. From its humble beginnings to its modern-day prominence, the D chord has evolved alongside the acoustic guitar, adapting to diverse musical styles and serving as a fundamental building block for countless musicians.

The concept of an “acoustic challenge” can be interpreted in many ways. If you’re interested in understanding the different definitions and applications of this term, you can find a comprehensive explanation here. From music competitions to environmental noise control, the term “acoustic challenge” covers a wide range of topics.

This guide explores the D chord’s evolution, structure, mastering techniques, and its impact on popular music.

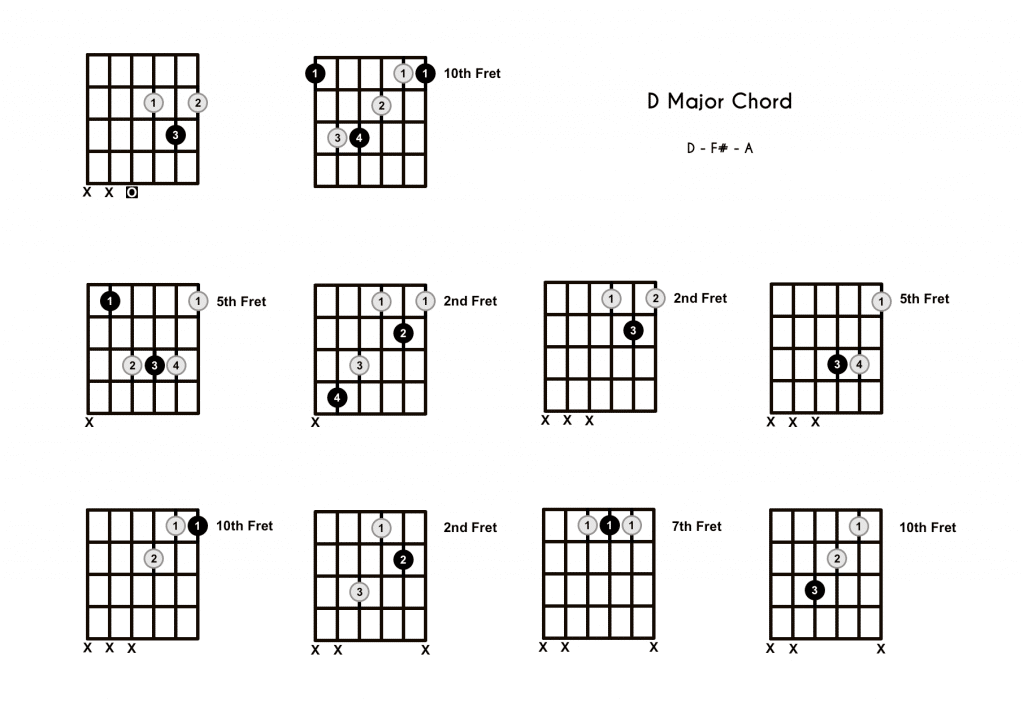

Understanding the D chord’s structure and finger placement is crucial for achieving a clear and resonant sound. We’ll delve into the standard fingering, analyze its theoretical basis, and explore alternative fingerings for greater versatility. We’ll also address common challenges encountered while learning the D chord and provide practical solutions for overcoming them.

If you’re considering buying a silent piano, you might be interested in learning about the latest advancements in this technology. You can find a detailed article about the revolutionary impact of silent pianos here. Silent pianos offer a unique solution for musicians who need to practice without disturbing others.

Closing Notes: D Acoustic Guitar Chord 2024

The D chord is more than just a fundamental building block; it’s a gateway to creative expression. By mastering its nuances, you unlock a world of musical possibilities. Whether you’re a seasoned guitarist or a beginner, this guide provides a comprehensive framework for understanding and utilizing the D chord effectively.

The field of acoustic solutions is constantly evolving, with new products and technologies emerging all the time. If you’re interested in exploring the latest innovations in noise reduction and acoustic design, you can find a comprehensive overview here.

From soundproofing materials to acoustic panels, there are many ways to create a quieter and more comfortable environment.

Explore its history, its structure, and its application in music, and embark on a journey of musical exploration.

Frequently Asked Questions

What is the easiest way to learn the D chord?

Are you looking for the latest information on Tony’s Acoustic Challenge? You can find details on the cost, refund policy, and even a downloadable PDF guide by clicking here. You can also read reviews and compare prices for the Challenger Acoustic Guitar, which is often mentioned in conjunction with Tony’s challenge.

Start with the standard fingering and practice gradually, focusing on finger placement and hand position. Break down the chord into smaller parts and practice each finger individually before putting them together.

The sound of an acoustic guitar is often described as warm and natural. If you’re interested in learning more about the factors that influence an acoustic guitar’s sound, you can read this article here. From the type of wood used to the construction techniques, many elements contribute to the unique sound of an acoustic guitar.

What are some common mistakes when playing the D chord?

Common mistakes include incorrect finger placement, weak finger pressure, and neglecting to use all three fingers. Pay attention to these aspects during practice to avoid these pitfalls.

How can I make the D chord sound better?

The Challenger Acoustic Guitar is a popular choice for aspiring guitarists. If you’re curious about its features and price, you can check out this article here. There’s a lot of discussion online about the Challenger, and you can find plenty of information about its sound quality and performance.

Experiment with alternative fingerings, adjust finger pressure, and practice smooth transitions to enhance the D chord’s sound.