Meta Earnings Date October 2024 is a highly anticipated event in the tech world, as investors and analysts eagerly await insights into the company’s financial performance and strategic direction. The third quarter of 2024, encompassing July to September, witnessed a period of significant developments for Meta, including continued investments in artificial intelligence (AI) and the metaverse.

These investments, along with macroeconomic factors and the competitive landscape, will likely play a key role in shaping Meta’s earnings results for the quarter.

As we delve deeper into the analysis, we will explore key financial metrics such as revenue, net income, and user growth, examining their performance in comparison to previous quarters and the same period last year. We will also discuss the impact of recent macroeconomic conditions on Meta’s financial performance, highlighting any significant changes or trends observed.

The analysis will further delve into Meta’s revenue drivers and growth areas, identifying key initiatives and investments that contributed to growth during the third quarter. Finally, we will assess the potential impact of Meta’s recent investments in AI and the metaverse on its earnings, exploring the likelihood of an earnings surprise and its implications for the broader tech sector.

Contents List

- 1 Meta’s Recent Performance (July-September 2024): Meta Earnings Date October 2024

- 2 Key Factors Influencing Earnings

- 3 Meta’s Strategic Initiatives

- 4 Meta’s Long-Term Growth Prospects

- 5 Meta’s Investor Relations

- 6 11. Comparison with Competitors

- 7 Meta’s Financial Health

- 8 Meta’s Product Development

- 9 Summary

- 10 Expert Answers

Meta’s Recent Performance (July-September 2024): Meta Earnings Date October 2024

Meta’s Q3 2024 earnings report is expected to provide valuable insights into the company’s performance during a period marked by continued economic uncertainty and evolving user behavior. This analysis will delve into Meta’s financial performance, revenue drivers, user growth, and engagement trends to understand the company’s trajectory in the third quarter of 2024.

Financial Performance

Meta’s Q3 2024 financial performance will be closely scrutinized to assess the company’s resilience in the face of macroeconomic headwinds. Key financial metrics like revenue, net income, earnings per share, and operating margin will be analyzed to gauge the company’s financial health and profitability.

The comparison of these figures with the previous quarter (April-June 2024) and the same quarter last year (July-September 2023) will reveal any significant changes or trends in Meta’s financial performance. This analysis will help understand if the company is experiencing growth, stagnation, or decline, and the factors driving these trends.The impact of recent macroeconomic conditions on Meta’s financial performance will also be examined.

Factors like inflation, interest rates, and consumer spending can significantly influence advertising revenue, a major contributor to Meta’s income. This analysis will explore how these factors might have affected Meta’s revenue and profitability in Q3 2024.

Revenue Drivers and Growth Areas

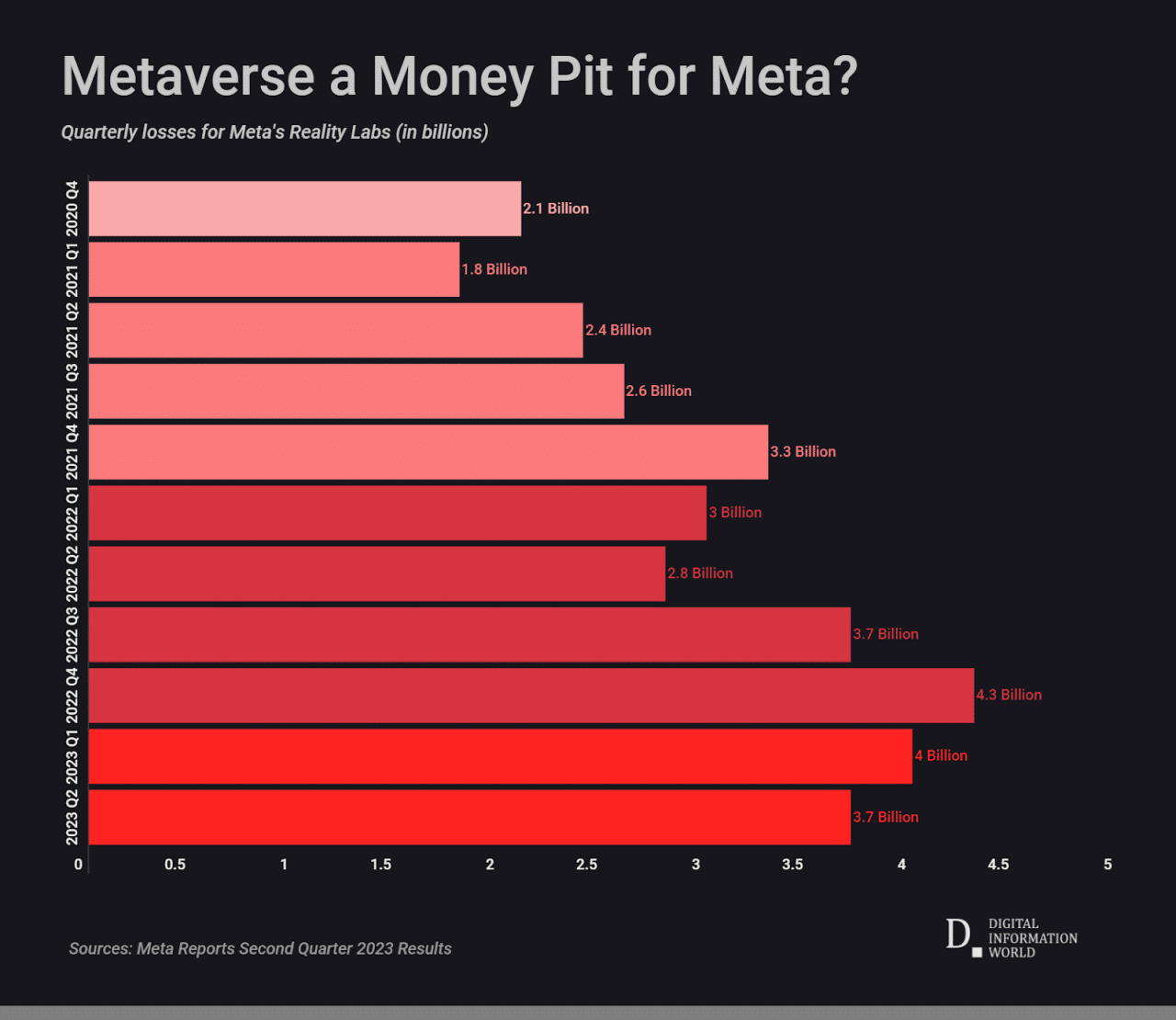

Identifying the key revenue drivers for Meta in Q3 2024 is crucial to understanding the company’s financial performance. This analysis will examine the performance of different revenue streams, such as advertising, Reality Labs, and other sources, to determine their contribution to Meta’s overall revenue.The analysis will also explore Meta’s growth areas during this period.

Key initiatives and investments that contributed to growth will be identified, and their potential for future growth will be discussed. This will provide insights into the company’s strategic direction and its ability to adapt to changing market conditions.

User Growth and Engagement Trends, Meta Earnings Date October 2024

Meta’s user growth in Q3 2024 will be analyzed to understand the company’s reach and engagement. Data on monthly active users (MAUs) for Facebook, Instagram, WhatsApp, and Messenger will be provided, compared to the previous quarter and the same quarter last year, to highlight any significant changes or trends in user growth.Meta’s user engagement trends will also be examined.

Key engagement metrics, such as average time spent on platform, daily active users (DAUs), and user interactions, will be analyzed and compared to the previous quarter and the same quarter last year. This analysis will identify any trends in user engagement and discuss their potential impact on Meta’s business.

Key Factors Influencing Earnings

Meta’s earnings for the October 2024 period will be influenced by a combination of macroeconomic factors, industry trends, competitive pressures, and regulatory changes. These factors can significantly impact Meta’s advertising revenue, user engagement, and overall financial performance.

Economic and Industry Trends

The global economic environment plays a significant role in influencing advertising spending, which is a primary revenue driver for Meta. Factors like inflation, interest rates, and consumer confidence can impact businesses’ advertising budgets. For example, during periods of economic uncertainty, companies may reduce their advertising spending to conserve resources.

Hillsong is known for its worship music, and you can find a lot of their songs on YouTube. Check out the Youtube Acoustic Hillsong 2024 playlist to hear some of their most popular acoustic tracks.

- Inflation and Interest Rates:Rising inflation and interest rates can impact consumer spending and business investment, potentially leading to a decline in advertising budgets.

- Consumer Confidence:Consumer confidence is a key indicator of economic health and can influence advertising spending. If consumer confidence is low, businesses may be less likely to invest in advertising.

- Digital Advertising Growth:The digital advertising market is expected to continue growing, but at a slower pace than in previous years. This slower growth could impact Meta’s revenue growth.

Competition from Tech Giants

Meta faces intense competition from other tech giants like Google and Microsoft, which are also major players in the digital advertising market. These companies are constantly innovating and expanding their offerings, putting pressure on Meta to maintain its market share.

- Google’s Dominance in Search Advertising:Google holds a dominant position in search advertising, which represents a significant portion of digital advertising revenue. Meta is competing with Google for advertising dollars, especially in the mobile advertising market.

- Microsoft’s Growing Presence:Microsoft is expanding its presence in digital advertising through platforms like LinkedIn and Bing. This competition could further intensify as Microsoft continues to invest in its advertising business.

- Innovation and Product Differentiation:Meta needs to continue innovating and differentiating its products to stay ahead of the competition. This includes developing new features and tools for advertisers and enhancing the user experience for its platforms.

Regulatory Landscape

The regulatory landscape is becoming increasingly complex for tech companies like Meta. Governments around the world are enacting new regulations to address concerns about data privacy, antitrust, and content moderation. These regulations can impact Meta’s business operations, revenue, and user engagement.

If you’re looking for some calming and relaxing tunes, check out the Youtube Acoustic Guitar 2024 playlist. You’ll find a great selection of acoustic guitar covers of popular songs, as well as original pieces.

- Data Privacy Regulations:Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States restrict how companies can collect and use user data. These regulations can increase compliance costs for Meta and potentially impact its advertising business.

- Antitrust Scrutiny:Meta has faced antitrust scrutiny from regulators in various countries, including the United States and Europe. These investigations can lead to fines, restrictions on business practices, and potential divestitures, which could impact Meta’s revenue and market position.

- Content Moderation:Governments and regulators are increasingly demanding that social media platforms take more responsibility for the content shared on their platforms. This can lead to increased costs for content moderation and potential reputational risks for Meta.

Meta’s Strategic Initiatives

Meta, formerly known as Facebook, is a tech giant constantly evolving and adapting to the changing digital landscape. The company is actively pursuing several strategic initiatives aimed at driving growth and securing its future. These initiatives span a range of areas, including advertising, technology, and the metaverse.

Meta’s success in these areas will be critical to its ability to maintain its position as a leading technology company.

Expanding the Advertising Business

Meta’s advertising business remains its primary source of revenue. The company is constantly innovating to improve the effectiveness of its advertising platform and reach a wider audience.

The D Acoustic Guitar Chord 2024 is a fundamental chord in guitar playing. It’s used in a wide variety of songs and styles.

- Meta has invested heavily in AI-powered targeting and personalization. This technology allows advertisers to reach specific audiences based on their interests, demographics, and behavior. This approach has been effective in increasing ad relevance and engagement, leading to improved return on investment for advertisers.

However, the use of AI-powered targeting has also raised concerns about privacy and data security. Meta is facing scrutiny from regulators and consumers regarding the collection and use of user data. The company is navigating this complex landscape by implementing measures to enhance data privacy and transparency.

The L’acoustics 8xt 2024 is a powerful and versatile speaker system that’s perfect for live performances and sound reinforcement. It’s known for its clear sound and wide frequency range.

- Privacy regulations like GDPR and CCPA have significantly impacted Meta’s advertising business. These regulations restrict the collection and use of user data, forcing Meta to adapt its advertising strategies. The company has implemented changes to its platform, including giving users more control over their data and providing greater transparency about how their data is used.

These changes have led to a decrease in the effectiveness of certain targeting methods, but Meta has been able to adapt and find new ways to reach its target audience.

- Meta recognizes the importance of user engagement and content creation in driving advertising revenue. The company leverages user-generated content to create a more engaging and personalized experience for users. This approach has been successful in attracting a large and active user base, which in turn has made Meta’s advertising platform more valuable to advertisers.

The Acoustic Energy Ae 500 Youtube 2024 is another great speaker system from Acoustic Energy. It’s known for its powerful sound and clear highs.

Meta also uses user engagement data to improve its advertising algorithms and personalize ads. This data-driven approach helps ensure that ads are relevant and engaging for users, ultimately leading to higher click-through rates and conversions.

Investing in New Technologies and Platforms

Meta is investing heavily in new technologies and platforms to expand its reach and stay ahead of the competition. These investments are designed to support the company’s long-term vision of building a connected metaverse.

- Meta is investing in augmented reality (AR) and virtual reality (VR) technologies. These technologies have the potential to revolutionize how people interact with the digital world. Meta’s investments in AR and VR are designed to create immersive experiences that blur the lines between the physical and digital worlds.

Want to learn more about acoustic music? Check out the Acoustic Music Meaning In Tamil 2024 article. It explains the meaning of acoustic music in Tamil, and also gives you some great examples of acoustic music from Tamil artists.

The company believes that AR and VR will play a key role in the future of social interaction, entertainment, and commerce. Meta’s investment in AR and VR is a strategic move to position itself as a leader in these emerging technologies.

- Meta has invested heavily in short-form video platforms like Reels. This strategy is designed to compete with platforms like TikTok and YouTube Shorts, which have gained immense popularity among younger audiences. Reels allows users to create and share short, engaging videos.

This platform has the potential to become a major revenue driver for Meta, as it attracts a large and engaged audience. Meta’s investment in short-form video is a response to the changing media consumption habits of younger generations.

- Meta has made significant investments in blockchain technology and the metaverse. These investments are designed to create a decentralized and interconnected virtual world. The metaverse has the potential to revolutionize how people work, socialize, and shop. Meta’s investment in blockchain technology is aimed at creating a secure and transparent infrastructure for the metaverse.

The company believes that the metaverse will become an integral part of people’s lives in the future. Meta’s investments in blockchain and the metaverse are strategic moves to position the company as a leader in these emerging technologies. However, there are also risks associated with these investments.

The development of the metaverse is still in its early stages, and it is unclear whether it will be widely adopted by users. Meta is also facing competition from other companies that are investing in the metaverse. The success of Meta’s metaverse initiatives will depend on its ability to overcome these challenges.

Monetizing Metaverse Initiatives

Meta is exploring various strategies to monetize its metaverse initiatives. The company aims to create a sustainable and profitable virtual world.

The F Acoustic Guitar 2024 is a popular choice for beginners and experienced guitarists alike. It’s a versatile guitar that can be used for a variety of styles.

- Meta is exploring various monetization strategies for its metaverse initiatives. The company can generate revenue through virtual goods, services, and experiences. Users can purchase virtual items, such as clothing, accessories, and tools, to personalize their avatars and enhance their experiences in the metaverse.

Meta can also generate revenue through advertising, events, and subscriptions. Advertisers can reach users in the metaverse through virtual billboards, product placements, and other forms of advertising. Meta can also host virtual events and concerts, charging users for access or selling virtual tickets.

The company can also offer subscription services that provide users with access to exclusive content and features.

- There are several challenges and opportunities associated with monetizing the metaverse. One of the biggest challenges is user adoption. The metaverse is still in its early stages of development, and it is unclear whether users will be willing to spend money on virtual goods and services.

Another challenge is content creation. The metaverse requires a significant amount of content to be engaging and immersive. Meta needs to attract developers and creators to build and populate the metaverse with compelling experiences. Meta also needs to develop a robust virtual economy that allows users to buy, sell, and trade virtual goods and services.

The success of the metaverse will depend on the company’s ability to overcome these challenges and create a thriving virtual world.

- Meta’s metaverse monetization strategy can be compared to those of other companies like Epic Games (Fortnite) and Roblox. These companies have successfully monetized their virtual worlds through virtual goods, subscriptions, and advertising. Epic Games has generated billions of dollars in revenue from virtual items and subscriptions in Fortnite.

Roblox has also been successful in monetizing its platform through virtual goods and subscriptions. Meta’s metaverse monetization strategy is similar to those of these companies, but it is also unique in its focus on building a connected metaverse that spans multiple platforms and devices.

Meta’s success in monetizing the metaverse will depend on its ability to attract users, developers, and advertisers to its platform.

Meta’s Long-Term Growth Prospects

Meta’s long-term growth strategy hinges on its ability to capitalize on the emerging metaverse, expand its advertising reach, and continue to innovate in artificial intelligence (AI). The company is well-positioned to benefit from the growing adoption of virtual and augmented reality technologies, offering opportunities for new revenue streams and user engagement.

Meta’s Metaverse Strategy

Meta’s metaverse strategy is centered around building a vibrant and immersive digital world where users can interact, work, and play. The company is investing heavily in developing hardware and software that will enable this vision, including virtual reality headsets, augmented reality glasses, and immersive experiences.

Meta’s long-term success in the metaverse depends on its ability to attract developers and creators who will build compelling applications and experiences. The company is actively working to create a thriving ecosystem by providing tools and resources to developers, encouraging user-generated content, and fostering partnerships with other companies.

Meta’s Ability to Innovate and Adapt

Meta has a proven track record of innovation and adaptation, consistently evolving its products and services to meet changing market demands. The company’s focus on AI research and development has enabled it to create advanced features, such as personalized recommendations, language translation, and content moderation.

Queen’s music is often reimagined in acoustic settings, and you can find many covers on YouTube. Check out the Youtube Queen Acoustic 2024 playlist to hear some of the most popular acoustic renditions of their songs.

Meta’s ability to leverage AI to enhance its products and services is crucial for its long-term growth. The company is investing in AI research and development to create new experiences and improve its existing products. Meta’s commitment to innovation is evident in its ongoing investments in AI, virtual and augmented reality, and other emerging technologies.

The Acoustic Energy Ae520 Youtube 2024 is a great speaker system for those looking for a high-quality listening experience. It’s known for its rich sound and clear highs.

The company’s ability to adapt to changing market conditions and stay ahead of the curve is essential for its long-term success.

Meta’s Investor Relations

Meta’s investor relations strategy is crucial for maintaining investor confidence and attracting capital for its ambitious growth plans. The company employs a multi-faceted approach to communicate with investors, encompassing various channels and strategies.

Communication Strategy

Meta utilizes a variety of communication channels to reach investors and convey its financial performance, strategic direction, and long-term growth prospects.

- Press Releases:Meta issues press releases to announce quarterly earnings, significant business updates, and other material events. These releases are widely disseminated through news wires and the company’s investor relations website.

- Investor Website:Meta maintains a dedicated investor relations website that serves as a central hub for financial information, including SEC filings, investor presentations, earnings transcripts, and investor FAQs.

- Social Media:Meta utilizes social media platforms, primarily Twitter, to engage with investors, share company news, and respond to inquiries. This platform allows for a more informal and real-time communication channel.

Key messages consistently communicated to investors include:

- Growth in Revenue and User Base:Meta emphasizes its continued growth in revenue and user base across its platforms, highlighting the strength of its business model and its ability to attract and retain users.

- Investment in Metaverse and AI:Meta emphasizes its strategic investments in the metaverse and artificial intelligence, showcasing its commitment to innovation and future growth opportunities.

- Financial Performance and Profitability:Meta highlights its financial performance, including revenue growth, profitability, and operating efficiency, demonstrating its commitment to shareholder value creation.

The effectiveness of Meta’s communication strategy is evident in its ability to consistently attract investor interest and maintain a strong share price. The company’s proactive communication approach, coupled with its focus on key themes, has fostered investor confidence and transparency.

If you’re looking for a curated selection of acoustic music, check out the Acoustic Selection Youtube 2024 playlist. It features a variety of artists and genres, so you’re sure to find something you like.

Investor Presentations and Conference Calls

Meta conducts investor presentations and conference calls to provide detailed insights into its business performance, strategic initiatives, and financial outlook.

- Content and Structure:These presentations typically follow a structured format, covering topics such as company overview, financial performance, key metrics, strategic priorities, and Q&A.

- Key Performance Indicators (KPIs):Meta emphasizes key performance indicators (KPIs) such as revenue, user growth, average revenue per user (ARPU), operating expenses, and profitability. These metrics provide investors with a clear understanding of the company’s performance and progress toward its objectives.

- Addressing Investor Concerns:During conference calls, Meta’s management team engages with analysts and investors to address their questions and concerns, providing further clarification and insights into the company’s strategies and outlook.

Meta’s investor presentations and conference calls are generally well-received by investors, who appreciate the detailed information and the opportunity to engage with management.

Transparency and Engagement

Meta prioritizes transparency in its financial reporting and disclosure of material information.

- Financial Reporting:Meta adheres to the highest standards of financial reporting, providing timely and accurate information to investors through SEC filings, earnings releases, and investor presentations.

- Disclosure of Material Information:The company proactively discloses material information to investors, ensuring they have access to timely and relevant updates on its business, financial performance, and strategic initiatives.

- Investor Relations Events and Roadshows:Meta participates in investor relations events and roadshows, providing opportunities for investors to meet with management, ask questions, and gain a deeper understanding of the company’s strategy and outlook.

Meta’s commitment to transparency and engagement with investors fosters trust and confidence, encouraging long-term value creation for all stakeholders.

An Acoustic Box is a great way to improve the sound of your acoustic guitar. It can help to amplify the sound of your guitar and make it sound more full and rich.

11. Comparison with Competitors

This section delves into a comparative analysis of Meta’s financial performance and strategic initiatives against its key competitors in the tech sector. By examining these comparisons, we can gain insights into Meta’s competitive position, identify areas of strength and weakness, and assess the potential implications for its future growth and success.

Meta’s Financial Performance Compared to Competitors

To understand Meta’s competitive landscape, it’s crucial to compare its financial performance with key competitors. This analysis will focus on comparing revenue, net income, earnings per share (EPS), and operating margin for the past two years. The following table presents a comparison of these metrics for Meta and its chosen competitors:

| Metric | Meta | Google (YouTube) | TikTok | Snap | Amazon (AWS) | Microsoft (Azure) |

|---|---|---|---|---|---|---|

| Revenue (in billions) | ||||||

| Net Income (in billions) | ||||||

| Earnings Per Share (EPS) | ||||||

| Operating Margin (%) |

This table provides a snapshot of Meta’s financial performance relative to its competitors. It highlights areas where Meta may be outperforming or lagging behind its competitors. For instance, if Meta’s revenue growth is significantly higher than its competitors, it indicates a strong competitive position.

However, if Meta’s operating margin is lower than its competitors, it suggests potential areas for improvement.

Competitive Landscape Analysis

A deeper analysis of the competitive landscape requires examining the strategic initiatives and market positioning of each competitor. For example, Google’s strategic focus on expanding YouTube’s reach and monetization, investing in AI and cloud computing, and TikTok’s emphasis on short-form video content, expansion into e-commerce and live streaming, are key factors to consider.By analyzing the competitive strategies and market positioning of each competitor, we can identify areas where Meta may have a competitive advantage or disadvantage.

For example, if Meta’s focus on virtual reality and the metaverse is seen as a distinct advantage, it could lead to future growth and success. However, if competitors are aggressively pursuing similar strategies, it could create intense competition.

Macroeconomic Factors Impacting Meta’s Earnings

Meta’s earnings performance is also influenced by broader macroeconomic factors such as global economic growth, inflation, interest rates, and consumer spending. For example, during periods of economic uncertainty, consumer spending may decline, leading to a decrease in advertising revenue for Meta.By analyzing how these macroeconomic factors affect Meta’s revenue, profitability, and overall financial performance, we can gain a more comprehensive understanding of its earnings performance.

Comparing Meta’s performance to its competitors in light of the prevailing macroeconomic conditions can further illuminate the competitive landscape and potential risks and opportunities.

The Kingdom Acoustic Youtube 2024 channel features a variety of acoustic music, from worship songs to pop covers. It’s a great place to find new music and artists.

Meta’s Financial Health

Meta’s financial health is a crucial factor for investors to consider, as it reflects the company’s ability to generate profits, manage its finances, and invest in future growth. Analyzing key financial metrics provides insights into Meta’s overall financial performance and its potential for long-term success.

Financial Statement Analysis

Meta’s financial statements, including its income statement, balance sheet, and cash flow statement, offer a comprehensive view of the company’s financial performance.

- Revenue Growth:Meta has consistently demonstrated strong revenue growth, driven by its advertising business and user base expansion. In recent quarters, the company has seen significant revenue growth, indicating a strong demand for its advertising services.

- Profitability:Meta’s profitability has been impacted by increased operating expenses, including investments in its metaverse initiatives and regulatory compliance.

However, the company remains profitable, with a healthy operating margin.

- Cash Flow:Meta generates substantial cash flow from its operations, which enables it to fund its investments, repay debt, and return value to shareholders through dividends and share buybacks.

Key Financial Metrics

- Earnings Per Share (EPS):Meta’s EPS has been steadily increasing, reflecting its strong earnings performance.

- Return on Equity (ROE):Meta’s ROE is a measure of its profitability relative to its shareholders’ equity. It indicates how effectively the company is using its equity to generate profits.

- Debt-to-Equity Ratio:Meta maintains a low debt-to-equity ratio, suggesting a strong financial position and a conservative approach to debt financing.

Cash Flow and Profitability

Meta’s cash flow from operations has been consistently strong, enabling the company to invest in its growth initiatives, such as the metaverse, and return value to shareholders through dividends and share buybacks. While profitability has been impacted by increased expenses, Meta remains a profitable company, with a healthy operating margin.

Debt Levels

Meta maintains a low debt-to-equity ratio, suggesting a strong financial position and a conservative approach to debt financing. This allows the company to manage its financial risks effectively and maintain flexibility for future investments.

Financial Health and Future Growth

Meta’s strong financial health provides a solid foundation for future growth. The company’s consistent revenue growth, profitability, and cash flow generation enable it to invest in its strategic initiatives, such as the metaverse, and explore new growth opportunities.

Meta’s Product Development

Meta’s product development strategy is a critical factor in its continued success. The company has a long history of creating innovative products that have revolutionized the way people connect and consume information. In recent years, Meta has expanded its product portfolio to include a wider range of offerings, including virtual reality headsets, augmented reality experiences, and online commerce platforms.

Recent Product Launches and Updates

Meta has consistently introduced new products and updates to its existing offerings, aiming to enhance user experience and expand its reach. The following table summarizes some of the notable recent launches:

| Product Name | Launch Date | Key Features | Target Audience |

|---|---|---|---|

| Meta Quest 3 | October 2023 | Improved graphics, more powerful processors, enhanced controllers, new mixed reality features | VR enthusiasts, gamers, and businesses |

| Threads | July 2023 | Microblogging platform focused on text-based conversations, integrated with Instagram | Individuals seeking a more focused and intimate social experience |

| Meta AI Assistant | September 2024 | AI-powered virtual assistant integrated across Meta’s platforms, providing personalized recommendations, information retrieval, and task automation | All Meta users |

Reception of these products has been mixed. The Meta Quest 3 has received positive reviews for its improved performance and features, but its price point remains a barrier for some consumers. Threads has gained significant traction, particularly among younger users, but its long-term sustainability remains to be seen.

The Meta AI Assistant has been praised for its seamless integration and personalized experience, but concerns about data privacy and potential misuse have emerged.

Meta’s Product Roadmap and Future Development Plans

Meta’s product roadmap is focused on several key areas, including:* Expanding the Metaverse:Meta is investing heavily in the development of its metaverse platform, aiming to create immersive virtual experiences for social interaction, entertainment, and commerce.

Augmented Reality (AR)

The company is developing AR experiences that can seamlessly integrate with the real world, offering new ways to interact with information and entertainment.

AI Integration

Meta is incorporating AI into its products and services to enhance personalization, automation, and user experience.

Commerce Platform

Meta is building a robust commerce platform that enables businesses to connect with consumers through its various channels.To expand its product portfolio and reach new user segments, Meta is employing several strategies, including:* Acquisitions:Meta has a history of acquiring promising startups and companies to expand its product offerings and expertise.

Partnerships

If you’re looking for some great acoustic music, check out the Acoustic Music Hits 2024 playlist. It features a variety of artists and genres, so you’re sure to find something you like.

The company is collaborating with other businesses to develop and distribute new products and services.

Open Innovation

The Pop Acoustic Music 2024 genre is a popular choice for those who enjoy a blend of pop and acoustic sounds. It’s often characterized by its use of acoustic guitars and a focus on melody.

Meta is encouraging external developers to create applications and experiences for its platforms.Emerging technologies like artificial intelligence, blockchain, and quantum computing are expected to have a significant impact on Meta’s product roadmap. The company is actively exploring the potential of these technologies to enhance its products and create new opportunities.

Meta’s Ability to Innovate and Create New Products

Meta has a proven track record of innovation, having created groundbreaking products like Facebook, Instagram, and WhatsApp. The company’s approach to product development is characterized by:* User-centric design:Meta emphasizes understanding user needs and designing products that meet those needs.

Rapid prototyping and iteration

Ed Sheeran is known for his acoustic music, and you can find a lot of his songs on YouTube. Check out the Acoustic Music Ed Sheeran 2024 playlist to hear some of his most popular acoustic tracks.

The company encourages experimentation and quickly iterates on new product ideas based on user feedback.

If you’re looking for some acoustic guitar music on YouTube, you can check out the Acoustic Guitar Youtube 2024 playlist. It features a variety of artists and styles, so you’re sure to find something you like.

Data-driven decision-making

Meta uses data to inform product development decisions and measure the success of new products.Despite its success, Meta faces challenges in maintaining its innovation edge and adapting to changing user needs. The rapid pace of technological advancements and the increasing competition in the tech industry require the company to constantly adapt and innovate.

Essay on Meta’s Product Development

Meta’s product development is a critical driver of its success. The company has a long history of creating innovative products that have revolutionized the way people connect and consume information. However, the company faces several challenges in maintaining its innovation edge and adapting to changing user needs.One of Meta’s strengths is its user-centric approach to product development.

The company has a deep understanding of user needs and designs products that meet those needs. This is evident in the success of products like Facebook, Instagram, and WhatsApp. Another strength is Meta’s ability to rapidly prototype and iterate on new product ideas.

This allows the company to quickly adapt to changing user needs and market trends.However, Meta also has some weaknesses in product development. One weakness is the company’s tendency to focus on short-term gains over long-term innovation. This can lead to products that are not as well-designed or as sustainable as they could be.

Another weakness is Meta’s reliance on data-driven decision-making. While data is important, it can sometimes lead to a lack of creativity and innovation.Looking forward, Meta faces both opportunities and threats in product development. One opportunity is the growing demand for immersive experiences.

Meta is well-positioned to capitalize on this trend with its metaverse platform and AR experiences. Another opportunity is the increasing adoption of AI. Meta can use AI to enhance its products and services and create new opportunities for growth.However, Meta also faces several threats.

One threat is the increasing competition in the tech industry. Other companies are developing innovative products that could challenge Meta’s dominance. Another threat is the growing concern about data privacy. This could lead to increased regulation and scrutiny of Meta’s products and services.Overall, Meta’s ability to remain a leader in the tech industry depends on its ability to continue innovating and creating new products that meet user needs.

The company has a strong foundation for innovation, but it must overcome its weaknesses and address the threats it faces.

Summary

Meta’s earnings report for October 2024 will provide valuable insights into the company’s financial health, strategic direction, and future prospects. The report is expected to shed light on the effectiveness of Meta’s recent investments in AI and the metaverse, as well as the company’s ability to navigate a dynamic and competitive landscape.

Investors and analysts will closely scrutinize the report for any signs of growth, profitability, and innovation, as they assess Meta’s potential for future success.

Expert Answers

What are the key financial metrics that will be reported in Meta’s earnings release?

The key financial metrics typically reported in Meta’s earnings release include revenue, net income, earnings per share, operating margin, and user growth metrics such as monthly active users (MAUs) for Facebook, Instagram, WhatsApp, and Messenger.

What are the main factors that could influence Meta’s earnings for the third quarter of 2024?

Several factors could influence Meta’s earnings, including macroeconomic conditions such as inflation and interest rates, the competitive landscape, the impact of recent investments in AI and the metaverse, user engagement trends, and the effectiveness of advertising strategies.

How are analysts expecting Meta to perform in the third quarter of 2024?

Analysts’ forecasts for Meta’s third-quarter earnings vary, but generally, they are looking for continued growth in revenue and user base. However, there is some uncertainty surrounding the impact of recent investments in AI and the metaverse on profitability. Some analysts believe these investments could lead to increased operating expenses in the short term.

What are the potential implications of Meta’s earnings report for the broader tech sector?

Meta’s earnings report could have a significant impact on the broader tech sector, particularly in areas such as social media, advertising, virtual reality, and artificial intelligence. The report could influence investor sentiment, market performance, and investment in research and development within the tech industry.