What are the eligibility requirements for stimulus payments in October 2024? This question is likely on the minds of many Americans as we approach the potential for another round of economic assistance. With the ever-changing economic landscape, the possibility of stimulus payments in October 2024 is a topic of considerable interest.

Understanding the eligibility requirements is crucial for individuals hoping to benefit from such a program.

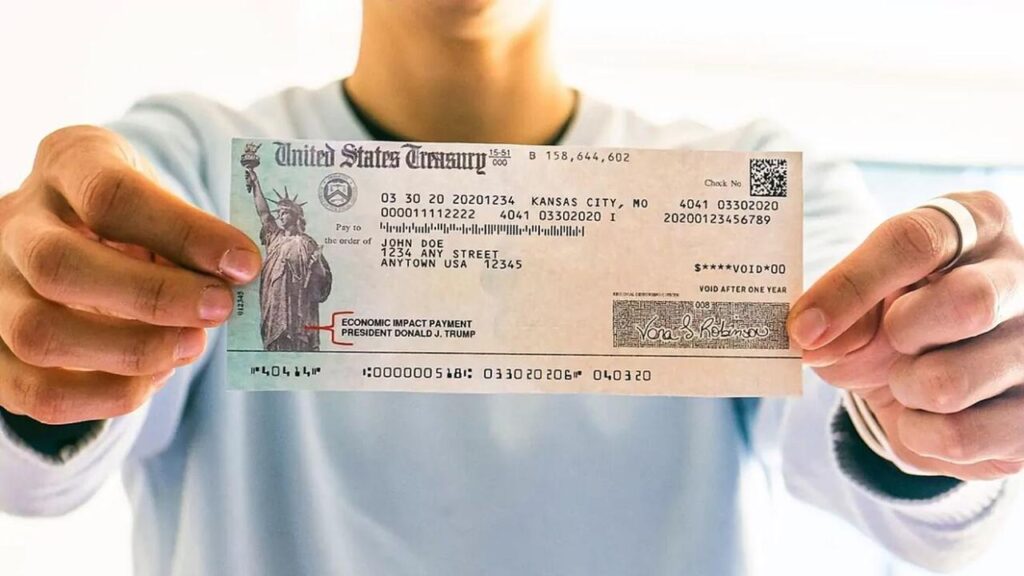

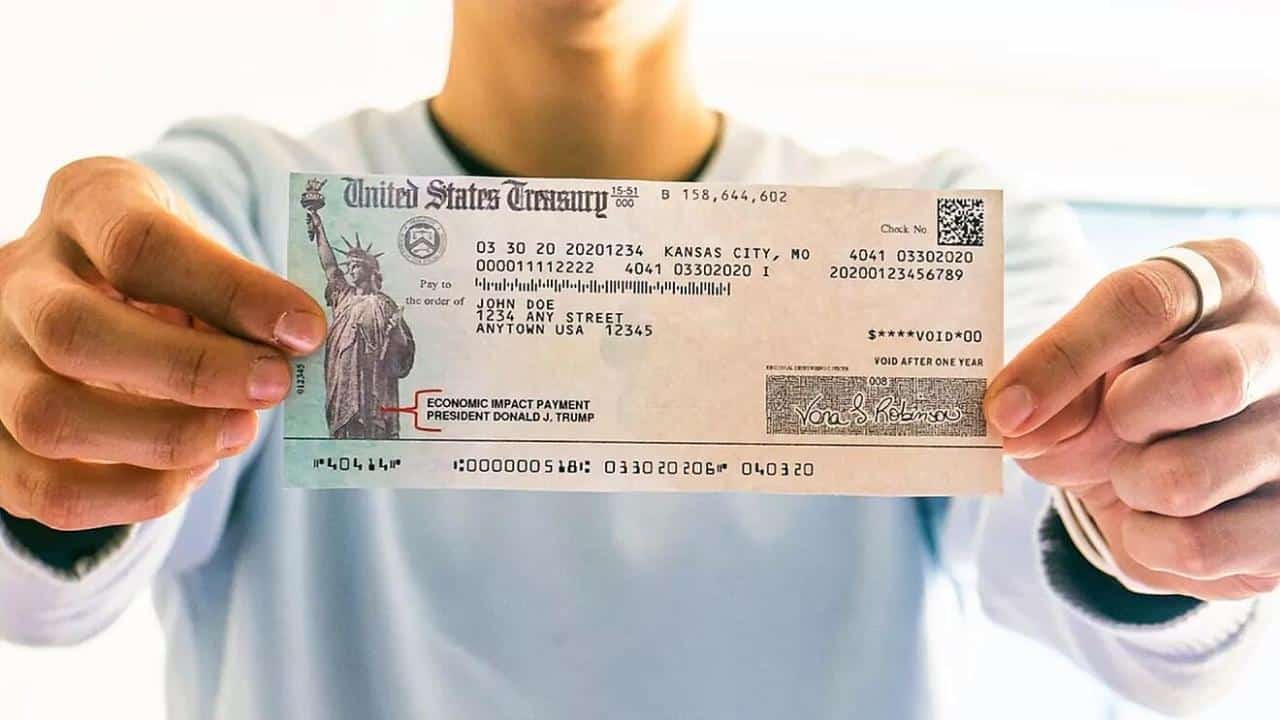

Stimulus payments, often referred to as economic impact payments, are a form of government assistance designed to provide financial relief to individuals and families during periods of economic hardship. These payments can be used to cover essential expenses, stimulate consumer spending, and ultimately help to boost the overall economy.

The potential for stimulus payments in October 2024 depends on a variety of factors, including the state of the economy, inflation rates, and the political landscape. If such payments are indeed authorized, it’s essential to understand the criteria that determine eligibility.

Thanksgiving is a time for delicious food and cherished traditions. Dive into the history and evolution of Thanksgiving dishes with this insightful guide, Thanksgiving 2024 Food Traditions and Origins: A Culinary Journey Through Time , exploring the origins and cultural influences behind this iconic holiday feast.

Contents List

Stimulus Payments in October 2024: An Overview

The possibility of stimulus payments in October 2024 is a topic of ongoing speculation, with no official announcements from the government. The economic landscape at that time will be a crucial factor in determining the need for such payments. Potential factors influencing the decision include inflation rates, unemployment levels, and overall economic growth.

If the economy experiences a downturn or significant challenges, stimulus payments could be considered to provide relief and stimulate spending.

Stimulus payments are designed to inject money into the economy, boosting consumer spending and supporting businesses. They can be particularly beneficial during periods of economic uncertainty, as they provide direct financial assistance to individuals and families. This can help offset lost income, stimulate demand for goods and services, and contribute to economic recovery.

The rental market is constantly evolving, so staying informed is key. This guide, Houses And Apartments For Rent 2024: A Guide to the Market , provides insights into current trends, helping you make informed decisions when renting in 2024.

Eligibility Criteria: General Requirements

To be eligible for stimulus payments, individuals typically need to meet certain general criteria. These criteria usually include:

- Residency Status:Individuals must be U.S. citizens or permanent residents.

- Age:There are generally no age restrictions for stimulus payments, meaning both adults and children can be eligible.

- Social Security Number:A valid Social Security Number is typically required for identification and processing payments.

Income thresholds play a significant role in determining eligibility. The specific income limits for stimulus payments are typically determined by the government based on factors like household size and filing status. For instance, a single filer might have a lower income limit than a family with multiple dependents.

The term “dependent” in the context of stimulus payments refers to a person who relies on another individual for financial support. This typically includes children under a certain age, as well as individuals with disabilities who meet specific criteria.

Eligibility Criteria: Specific Situations

Eligibility criteria can vary for individuals in specific situations, such as those with disabilities or those receiving Social Security benefits. Let’s examine these situations:

- Individuals with Disabilities:Individuals receiving Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) are generally eligible for stimulus payments. However, specific eligibility requirements may apply depending on the individual’s income and other factors.

- Students:Students attending college or university are typically eligible for stimulus payments if they meet the general eligibility requirements. However, their eligibility may be based on their own income and filing status, rather than their parents’ income.

- Undocumented Immigrants:Undocumented immigrants are generally not eligible for stimulus payments. However, there may be exceptions for undocumented immigrants with children who are U.S. citizens. Eligibility rules for undocumented immigrants are complex and subject to change, so it’s essential to consult official government resources for the most up-to-date information.

Payment Method and Distribution, What are the eligibility requirements for stimulus payments in October 2024?

Stimulus payments are typically distributed through various methods, including:

- Direct Deposit:This is the most common method, allowing payments to be deposited directly into eligible individuals’ bank accounts.

- Paper Check:If direct deposit information is unavailable, stimulus payments may be sent via paper check to the recipient’s mailing address.

- Debit Card:In some cases, stimulus payments may be distributed through a prepaid debit card.

To ensure timely delivery, it’s crucial to keep contact information updated with the relevant government agencies. This includes bank account details, mailing address, and phone number. The timeline for payment distribution can vary depending on factors such as the number of eligible recipients and the complexity of the payment processing system.

Tax Implications of Stimulus Payments

The taxability of stimulus payments can vary depending on the specific program and the year in which they were issued. In some cases, stimulus payments may be considered taxable income, while in other cases, they may be excluded from taxable income.

Searching for the perfect apartment in New Jersey? Look no further than this guide, Apartments For Rent New Jersey 2024: Your Guide to Finding the Perfect Place , which offers valuable information on neighborhoods, rental prices, and tips for a smooth rental process.

It’s important to consult official tax guidance or seek advice from a tax professional to determine the tax implications of any stimulus payments received.

Taxpayers may be able to claim certain deductions or credits related to stimulus payments on their tax returns. These deductions or credits can help reduce the overall tax liability. For example, taxpayers might be able to claim a credit for certain expenses related to dependents, which could be relevant for families receiving stimulus payments on behalf of their children.

When filing taxes, taxpayers should report any stimulus payments received on their tax forms. The specific form and reporting instructions will depend on the type of stimulus payment and the tax filing year. It’s essential to follow the official instructions provided by the Internal Revenue Service (IRS) to ensure accurate reporting.

Resources and Further Information

For the most up-to-date information on stimulus payments, it’s recommended to consult official government websites and resources. These resources can provide details on eligibility criteria, payment methods, and other relevant information.

- Internal Revenue Service (IRS):The IRS website provides comprehensive information on stimulus payments, including eligibility requirements, payment methods, and tax implications.

- U.S. Treasury Department:The Treasury Department’s website provides information on government programs and initiatives, including stimulus payments.

- State and Local Government Websites:Many state and local governments provide information on stimulus programs and resources specific to their jurisdictions.

For additional information or to address specific questions, individuals can contact the relevant government agencies, such as the IRS or the U.S. Treasury Department. These agencies have dedicated customer service lines and online resources to assist taxpayers with their inquiries.

End of Discussion

Navigating the eligibility requirements for potential stimulus payments in October 2024 can be a complex process. It’s crucial to stay informed about the latest updates and guidelines from official government sources. By understanding the criteria and potential timelines, individuals can be better prepared to take advantage of any available assistance.

Remember, the goal of stimulus payments is to provide financial relief and support during challenging economic times. Keep an eye on the news and official government websites for the most up-to-date information.

Frequently Asked Questions: What Are The Eligibility Requirements For Stimulus Payments In October 2024?

What are the income thresholds for eligibility?

Finding the perfect apartment in New York City can be a daunting task, but with the right resources, it’s achievable. Check out this comprehensive guide, Apartments For Rent New York City 2024: A Guide , which covers everything from neighborhood insights to rental tips.

Income thresholds for stimulus payments are subject to change based on the specific program guidelines. It’s best to consult official government resources for the most up-to-date information on income limitations.

Moving to Ndjamena? This guide, Ndjamena Apartments For Rent 2024: Your Guide to Finding the Perfect Home , will help you navigate the local rental market, offering valuable tips and information on finding the ideal apartment for your needs.

How can I update my contact information to ensure I receive payments?

The method for updating contact information will vary depending on the specific program. You can typically find instructions on the relevant government website or by contacting the designated agency.

Are stimulus payments taxable income?

The taxability of stimulus payments depends on the specific program and may vary from year to year. It’s recommended to consult with a tax professional for guidance on how stimulus payments might affect your tax filings.