How will the debt ceiling affect the possibility of a stimulus in October 2024? This question looms large as the United States navigates a complex economic landscape. With the potential for a debt ceiling crisis coinciding with a critical election year, the decision to implement a stimulus package becomes a delicate balancing act between political pressure and economic realities.

The looming debt ceiling deadline and the potential for a stimulus package in October 2024 intertwine in a crucial economic and political scenario. This analysis delves into the historical context of debt ceiling negotiations, the economic factors at play, and the potential impact on financial markets.

We’ll explore the political dynamics, alternative policy options, and the potential ramifications for the U.S. economy.

Contents List

- 1 The Debt Ceiling and Stimulus Packages

- 2 Economic Conditions in October 2024

- 3 Political Dynamics and Budgetary Constraints

- 4 Alternative Policy Options

- 5 Potential Impacts on the Financial Markets

- 6 Ending Remarks: How Will The Debt Ceiling Affect The Possibility Of A Stimulus In October 2024?

- 7 FAQ Overview

The Debt Ceiling and Stimulus Packages

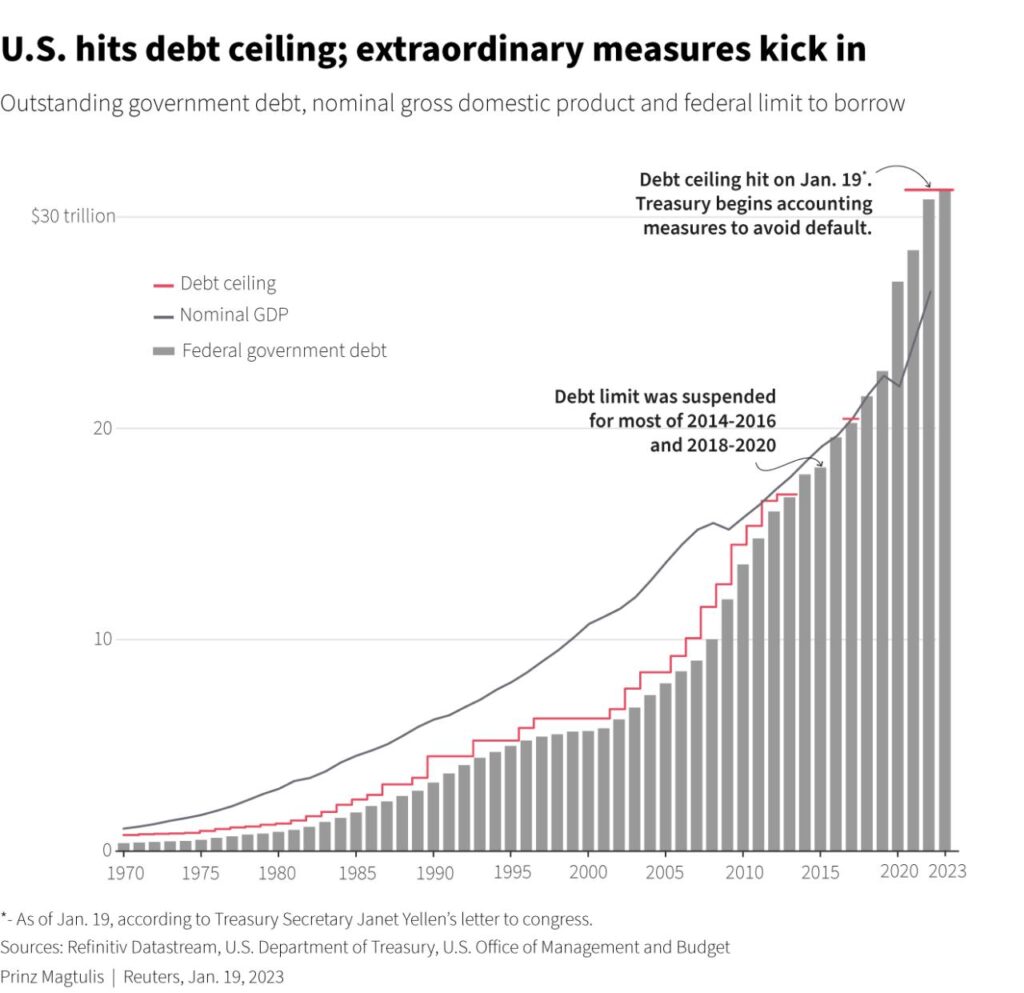

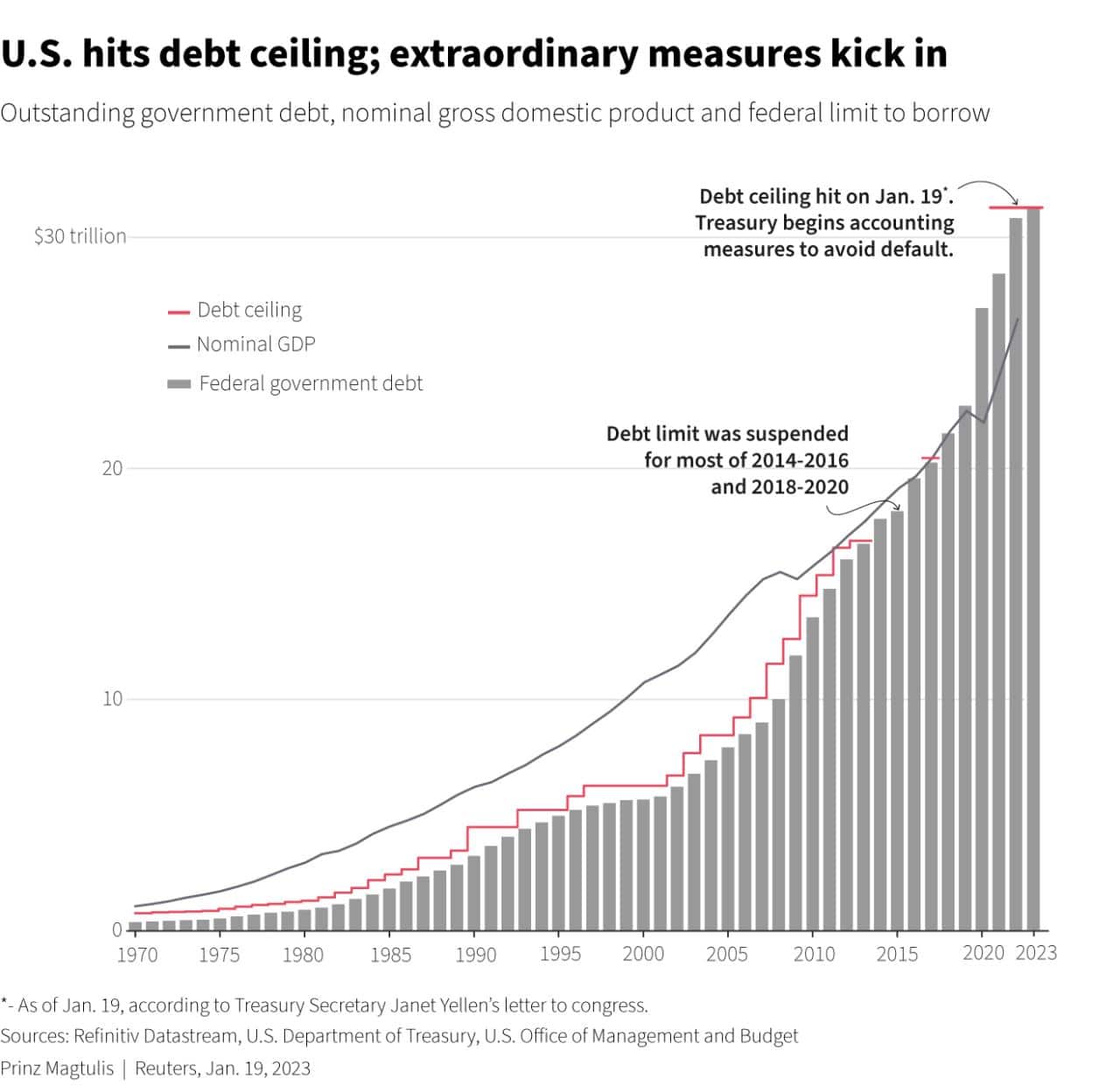

The debt ceiling is a legal limit on the amount of money that the U.S. government can borrow. When the debt ceiling is reached, the government can no longer issue new debt, which can have significant consequences for the economy.

The relationship between the debt ceiling and the ability of the government to issue new debt is straightforward: if the debt ceiling is not raised, the government will be unable to borrow money to finance its operations, including spending on stimulus packages.

Finding a comfortable and convenient apartment in New Jersey can be a breeze with the right resources. Apartments For Rent New Jersey 2024: Your Guide to Finding the Perfect Place offers a comprehensive guide to the rental market, covering key factors like location, amenities, and pricing.

Historical Overview of Debt Ceiling Negotiations

The debt ceiling has been raised or suspended numerous times throughout history. However, negotiations over the debt ceiling have often been contentious, leading to political gridlock and economic uncertainty. For instance, in 2011, a standoff over the debt ceiling resulted in a downgrade of the U.S.

credit rating and a period of market volatility.

- In 2011, a prolonged standoff over the debt ceiling resulted in a downgrade of the U.S. credit rating by Standard & Poor’s, causing significant market volatility and raising concerns about the country’s financial stability.

- In 2013, a similar situation arose, leading to a last-minute agreement to raise the debt ceiling just hours before the government was set to default on its obligations.

These past debt ceiling crises have demonstrated the potential for such negotiations to disrupt the government’s ability to finance its operations, including the implementation of stimulus packages.

Impact of Debt Ceiling Crises on Stimulus Packages

Past debt ceiling crises have often coincided with periods of economic uncertainty and recession. In these situations, the government may have been considering or implementing stimulus packages to boost economic growth. However, the threat of a government default due to the debt ceiling can significantly impact the timing and implementation of these packages.

- The 2009 American Recovery and Reinvestment Act, a major stimulus package enacted during the Great Recession, was passed before the first major debt ceiling debate of the Obama administration. However, the 2011 debt ceiling crisis cast a shadow over the implementation of the stimulus package, as it raised concerns about the government’s ability to finance its operations and potentially jeopardized the recovery efforts.

- The 2013 debt ceiling standoff coincided with a period of economic uncertainty, leading to a delay in the implementation of some government programs, including infrastructure projects, which could have contributed to economic growth.

These examples illustrate how debt ceiling crises can create uncertainty and hinder the government’s ability to implement economic policies, including stimulus packages.

Economic Conditions in October 2024

Predicting economic conditions in October 2024 requires considering various factors, including inflation, unemployment, GDP growth, and global economic trends.

Key Economic Indicators, How will the debt ceiling affect the possibility of a stimulus in October 2024?

Several economic indicators will be crucial in determining the need for a stimulus package in October 2024.

- Inflation:The rate of inflation will be a key factor. High inflation erodes purchasing power and can stifle economic growth. If inflation remains elevated in October 2024, it could indicate a need for policies to cool the economy, which may not include a stimulus package.

Thanksgiving is a time for family, friends, and of course, delicious food! Thanksgiving 2024 Food Traditions and Origins: A Culinary Journey Through Time explores the fascinating history and evolution of Thanksgiving dishes, offering a glimpse into the cultural tapestry of this beloved holiday.

- Unemployment:The unemployment rate will provide insights into the health of the labor market. A rising unemployment rate could indicate a weakening economy, potentially necessitating a stimulus package to boost job creation and support economic growth.

- GDP Growth:The rate of GDP growth will be a critical indicator of the overall health of the economy. Slow or negative GDP growth could signal a recession, making a stimulus package more likely.

Potential State of the Economy

By October 2024, the U.S. economy may be facing various challenges. Inflation could remain a concern, potentially driven by global supply chain disruptions and rising energy prices. The labor market could be experiencing some slowdown, with potential for job losses in certain sectors.

Economic Concerns

The economy in October 2024 may be grappling with a combination of factors that could necessitate a stimulus package, including:

- Persistently High Inflation:If inflation remains high, it could erode consumer confidence and dampen economic growth. This could necessitate a stimulus package to help offset the impact of inflation on households and businesses.

- Potential Recession:The possibility of a recession in October 2024 cannot be ruled out. If the economy enters a recession, a stimulus package could be crucial to help mitigate the economic downturn and support job creation.

- Global Economic Uncertainty:The global economy may be facing significant challenges in 2024, including geopolitical tensions and potential disruptions to supply chains. These factors could create uncertainty and impact the U.S. economy, potentially necessitating a stimulus package to provide support and stability.

Political Dynamics and Budgetary Constraints

The political landscape in October 2024 will be a crucial factor in determining the feasibility of a stimulus package.

Political Landscape in October 2024

The composition of Congress and the President’s priorities will play a significant role in shaping the political dynamics surrounding a potential stimulus package.

- Congressional Composition:The composition of Congress in October 2024 will determine the level of support or opposition to a stimulus package. A divided Congress, with different party control of the House and Senate, could make it challenging to pass legislation, especially if there are significant partisan divides on the issue of stimulus spending.

- President’s Priorities:The President’s economic priorities will also influence the likelihood of a stimulus package. If the President prioritizes addressing inflation or other economic concerns, a stimulus package may not be a top priority. However, if the President sees a stimulus package as essential for economic growth and job creation, it could become a key part of their agenda.

Political Feasibility of a Stimulus Package

Passing a stimulus package in October 2024 will likely face significant political hurdles.

- Budgetary Constraints:The government’s budget deficit and the potential for rising interest rates could make it challenging to find the fiscal space for a stimulus package. Political negotiations over spending priorities could further complicate the process.

- Partisan Divides:Partisan divisions over the role of government in the economy and the best way to address economic challenges could create significant obstacles to passing a stimulus package. Republicans may be less inclined to support a stimulus package, particularly if they perceive it as adding to the national debt or as being ineffective in addressing the underlying economic challenges.

Potential for Bipartisan Support

Despite the potential for partisan divides, there could be some opportunities for bipartisan support for a stimulus package, particularly if it is targeted toward specific sectors or groups that are facing significant economic challenges. For instance, a bipartisan agreement on infrastructure spending could be possible, as it has been in the past.

Alternative Policy Options

If a stimulus package is not feasible or desirable in October 2024, alternative policy options could be considered to address economic challenges.

Potential Economic Effects of Alternative Policy Options

Several alternative policy options could be considered, each with its own potential economic effects.

- Tax Cuts:Tax cuts can stimulate economic growth by increasing disposable income for households and businesses. However, they can also lead to a larger budget deficit and may not be effective in addressing certain economic challenges, such as inflation.

- Infrastructure Spending:Infrastructure spending can create jobs, boost economic activity, and improve productivity. However, it can be a slow-acting policy and may not be effective in addressing short-term economic concerns.

- Targeted Aid Programs:Targeted aid programs can provide direct support to households or businesses that are facing specific economic challenges, such as unemployment or rising energy costs. However, they can be expensive and may not address the underlying economic issues.

Downsides and Risks Associated with Alternative Policy Options

Each alternative policy option has potential downsides and risks.

- Tax Cuts:Tax cuts can exacerbate income inequality and may not be effective in stimulating investment or job creation if businesses are already operating at full capacity.

- Infrastructure Spending:Infrastructure spending can be subject to delays and cost overruns, potentially reducing its effectiveness in stimulating the economy.

- Targeted Aid Programs:Targeted aid programs can be subject to fraud and abuse, and may not be effective in addressing the underlying economic issues if they are not well-designed and implemented.

Potential for Alternative Policy Options to Address Economic Challenges

Alternative policy options can be effective in addressing specific economic challenges, but they may not be a substitute for a comprehensive stimulus package.

- Tax Cuts:Tax cuts can be effective in boosting consumer spending, but they may not be effective in addressing long-term economic challenges such as infrastructure needs or skills gaps.

- Infrastructure Spending:Infrastructure spending can create jobs and boost economic activity, but it can be a slow-acting policy and may not be effective in addressing short-term economic concerns such as inflation.

- Targeted Aid Programs:Targeted aid programs can provide immediate relief to households or businesses that are facing specific economic challenges, but they may not be effective in addressing the underlying economic issues.

Potential Impacts on the Financial Markets

The debt ceiling negotiations and potential stimulus package could have significant impacts on the financial markets.

Potential Impact of Different Debt Ceiling Scenarios on the Financial Markets

| Scenario | Impact on Financial Markets |

|---|---|

| Debt ceiling raised without major disruption | Minimal impact on financial markets. |

| Debt ceiling raised with last-minute agreement and political uncertainty | Increased market volatility, potentially leading to higher interest rates and lower stock prices. |

| Debt ceiling not raised, leading to government default | Significant market disruption, including a sharp decline in stock prices, rising interest rates, and potential for a financial crisis. |

Impact of a Stimulus Package on Financial Markets

A stimulus package could have a mixed impact on financial markets.

Whether you’re seeking a cozy apartment or a spacious house, understanding the current market is key. Houses And Apartments For Rent 2024: A Guide to the Market provides valuable insights into rental trends, pricing, and factors to consider when making your decision.

- Interest Rates:A stimulus package could lead to higher interest rates if it is perceived as increasing the national debt and inflationary pressures. This could make it more expensive for businesses to borrow money and could lead to slower economic growth.

- Bond Yields:A stimulus package could lead to higher bond yields if investors become concerned about the government’s ability to manage its debt. This could lead to lower bond prices.

- Stock Prices:A stimulus package could lead to higher stock prices if it is perceived as boosting economic growth and corporate profits. However, if the stimulus package is perceived as inflationary or unsustainable, it could lead to lower stock prices.

Risks to Financial Stability

The debt ceiling negotiations and potential stimulus package could pose risks to financial stability.

- Market Volatility:The uncertainty surrounding the debt ceiling negotiations could lead to increased market volatility, making it more difficult for businesses to plan and invest.

- Higher Interest Rates:If the debt ceiling negotiations lead to higher interest rates, it could make it more expensive for businesses to borrow money, potentially slowing economic growth and increasing the risk of a recession.

- Government Default:A government default on its debt would be a catastrophic event for the U.S. economy and the global financial system. It could lead to a sharp decline in asset prices, a loss of confidence in the U.S. dollar, and a global financial crisis.

Ending Remarks: How Will The Debt Ceiling Affect The Possibility Of A Stimulus In October 2024?

The interplay between the debt ceiling and the possibility of a stimulus package in October 2024 presents a multifaceted challenge. Understanding the historical precedents, the economic outlook, and the political landscape is crucial for navigating this complex situation. The outcome of these negotiations will have far-reaching implications for the U.S.

economy, financial markets, and the political landscape.

Looking to relocate to Ndjamena? Ndjamena Apartments For Rent 2024: Your Guide to Finding the Perfect Home offers a detailed overview of the rental landscape, helping you find the ideal apartment that fits your needs and budget.

FAQ Overview

What is the debt ceiling?

The debt ceiling is a legal limit on the amount of money that the U.S. government can borrow. When the debt ceiling is reached, the government can no longer borrow money to pay its obligations, which could lead to a default on its debt.

What is a stimulus package?

A stimulus package is a set of government policies designed to stimulate economic growth. These policies can include tax cuts, increased government spending, or other measures to encourage businesses and consumers to spend more money.

Finding the perfect apartment in New York City can be a daunting task, but with our comprehensive guide, you’ll be well-equipped to navigate the market. Apartments For Rent New York City 2024: A Guide provides insights on neighborhoods, rental trends, and essential tips for securing your dream NYC dwelling.

Why is October 2024 a significant date?

October 2024 is significant because it is close to the 2024 presidential election. The outcome of the election could have a major impact on the political climate and the likelihood of a stimulus package being passed.