What are the potential drawbacks of a stimulus in October 2024? This question is particularly relevant as we approach a potential election year, with economic anxieties often taking center stage. While a stimulus package might seem like a quick fix to boost economic activity, it’s crucial to consider the potential downsides that could accompany such a move.

This analysis delves into the various implications, ranging from economic repercussions to political and social impacts, highlighting the complex web of factors that must be carefully considered before implementing a stimulus in October 2024.

New Jersey offers a diverse range of rental options, from bustling city apartments to charming suburban homes. This guide, Apartments For Rent New Jersey 2024: Your Guide to Finding the Perfect Place , provides insights into the best areas to live and tips for finding your ideal rental.

The economic landscape in October 2024 will likely be shaped by various factors, including inflation, government debt, and the effectiveness of previous economic policies. Analyzing the impact of a stimulus on these factors is crucial to understand its potential drawbacks.

For instance, a stimulus could exacerbate existing inflationary pressures, further straining household budgets. Additionally, the increased government spending associated with a stimulus package would contribute to the national debt, potentially leading to long-term fiscal challenges. The effectiveness of a stimulus in October 2024 will also depend on the specific economic conditions at that time, and historical comparisons with previous stimulus packages can offer valuable insights.

Contents List

Economic Impact

A stimulus package in October 2024 could have a significant impact on the US economy, particularly given the current economic climate. While a stimulus might seem like a quick fix, it’s crucial to understand the potential drawbacks and unintended consequences.

Inflation

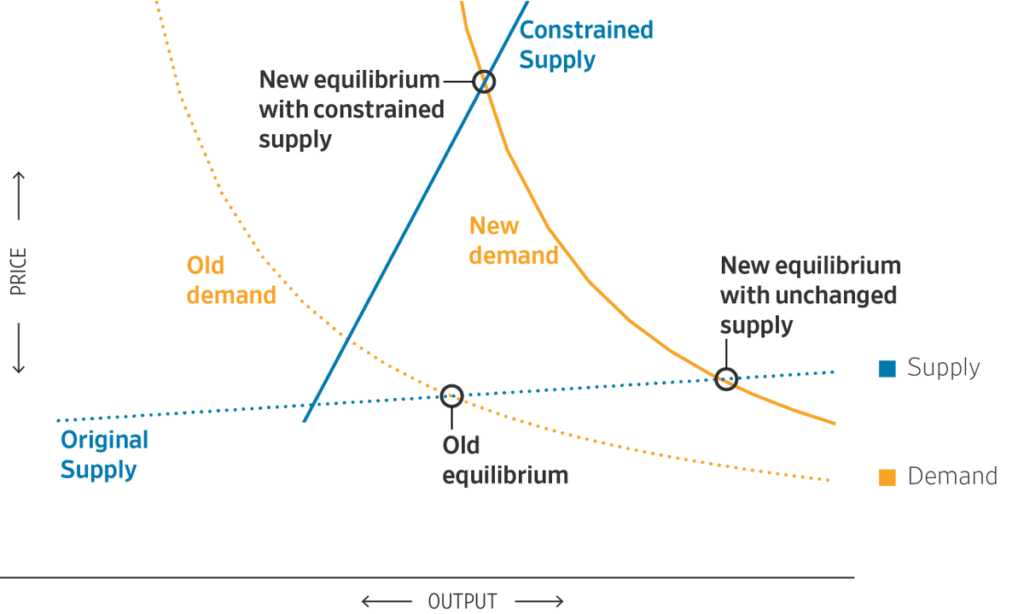

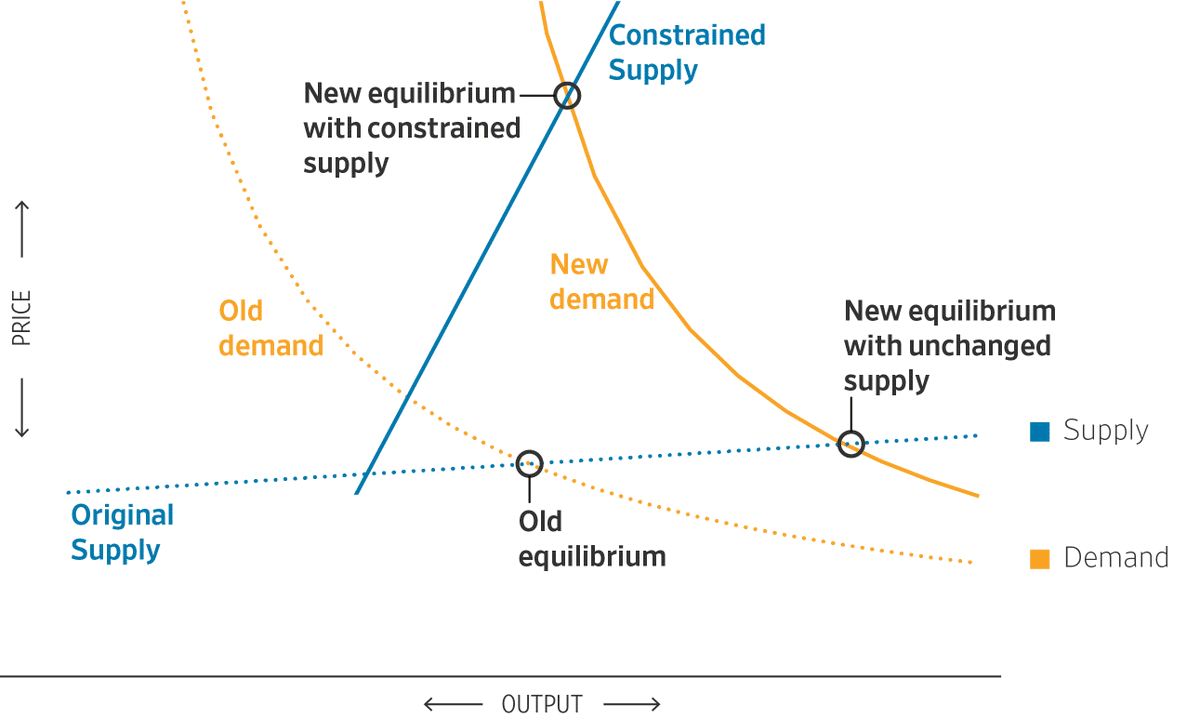

One of the primary concerns with a stimulus is its potential to exacerbate inflation. With the Federal Reserve already battling rising prices, injecting more money into the economy could fuel further inflation. The current economic climate is characterized by high inflation, driven by factors like supply chain disruptions and pent-up demand.

A stimulus could further increase demand, putting upward pressure on prices and eroding consumer purchasing power.

Government Debt

A stimulus package would inevitably increase government debt. The US already has a substantial national debt, and adding more debt could have long-term consequences. Higher debt levels could lead to higher interest rates, making it more expensive for the government to borrow money in the future.

This could crowd out private investment, potentially slowing economic growth.

Moving to Ndjamena? Finding the right apartment is crucial for settling in. This guide, Ndjamena Apartments For Rent 2024: Your Guide to Finding the Perfect Home , will help you discover the best neighborhoods and rental options in the city.

Effectiveness, What are the potential drawbacks of a stimulus in October 2024?

The effectiveness of a stimulus in October 2024 compared to previous economic conditions is a complex issue. The economic landscape has changed significantly since the 2008 financial crisis and the COVID-19 pandemic, making it difficult to predict how a stimulus would perform.

The current economic environment is marked by high inflation and supply chain constraints, which could potentially limit the effectiveness of a stimulus in boosting economic growth. For instance, a stimulus might not be as effective if businesses are unable to expand production due to supply chain bottlenecks.

Political Implications

A stimulus package in October 2024 could have significant political implications, particularly in the context of the upcoming presidential election. The potential political ramifications could influence voter sentiment, party dynamics, and the overall political landscape.

Voter Sentiment

A stimulus package could potentially influence voter sentiment in the 2024 presidential election. If a stimulus is perceived as successful in boosting the economy and providing relief to struggling Americans, it could benefit the incumbent party. Conversely, if the stimulus is seen as ineffective or even harmful, it could hurt the incumbent party’s chances of re-election.

Party Dynamics

The political dynamics surrounding a stimulus package could be complex. The two major political parties might have differing views on the need for a stimulus and its design. For example, Republicans might favor a more targeted approach that focuses on tax cuts or specific industries, while Democrats might advocate for a broader stimulus that includes direct payments to individuals and increased spending on social programs.

This could lead to partisan gridlock, making it difficult to pass a stimulus package.

Influence on the 2024 Election

A stimulus package could potentially influence the 2024 presidential election by shaping the economic narrative. If a stimulus is seen as a success, it could help the incumbent party paint a positive picture of the economy. Conversely, if the stimulus is perceived as a failure, it could give the opposition party ammunition to criticize the incumbent’s economic policies.

The timing of a stimulus package could also be politically significant. A stimulus package passed close to the election could have a more immediate impact on voter sentiment.

Social Impact

A stimulus package in October 2024 could have significant social implications, potentially exacerbating existing social issues and impacting consumer behavior. It’s important to consider the potential for a stimulus to create unintended social consequences.

Finding the perfect apartment in New York City can be a daunting task, but with the right resources, it’s achievable. Check out this guide, Apartments For Rent New York City 2024: A Guide , for tips on navigating the competitive NYC rental market.

Income Inequality

A stimulus package could potentially exacerbate income inequality. While a stimulus might provide temporary relief to struggling families, it could also benefit wealthier individuals and corporations. For example, a stimulus that includes tax cuts for businesses might disproportionately benefit large corporations, while a stimulus that provides direct payments to individuals might not be sufficient to address the needs of those living in poverty.

The distribution of stimulus funds is crucial to ensure that it benefits those who need it most and doesn’t further widen the gap between rich and poor.

Consumer Behavior

A stimulus package could impact consumer behavior and spending patterns. If individuals receive direct payments or tax cuts, they might increase their spending, boosting economic activity. However, this could also lead to a short-term increase in demand, which could further exacerbate inflation.

The long-term impact of a stimulus on consumer behavior is uncertain and could depend on factors like the overall economic climate and consumer confidence.

Social Programs

A stimulus package could potentially impact social programs, depending on its design. For example, a stimulus that includes funding for social programs could provide much-needed support for vulnerable populations. However, a stimulus that focuses primarily on tax cuts might not provide sufficient funding for social programs.

The social implications of a stimulus package depend heavily on its specific provisions and how it interacts with existing social programs.

Long-Term Effects: What Are The Potential Drawbacks Of A Stimulus In October 2024?

A stimulus package in October 2024 could have long-term consequences for the US economy, potentially affecting economic growth, productivity, and the role of government intervention. It’s essential to consider the potential unintended consequences and their long-term impact.

Economic Growth and Productivity

The long-term impact of a stimulus on economic growth and productivity is uncertain. While a stimulus might provide a temporary boost to economic activity, it could also lead to a decline in investment and productivity in the long run.

If businesses become reliant on government support, they might be less likely to invest in innovation and productivity improvements. The long-term impact of a stimulus on economic growth and productivity depends on how it is designed and implemented.

Government Intervention

A stimulus package could potentially create a dependence on government intervention. If businesses and individuals come to rely on government support, they might be less likely to take risks and innovate. This could lead to a decline in entrepreneurship and economic dynamism.

It’s crucial to ensure that a stimulus package does not create a culture of dependency on government intervention.

Unintended Consequences

A stimulus package could lead to unintended consequences, such as a decline in investment or an increase in government spending. For example, if a stimulus includes tax cuts for businesses, it could lead to a decrease in investment if businesses use the tax savings to buy back stock or pay dividends instead of investing in new projects.

Whether you’re looking for a cozy apartment or a spacious house, the rental market can be tricky to navigate. For a comprehensive overview of the current trends and tips for finding the right property, check out this guide, Houses And Apartments For Rent 2024: A Guide to the Market.

A stimulus package could also lead to an increase in government spending if it includes funding for new programs or expands existing programs. It’s important to carefully consider the potential unintended consequences of a stimulus package and design it in a way that minimizes these risks.

Epilogue

In conclusion, the potential drawbacks of a stimulus in October 2024 are multifaceted and require careful consideration. While a stimulus might provide a temporary boost to the economy, it could also exacerbate inflation, increase government debt, and potentially lead to unintended consequences.

The political and social implications are equally important, as a stimulus could influence voter sentiment, party dynamics, and potentially exacerbate income inequality. Ultimately, the decision to implement a stimulus in October 2024 should be based on a thorough analysis of its potential benefits and drawbacks, considering the complex interplay of economic, political, and social factors.

FAQ Resource

What are the potential benefits of a stimulus in October 2024?

Thanksgiving is a time for family, friends, and of course, delicious food. Delve into the rich history and evolution of Thanksgiving dishes with this guide, Thanksgiving 2024 Food Traditions and Origins: A Culinary Journey Through Time. Learn about the origins of the iconic turkey, stuffing, and pumpkin pie, and discover how these traditions have evolved over time.

A stimulus could potentially boost economic growth, create jobs, and provide temporary relief to struggling households. However, these benefits must be weighed against the potential drawbacks discussed in this analysis.

How does the current economic climate influence the potential drawbacks of a stimulus?

The current economic climate, including inflation levels, interest rates, and overall economic growth, significantly impacts the potential effectiveness and drawbacks of a stimulus. A stimulus might be more effective in a recessionary environment, but its impact could be less significant in a period of high inflation.

What are the historical precedents for stimulus packages?

Analyzing past stimulus packages, their effectiveness, and their long-term consequences can provide valuable insights into the potential drawbacks of a stimulus in October 2024. However, it’s important to remember that each economic situation is unique and historical precedents should be used with caution.