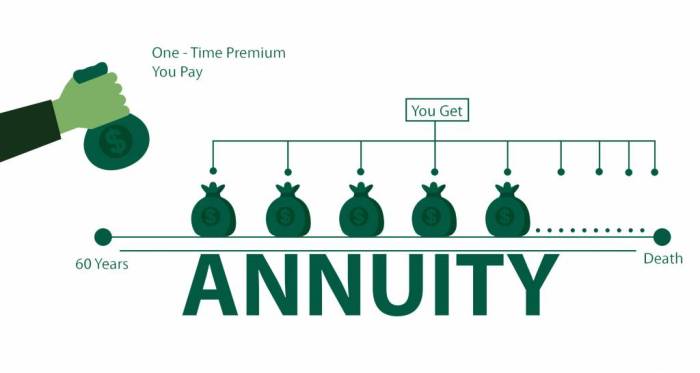

Immediate Annuity Definition Wikipedia: Imagine a financial product that provides you with a guaranteed stream of income for life, regardless of market fluctuations. This is the promise of an immediate annuity, a financial instrument that converts a lump sum payment into regular payments starting immediately.

Understanding the An Immediate Annuity Accumulation Period is crucial for maximizing your investment. This period allows your initial investment to grow before payments begin, potentially leading to higher payouts.

Immediate annuities can be a powerful tool for retirees seeking income security and those seeking to protect their assets from market volatility.

Understanding how your annuity grows over time is crucial. Calculating Annuity Future Value Compounded Monthly 2024 explains the process of calculating the future value of your investment based on monthly compounding.

The concept of an immediate annuity is simple: you give a lump sum to an insurance company in exchange for a stream of regular payments. These payments can be fixed or variable, and they can be paid for a specific period of time or for life.

Calculating the potential benefits of an annuity can be complex, but Omni Calculator Annuity 2024 can simplify the process. This online tool helps you estimate payments based on your investment and desired payout schedule.

Immediate annuities can be a valuable option for individuals looking for a predictable income stream in retirement or for those seeking to protect their assets from market risk.

Annuity calculations can be simplified with the right tools. How To Calculate Annuity Using Financial Calculator 2024 provides step-by-step instructions for using a financial calculator to determine your potential returns.

Contents List

Immediate Annuity Definition

An immediate annuity is a financial product that provides a guaranteed stream of income payments for a set period of time, often for life. It is purchased with a lump sum of money, and the payments begin immediately after the purchase.

Want to visualize how your annuity savings will grow? Calculator Annuity Savings 2024 offers tools to project your savings over time based on your investment strategy.

Immediate annuities are a popular option for individuals who want to convert a lump sum of money into a reliable source of income, particularly in retirement.

For those looking for annuity options in Hong Kong, Annuity Hk 2024 provides information on the latest annuity products and regulations available in the region.

Definition of Immediate Annuity

An immediate annuity is a type of annuity contract that provides regular income payments that begin immediately after the purchase. The payments are guaranteed for a set period, which can be for a specific number of years or for the lifetime of the annuitant.

Annuity investments can benefit from growth over time. The Pv Annuity With Growth 2024 model helps you understand how future value increases based on interest rates and investment growth.

The amount of the payments is determined by the size of the lump sum payment, the age of the annuitant, and the interest rate offered by the annuity provider.

Planning to withdraw or surrender part of your Jackson Variable Annuity? The Jackson Variable Annuity Partial Withdrawal/Surrender Request 2024 process can be complicated. Consult with a financial advisor to understand the implications and potential fees.

For example, a person who has $100,000 saved for retirement could purchase an immediate annuity that provides monthly payments of $500 for the rest of their life. The payments would begin immediately after the purchase of the annuity.

Deferred annuities offer a unique approach to retirement planning. How To Calculate A Deferred Annuity 2024 provides a guide to calculating the potential benefits of deferring payments for a later date.

Key Features of Immediate Annuities, Immediate Annuity Definition Wikipedia

Immediate annuities are characterized by several key features that distinguish them from other types of annuities:

- Lump Sum Payment:Immediate annuities are purchased with a single, upfront payment. This payment is used to fund the annuity and determine the amount of the regular income payments.

- Immediate Payments:Income payments begin immediately after the annuity is purchased, providing an immediate source of income.

- Guaranteed Payments:The income payments are guaranteed for a specific period, typically for a fixed number of years or for the lifetime of the annuitant. This provides financial security and peace of mind.

- Interest Rate:The interest rate offered by the annuity provider plays a significant role in determining the amount of the income payments. Higher interest rates generally result in larger payments.

Types of Immediate Annuities

Immediate annuities are available in a variety of types, each with its own unique payout structure. The type of immediate annuity you choose will depend on your individual financial goals and risk tolerance.

Thinking about withdrawing from your variable annuity before age 59 1/2? Variable Annuity Withdrawal Before 59 1/2 2024 often comes with penalties and tax implications. It’s essential to carefully consider the financial consequences.

| Type | Description | Advantages | Disadvantages |

|---|---|---|---|

| Fixed Annuity | Provides a fixed, guaranteed income payment for a specific period. The payment amount does not change, regardless of interest rate fluctuations. | Provides predictable and reliable income. | Limited potential for growth. Payments may not keep pace with inflation. |

| Variable Annuity | Provides income payments that fluctuate based on the performance of a specific investment portfolio. | Potential for higher returns. Payments may grow over time. | Income payments are not guaranteed. Payments can be volatile and may decline in value. |

| Indexed Annuity | Provides income payments that are linked to the performance of a specific market index, such as the S&P 500. | Potential for growth. Payments may increase with market gains. | Payments are not guaranteed. Payments may be limited by a cap or minimum return. |

| Guaranteed Lifetime Withdrawal Benefit (GLWB) Annuity | Provides a guaranteed minimum income payment for life, even if the investment portfolio performs poorly. | Provides guaranteed income for life. | May have higher fees than other types of annuities. |

Advantages and Disadvantages of Immediate Annuities

Immediate annuities offer a number of advantages and disadvantages that should be carefully considered before purchasing one.

Financial calculators can be valuable for annuity planning. Financial Calculator Annuity 2024 guides you through the features and functions of financial calculators specifically designed for annuity calculations.

Advantages

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income, regardless of market fluctuations. This provides financial security and peace of mind, especially in retirement.

- Longevity Protection:Immediate annuities can provide income for life, ensuring that you have a steady source of income even if you live longer than expected.

- Simplified Investment Management:Immediate annuities eliminate the need for active investment management, as the income payments are guaranteed.

Disadvantages

- Limited Flexibility:Once you purchase an immediate annuity, you cannot typically access the principal amount. This can limit your flexibility if you need to withdraw funds for unexpected expenses.

- Potential for Low Returns:The interest rates offered by immediate annuities may be lower than other investment options, particularly in a low-interest-rate environment.

- Fees:Immediate annuities typically involve fees, such as surrender charges and administrative fees. These fees can reduce the overall return on your investment.

Considerations for Choosing an Immediate Annuity

Choosing the right immediate annuity is an important decision. Consider the following factors:

- Financial Goals:Determine your income needs and how an immediate annuity can help you achieve your financial goals.

- Risk Tolerance:Assess your risk tolerance and choose an annuity that aligns with your comfort level.

- Age and Health:Consider your age and health when determining the type and duration of the annuity.

- Annuity Provider:Compare different annuity options from reputable providers and carefully review the terms and conditions before making a decision.

Wrap-Up

Immediate annuities offer a unique blend of security and flexibility. They provide guaranteed income for life, eliminating the uncertainty of market fluctuations and potentially allowing you to enjoy a comfortable retirement. However, it’s important to carefully consider the trade-offs involved, such as limited flexibility and potential for lower returns compared to other investment options.

If you’re seeking a variable annuity solution in Amarillo, TX, Variable Annuity Life Insurance Company Amarillo Tx 2024 might be worth exploring. They offer a range of options to suit your individual needs and risk tolerance.

Before making a decision, consult with a financial advisor to determine if an immediate annuity is the right fit for your individual financial goals and risk tolerance.

Questions Often Asked: Immediate Annuity Definition Wikipedia

What are the main types of immediate annuities?

Immediate annuities come in various forms, including fixed, variable, and indexed annuities, each with its own payout structure and risk profile.

How do I choose the right immediate annuity for my needs?

Selecting the right immediate annuity depends on your financial goals, risk tolerance, and desired payout structure. Consulting with a financial advisor is recommended to determine the best option for you.

Are there any tax implications associated with immediate annuities?

Yes, immediate annuities can have tax implications. The payments you receive may be subject to taxation, and there may be tax penalties for withdrawing funds before a certain age. It’s essential to consult with a tax professional to understand the tax implications of an immediate annuity.

Can I access my annuity funds before I start receiving payments?

Looking for a way to ensure a steady income stream for the next 20 years? A Annuity 20 Year Certain 2024 might be the answer. It guarantees regular payments for a fixed period, providing financial security during retirement.

Generally, you cannot access the funds used to purchase an immediate annuity before you begin receiving payments. However, there may be some exceptions, such as in cases of hardship or illness.

Before investing in a Jackson Variable Annuity, consider reading Jackson Variable Annuity Reviews 2024 to gain insights from other investors and understand the potential risks and rewards.

To gauge the success of your annuity investment, it’s essential to calculate the rate of return. Calculating Annuity Rate Of Return 2024 explains how to determine the overall return on your annuity investment.