Current Immediate Annuity Rates offer a unique opportunity to secure a steady stream of income for life. These annuities, purchased with a lump sum, begin paying out monthly, quarterly, or annually, providing financial stability and peace of mind. Whether you’re looking to supplement your retirement income, protect your savings from market fluctuations, or simply guarantee a predictable cash flow, understanding the current rates and how they work is essential.

Before investing in a variable annuity, it’s important to understand “12b-1 Fees Variable Annuity 2024”. 12b-1 Fees Variable Annuity 2024 can impact your returns, so make sure you’re aware of them.

Immediate annuities are a powerful financial tool, but they are not without their complexities. Factors like interest rates, economic conditions, and the financial strength of the issuing insurance company all influence the rates you’ll receive. This guide will demystify these factors, explore the different types of immediate annuities available, and help you understand how to make an informed decision that aligns with your financial goals.

Inflation can impact the purchasing power of your annuity payments. Check out “Variable Annuity Inflation 2024” Variable Annuity Inflation 2024 to understand how inflation might affect your retirement income.

Contents List

Understanding Immediate Annuities: Current Immediate Annuity Rates

An immediate annuity is a type of insurance contract that provides a guaranteed stream of income payments for life, starting immediately after the purchase. It’s a popular option for retirees seeking a reliable source of income and a hedge against market volatility.

Planning your retirement? The “Annuity Calculator Quarterly 2024” Annuity Calculator Quarterly 2024 can help you estimate potential payouts based on current market conditions.

Imagine having a steady income stream that doesn’t depend on stock market fluctuations or your own investment decisions. That’s what an immediate annuity offers.

Want guaranteed income in retirement? “Variable Annuity With Income Rider 2024” Variable Annuity With Income Rider 2024 can provide you with that peace of mind.

Types of Immediate Annuities

Immediate annuities come in various forms, each with unique features and benefits:

- Single Premium Immediate Annuity (SPIA):This is the most common type, where you make a lump-sum payment upfront, and the insurer starts paying you a regular income stream for life.

- Fixed Annuity:This provides a fixed payment amount for life, regardless of market performance. You know exactly how much income you’ll receive each month, offering predictable cash flow.

- Variable Annuity:This offers a payment amount that fluctuates based on the performance of the underlying investment portfolio. The potential for higher returns comes with greater risk.

- Indexed Annuity:This links the payment amount to the performance of a specific index, such as the S&P 500. It offers some potential for growth while providing downside protection.

How Immediate Annuities Work

The process of purchasing and receiving payments from an immediate annuity is straightforward:

- Choose an Annuity Type:Select the type of annuity that best aligns with your risk tolerance and income needs.

- Determine Payment Amount:Decide how much you want to receive as a monthly or annual payment. The higher the payment, the smaller the lump sum you’ll need to invest.

- Choose Payment Options:You can choose from various payment options, such as a fixed amount for life, a fixed amount for a specific period, or a growing payment amount.

- Make a Lump Sum Payment:You’ll make a lump sum payment to the insurance company to purchase the annuity.

- Receive Regular Income Payments:The insurance company will start making regular payments to you, as per the terms of the contract.

Factors Influencing Current Rates

Immediate annuity rates are influenced by a complex interplay of economic and market factors:

Economic Conditions and Interest Rates, Current Immediate Annuity Rates

Interest rates play a crucial role in determining annuity rates. When interest rates rise, insurance companies can earn more on their investments, leading to higher annuity payouts. Conversely, falling interest rates can result in lower annuity rates. Inflation also impacts rates.

Understanding the “Immediate Annuity Accumulation Period” Immediate Annuity Accumulation Period is crucial for those seeking immediate income. It’s the period where your premium grows before payouts begin.

If inflation is high, insurers need to offer higher payouts to compensate for the erosion of purchasing power.

Calculating the present value of an annuity can be tricky. “Calculating Annuity Present Values 2024” Calculating Annuity Present Values 2024 can help you understand the process.

Market Volatility and Insurance Company Financial Health

Market volatility can also influence annuity rates. During periods of market uncertainty, insurance companies may offer lower rates to mitigate risk. The financial health of the insurance company issuing the annuity is also important. Companies with strong financial standing can offer more competitive rates, as they have the resources to honor their obligations.

Annuity jokes? You bet! Check out “Annuity Jokes 2024” Annuity Jokes 2024 for some lighthearted humor on the topic of retirement planning.

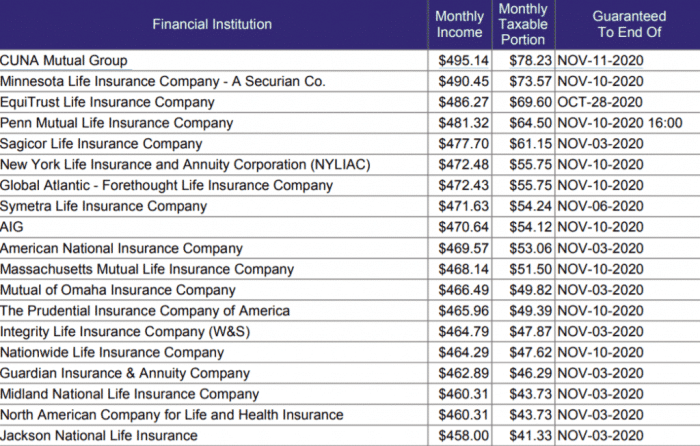

Current Rate Trends and Comparisons

Immediate annuity rates vary depending on the provider, product type, and other factors. It’s essential to compare rates from different reputable providers to find the best deal.

Curious about what an annuity with a starting amount of 60,000 could generate? “Annuity 60000 2024” Annuity 60000 2024 can help you explore different scenarios.

Table of Current Immediate Annuity Rates

| Provider | Rate | Product Features |

|---|---|---|

| Company A | 4.5% | Fixed Annuity, Lifetime Income |

| Company B | 4.2% | Variable Annuity, Growth Potential |

| Company C | 4.0% | Indexed Annuity, Market Participation |

The table above shows hypothetical rates and product features. It’s essential to consult with a financial advisor to get personalized rate quotes and compare different options.

Need to calculate annuity future values? “Problem 6-24 Calculating Annuity Future Values 2024” Problem 6-24 Calculating Annuity Future Values 2024 provides a step-by-step guide.

Key Considerations for Choosing an Annuity

Choosing the right immediate annuity requires careful consideration of several factors:

Financial Stability and Reputation of the Issuing Company

It’s crucial to select an insurance company with a strong financial track record and a reputation for stability. Research the company’s financial ratings, such as those provided by A.M. Best or Moody’s. Look for companies with high ratings, indicating their ability to meet their financial obligations.

Want to explore annuity options without providing personal details? “Annuity Calculator No Personal Details 2024” Annuity Calculator No Personal Details 2024 can help you get an initial understanding.

Payment Options

Immediate annuities offer various payment options to suit your individual needs. You can choose to receive a fixed payment amount for life, a fixed amount for a specific period, or a growing payment amount. Consider your income needs and your desire for potential growth when selecting a payment option.

Looking for a quick and easy way to calculate annuity payments? “Calculator.Net Annuity 2024” Calculator.Net Annuity 2024 offers a user-friendly online tool.

Risks and Benefits of Immediate Annuities

Immediate annuities offer both potential risks and benefits. It’s essential to weigh these factors carefully before making a decision.

Want to learn more about annuities from a trusted source? “Annuity Khan Academy 2024” Annuity Khan Academy 2024 provides free educational resources.

Risks

Immediate annuities come with certain risks, such as:

- Inflation Risk:The purchasing power of your annuity payments can be eroded by inflation, especially if you receive a fixed payment amount.

- Longevity Risk:If you live longer than expected, you might outlive your annuity payments, leaving you with no income source.

Benefits

Immediate annuities offer several benefits, including:

- Guaranteed Income:You receive a guaranteed stream of income for life, providing financial security and peace of mind.

- Protection from Market Volatility:Your income is not tied to the performance of the stock market, offering protection against market fluctuations.

- Tax Advantages:In some cases, annuity payments may be taxed favorably, depending on the type of annuity and your individual circumstances.

Immediate annuities can be a valuable tool for achieving financial goals, such as generating a steady income stream in retirement, protecting against market risk, and supplementing other income sources. Consulting with a financial advisor can help you determine if an immediate annuity is right for you and guide you through the selection process.

Outcome Summary

In today’s unpredictable financial landscape, seeking guaranteed income can be a wise strategy. Immediate annuities offer a unique solution, providing a steady stream of payments for life, regardless of market volatility. While there are risks to consider, such as inflation and longevity, the potential benefits, including financial security and tax advantages, make them a valuable option for many individuals.

By carefully researching and understanding the current rates, comparing different providers, and weighing the risks and benefits, you can make an informed decision that aligns with your financial goals and secures your future.

Answers to Common Questions

What is the difference between an immediate annuity and a deferred annuity?

Planning for future growth? Learn about “Pv Annuity With Growth 2024” Pv Annuity With Growth 2024 to understand how to factor in potential growth when calculating your annuity.

An immediate annuity starts paying out immediately after purchase, while a deferred annuity has a delay before payments begin. This delay allows the investment to grow tax-deferred until the payout period starts.

Looking for the best “Variable Annuity Options 2024”? Variable Annuity Options 2024 offer potential for growth, but also come with risk. Carefully consider your options and risk tolerance.

Are immediate annuity payments taxed?

Yes, payments from an immediate annuity are generally taxed as ordinary income. However, the portion of the payment that represents your original investment is typically tax-free.

How do I find the best immediate annuity rates?

Compare rates from multiple reputable insurance companies. Consider factors like the financial strength of the company, the product features, and the payment options offered.

What are some of the risks associated with immediate annuities?

Risks include inflation risk, where your purchasing power diminishes over time, and longevity risk, where you outlive your annuity payments. It’s important to carefully consider these risks and weigh them against the potential benefits.

Need an annuity calculator tailored for Nigeria? “Annuity Calculator Nigeria 2024” Annuity Calculator Nigeria 2024 can help you navigate local market specifics.