Immediate Annuity Exclusion Ratio Calculator is a powerful tool that helps individuals understand the tax implications of receiving annuity payments. Annuity payments, often used as a source of retirement income, are subject to taxation, and the exclusion ratio plays a crucial role in determining the taxable portion of each payment.

Annuity products can be offered by various insurance companies, and understanding the differences can be important. Is Annuity Lic 2024 provides you with information on whether LIC (Life Insurance Corporation of India) offers annuity products and helps you explore your options.

This calculator simplifies the process of calculating the exclusion ratio, allowing individuals to better understand their financial obligations and make informed decisions about their retirement planning.

The HP12c financial calculator is a popular choice for annuity calculations. Calculate Annuity Hp12c 2024 provides you with a detailed explanation of how to use the HP12c to calculate different types of annuities, helping you understand the functionalities of this powerful tool.

Immediate annuities are financial products that provide a guaranteed stream of income for a specific period of time, typically throughout retirement. These annuities can be fixed, variable, or indexed, offering different levels of risk and potential returns. The exclusion ratio, a key component of annuity taxation, represents the portion of each annuity payment that is considered a return of principal and is therefore not subject to income tax.

If you’re considering an annuity in the UK, it’s important to understand the current regulations and market trends. Annuity Uk 2024 provides you with insights into the UK annuity market, helping you make informed decisions about your retirement planning.

This ratio is determined by dividing the original investment in the annuity by the expected total payments over the annuity’s term.

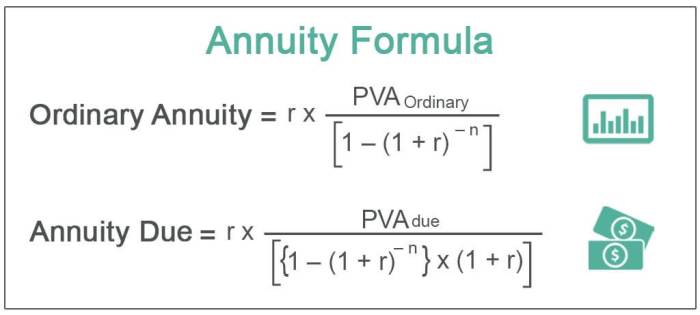

Need to determine the present value of an annuity? Pv Calculator Annuity 2024 guides you through the process of using a present value calculator to find the current value of a series of future payments.

Contents List

Understanding Immediate Annuities: Immediate Annuity Exclusion Ratio Calculator

An immediate annuity is a type of insurance contract that provides a guaranteed stream of income payments starting immediately after the purchase. It’s a popular choice for retirees seeking a reliable source of income to supplement their savings and investments.

Variable annuities often have age requirements, which can vary depending on the specific annuity contract. Variable Annuity Age Requirements 2024 provides you with an overview of the common age requirements for variable annuities, helping you determine if you meet the eligibility criteria.

Key Features and Benefits

Immediate annuities offer several key features and benefits that make them attractive to retirees:

- Guaranteed Income:Annuities provide a fixed stream of payments for life, regardless of market fluctuations or changes in interest rates. This eliminates the risk of outliving your savings.

- Lifetime Income:Payments continue for the lifetime of the annuitant, ensuring a steady income stream throughout retirement.

- Tax-Deferred Growth:In some cases, the interest earned on the annuity’s principal grows tax-deferred, meaning you won’t pay taxes on the earnings until you begin receiving payments.

- Protection from Inflation:Some annuities offer inflation protection, adjusting payments to keep pace with rising prices.

- Flexibility:Immediate annuities offer various payment options, including lump-sum payments, monthly payments, or a combination of both.

Types of Immediate Annuities

Immediate annuities come in several variations, each with its own characteristics and risk-return profile:

- Fixed Annuities:Offer a guaranteed fixed rate of return, providing predictable income payments. They are less risky than variable annuities but may offer lower potential returns.

- Variable Annuities:Link the income payments to the performance of underlying investment portfolios, potentially offering higher returns but also exposing the annuitant to market risk.

- Indexed Annuities:Link the income payments to the performance of a specific index, such as the S&P 500. They offer the potential for growth while providing some protection against market downturns.

The Role of the Exclusion Ratio

The exclusion ratio is a crucial factor in determining the taxable portion of your annuity payments. It represents the percentage of each payment that is considered a return of your original investment and therefore not taxable.

For federal employees, understanding how to calculate their annuity under the Federal Employees Retirement System (FERS) is essential for retirement planning. Calculate Annuity Fers 2024 provides you with the information you need to calculate your FERS annuity and understand your retirement benefits.

Factors Influencing the Exclusion Ratio

The exclusion ratio is determined by several factors, including:

- Contract Terms:The terms of your annuity contract specify the initial investment amount and the expected payout period.

- Age:Your age at the time of purchase affects the exclusion ratio, as it influences your life expectancy.

- Life Expectancy:The longer your life expectancy, the lower the exclusion ratio, as the payments are spread over a longer period.

Examples of Exclusion Ratio Application

Let’s consider an example to illustrate how the exclusion ratio is applied. Suppose you invest $100,000 in an immediate annuity and receive annual payments of $10,000. If your exclusion ratio is 50%, then $5,000 of each payment is considered a return of your original investment and is not taxable, while the remaining $5,000 is taxable income.

Annuities can provide a stream of income for life, but it’s important to understand the different types and features available. Is Annuity For Life 2024 explains the concept of life annuities and helps you determine if this type of annuity is right for your financial goals.

Using an Immediate Annuity Exclusion Ratio Calculator

An immediate annuity exclusion ratio calculator is a valuable tool for estimating the taxable portion of your annuity payments. These calculators are typically available online or through financial planning software.

Whether you’re planning for retirement or simply want to understand the basics of annuities, knowing how to calculate the annual payment is essential. How To Calculate Annual Annuity 2024 offers a clear explanation of the formula and steps involved in calculating the annual annuity payment.

Calculator Functionality

The calculator requires you to input the following information:

- Annuity Amount:The total amount you invested in the annuity.

- Age:Your age at the time of purchase.

- Life Expectancy:Your estimated life expectancy.

Calculating Exclusion Ratio and Taxable Income, Immediate Annuity Exclusion Ratio Calculator

Based on the information you provide, the calculator will determine the exclusion ratio and the taxable portion of each annuity payment. This information can help you plan for your tax liability and make informed financial decisions.

Calculating the annual payment for an annuity is a key step in financial planning. Calculating Annuity Annual Payment 2024 explains the formula and steps involved in calculating the annual payment, providing you with a clear understanding of this essential calculation.

Practical Applications and Considerations

The exclusion ratio calculator can be used in various financial planning scenarios, including:

- Retirement Planning:Estimate your annual taxable income from annuity payments to project your overall retirement income and tax liability.

- Tax Optimization:Use the exclusion ratio to adjust your investment strategy or other income sources to minimize your tax burden.

- Estate Planning:Consider the tax implications of annuity payments for your beneficiaries in estate planning.

Tax Implications

While annuity payments are generally taxed as ordinary income, the exclusion ratio helps reduce your taxable income. However, it’s crucial to consult with a tax professional to understand the specific tax implications of your annuity contract and ensure you are complying with all tax regulations.

Understanding how to calculate an annuity due on a financial calculator like the BA II Plus 2024 can be a valuable skill. Calculating Annuity Due On Ba Ii Plus 2024 guides you through the process step-by-step, ensuring you can accurately determine the present or future value of an annuity due.

Benefits and Drawbacks of Immediate Annuities

Immediate annuities offer a guaranteed stream of income, providing peace of mind in retirement. However, they also have drawbacks:

- Limited Flexibility:Once you purchase an annuity, you generally cannot access the principal investment without incurring penalties.

- Potential for Lower Returns:Fixed annuities may offer lower returns compared to other investment options.

- Inflation Risk:Some annuities do not offer inflation protection, which can erode the purchasing power of your payments over time.

Closing Notes

Understanding the exclusion ratio and utilizing an Immediate Annuity Exclusion Ratio Calculator can be invaluable for retirement planning. By accurately calculating the taxable portion of annuity payments, individuals can make informed decisions about their financial future, ensuring they are maximizing their retirement income while minimizing their tax obligations.

As with any financial decision, it is always recommended to consult with a qualified financial advisor to determine the best strategies for your individual needs and circumstances.

Question & Answer Hub

How often is the exclusion ratio calculated?

The exclusion ratio is calculated once at the beginning of the annuity period and remains the same for the entire duration of the annuity contract.

What happens if I die before receiving all the annuity payments?

If you die before receiving all the annuity payments, the remaining payments may be subject to different tax rules. Consult with a tax professional to determine the specific implications.

Can I adjust the exclusion ratio based on my investment strategy?

When it comes to annuities, knowing how to calculate the taxable income can be crucial for tax planning. Calculating Taxable Annuity Income 2024 provides you with the information you need to understand how the IRS treats annuity payments and helps you determine your tax liability.

The exclusion ratio is determined by the terms of the annuity contract and cannot be adjusted based on your investment strategy.

Variable annuities offer potential for growth but also come with risks. Variable Annuity Rates Today 2024 provides you with information on the current rates for variable annuities, helping you assess the potential returns and risks involved.

Deferred variable annuities allow you to delay receiving payments until a later date, often during retirement. Deferred Variable Annuities 2024 explains the benefits and considerations of this type of annuity, helping you determine if it’s a suitable option for your financial planning.

An annuity due is a type of annuity where payments are made at the beginning of each period. Calculating Annuity Due 2024 provides you with a comprehensive guide to calculating the present and future value of an annuity due, helping you understand this important concept.

Understanding the features and benefits of a T-C annuity can be essential for retirement planning. T-C Annuity 2024 provides you with information on this type of annuity, helping you determine if it aligns with your financial goals.