A Variable Annuity Is Both An Annuity And A 2024 Investment, offering a unique blend of retirement income security and investment potential. Variable annuities act as both a traditional annuity providing guaranteed income streams and an investment vehicle allowing for growth based on market performance.

Annuity payments are a form of income, but their tax implications can vary. Annuity Is Income 2024 clarifies the tax treatment of annuity payments, helping you understand how they might affect your overall financial picture.

This duality presents an opportunity for investors to diversify their portfolios and potentially enhance their retirement savings, but it also comes with inherent risks.

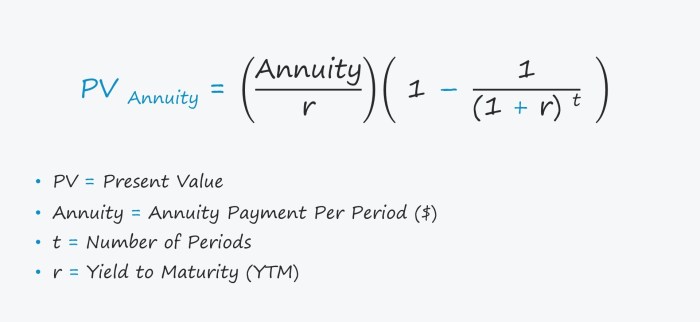

To understand how annuities work, it’s helpful to understand the formula used to calculate their payouts. Annuity Formula Quarterly 2024 provides a detailed breakdown of the factors that go into determining your annuity payments.

The variable nature of these annuities stems from their investment components, primarily mutual funds or sub-accounts. These investment options allow individuals to tailor their portfolio based on their risk tolerance and financial goals. However, the returns generated by these investments are not guaranteed and are subject to market fluctuations, potentially leading to losses in principal.

Annuity contracts are often described as the opposite of a lump sum payment. An Annuity Is Sometimes Called The Flip Side Of 2024 explores this concept, comparing annuities to other retirement options.

Contents List

Understanding Variable Annuities

Variable annuities are financial instruments that combine the features of both traditional annuities and investments. They offer the potential for growth through investment in various market instruments, while also providing income security in retirement. Unlike fixed annuities, which guarantee a fixed rate of return, variable annuities offer a variable rate of return based on the performance of the underlying investments.

While annuities offer potential benefits, they also have drawbacks. Why An Annuity Is Bad 2024 examines the potential downsides of annuities, highlighting factors to consider before making a decision.

Defining Variable Annuities

A variable annuity is a type of annuity contract that allows you to invest your premiums in a variety of sub-accounts, similar to mutual funds. The value of your annuity will fluctuate based on the performance of these sub-accounts. This means that your returns are not guaranteed, but they also have the potential to grow significantly over time.

Variable Annuity Investment Components

The “variable” aspect of variable annuities stems from the investment options available within the contract. These investment options typically include:

- Mutual Funds:Variable annuities often offer a wide selection of mutual funds, allowing you to diversify your investments across different asset classes, such as stocks, bonds, and real estate.

- Sub-Accounts:Variable annuities are often structured with sub-accounts, which are separate investment accounts within the annuity contract. These sub-accounts may be managed by different investment managers, each with their own investment strategy and risk profile.

- Separate Accounts:Some variable annuities offer separate accounts, which are custom-managed investment accounts that are tailored to your specific investment goals and risk tolerance. This option allows you to work directly with a financial advisor to create a personalized investment strategy.

The investment performance of these sub-accounts will directly impact the value of your variable annuity. When the market performs well, the value of your annuity may increase. However, if the market declines, the value of your annuity may also decrease.

Risks Associated with Variable Annuities

While variable annuities offer the potential for growth, they also come with certain risks:

- Market Volatility:The value of your variable annuity is directly tied to the performance of the underlying investments. Market volatility can lead to fluctuations in the value of your annuity, and you could potentially lose some or all of your principal.

- Investment Risk:The investment options available within a variable annuity may have different risk profiles. It is important to carefully consider the risk tolerance of each investment option before making a decision.

- Fees and Expenses:Variable annuities often have higher fees and expenses compared to traditional fixed annuities. These fees can impact the overall returns on your investment.

It is crucial to understand these risks before investing in a variable annuity. Consulting with a financial advisor can help you determine if a variable annuity is appropriate for your individual financial goals and risk tolerance.

Looking for a tool to help you calculate potential annuity payments in the UK? Annuity Calculator Gov Uk 2024 provides access to a calculator specifically designed for UK residents, offering a personalized estimate of your annuity income.

Annuity Features of Variable Annuities: A Variable Annuity Is Both An Annuity And A 2024

Variable annuities also offer several annuity features, allowing you to receive income payments in retirement. These features include:

Payout Options

Variable annuities offer a variety of payout options, including:

- Lifetime Income:This option provides you with a guaranteed stream of income for the rest of your life. The amount of income you receive will depend on the value of your annuity at the time of annuitization and the chosen payout option.

Curious about the potential of a $400,000 annuity? Annuity $400 000 2024 delves into the factors that can influence the size of your annuity payments and what a $400,000 annuity could mean for your retirement.

- Lump Sum:You can choose to receive your entire annuity payout as a lump sum. This option gives you complete control over how you use the funds.

- Periodic Payments:You can choose to receive your annuity payout in regular periodic payments, such as monthly or quarterly payments. This option provides you with a steady stream of income.

Annuitization

Annuitization is the process of converting your variable annuity into a stream of guaranteed income payments. When you annuitize your annuity, you are essentially exchanging the potential for growth in your annuity for a guaranteed income stream. The amount of income you receive will depend on the value of your annuity at the time of annuitization and the chosen payout option.

Understanding how annuity cash flows are calculated is crucial for financial planning. Calculating Annuity Cash Flows 2024 explains the process of determining your annuity payments over time.

Factors Influencing Payout Amount, A Variable Annuity Is Both An Annuity And A 2024

Several factors influence the payout amount for variable annuities, including:

- Investment Performance:The performance of the underlying investments in your variable annuity will directly impact the value of your annuity at the time of annuitization. Higher investment returns will result in a larger payout amount.

- Chosen Payout Option:The payout option you choose will also impact the amount of income you receive. Lifetime income options typically provide lower monthly payments than lump sum options.

- Age and Gender:Your age and gender can also influence the payout amount. Generally, younger individuals with a longer life expectancy will receive lower monthly payments than older individuals with a shorter life expectancy.

Tax Considerations for Variable Annuities

Variable annuities have unique tax implications that investors should understand. The tax treatment of contributions, withdrawals, and payouts can vary depending on the specific features of the annuity.

Tax Implications Table

| Feature | Tax Treatment |

|---|---|

| Contributions | Generally not tax-deductible. |

| Withdrawals | Taxed as ordinary income, subject to the “first in, first out” (FIFO) rule. |

| Payouts | Taxed as ordinary income, with a portion potentially representing a return of principal that is tax-free. |

The tax treatment of growth and income generated within a variable annuity can be complex. While the growth of your investment is generally tax-deferred, withdrawals are typically taxed as ordinary income. This means that you may have to pay taxes on your investment gains when you withdraw money from your annuity.

For those familiar with R programming, there are tools available to help you calculate annuities. R Calculate Annuity 2024 provides insights into using R for annuity calculations, offering a more technical approach to understanding these financial instruments.

Tax Implications of Annuitization

When you annuitize your variable annuity, the payout stream is generally taxed as ordinary income. This means that you will have to pay taxes on the income you receive from your annuity each year.

However, some variable annuities offer a “death benefit” feature, which can provide a tax-free payout to your beneficiaries upon your death. This feature can be particularly beneficial for those who want to ensure that their loved ones receive a tax-free inheritance.

If you’re considering an annuity, it’s important to understand the nuances of how they operate in different regions. Annuity Hk 2024 focuses on the specifics of annuities in Hong Kong, offering insights into local regulations and offerings.

Variable Annuities in 2024

The variable annuity market is constantly evolving, with new trends and developments emerging each year. Here are some key trends to watch for in 2024:

Market Trends and Developments

The variable annuity market is expected to continue to grow in 2024, driven by factors such as the aging population and the need for retirement income security. However, the market is also facing challenges, such as low interest rates and increased regulatory scrutiny.

As a result, variable annuity providers are likely to focus on innovation and product development to meet the evolving needs of investors.

Need a tool to help you calculate potential annuity payouts? Annuity Calculator Nsdl 2024 provides access to a calculator that can help you estimate your future annuity income.

- Increased Product Innovation:Variable annuity providers are expected to introduce new products and features to attract investors, such as enhanced death benefit options, guaranteed minimum income riders, and more flexible withdrawal options.

- Focus on Transparency and Disclosure:Regulatory changes are expected to continue to increase transparency and disclosure requirements for variable annuities, making it easier for investors to understand the costs and risks associated with these products.

- Growing Importance of Personalized Solutions:Variable annuity providers are increasingly focusing on offering personalized solutions that meet the specific needs of individual investors. This includes providing tailored investment advice and guidance to help investors make informed decisions.

Economic Factors and Impact

Economic factors, such as interest rates and inflation, will continue to have a significant impact on the variable annuity market in 2024. Rising interest rates could lead to lower returns on fixed income investments, making variable annuities more attractive to investors seeking growth potential.

Wondering if an annuity is the right retirement option for you in 2024? Is Annuity Retirement 2024 explores the pros and cons of this financial tool and helps you determine if it aligns with your retirement goals.

However, inflation could also erode the purchasing power of retirement income, making it more challenging for investors to meet their financial goals.

Are you wondering if annuities qualify as part of your retirement plan? Is Annuity A Qualified Plan 2024 provides a comprehensive overview of annuity eligibility and its potential tax implications.

Opportunities and Challenges for Investors

Variable annuities can be a valuable tool for investors seeking to grow their retirement savings and generate income in retirement. However, it is essential to carefully consider the risks and costs associated with these products before making a decision. Consulting with a financial advisor can help you determine if a variable annuity is appropriate for your individual financial goals and risk tolerance.

Dreaming of a substantial retirement payout? 3 Million Annuity Payout 2024 explores the possibility of receiving a significant annuity payment, discussing factors that can influence its size.

For investors seeking growth potential, variable annuities can offer an opportunity to participate in the stock market and potentially generate higher returns than fixed annuities. However, it is important to remember that variable annuities are not guaranteed, and you could potentially lose some or all of your principal.

Annuity payments can be a reliable source of income in retirement. Is Annuity Income 2024 explores the concept of annuity payments as income and how they can contribute to your overall financial security.

In 2024, investors considering variable annuities should carefully evaluate the product offerings and investment options available. They should also consider the potential impact of economic factors, such as interest rates and inflation, on their investment decisions.

One of the key features of annuities is their indefinite duration. Annuity Is Indefinite Duration 2024 delves into the concept of guaranteed income streams that can last a lifetime, providing financial security in retirement.

Conclusive Thoughts

In conclusion, variable annuities offer a complex and multifaceted approach to retirement planning. By understanding their dual nature as both an annuity and an investment, investors can evaluate their suitability for individual financial goals and risk profiles. While the potential for growth and guaranteed income streams are attractive, it’s crucial to carefully consider the associated risks, including market volatility and the potential for loss of principal.

By consulting with a financial advisor and conducting thorough research, individuals can make informed decisions about whether variable annuities align with their retirement planning objectives.

Questions and Answers

What are the advantages of a variable annuity?

Variable annuities offer potential for growth through market participation, tax-deferred growth, and the possibility of guaranteed income streams in retirement.

What are the disadvantages of a variable annuity?

Variable annuities carry investment risk, potential for loss of principal, high fees, and complex tax implications.

How do variable annuities compare to traditional fixed annuities?

Unlike fixed annuities that provide a guaranteed rate of return, variable annuities offer the potential for higher returns but also carry greater risk. Fixed annuities provide predictable income streams, while variable annuities offer the potential for growth but with the risk of losing principal.