Affordable travel insurance for backpackers in October 2024 is a must-have for any adventurous soul planning a trip. As you embark on your journey, it’s crucial to consider the unique challenges and risks that backpackers face, especially during this time of year.

Wondering if an annuity is right for you? Is Annuity For Life 2024 can help you determine if an annuity is a good fit for your financial goals. Annuities can provide guaranteed income for life, but they can also have high fees and limited flexibility.

With unpredictable weather, potential health issues, and the ever-present possibility of lost luggage or travel disruptions, securing the right insurance can provide peace of mind and financial protection. This guide will delve into the essential coverage backpackers should prioritize, factors influencing affordability, and tips for finding the most suitable and affordable travel insurance options.

The Omni Calculator Annuity 2024 is a great tool for estimating how much income an annuity can provide. You can input your own information, such as your age, savings, and desired income, to see how much you could receive.

October brings a unique blend of travel opportunities and potential challenges for backpackers. While the weather might be pleasant in some destinations, it can also be unpredictable in others. Additionally, the busy travel season can lead to crowded destinations, potential delays, and increased risks of theft or injury.

Annuities can be complex, so it’s helpful to have answers to common questions. Annuity Questions And Answers 2024 provides clear explanations to frequently asked questions, helping you make informed decisions about your retirement planning.

This is where affordable travel insurance comes in, acting as a safety net for unexpected situations and ensuring that your journey remains enjoyable and worry-free.

The cost of immediate needs annuities can vary, especially in different regions. Immediate Needs Annuity Cost Uk provides information about the cost of these annuities in the UK, giving you a better understanding of the financial commitment involved.

Contents List

Affordable Travel Insurance for Backpackers in October 2024

Embarking on a backpacking adventure in October 2024? It’s an exciting time to explore the world, but it’s also crucial to prioritize your safety and well-being. Travel insurance acts as a safety net, providing financial protection against unexpected events that can derail your trip.

HDFC is a well-known financial institution offering annuity products. Annuity Calculator Hdfc 2024 allows you to explore the features and calculate potential payments for HDFC annuities, providing a personalized understanding of their offerings.

While travel insurance might seem like an added expense, it can save you from significant financial burdens and allow you to focus on enjoying your journey without worry.

Getting a quote for a variable annuity is a crucial step in the decision-making process. Variable Annuity Quote 2024 helps you understand how to obtain quotes and what factors influence the pricing of these annuities.

Backpackers often face unique challenges, especially during peak travel seasons like October. From unpredictable weather to potential health issues, the unexpected can happen. Finding affordable travel insurance that caters to your specific needs as a backpacker becomes essential.

Tax implications are a key consideration when evaluating annuities. Is Annuity Counted As Income 2024 helps you understand how annuity payments are treated for tax purposes, allowing you to plan accordingly.

This article explores the key aspects of affordable travel insurance for backpackers in October 2024, empowering you to make informed decisions and travel with peace of mind.

Using a financial calculator can simplify annuity calculations. Calculating Annuity On Financial Calculator 2024 provides a guide on how to use a financial calculator to determine annuity payments, making the process more straightforward.

Essential Coverage for Backpackers

Backpackers require specific coverage to address the inherent risks of independent travel. Here are some essential types of coverage to consider:

- Medical Expenses:This covers medical costs incurred due to illness or injury while traveling. October is a popular travel month, potentially leading to crowded hospitals and higher medical bills.

- Emergency Evacuation:This covers the cost of transporting you back home in case of a medical emergency or natural disaster. Backpackers often travel to remote locations where access to medical facilities might be limited.

- Lost Luggage:This covers the cost of replacing lost or stolen luggage. Backpackers often rely on their luggage for essential belongings, and losing it can be a significant inconvenience.

- Trip Cancellation:This covers the cost of non-refundable travel expenses if you have to cancel your trip due to unforeseen circumstances like illness or a family emergency. Backpackers often book flights and accommodations in advance, making trip cancellation coverage particularly important.

Immediate annuity rates are subject to change, so it’s important to stay informed. Immediate Annuity Rates 2021 offers insights into the current rates, helping you make informed decisions based on the latest market trends.

Consider these real-life scenarios where these coverages would be crucial:

- Medical Expenses:You get sick with a severe case of food poisoning while trekking in Southeast Asia. Your medical expenses could easily exceed thousands of dollars, but your travel insurance covers the cost of treatment and hospitalization.

- Emergency Evacuation:You’re caught in a natural disaster while backpacking in South America. Your travel insurance covers the cost of evacuating you to a safe location and arranging your return home.

- Lost Luggage:Your luggage is stolen from your hostel in Europe. Your travel insurance covers the cost of replacing your essential belongings, allowing you to continue your trip without significant financial strain.

- Trip Cancellation:You get a sudden family emergency and have to cancel your backpacking trip to South Africa. Your travel insurance covers the cost of non-refundable flights and accommodations, preventing a significant financial loss.

Factors Influencing Affordability, Affordable travel insurance for backpackers in October 2024

The cost of travel insurance depends on various factors, including:

- Age:Older travelers generally pay higher premiums due to increased health risks.

- Destination:Traveling to high-risk destinations with potential for political instability, natural disasters, or infectious diseases typically results in higher premiums.

- Length of Trip:Longer trips usually mean higher premiums. Backpackers often travel for extended periods, so it’s crucial to factor in the duration of your trip when comparing insurance plans.

- Activity Level:Engaging in adventurous activities like extreme sports or hiking in remote areas can increase your insurance costs. Backpackers often participate in these activities, so it’s important to disclose your planned activities to your insurer.

These factors play a significant role in determining the affordability of travel insurance for backpackers in October 2024. Consider these tips to reduce your insurance costs while maintaining essential coverage:

- Travel During the Off-Season:Traveling outside peak seasons like October can often result in lower premiums. Consider exploring destinations during shoulder seasons for a more budget-friendly experience.

- Compare Quotes:Don’t settle for the first insurance quote you find. Compare prices and coverage from multiple providers to find the best value for your money.

- Choose a Basic Plan:If you’re a healthy traveler and plan to stick to relatively safe activities, consider a basic plan that offers essential coverage without unnecessary extras. This can help you save on premiums.

- Consider Exclusions:Pay attention to any exclusions in your policy, such as pre-existing conditions or specific activities. Make sure your policy covers your planned activities and doesn’t exclude any potential health risks.

Finding Affordable Options

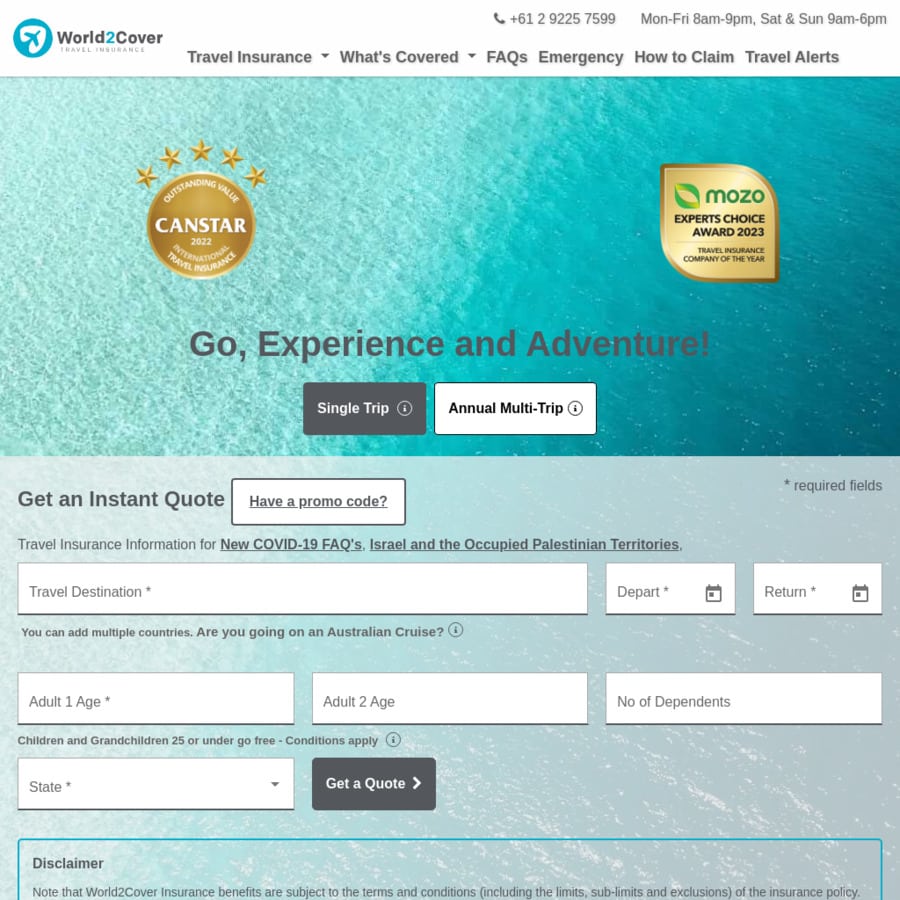

Several travel insurance providers cater to backpackers, offering affordable plans with various coverage options. Here’s a comparison of some popular providers:

| Provider | Key Features | Pricing Structure | Customer Reviews |

|---|---|---|---|

| World Nomads | Comprehensive coverage, including medical expenses, emergency evacuation, lost luggage, and trip cancellation; flexible plan options for different travel styles; strong customer support. | Premiums vary based on age, destination, length of trip, and activity level; offers discounts for multi-trip policies. | Generally positive reviews, praising the company’s responsiveness, coverage options, and ease of use. |

| SafetyWing | Affordable and comprehensive coverage for digital nomads and long-term travelers; includes medical expenses, emergency evacuation, and lost luggage; offers monthly subscriptions. | Fixed monthly subscription fee, regardless of destination or length of trip; provides coverage for up to 365 days. | Favorable reviews, highlighting the affordability and convenience of monthly subscriptions, especially for long-term travel. |

| InsureMyTrip | Wide range of plans to choose from, catering to different needs and budgets; allows you to customize your coverage based on your specific requirements. | Prices vary based on plan selection, age, destination, length of trip, and activity level; offers discounts for group travel and multiple trips. | Mixed reviews, with some praising the wide selection of plans and others expressing concerns about the complexity of choosing the right option. |

This table provides a snapshot of some affordable travel insurance options for backpackers. Remember to research and compare different providers to find the plan that best suits your needs and budget.

Understanding how to calculate an annuity is crucial for making informed decisions about your retirement planning. How Calculate Annuity 2024 provides step-by-step guidance on calculating annuity payments, helping you make sense of the numbers.

Tips for Smart Insurance Choices

Making smart insurance choices is essential for ensuring you have the right protection without overspending. Follow these tips:

- Identify Your Needs:Before purchasing insurance, assess your travel plans, destinations, activities, and potential risks. This helps you determine the essential coverage you require.

- Read the Fine Print:Carefully review the policy terms and conditions before purchasing insurance. Pay attention to exclusions, limitations, and any specific requirements.

- Contact the Provider:If you have any questions or need clarification on specific aspects of the policy, don’t hesitate to contact the insurance provider directly. They can provide valuable insights and ensure you understand your coverage.

- Negotiate:Some insurance providers might be willing to negotiate premiums or offer discounts, especially if you’re purchasing a multi-trip policy or have a good travel history. Don’t be afraid to ask for a better deal.

- Maximize Value:Look for insurance plans that offer additional benefits, such as 24/7 emergency assistance, travel assistance services, or discounts on travel-related products and services.

Additional Considerations

For specific destinations or activities, you might require additional coverage. For example, if you plan to go scuba diving or skiing, you might need specialized insurance for those activities. Additionally, traveling during October 2024 might pose unique risks due to potential weather events or seasonal health concerns.

Ensure your travel insurance policy addresses these risks and provides adequate coverage for your planned itinerary.

Jackson Perspective L Variable Annuity is another popular option for those seeking growth potential. Jackson Perspective L Variable Annuity 2024 provides details about this specific annuity, allowing you to compare it with other options.

Remember to prioritize travel safety and responsible backpacking practices. Research your destinations, stay informed about local laws and customs, and take necessary precautions to minimize risks. By combining affordable travel insurance with smart travel choices, you can enjoy your backpacking adventure in October 2024 with peace of mind.

Variable annuities often tie their performance to market indices like the S&P 500. Variable Annuity S&P 500 2024 offers insights into how these annuities perform based on the S&P 500’s fluctuations, providing a clear picture of potential gains and risks.

Final Conclusion: Affordable Travel Insurance For Backpackers In October 2024

Choosing the right travel insurance plan is an essential step in responsible backpacking. By understanding the key coverage options, factors influencing affordability, and smart tips for finding the best deals, you can ensure a secure and enjoyable adventure. Remember to carefully read policy terms and conditions, compare different providers, and prioritize coverage that aligns with your specific needs and budget.

When choosing an immediate annuity, you have various settlement options. Immediate Annuity Settlement Options outlines the different ways you can receive payments, including fixed, variable, and joint life options, enabling you to choose the best fit for your circumstances.

With the right insurance in place, you can embrace the freedom of backpacking with the confidence of knowing you’re protected in case of unforeseen circumstances.

FAQ Summary

What are the common reasons for needing travel insurance?

Travel insurance provides coverage for a wide range of situations, including medical emergencies, flight delays or cancellations, lost luggage, theft, and even natural disasters.

How can I find the most affordable travel insurance plan?

If you’re looking for information on the Brighthouse Series L Variable Annuity, you’ve come to the right place. Brighthouse Series L Variable Annuity 2024 is a popular choice for those looking for a way to grow their retirement savings, but it’s important to understand the risks and rewards before making a decision.

Compare quotes from multiple providers, consider your specific needs and budget, and look for plans that offer discounts or special promotions.

Is travel insurance necessary for every backpacker?

While not mandatory, travel insurance is highly recommended for backpackers as it offers crucial financial protection against unexpected events.

What are the benefits of having travel insurance?

Travel insurance provides peace of mind, financial security, and access to emergency assistance in case of unexpected situations.

What are some tips for choosing the right travel insurance plan?

Read the policy terms and conditions carefully, consider the coverage options, compare prices, and choose a plan that aligns with your specific needs and budget.

Understanding the interest rates associated with variable annuities is essential. Variable Annuity Interest Rates 2024 provides insights into how these rates fluctuate and what factors influence their movement, helping you make informed decisions based on current market conditions.