Affordable travel insurance with COVID-19 protection is essential for peace of mind in today’s world. Travel plans can be disrupted by unexpected events, and having the right insurance can provide financial security and coverage for medical expenses, quarantine costs, and even trip cancellations due to COVID-19.

Variable annuities are a type of investment that offers both growth potential and income guarantees. You can find information on what a variable annuity is for 2024 here. This information can help you understand the basic characteristics of this type of investment.

Navigating the complexities of travel insurance can be challenging, especially when it comes to finding affordable options with adequate COVID-19 protection. This guide aims to demystify the process, providing insights into the importance of travel insurance, exploring various coverage options, and offering practical tips for finding the best value for your needs.

The concept of an annuity is important in financial planning. You can find the meaning of annuity in Tamil for 2024 here. This resource can be helpful for understanding annuity concepts in a specific cultural context.

Contents List

- 1 The Importance of Travel Insurance

- 2 COVID-19 Protection in Travel Insurance

- 3 Factors to Consider When Choosing Affordable Travel Insurance

- 4 Tips for Finding Affordable Travel Insurance with COVID-19 Protection

- 5 Understanding the Policy Terms and Conditions

- 6 Travel Insurance and the Future of Travel: Affordable Travel Insurance With COVID-19 Protection

- 7 Conclusion

- 8 FAQ Compilation

The Importance of Travel Insurance

Travel insurance is an essential investment for any trip, especially in today’s uncertain world. It provides a safety net against unexpected events that can disrupt your travel plans and lead to significant financial losses. From medical emergencies to flight cancellations, travel insurance can help you navigate unforeseen challenges and minimize the impact on your journey.

While both annuities and IRAs are retirement savings tools, they have different features and benefits. You can find information on whether an annuity is the same as an IRA for 2024 here. This information can help you understand the key differences between these two options.

Potential Risks and Unexpected Events

The world is full of unpredictable situations that can arise during your travels. Here are some common risks that travel insurance can help you manage:

- Medical emergencies:Unexpected illnesses or injuries while traveling can be costly, and travel insurance can cover medical expenses, hospital stays, and even medical evacuation.

- Flight cancellations or delays:Airlines sometimes cancel or delay flights due to weather, mechanical issues, or other unforeseen circumstances. Travel insurance can reimburse you for lost travel expenses and help you book alternative flights.

- Lost or stolen luggage:Losing your luggage can be a major inconvenience and financial burden. Travel insurance can cover the cost of replacing lost or stolen items, providing peace of mind.

- Trip cancellations or interruptions:Unexpected events like family emergencies, job loss, or natural disasters can force you to cancel or interrupt your trip. Travel insurance can help you recoup some of your non-refundable travel expenses.

Real-Life Examples

Here are some real-life examples of how travel insurance has helped individuals in challenging situations:

- A traveler in Thailand was hospitalized after a motorcycle accident. Travel insurance covered their medical expenses, including ambulance transportation and hospital stays.

- A family traveling to Europe had their flight canceled due to a volcanic eruption. Travel insurance reimbursed them for their non-refundable flight tickets and helped them book alternative flights.

- A backpacker in South America had their luggage stolen. Travel insurance covered the cost of replacing their essential belongings.

COVID-19 Protection in Travel Insurance

In the wake of the COVID-19 pandemic, travel insurance has become even more crucial. Many providers now offer specific coverage for COVID-19-related events, providing travelers with additional protection and peace of mind.

Annuity rates can vary depending on factors like interest rates and market conditions. You can find information on annuities with an 8% return for 2024 here. This information can be helpful for comparing different annuity options.

COVID-19 Coverage Options

COVID-19 coverage varies depending on the insurance provider and the specific policy. Common types of COVID-19 protection include:

- Medical expenses:Covers medical costs associated with COVID-19, including hospitalization, treatment, and medication.

- Quarantine costs:Reimburses expenses incurred during mandatory quarantine, such as accommodation, meals, and transportation.

- Trip cancellation or interruption due to COVID-19:Covers non-refundable travel expenses if you need to cancel or interrupt your trip due to a positive COVID-19 test, travel restrictions, or illness.

Understanding Policy Limitations and Exclusions

It’s crucial to carefully review the terms and conditions of your travel insurance policy to understand its limitations and exclusions regarding COVID-19 coverage. Some policies may have specific requirements, such as pre-existing conditions or waiting periods, that could affect your coverage.

Variable annuities often have separate accounts that hold the underlying investments. You can find information on variable annuity separate accounts for 2024 here. This information can help you understand how these accounts work and their potential impact on your investment.

- Pre-existing conditions:Some policies may exclude coverage for medical expenses related to pre-existing conditions, even if they are COVID-19-related.

- Waiting periods:There may be a waiting period before certain COVID-19 coverage becomes effective, such as trip cancellation due to illness.

- Exclusions:Policies may have specific exclusions related to COVID-19, such as coverage for travel to high-risk areas or for specific activities.

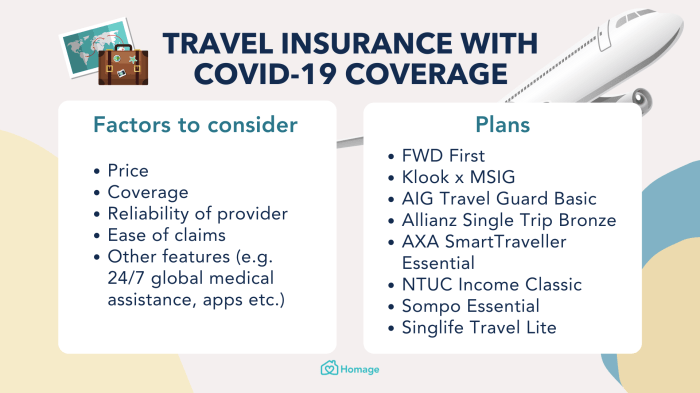

Factors to Consider When Choosing Affordable Travel Insurance

Finding affordable travel insurance with COVID-19 protection requires careful consideration of your needs and budget. You need to balance affordability with comprehensive coverage to ensure you’re adequately protected during your travels.

Immediate annuities are a type of annuity that provides payments immediately after purchase. You can find information on the fees associated with immediate annuities here. This information can help you understand the costs involved in this type of annuity.

Comparing Insurance Providers

| Insurance Provider | Coverage Limits | Premium | Customer Reviews |

|---|---|---|---|

| Provider A | $100,000 | $50 | 4.5 stars |

| Provider B | $50,000 | $30 | 4 stars |

| Provider C | $75,000 | $40 | 3.5 stars |

Checklist for Choosing Affordable Travel Insurance

- Determine your coverage needs:Consider the types of risks you’re most concerned about, such as medical emergencies, flight cancellations, or COVID-19-related events.

- Compare quotes from multiple providers:Get quotes from several insurance providers to compare coverage options and premiums.

- Read the policy terms and conditions carefully:Pay close attention to the coverage limits, exclusions, and claim procedures.

- Consider your budget:Choose a policy that provides adequate coverage without breaking the bank.

- Check customer reviews:Read reviews from other travelers to get insights into the provider’s customer service and claims handling process.

Tips for Finding Affordable Travel Insurance with COVID-19 Protection

Finding affordable travel insurance with COVID-19 protection doesn’t have to be a daunting task. By following these tips, you can find a policy that meets your needs and budget.

Transamerica offers a variable annuity series known as X-Share, and you can find information about it for 2024 here. This series is designed to provide investors with growth potential while offering income guarantees.

Comparing Quotes and Exploring Discounts, Affordable travel insurance with COVID-19 protection

- Compare quotes from multiple providers:Use online comparison websites or contact insurance brokers to get quotes from different providers.

- Consider travel duration:The cost of travel insurance often depends on the length of your trip. Shorter trips generally cost less.

- Explore discounts:Some providers offer discounts for seniors, students, or members of certain organizations.

Step-by-Step Guide to Choosing Travel Insurance

- Determine your travel needs:Identify the specific risks you want to cover, such as medical emergencies, flight cancellations, or COVID-19-related events.

- Research insurance providers:Compare quotes from multiple providers and read customer reviews.

- Read the policy terms and conditions:Pay close attention to coverage limits, exclusions, and claim procedures.

- Choose a policy that meets your needs and budget:Find a balance between affordability and comprehensive coverage.

- Purchase your policy:Make sure you understand the policy terms and conditions before purchasing.

- Bundle your insurance:Some providers offer discounts if you bundle your travel insurance with other types of insurance, such as health insurance or car insurance.

- Negotiate with the provider:If you’re a loyal customer or have a good credit score, you may be able to negotiate a lower premium.

- Consider purchasing a policy with a higher deductible:A higher deductible generally means a lower premium.

- Pre-existing conditions:Make sure you understand how pre-existing conditions are handled, as they may affect your COVID-19 coverage.

- Waiting periods:Be aware of any waiting periods before certain coverage becomes effective, such as trip cancellation due to illness.

- Claim procedures:Familiarize yourself with the steps involved in filing a claim, including required documentation and deadlines.

- Medical expenses:If you require medical treatment due to COVID-19, you can file a claim for covered medical expenses.

- Quarantine costs:If you’re required to quarantine due to a positive COVID-19 test or travel restrictions, you can file a claim for covered quarantine expenses.

- Trip cancellation or interruption:If you need to cancel or interrupt your trip due to a positive COVID-19 test, travel restrictions, or illness, you can file a claim for covered non-refundable travel expenses.

- Expanded coverage for COVID-19-related events:Providers may offer coverage for additional COVID-19-related expenses, such as testing costs or lost wages due to quarantine.

- Integration of technology:Travel insurance policies may be integrated with wearable technology to provide real-time health monitoring and support.

- Personalized coverage:Travel insurance policies may become more personalized, tailoring coverage to individual needs and travel styles.

Negotiating Better Rates

Understanding the Policy Terms and Conditions

Thoroughly reading and understanding the terms and conditions of your travel insurance policy is crucial, especially regarding COVID-19 coverage. This will ensure you know what’s covered, what’s not covered, and how to file a claim.

To better understand the present value of an annuity, you can use a PV annuity chart. You can find a chart specifically for 2024 here. This chart helps visualize the relationship between time, interest rates, and the present value of future payments.

Key Aspects of the Policy

Common Scenarios for Filing a Claim

Travel Insurance and the Future of Travel: Affordable Travel Insurance With COVID-19 Protection

Travel insurance is playing an increasingly important role in the post-pandemic world, with COVID-19 protection becoming a key consideration for travelers. As the travel landscape continues to evolve, travel insurance is adapting to meet the changing needs of travelers.

Variable annuities are popular investment options in the United States. You can find information on variable annuities in the USA for 2024 here. This information can help you understand the current market landscape and available options.

Evolving Role of Travel Insurance

Travel insurance is becoming more comprehensive, with providers offering expanded coverage for COVID-19-related events, such as medical expenses, quarantine costs, and trip cancellations due to travel restrictions. Travelers are increasingly seeking policies that offer specific COVID-19 protection, ensuring they are adequately covered in case of unforeseen circumstances.

Looking for information on the variable annuity market? You can find data on variable annuity sales from 2020 to 2024 here. This data can be helpful for understanding the growth and trends in this type of investment.

Future Trends in Travel Insurance

The future of travel insurance is likely to see further developments in COVID-19 coverage, with providers offering new and innovative solutions. This may include:

Adapting to Changing Travel Regulations

Travel insurance can help travelers adapt to changing travel regulations and health guidelines. It can provide coverage for expenses related to COVID-19 testing, quarantine, and travel restrictions. Travelers can feel more confident about their travel plans knowing they have a safety net in place.

Calculating annuities can be a complex process, but there are resources available to help. You can find information on calculating annuities for 2024 here. This information can be helpful for both individuals and financial professionals.

Conclusion

In a world where travel plans can be unpredictable, affordable travel insurance with COVID-19 protection offers a valuable safety net. By understanding the key features of different policies, comparing options, and taking the time to carefully read the terms and conditions, travelers can make informed decisions and enjoy their trips with confidence.

FAQ Compilation

What is the difference between travel insurance and medical insurance?

If you’re looking for a visual explanation of the annuity formula, YouTube is a great resource. You can find videos on the annuity formula for 2024 here. These videos can help you understand the concept in a more intuitive way.

Travel insurance provides broader coverage for various travel-related risks, including medical expenses, trip cancellations, lost luggage, and emergency evacuation. Medical insurance, on the other hand, primarily focuses on health-related expenses.

How do I know if I need COVID-19 protection in my travel insurance?

It’s highly recommended to have COVID-19 protection, especially considering the ongoing pandemic. Check the policy details to understand the specific coverage offered for COVID-19-related events.

Can I purchase travel insurance after I’ve booked my trip?

Yes, you can usually purchase travel insurance after booking your trip, but it’s best to do so as soon as possible to ensure comprehensive coverage. However, some insurance providers may have waiting periods before certain benefits become effective.

What are the common exclusions in travel insurance policies?

Exclusions vary depending on the insurer, but they often include pre-existing medical conditions, activities considered dangerous or risky, and events beyond the insurer’s control, such as natural disasters.

Fixed immediate annuities offer guaranteed income payments at a fixed rate. You can find information on fixed immediate annuity rates here. This information can be helpful for comparing different annuity options and understanding the current market conditions.

Understanding how variable annuities work is essential for making informed investment decisions. You can find information on how variable annuities work for 2024 here. This information can help you understand the features and benefits of this type of investment.

Variable annuities can be customized with various riders that offer additional features and protection. You can find information on variable annuity riders for 2024 here. This information can help you choose the right riders for your specific needs and goals.